UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☒

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

CytoDyn

Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

CYTODYN INC.

1111 Main

Street, Suite 660

Vancouver, Washington 98660

(360)

980-8524

May , 2018

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders of CytoDyn Inc. (the “Company”) to be held at 9:30 a.m., Eastern Time,

on Tuesday, June 5, 2018, at the offices of the Company’s counsel, Lowenstein Sandler LLP, at One Lowenstein Drive, Roseland, New Jersey 07068.

Matters to be presented for action at the meeting include a proposal to increase the total number of authorized shares of common stock from 375,000,000 to

450,000,000 shares and a proposal to approve the adjournment of the special meeting to solicit additional proxies if there are insufficient proxies at the special meeting to approve the foregoing proposal.

We are excited about the future of our company, and we look forward to conversing with those of you who are able to attend the meeting in person. Whether or

not you can attend, it is important that you sign, date, and return your proxy, or submit your proxy by telephone or Internet as instructed on the enclosed proxy card. If you are a stockholder of record and attend the meeting in person, you may

revoke your proxy and vote at the meeting if you wish.

Sincerely,

Nader Z. Pourhassan, Ph.D.

President and Chief Executive

Officer

If you have any questions or require any assistance in voting your shares, please call:

Alliance Advisors LLC

200

Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833)

814-9456

CYTODYN INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

JUNE 5, 2018

You are invited to attend a

special meeting of stockholders (the “Special Meeting”) of CytoDyn Inc., a Delaware corporation (the “Company”), to be held at the offices of the Company’s counsel, Lowenstein Sandler LLP, at One Lowenstein Drive, Roseland,

New Jersey 07068, on Tuesday, June 5, 2018, at 9:30 a.m., Eastern Time.

Only stockholders of record at the close of business on April 30, 2018, will

be entitled to notice of and to vote at the Special Meeting or any postponements or adjournments thereof.

The Special Meeting is being held to consider

and vote on the following matters:

|

|

1.

|

Approval of a proposal to amend the Company’s Certificate of Incorporation to increase the total number of authorized shares of common stock from 375,000,000 to 450,000,000 shares;

|

|

|

2.

|

Approval of a proposal for the adjournment of the Special Meeting to solicit additional proxies, if there are insufficient proxies at the Special Meeting to approve the foregoing proposal.

|

Please sign and date the accompanying form of proxy and return it promptly in the enclosed postage-paid envelope, or submit your proxy by telephone or the

Internet as instructed on the enclosed proxy card to avoid the expense of further solicitation. If you are a stockholder of record and attend the Special Meeting, you may revoke your proxy and vote your shares in person.

The board of directors of the Company recommends that you vote “FOR” each of the proposals set forth above.

By Order of the Board of Directors

Michael D. Mulholland

Chief Financial Officer, Treasurer, and

Corporate Secretary

Vancouver, Washington

May , 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDERS’ MEETING TO BE HELD ON JUNE 5, 2018:

The proxy statement for the Special Meeting is available at www.cytodyn.com.

CYTODYN INC.

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with

the solicitation of proxies by the Board of Directors (the “Board”) of CytoDyn Inc., a Delaware corporation (“CytoDyn” or the “Company”), to be voted at a special meeting of stockholders to be held on June 5, 2018

(the “Special Meeting”), and any postponements or adjournments thereof. The proxy statement and accompanying form of proxy were first mailed to stockholders on or about May , 2018.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

Solicitation of Proxies

. The enclosed proxy is solicited by and on behalf of the Board, with the cost of solicitation borne by the Company.

Solicitation may also be made by directors and officers of the Company without additional compensation for such services. In addition to mailing proxy materials, the directors, officers and employees may solicit proxies in person, by telephone or

otherwise.

The Company has also retained Alliance Advisors LLC to assist it in the solicitation of proxies. Alliance Advisors LLC will solicit proxies on

behalf of the Company from individuals, brokers, bank nominees and other institutional holders in the same manner described above. Alliance Advisors LLC will receive a fee of $7,500, plus approved and reasonable out of pocket expenses, for its

services to the Company for the solicitation of the proxies. The Company has also agreed to indemnify Alliance Advisors LLC against certain claims.

Voting

. You may submit a proxy to have your shares of common stock voted at the Special Meeting in one of three ways: (i) completing, signing,

dating and returning the enclosed proxy card in the accompanying prepaid envelope; (ii) calling toll-free at the telephone number indicated on the enclosed proxy card; or (iii) using the Internet in accordance with the instructions set

forth on the enclosed proxy card. When a proxy is properly returned, the shares represented by the proxy will be voted at the Special Meeting in accordance with the instructions specified in the spaces provided in the proxy

. If no instructions

are specified, the proxies will be counted for purposes of determining whether or not a quorum is present, and will be voted FOR Proposals

1 and

2

. If a stockholder of record attends the Special Meeting, he

or she may vote in person. If you hold shares through a broker or nominee (that is, in “street name”), please follow their directions on how to vote your shares.

Banks and brokers acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by

the New York Stock Exchange, but are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed

“non-routine”

by the New York Stock Exchange. The determination

of which proposals are deemed “routine” versus

“non-routine”

may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As

such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares. If the New York Stock Exchange determines such proposal to be

“non-routine,”

failure to vote, or to instruct your broker how to vote any shares held for you in your broker’s names will have the same effect as a vote against Proposal 1, but will have

no effect with respect to Proposal 2. If the New York Stock Exchange determines any such proposal to be “routine,” brokers will have voting authority to vote proxies for uninstructed shares according to their discretion for that proposal.

1

A broker

“non-vote”

occurs when a proposal is deemed

“non-routine”

and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the matter being considered and has not received instructions from the

beneficial owner.

If you have additional questions, need assistance in submitting your proxy or voting your shares of common stock, or need additional

copies of the proxy statement or the enclosed proxy card, please contact Alliance Advisors LLC.

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833)

814-9456

Revocation of Proxies

. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by submitting a

later-dated proxy prior to a vote being taken at the Special Meeting. Attendance at the Special Meeting alone may not be sufficient to revoke a previously submitted proxy. If you hold shares through a broker or nominee (that is, in “street

name”), please follow their directions on how to revoke previously submitted instructions relating to your shares.

OUTSTANDING

VOTING SECURITIES AND QUORUM

Stockholders of record as of the close of business on April 30, 2018, are entitled to one vote at the Special

Meeting for each share of common stock, par value $0.001 per share (“Common Stock”), of the Company then held by each stockholder. As of that date, the Company had

shares of Common Stock issued and outstanding. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote constitutes a quorum at the Special Meeting. Abstentions will be

considered present for purposes of determining the presence of a quorum at the Special Meeting. Broker

non-votes,

if any, will not be considered present for purposes of determining the presence of a quorum at

the Special Meeting if the New York Stock Exchange determines both of the proposals to be

“non-routine,”

but will be considered present for purposes of determining the presence of a quorum at the

Special Meeting if the New York Stock Exchange determines either of the proposals to be “routine.”

VOTES REQUIRED

Pursuant to the General Corporation Law of the State of Delaware, Proposal 1 must be approved by a majority of the outstanding shares of stock of the

Company entitled to vote on the proposal. Proposal 2 will be approved if a quorum exists and the votes cast favoring the proposal exceed the votes cast opposing the proposal.

2

SUMMARY TERM SHEET

The following is only a summary of certain material information contained in this document. You should carefully review this entire document along with the

exhibits attached hereto to understand the proposals fully.

|

|

•

|

|

Time and Place of Special Meeting (See cover page, Notice of Special Meeting of Stockholders):

Tuesday, June 5, 2018 at 9:30 a.m., Eastern Time, at the offices of the Company’s counsel, Lowenstein

Sandler LLP, at One Lowenstein Drive, Roseland, New Jersey 07068.

|

|

|

•

|

|

Record Date (See page 2):

You can vote at the Special Meeting if you owned Common Stock of CytoDyn Inc. at the close of business on April 30, 2018.

|

|

|

•

|

|

Proposals to be Voted on (See Notice of Special Meeting of Stockholders):

Matters to be presented for action at the meeting include a proposal to increase the total number of authorized shares of Common Stock

from 375,000,000 to 450,000,000 shares and a proposal to approve the adjournment of the special meeting to solicit additional proxies if there are insufficient proxies at the special meeting to approve the foregoing proposal.

|

|

|

•

|

|

Reasons for the Increase in Authorized Shares (See page 5)

: The primary reason for the increase in authorized shares is to have sufficient authorized shares of Common Stock available for future financings to

raise the capital needed to operate its business, and for possible future acquisition transactions, joint ventures and other general corporate purposes as further described in this proxy statement.

|

|

|

•

|

|

Effect of Approving the Increase in Authorized Shares (See page 5)

: If the increase in authorized shares of Common Stock is approved, the authorized shares of the Company will be increased from 375,000,000 shares

to 450,000,000 shares.

|

|

|

•

|

|

Effect of Not Approving the Increase in Authorized Shares (See page 6)

: If the increase to authorized shares proposal fails to obtain the vote required for approval, the number of shares authorized for issuance

by the Company will remain at 375,000,000 shares of Common Stock and the Company will be limited in its ability to issue shares of its Common Stock to advance its business through financings and possible future acquisition transactions, joint

ventures and other general corporate purposes.

|

|

|

•

|

|

Recommendation of the Board (See page 7):

The Board recommends that you vote “FOR” Proposals 1 and 2.

|

|

|

•

|

|

Vote Required (See page 7):

Pursuant to the General Corporation Law of the State of Delaware, Proposal 1 must be approved by a majority the outstanding shares of stock of the Company entitled to vote on the

proposal, and Proposal 2 will be approved if a quorum exists and the votes cast favoring the proposal exceed the votes cast opposing the proposal.

|

|

|

•

|

|

How to Vote Your Shares (See page 1):

Complete, date and sign the enclosed proxy card and mail it in the enclosed return envelope, or submit your proxy by telephone or the Internet as instructed on the enclosed

proxy card, as soon as possible, so that your shares may be represented at the Special Meeting. In order to assure that your vote is obtained, please submit your proxy even if you currently plan to attend the Special Meeting in person.

|

|

|

•

|

|

How to Revoke Your Proxy (See page 1):

Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by submitting a later-dated proxy prior to a vote being taken at

the Special Meeting. Attendance at the Special Meeting alone may not be sufficient to revoke a previously submitted proxy. If you hold shares through a broker or nominee (that is, in “street name”), please follow their directions on how to

revoke previously submitted instructions relating to your shares.

|

3

|

|

•

|

|

Voting of Shares Held in “Street Name” (See page 1):

Your broker is permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the New York

Stock Exchange, but is not permitted to use discretionary voting authority to vote proxies for proposals that are deemed

“non-routine”

by the New York Stock Exchange. The determination of which

proposals are deemed “routine” versus

“non-routine”

may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is

important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares. If the New York Stock Exchange determines such proposals to be

“non-routine,”

failure to vote, or to instruct your broker how to vote any shares held for you in your broker’s name, will have the same effect as a vote against Proposal 1, but will have

no effect with respect to Proposal 2. If the New York Stock Exchange determines any such proposal to be “routine,” brokers will have voting authority to vote proxies for uninstructed shares according to their discretion for that proposal.

|

|

|

•

|

|

Whom You Should Call with Questions:

If you have further questions, you may contact the Company’s proxy solicitor, Alliance Advisors LLC. at:

|

Alliance Advisors LLC

200

Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833)

814-9456

4

PROPOSAL 1

PROPOSAL TO INCREASE THE COMPANY’S AUTHORIZED CAPITAL

TO 450,000,000 SHARES OF COMMON STOCK

The Board believes it is in the best interest of the Company to increase the number of shares of Common Stock authorized for issuance by 75,000,000 shares of

Common Stock, bringing the total number of shares of Common Stock authorized from 375,000,000 to 450,000,000 shares. These shares do not offer any preemptive rights. The text of the proposed certificate of amendment to the Company’s

Certificate of Incorporation is attached hereto as Exhibit A. This proposal to increase the number of shares of Common Stock authorized for issuance, if approved at the Special Meeting, will become effective and the Company’s number of shares

of authorized Common Stock will be increased to 450,000,000 shares upon the filing of the certificate of amendment with the Secretary of State of Delaware. The following discussion is qualified in its entirety by the full text of the

certificate of amendment, which is incorporated herein by reference.

Reasons for the Increase

The Board believes that it is desirable to have sufficient authorized shares of Common Stock available for future financings to raise the capital needed to

operate its business, and for and possible future acquisition transactions, joint ventures and other general corporate purposes. The Board believes that having such authorized shares of Common Stock available for issuance in the future will give the

Company greater flexibility and may allow such shares to be issued without the expense and delay of an additional special stockholders’ meeting unless such approval is expressly required by applicable law. Although such issuance of additional

shares with respect to future financings and acquisitions would dilute existing stockholders, management believes that such transactions would increase the overall value of the Company to its stockholders. There are certain advantages and

disadvantages of an increase in authorized Common Stock. The advantages include:

|

|

•

|

|

The ability to raise additional capital by issuing capital stock under the type of transactions described above, or other financing transactions.

|

|

|

•

|

|

To have shares of Common Stock available to finance its ongoing operating capital requirements to advance the Company’s lead product candidate, PRO 140, towards regulatory approval, and to pursue other

potential business expansion opportunities, if any.

|

The disadvantages include:

|

|

•

|

|

Further dilution of stockholders’ ownership.

|

|

|

•

|

|

Stockholders do not have any preemptive or similar rights to subscribe for or purchase any additional shares of Common Stock that may be issued in the future, and therefore, future issuances of Common Stock may,

depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of existing stockholders of the Company.

|

|

|

•

|

|

The additional shares of Common Stock for which authorization is sought in this proposal would be part of the existing class of Common Stock and, if and when issued, would have the same rights and privileges as the

shares of Common Stock presently outstanding. The Company intends to use the proceeds from any future capital raises for general corporate purposes. The Company has no arrangements, agreements, or understandings in place at the present time for the

issuance or use of the additional shares of Common Stock to be authorized by the proposed Certificate Amendment; however, the Company will require additional capital in the near future to fund its operations and it is foreseeable that the Company

may seek to issue such additional shares of Common Stock in connection with any such capital raising activities. The Board does not intend to issue any Common Stock or securities convertible into Common Stock except on terms that the Board deems to

be in the best interests of the Company and its stockholders.

|

|

|

•

|

|

The issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing

shares to a stockholder that will vote in accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of

stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences.

|

5

Although an increase in the authorized shares of Common Stock could, under certain circumstances, have an

anti-takeover effect, this proposal to adopt the amendment is not in response to any effort of which the Company is aware to accumulate Common Stock or obtain control of the Company. Nor is it part of a plan by management to recommend a series of

similar amendments to the Board and stockholders. The Company has no arrangements, agreements, or understandings in place at the present time to enter into any merger, consolidation, acquisition or similar business transaction.

If the Company’s stockholders do not approve the increase in authorized shares of Common Stock, then the Company will not be able to increase the total

number of authorized shares of Common Stock from 375,000,000 to 450,000,000, and therefore, the Company will be severely limited in its ability to use shares of Common Stock for the financings required to raise the capital needed to operate its

business, acquisitions or other general corporate purposes. As of March 31, 2018, the Company only had 29,628,205 shares of Common Stock authorized and unreserved for issuance, which would be available for such purposes.

Preferred Stock

Whether or not the Company’s

stockholders approve the increase in authorized shares of Common Stock pursuant to this proposal, the Company will still have 4,600,000 undesignated shares of preferred stock, par value $0.001 per share, available for issuance in one or more series.

The Board has the authority, within the limitations and restrictions prescribed by law and without stockholder approval, to provide by resolution for the issuance of shares of preferred stock, and to fix the rights, preferences, privileges and

restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preference and the number of shares constituting any series of the designation of such series, by delivering an appropriate

certificate of amendment to the Company’s Certificate of Incorporation to the Delaware Secretary of State pursuant to the General Corporation Law of the State of Delaware. The issuance of preferred stock could have the effect of decreasing the

market price of the common stock, impeding or delaying a possible takeover and adversely affecting the voting and other rights of the holders of the Company’s common stock.

Prior Approval of Reverse Stock Split

The Company’s

stockholders previously approved a reverse stock split at a ratio of any whole number between

one-for-two

and

one-for-fifteen,

as determined by the Board, and a simultaneous reduction in the total number of authorized shares of Common Stock to 200,000,000 upon the effectiveness of the reverse stock split, at any time

before August 24, 2018, if and as determined by the Board. Accordingly, whether or not the Company’s stockholders approve the increase in authorized shares of Common Stock pursuant to this proposal, the Board will continue to have the

flexibility to effectuate such a reverse stock split at any time prior to August 24, 2018, if the Board believes such a reverse stock split would be in the best interest of the Company and its stockholders.

If effectuated, a reverse stock split would reduce, on a proportionate basis for each stockholder, the aggregate number of shares of Common Stock outstanding

while only reducing the total number of shares of Common Stock authorized for issuance to 200,000,000, whether or not such number remains at 375,000,000 or is increased to 450,000,000 by this proposal. As a result, if a reverse stock split were

effectuated, the Company could have a greater amount of authorized share capital available for future issuance following the reverse stock split than it had prior to the reverse stock split, without any further stockholder approval. Any such future

issuance of Common Stock could, depending on the circumstances, be used to deter a potential takeover or have a further dilutive effect on the earnings per share, voting power and other interests of existing stockholders.

The current proposal to increase the number of authorized shares of Common Stock to 450,000,000 has no bearing on the Board’s ability to effect a reverse

stock split, as previously authorized by stockholders and described above. The Board’s determination as to whether to effect a reverse stock split and, if so, at what ratio, would be based on the same factors previously reported in Proposal 1

of the Company’s Proxy Statement filed with the United States Securities and Exchange Commission (the “SEC”) on October 2, 2017, which was approved by the Company’s stockholders on November 1, 2017.

6

Approval Required

Pursuant to the General Corporation Law of the State of Delaware, this proposal must be approved by the affirmative vote of a majority of the outstanding

shares of Common Stock of the Company entitled to vote on the proposal. Shares that are not represented at the Special Meeting and abstentions and, if this proposal is deemed to be

“non-routine”

as

described above, broker

non-votes

with respect to this proposal will have the same practical effect as a vote against this proposal.

The Board recommends that stockholders vote “FOR” the proposal to increase in the Company’s authorized capital to 450,000,000 shares of

Common Stock.

Notwithstanding stockholder approval of Proposal 1, the Board may abandon Proposal 1 at any time prior to filing the

certificate of amendment to the Company’s Certificate of Incorporation with the Secretary of State of Delaware, without further stockholder action.

7

PROPOSAL 2

APPROVAL THE ADJOURNMENT OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES

Adjournment of the Special Meeting

In the event that the

number of shares of Common Stock present in person or represented by proxy at the Special Meeting and voting “FOR” the adoption of Proposal 1 is insufficient to adopt Proposal 1, the Company may move to adjourn the Special Meeting in order

to enable the Board to solicit additional proxies in favor of the adoption of Proposal 1. In that event, the Company will ask stockholders to vote only upon the adjournment proposal and not on any other proposal discussed in this proxy statement. If

the adjournment is for more than thirty (30) days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Vote Required and Board Recommendation

If a quorum is

present, approval of the proposal to adjourn the Special Meeting to a later date requires that the votes cast favoring the proposal exceed the votes cast opposing the proposal.

Assuming a quorum is present, shares that are not represented at the Special Meeting and abstentions and, if this proposal is deemed to be

“non-routine”

as described above, broker

non-votes

with respect to this proposal will not be counted for the purpose of determining the number of votes cast and will

therefore not have any effect with respect to this adjournment proposal.

The Board recommends that stockholders vote “FOR” the proposal to

adjourn the Special Meeting to solicit additional proxies, if there are insufficient proxies at the Special Meeting to approve Proposal 1.

8

MATTERS RELATING TO THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Warren Averett, LLC (“Warren Averett”) was the Company’s independent registered public accounting firm with respect to its audited financial

statements for the fiscal year ended May 31, 2017. Representatives of Warren Averett are not expected to be present at the Special Meeting.

OTHER MATTERS

Management is not aware of

any matters to be brought before the Special Meeting other than those discussed above.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

Communications by stockholders to the Board should be submitted in writing to Board of Directors, c/o CytoDyn Inc., 1111 Main Street, Suite 660,

Vancouver, Washington 98660. Communications to individual directors or committees should be sent to the attention of the intended recipient. Communications will be forwarded to the chair of the Audit Committee, who will be primarily responsible for

monitoring communications to the Board (or its members or committees) and for forwarding communications as he or she deems appropriate. Communications will not be forwarded if they do not appear to be within the scope of the Board’s (or such

other intended recipient’s) responsibilities or are otherwise inappropriate or frivolous.

HOUSEHOLDING OF SPECIAL MEETING

MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements.

This means that only one copy of this Proxy Statement may have been sent to multiple stockholders in the same household. The Company will promptly deliver a separate copy of this Proxy Statement to any stockholder upon written or oral request to:

CytoDyn Inc., 1111 Main Street, Suite 660, Vancouver, Washington 98660, Attn.: Secretary, or by phone at

(360) 980-8524.

Any stockholder who wants to receive a separate copy of this Proxy Statement, or of

the Company’s proxy statements or annual reports in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank, broker, or other nominee

record holder, or the stockholder may contact the Company at the address and phone number above.

STOCKHOLDER PROPOSALS FOR ANNUAL

MEETING IN 2018

For the 2018 annual meeting of stockholders, pursuant to the Company’s Bylaws, a proposal to take action at the meeting may be

made by any stockholder of record who is entitled to vote at the meeting and who delivers timely written notice. To be considered timely, the notice must be received between the close of business on April 26, 2018 and the close of business on

May 26, 2018; provided that, if the 2018 annual meeting is not first convened between July 25, 2018 and October 23, 2018, inclusive, then the notice must be delivered prior to the close of business on the later of (x) the

ninetieth day prior to the meeting date or (y) the tenth day following the first public announcement of the meeting date.

As previously disclosed by

the Company, in order to be eligible for inclusion in the proxy materials of the Company for the 2018 annual meeting of stockholders, pursuant to Rule

14a-8

under the Exchange Act, any stockholder proposal to

take action at such meeting must have been received by March 26, 2018. Any such proposal should have complied with the SEC’s rules governing stockholder proposals submitted for inclusion in proxy materials. In addition, if the Company

receives notice of a stockholder proposal after June 9, 2018, the persons named as proxies in such proxy statement and form of proxy will have discretionary authority to vote on such stockholder proposal.

9

Any proposals to take action at the 2018 annual meeting of stockholders should be addressed to Secretary, CytoDyn

Inc., 1111 Main Street, Suite 660, Vancouver, Washington 98660.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by the Company. Proxies may be solicited by mail, facsimile, telephone, telegraph,

Internet and in person.

The expenses of preparing, printing and distributing this Proxy Statement and the accompanying form of proxy and the cost of

soliciting proxies will be borne by the Company.

Copies of soliciting materials will be furnished to banks, brokerage houses and other custodians,

nominees and fiduciaries for forwarding to the beneficial owners of shares of Common Stock for whom they hold shares, and the Company will reimburse them for their reasonable

out-of-pocket

expenses in connection therewith.

The Company has also

retained Alliance Advisors LLC to assist it in the solicitation of proxies. Alliance Advisors LLC will solicit proxies on behalf of the Company from individuals, brokers, bank nominees and other institutional holders in the same manner described

above. Alliance Advisors LLC will receive a fee of $7,500, plus approved and reasonable out of pocket expenses, for its services to the Company for the solicitation of the proxies. The Company has also agreed to indemnify Alliance Advisors LLC

against certain claims.

WHERE YOU CAN FIND MORE INFORMATION

The SEC maintains a website that contains reports, proxies and information statements and other information regarding the Company and other issuers that file

electronically with the SEC at www.sec.gov. The Company’s proxy statements, annual reports on Form

10-K,

quarterly reports on Form

10-Q

and current reports on Form

8-K,

as well as any amendments to those reports, are available free of charge through the SEC’s website. Stockholders may also read and copy materials that the Company files with the SEC at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, DC 20549. Stockholders may obtain information on the operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330.

INCORPORATION BY REFERENCE

The SEC allows the Company to “incorporate by reference” into this Proxy Statement documents it files with the SEC. This means that the Company can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this Proxy Statement, and later information that the Company filed with the SEC as specified below

will update and supersede that information. Except to the extent that information is deemed furnished and not filed pursuant to securities laws and regulations, the Company incorporates by reference the following filing:

|

|

•

|

|

the Company’s Annual Report on Form

10-K

, as amended, for the fiscal year ended May 31, 2017, filed with the SEC on July 20, 2017, as amended on July 27,

2017;

|

|

|

•

|

|

the Company’s Quarterly Reports on Form

10-Q

for the quarters ended August 31, 2017, November 30, 2017 and February 28, 2018, filed with the SEC on

October 10, 2017, January 8, 2018 and April 9, 2018, respectively;

|

|

|

•

|

|

the Company’s Proxy Statements on Schedule 14A filed with the SEC on July 24, 2017 and October 2, 2017; and

|

10

|

|

•

|

|

the Company’s Current Reports on Form

8-K

filed with the SEC on June 2, 2017, June 22, 2017, July 7, 2017, July 14, 2017, July 31, 2017,

August 9, 2017 (except as to any portion deemed furnished and not filed), August 21, 2017 (except as to any portion deemed furnished and not filed), August 25, 2017, September 6, 2017, September 8, 2017, October 5, 2017

(except as to any portion deemed furnished and not filed), October 11, 2017, October 13, 2017 (except as to any portion deemed furnished and not filed), November 2, 2017, November 8, 2017, November 27, 2017, December 6,

2017, December 7, 2017 (except as to any portion deemed furnished and not filed), December 21, 2017, December 29, 2017, January 10, 2018, January 23, 2018, January 31, 2018, February 7, 2018, February 13,

2018, February 20, 2018 (except as to any portion deemed furnished and not filed), March 14, 2018 (except as to any portion deemed furnished and not filed), March 20, 2018, March 26, 2018 and April 11, 2018.

|

The Company undertakes to provide without charge to each person to whom a copy of this proxy statement has been delivered, upon written or

oral request, by first class mail or other equally prompt means and within one business day of receipt of such request, a copy of any or all of the documents incorporated by reference in this proxy statement, other than the exhibits to these

documents, unless the exhibits are specifically incorporated by reference into the information that this proxy statement incorporates. You may obtain documents incorporated by reference by requesting them in writing or by telephone at the following

address and telephone number:

CytoDyn Inc.

1111 Main Street, Suite 660

Vancouver, Washington 98660

(360)

980-8524

11

If you have any questions or require any assistance in voting your shares, please call:

Alliance Advisors LLC

200

Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833)

814-9456

Exhibit A

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF

INCORPORATION

OF

CYTODYN INC.

Pursuant to Section 242

of the General Corporation Law of the State of Delaware, CytoDyn Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), does hereby certify as follows:

|

1.

|

The name of the Corporation is CytoDyn Inc. The Corporation was incorporated by the filing of its original Certificate of Incorporation with the Secretary of State of the State of Delaware on January 12, 2015 (as

amended, the “Certificate of Incorporation”).

|

|

2.

|

The Certificate of Incorporation of the Corporation is hereby amended by deleting the first paragraph of Article IV and replacing such paragraph with the following paragraph:

|

“The total number of shares of capital stock which the Corporation shall have authority to issue is Four Hundred and Fifty-Five Million

(455,000,000), of which (i) Four Hundred and Fifty Million (450,000,000) shares shall be a class designated as common stock, par value $0.001 per share (the “

Common Stock

”), and (ii) Five Million Shares

(5,000,000) shares shall be a class designated as preferred stock, par value $0.001 per share (the “

Preferred Stock

”).”

|

3.

|

The Board of Directors of the Corporation has duly adopted a resolution pursuant to Section 242 of the General Corporation Law of the State of Delaware setting forth a proposed amendment to the Certificate of

Incorporation of the Corporation and declaring said amendment to be advisable. The requisite stockholders of the Corporation have duly approved said proposed amendment in accordance with Section 242 of the General Corporation Law of the State

of Delaware.

|

|

4.

|

This Certificate of Amendment and the amendment to the Certificate of Incorporation effected hereby has been duly adopted in accordance with Section 242 of the General Corporation Law of the State of Delaware and

shall be effective immediately upon filing.

|

[Signature Page Follows]

A-1

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its President and

Chief Executive Officer on this [ ] day of [ ], 2018.

|

|

|

|

|

CYTODYN INC.

|

|

|

|

|

By:

|

|

|

|

Name:

|

|

Michael D. Mulholland

|

A-2

|

|

|

|

|

|

|

Using a

black ink

pen, mark your votes with an

X

as shown in this example. Please do not write outside the designated areas.

|

|

☒

|

|

|

Electronic Voting Instructions

Available 24 hours a day, 7 days a week!

Instead of mailing your proxy, you

may choose one of the voting methods outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED BELOW IN THE TITLE BAR.

Proxies submitted by the Internet or telephone must be received by 1:00 a.m., Central Time, on June 5, 2018.

|

|

|

|

|

|

Vote by Internet

• Go to

www.investorvote.com/CYDY

• Or scan the QR code with your smartphone

• Follow the steps outlined on the secure website

|

Vote by telephone

|

•

|

|

Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone

|

|

•

|

|

Follow the instructions provided by the recorded message

|

q

IF YOU HAVE NOT VOTED VIA THE INTERNET

OR

TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

q

+

|

|

|

|

|

A

|

|

Proposals — The Board of Directors unanimously recommends a vote FOR Proposals 1 and 2.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

1. Approval of an increase in the total number of authorized shares of common stock to 450,000,000

shares

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

2. Adjournment of the Special Meeting

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

B

|

|

Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

|

Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate

officer, trustee, guardian, or custodian, please give full title.

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) — Please print date below.

|

|

|

|

Signature 1 — Please keep signature within the box.

|

|

|

|

Signature 2 — Please keep signature within the box.

|

|

/ /

|

|

|

|

|

|

|

|

|

02U0GB

q

IF YOU HAVE NOT VOTED VIA THE INTERNET

OR

TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED

ENVELOPE.

q

2018 SPECIAL MEETING OF STOCKHOLDERS

This

proxy is solicited on behalf of the Board of Directors of CytoDyn Inc.

The undersigned hereby appoints Anthony D. Caracciolo,

Nader Z. Pourhassan and Michael D. Mulholland as proxies and attorneys-in-fact, with full power of substitution, and hereby authorizes them, or either of them, to represent and to vote, as designated below, all the shares of the common stock of

CytoDyn Inc. held of record by the undersigned at the close of business on April 30, 2018, at the special meeting of stockholders to be held on June 5, 2018, at 9:30 a.m., Eastern Time, or any adjournments or postponements thereof, with all

powers which the undersigned would possess if present at the meeting.

This proxy, when properly executed, will be voted in the

manner directed by the undersigned stockholder. If no direction is provided, the proxies named above will vote FOR Proposals 1 and 2.

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any

adjournments or postponements thereof.

The undersigned acknowledges receipt of the Notice of Special Meeting of Stockholders and

accompanying Proxy Statement and revokes all prior proxies for the meeting. Please date and sign exactly as name(s) appear(s) hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give

your full title. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Please mark, sign, date and return the proxy using the enclosed envelope.

Change of Address

— Please print new address below.

|

|

|

|

|

|

|

∎

|

|

IF VOTING BY MAIL, YOU

MUST

COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

|

|

+

|

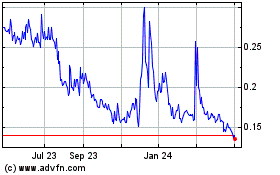

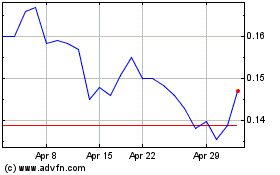

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024