REDUCE-IT Study On-Track for Reporting Top-Line

Results by the End of Q3 2018

Amarin Corporation plc (NASDAQ:AMRN), a biopharmaceutical

company focused on the commercialization and development of

therapeutics to improve cardiovascular health, today announced

financial results for the three months ended March 31, 2018, and

provided an update on company operations.

Key Amarin achievements through March 31, 2018

include:

- R&D progress: The REDUCE-IT cardiovascular outcomes study,

designed to provide data to support a significantly expanded market

opportunity for Vascepa® (icosapent ethyl), is estimated to have

reached the 100% mark for onset of the 1,612 target primary major

adverse cardiovascular events (MACE) specified in the study design.

Amarin anticipates that MACE from the study will be adjudicated

through Q2 2018, consistent with the company's objective of

reporting top-line results from this important study before the end

of Q3 2018.

- U.S. revenue growth: Recognized $43.8 million in net product

revenue from Vascepa sales in Q1 2018 compared to $34.3 million in

Q1 2017, an increase of 27%.

- U.S. prescription growth: Increased normalized prescriptions

for Vascepa by 25% and 27% compared to Q1 2017 based on data from

Symphony Health Solutions and IQVIA, respectively.

- International development: Announced the first international

approval for Vascepa with the regulatory approval of Vascepa in

Lebanon. The clinical trial of Vascepa for approval in China is in

process.

- Cash balance: As of March 31, 2018, Amarin had a cash balance

of $129.0 million, which includes approximately $70.0 million in

net cash proceeds from the equity offering announced in February

2018, compared to $73.6 million at December 31, 2017.

“There is tremendous energy and excitement

within Amarin currently as we approach the results of the REDUCE-IT

study and prepare for targeted future growth,” stated John F.

Thero, president and chief executive officer. “The unmet medical

need remains large for cost-effective therapies that lower

cardiovascular risk beyond the risk reduction achieved with

standard of care statin therapy alone. We are pleased that

increasing numbers of physicians are prescribing Vascepa to help

their patients and we are confident that the results from the

REDUCE-IT study will lead to better informed decisions regarding

patient care.”

REDUCE-IT Cardiovascular Outcomes

Study

REDUCE-IT is designed to determine if

intervention with 4 grams/day of prescription pure EPA Vascepa will

lower rates of major adverse cardiovascular events in

statin-treated patients with persistent hypertriglyceridemia and

other cardiovascular risk factors. Motivated by the vision of

Amarin and its scientific collaborators in identifying a large

unmet medical need in this important patient population, and

facilitated by the differentiation of Vascepa from earlier

generation triglyceride-lowering therapies, this is the first ever

prospective study of this population with any therapy.

The primary endpoint of this global,

double-blind study is the time to the first occurrence of a

composite of primary major adverse cardiovascular events

(MACE). Results will be compared between the Vascepa and

placebo groups. The study was designed to accumulate 1,612 MACE at

which level the study was robustly designed to have 90% power to

detect a 15% relative risk reduction in MACE between the Vascepa

and placebo arms of the study. The study is being conducted under a

Special Protocol Assessment (SPA) agreement with the FDA.

As previously reported, Amarin estimates that

the onset of approximately 1,612 MACE has occurred. In March 2018,

patients in the study began to complete their final clinical site

visits, a key step towards study completion.

Amarin is intentionally blinded to the results

of the study and will remain blinded to such results until after

the study is completed and the database is locked. Final patient

visits will be followed by completing data entry for the more than

35,000 patient years of study in REDUCE-IT, and typical database

quality control measures, known as cleaning. In parallel,

adjudication will be completed for all MACE which occurred during

the study, including adjudication for certain events which, per

protocol, cannot be finally adjudicated until patients complete

their final site visit and results are available from certain

non-invasive diagnostic testing conducted during such site visits.

These steps will be followed by the database lock and final

efficacy and safety analyses, including analysis of the trial's

primary endpoint of first MACE events in the study, and the

analyses of more than thirty pre-defined secondary and tertiary

endpoints. Winding down a study of this magnitude to

completion typically takes many months. The company believes that

it is on track to achieve its objective of reporting top-line

results from this important study before the end of Q3 2018.

Financial Update

Net product revenue for the three months ended

March 31, 2018 and 2017 was $43.8 million and $34.3 million,

respectively. The increase in net product revenue was primarily

attributable to increases in new and recurring prescriptions of

Vascepa.

During the first quarter, based on data from

Symphony Health Solutions and IQVIA, Amarin experienced continued

prescription growth and increase in Vascepa market share,

particularly among detailed physicians. These sources reported

estimated normalized total Vascepa prescriptions of approximately

381,000 and 392,000, respectively, for the three months ended March

31, 2018, representing growth of approximately 25% and 27%,

respectively, over levels reported for the first three months of

the prior year.

The company recognized licensing revenue of $0.1

million and $0.3 million in the three months ended March 31, 2018

and 2017, respectively, related to agreements for the

commercialization of Vascepa outside the United States.

Cost of goods sold for the three months ended

March 31, 2018 and 2017 was $10.6 million and $8.2 million,

respectively. Gross margin on net product revenue was 76% for

each of the three months ended March 31, 2018 and 2017.

Selling, general and administrative expenses in

the three months ended March 31, 2018 and 2017 were $43.4 million

and $34.2 million, respectively. This increase is due primarily to

increased promotional activities, including commercial spend for

anticipated expansion following successful REDUCE-IT results, and

increased co-promotion fees, including an accrual for co-promotion

tail payments as well as an increase in co-promotion fees

calculated on increased gross margin resulting from higher net

product revenue. The tail co-promotion fees, which are calculated

as a percentage of the 2018 co-promotion fee, are payable in 2019

through 2021. Such tail co-promotion fees will be accrued

throughout 2018.

Research and development expenses in the three

months ended March 31, 2018 and 2017 were $11.8 million and $10.8

million, respectively. This increase in expense was primarily

driven by the timing of REDUCE-IT and related costs.

Under U.S. GAAP, Amarin reported a net loss of $24.1 million in the

first quarter of 2018, or basic and diluted loss per share of

$0.08. This net loss included $3.8 million in non-cash stock-based

compensation expense. Amarin reported a net loss of $20.9 million

in the first quarter of 2017, or basic and diluted loss per share

of $0.08. This net loss included $3.4 million in non-cash

stock-based compensation expense.

Excluding non-cash gains or losses for

stock-based compensation, non-GAAP adjusted net loss was $20.3

million for the first quarter of 2018, or non-GAAP adjusted basic

and diluted loss per share of $0.07, compared to non-GAAP adjusted

net loss of $17.6 million for the first quarter of 2017, or

non-GAAP adjusted basic and diluted loss per share of $0.07.

Amarin reported cash and cash equivalents of

$129.0 million as of March 31, 2018. Excluding proceeds from the

equity financing completed in the first quarter and excluding other

financing-related amounts (interest and royalty) and without the

company’s high level of research and development payments, most of

which relates to advancing the REDUCE-IT study to completion this

year, net cash outflow in the quarter ended March 31, 2018 was

approximately $0.1 million. Cash outflows relating to research and

development in Q1 2018 totaled approximately $11.3 million and cash

paid for interest and royalties, in aggregate, was approximately

$5.9 million.

As of March 31, 2018, the company had $39.2

million in net accounts receivable ($57.6 million in gross accounts

receivable before allowances and reserves) and $35.1 million in

inventory.

As of March 31, 2018, Amarin had approximately

293.6 million American Depository Shares (ADSs) and ordinary shares

outstanding, 32.8 million common share equivalents of Series A

Convertible Preferred Shares outstanding and approximately 25.7

million equivalent shares underlying stock options at a

weighted-average exercise price of $3.35, as well as 12.4 million

equivalent shares underlying restricted or deferred stock

units.

Amarin’s partner in the Middle East and North

Africa, or MENA region, in the first quarter of 2018 obtained

approval for Vascepa in Lebanon. Amarin anticipates additional

approvals in the MENA region, including potential additional

approvals in 2018. Amarin’s partner for China, Eddingpharm, is

progressing in its clinical study of Vascepa in China. This

study, which recently commenced, potentially positions Vascepa to

be the first prescription grade EPA product to receive drug

approval in China.

Conference call and webcast

information

Amarin will host a conference call

at 7:30 a.m. ET today, May 2, 2018. The call

will be webcast live with slides and accessible through the

investor relations section of the company’s website at

www.amarincorp.com. The call can also be heard via telephone by

dialing 877-407-8033. A replay of the call will be made available

for a period of two weeks following the conference call. To hear a

replay of the call, dial 877-481-4010 (inside the United States) or

919-882-2331 (outside the United States). A replay of the call will

also be available through the company's website shortly after the

call. For both dial-in numbers please use conference ID 27922.

Use of non-GAAP adjusted financial

information

Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived by taking

GAAP net loss and adjusting it for non-cash stock-based

compensation expense. Management uses these non-GAAP adjusted

financial measures for internal reporting and forecasting purposes,

when publicly providing its business outlook, to evaluate the

company’s performance and to evaluate and compensate the company’s

executives. The company has provided these non-GAAP financial

measures in addition to GAAP financial results because it believes

that these non-GAAP adjusted financial measures provide investors

with a better understanding of the company’s historical results

from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a biopharmaceutical

company focused on the commercialization and development of

therapeutics to improve cardiovascular health. Amarin's

product development program leverages its extensive experience in

lipid science and the potential therapeutic benefits of

polyunsaturated fatty acids. Vascepa® (icosapent ethyl),

Amarin's first FDA-approved product, is a highly-pure, omega-3

fatty acid product available by prescription. For more

information about Vascepa visit www.vascepa.com. For more

information about Amarin visit www.amarincorp.com.

About REDUCE-IT

Amarin's clinical development program for

Vascepa includes a trial known as the REDUCE-IT cardiovascular

outcomes study, an 8,175-patient study commenced in 2011. REDUCE-IT

is the first multinational cardiovascular outcomes study evaluating

the effect of prescription pure EPA therapy, or any

triglyceride-lowering therapy, as an add-on to statins in patients

with high cardiovascular risk who, despite stable statin therapy,

have elevated triglyceride levels (150-499 mg/dL). A large portion

of the male and female patients enrolled in this outcomes study are

anticipated to also be diagnosed with type 2 diabetes. As reported

previously, Amarin expects to announce top-line results of this

important study before the end of Q3 2018. The REDUCE-IT

trial is being conducted under a Special Protocol Assessment

agreement with the U.S. Food and Drug Administration.

Additional information on clinical studies of

Vascepa can be found at www.clinicaltrials.gov.

About VASCEPA® (icosapent ethyl)

capsules

Vascepa® (icosapent ethyl) capsules are a

single-molecule prescription product consisting of the omega-3 acid

commonly known as EPA in ethyl-ester form. Vascepa is not fish oil,

but is derived from fish through a stringent and complex

FDA-regulated manufacturing process designed to effectively

eliminate impurities and isolate and protect the single molecule

active ingredient. Vascepa, known in scientific literature as

AMR101, has been designated a new chemical entity by the FDA.

Amarin has been issued multiple patents internationally based on

the unique clinical profile of Vascepa, including the drug’s

ability to lower triglyceride levels in relevant patient

populations without raising LDL-cholesterol levels.

FDA-approved indication and usage

- Vascepa (icosapent ethyl) is

indicated as an adjunct to diet to reduce triglyceride (TG) levels

in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia.

- The effect of Vascepa on the risk

for pancreatitis and cardiovascular mortality and morbidity in

patients with severe hypertriglyceridemia has not been

determined.

Important safety information for Vascepa

- Vascepa is contraindicated in

patients with known hypersensitivity (e.g., anaphylactic reaction)

to Vascepa or any of its components.

- Use with caution in patients with

known hypersensitivity to fish and/or shellfish.

- The most common reported adverse

reaction (incidence > 2% and greater than placebo) was

arthralgia (2.3% for Vascepa, 1.0% for placebo). There was no

reported adverse reaction > 3% and greater than placebo.

- Patients receiving treatment with

Vascepa and other drugs affecting coagulation (e.g., anti-platelet

agents) should be monitored periodically.

- In patients with hepatic

impairment, monitor ALT and AST levels periodically during

therapy.

- Patients should be advised to

swallow Vascepa capsules whole; not to break open, crush, dissolve,

or chew Vascepa.

- Adverse events and product

complaints may be reported by calling 1-855-VASCEPA or the FDA at

1-800-FDA-1088.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE

FOUND AT WWW.VASCEPA.COM.

Vascepa has been approved for use by the United

States Food and Drug Administration (FDA) as an adjunct to diet to

reduce triglyceride levels in adult patients with severe (≥500

mg/dL) hypertriglyceridemia. Nothing in this press release should

be construed as promoting the use of Vascepa in any indication that

has not been approved by the FDA.

About cardiovascular

disease

Worldwide, cardiovascular disease (CVD) remains

the #1 killer of men and women. In the United States, CVD leads to

one in every three deaths – one death approximately every 38

seconds – with annual treatment cost in excess of $500 billion.1,

2

Beyond the cardiovascular risk associated with

LDL-C, genetic, epidemiologic, clinical and real-world data suggest

that patients with elevated triglycerides (TG) (fats in the blood),

and TG-rich lipoproteins, are at increased risk for cardiovascular

disease. 3, 4, 5, 6

Leading clinical investigations seeking to

address cardiovascular risk reduction beyond lowering LDL-C focus

on interrupting the atherosclerotic process (e.g., plaque formation

and instability) by beneficially affecting other lipid, lipoprotein

and inflammation biomarkers and cellular functions thought to be

related to atherosclerosis and cardiovascular events.

Forward-looking statements

This press release contains forward-looking

statements, including expectations regarding adjudication of MACE

events, results and related timing and announcements with respect

to Amarin's REDUCE-IT cardiovascular outcomes study; expectations

related to the final outcomes of the REDUCE-IT study and the

anticipated successful completion of the REDUCE-IT study; and

statements regarding the potential and therapeutic benefits of

Vascepa. These forward-looking statements are not promises or

guarantees and involve substantial risks and uncertainties. In

particular, as disclosed in filings with the U.S. Securities and

Exchange Commission, Amarin's ability to effectively develop and

commercialize Vascepa will depend in part on its ability to

continue to effectively finance its business, efforts of third

parties, its ability to create market demand for Vascepa through

education, marketing and sales activities, to achieve increased

market acceptance of Vascepa, to receive adequate levels of

reimbursement from third-party payers, to develop and maintain a

consistent source of commercial supply at a competitive price, to

comply with legal and regulatory requirements in connection with

the sale and promotion of Vascepa and to maintain patent protection

for Vascepa. Among the factors that could cause actual results to

differ materially from those described or projected herein include

the following: uncertainties associated generally with research and

development, clinical trials and related regulatory approvals; the

risk that historical REDUCE-IT event rates may not be predictive of

future results and related cost may increase beyond expectations;

the risk that regulatory reviews may impact the current design of

the REDUCE-IT study or cause a change in strategic direction with

respect to continuation of the study; the risk that future legal

determinations and interactions with regulatory authorities may

impact Vascepa marketing and sales rights and efforts; the risk

that Vascepa may not show clinically meaningful effects in

REDUCE-IT or support regulatory approvals for cardiovascular risk

reduction; and the risk that patents may not be upheld in

anticipated patent litigation. A further list and description

of these risks, uncertainties and other risks associated with an

investment in Amarin can be found in Amarin’s filings with the U.S.

Securities and Exchange Commission, including its most recent

Quarterly Report on Form 10-Q. Existing and prospective

investors are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

hereof. Amarin undertakes no obligation to update or revise

the information contained in this press release, whether as a

result of new information, future events or circumstances or

otherwise.

Availability of other information about

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (www.amarincorp.com), the investor relations website

(investor.amarincorp.com), including but not limited to investor

presentations and investor FAQs, Securities and Exchange Commission

filings, press releases, public conference calls and

webcasts. The information that Amarin posts on these channels

and websites could be deemed to be material information. As a

result, Amarin encourages investors, the media, and others

interested in Amarin to review the information that is posted on

these channels, including the investor relations website, on a

regular basis. This list of channels may be updated from time

to time on Amarin’s investor relations website and may include

social media channels. The contents of Amarin’s website or

these channels, or any other website that may be accessed from its

website or these channels, shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933.

References

1 American Heart Association. 2018. Disease and

Stroke Statistics-2018 Update.

2 American Heart Association. 2017.

Cardiovascular disease: A costly burden for America projections

through 2035.

3 Budoff M. Triglycerides and triglyceride-rich lipoproteins in

the causal pathway of cardiovascular disease. Am J Cardiol.

2016;118:138-145.

4 Toth PP, Granowitz C, Hull M, et al. High triglycerides

increase cardiovascular events, medical costs, and resource

utilization in a real-world analysis of statin-treated patients

with high cardiovascular risk and well-controlled low-density

lipoprotein cholesterol [abstract]. Circulation. 2017;136(suppl

1):A15187.

5 Nordestgaard BG. Triglyceride-rich lipoproteins and

atherosclerotic cardiovascular disease - New insights from

epidemiology, genetics, and biology. Circ Res.

2016;118:547-563.

6 Nordestgaard BG, Varbo A. Triglycerides and cardiovascular

disease. Lancet. 2014; 384: 626–635.

Amarin contact information

Investor Relations:Elisabeth Schwartz Investor

Relations and Corporate Communications Amarin Corporation plc

In U.S.: +1 (908) 719-1315 investor.relations@amarincorp.com

Lee M. Stern Trout Group In U.S.: +1 (646)

378-2992lstern@troutgroup.com Media Inquiries: Kristie Kuhl

Finn Partners In U.S.: +1 (212) 583-2791

Kristie.kuhl@finnpartners.com

| |

|

| |

|

| CONSOLIDATED BALANCE SHEET DATA |

|

| (U.S. GAAP) |

|

| Unaudited |

|

|

|

|

|

|

|

|

|

|

|

March 31, 2018 |

|

December 31, 2017 |

|

|

|

|

(in thousands) |

|

|

ASSETS |

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

129,049 |

|

|

$ |

73,637 |

|

|

|

Restricted cash |

|

|

600 |

|

|

|

600 |

|

|

| Accounts

receivable, net |

|

|

39,180 |

|

|

|

45,318 |

|

|

|

Inventory, net |

|

|

35,104 |

|

|

|

30,260 |

|

|

| Prepaid

and other current assets |

|

|

3,618 |

|

|

|

3,455 |

|

|

|

Total current assets |

|

|

207,551 |

|

|

|

153,270 |

|

|

|

|

|

|

|

|

|

| Property,

plant and equipment, net |

|

|

20 |

|

|

|

28 |

|

|

| Other

long-term assets |

|

|

174 |

|

|

|

174 |

|

|

|

Intangible asset, net |

|

|

7,964 |

|

|

|

8,126 |

|

|

|

TOTAL ASSETS |

|

$ |

215,709 |

|

|

$ |

161,598 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

| Accounts

payable |

|

$ |

31,877 |

|

|

$ |

25,155 |

|

|

| Accrued

expenses and other current liabilities |

|

|

61,311 |

|

|

|

58,902 |

|

|

| Current

portion of exchangeable senior notes, net of discount |

|

|

219 |

|

|

|

481 |

|

|

| Current

portion of long-term debt from royalty-bearing instrument |

|

|

24,370 |

|

|

|

22,348 |

|

|

| Deferred

revenue, current |

|

|

1,453 |

|

|

|

1,644 |

|

|

|

Total current liabilities |

|

|

119,230 |

|

|

|

108,530 |

|

|

|

|

|

|

|

|

|

| Long-Term

Liabilities: |

|

|

|

|

|

|

Exchangeable senior notes, net of discount |

|

|

29,047 |

|

|

|

28,992 |

|

|

| Long-term

debt from royalty-bearing instrument |

|

|

65,480 |

|

|

|

70,834 |

|

|

| Deferred

revenue, long-term |

|

|

17,459 |

|

|

|

17,192 |

|

|

| Other

long-term liabilities |

|

|

1,150 |

|

|

|

1,150 |

|

|

|

Total liabilities |

|

|

232,366 |

|

|

|

226,698 |

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit: |

|

|

|

|

|

| Preferred

Stock |

|

|

24,364 |

|

|

|

24,364 |

|

|

| Common

stock |

|

|

225,246 |

|

|

|

208,768 |

|

|

|

Additional paid-in capital |

|

|

1,036,697 |

|

|

|

977,866 |

|

|

| Treasury

stock |

|

|

(6,782 |

) |

|

|

(4,229 |

) |

|

|

Accumulated deficit |

|

|

(1,296,182 |

) |

|

|

(1,271,869 |

) |

|

|

Total stockholders’ deficit |

|

|

(16,657 |

) |

|

|

(65,100 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

215,709 |

|

|

$ |

161,598 |

|

|

|

|

|

|

|

|

|

| |

|

| CONSOLIDATED STATEMENTS OF OPERATIONS

DATA |

|

| (U.S. GAAP) |

|

| Unaudited |

|

| |

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

(in thousands, except per share

amounts) |

|

| |

|

|

2018 |

|

|

|

2017 |

|

|

| Product revenue, net |

$ |

43,777 |

|

|

$ |

34,344 |

|

|

| Licensing revenue |

|

142 |

|

|

|

293 |

|

|

| Total

revenue, net |

|

43,919 |

|

|

|

34,637 |

|

|

| Less: Cost of goods sold |

|

10,648 |

|

|

|

8,198 |

|

|

| Gross margin |

|

33,271 |

|

|

|

26,439 |

|

|

| |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

| Selling,

general and administrative (1) |

|

43,407 |

|

|

|

34,171 |

|

|

| Research

and development (1) |

|

11,762 |

|

|

|

10,823 |

|

|

| Total

operating expenses |

|

55,169 |

|

|

|

44,994 |

|

|

| |

|

|

|

|

|

| Operating loss |

|

(21,898 |

) |

|

|

(18,555 |

) |

|

| |

|

|

|

|

|

| Interest expense, net |

|

(2,252 |

) |

|

|

(2,381 |

) |

|

| Other income (expense), net |

|

55 |

|

|

|

(5 |

) |

|

| Loss from operations before taxes |

|

(24,095 |

) |

|

|

(20,941 |

) |

|

| (Provision for) benefit from income taxes |

|

— |

|

|

|

— |

|

|

| Net loss |

$ |

(24,095 |

) |

|

$ |

(20,941 |

) |

|

| |

|

|

|

|

|

| Loss per share: |

|

|

|

|

| Basic |

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

| Diluted |

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

| |

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

| Basic |

|

285,207 |

|

|

|

270,163 |

|

|

|

Diluted |

|

285,207 |

|

|

|

270,163 |

|

|

| |

|

|

|

|

|

|

(1 |

) |

Excluding non-cash stock-based compensation, selling, general

and administrative expenses were $40,205 and $31,343 for the three

months ended March 31, 2018 and 2017, respectively, and research

and development expenses were $11,202 and $10,300, respectively,

for the same periods. Excluding non-cash stock-based compensation

as well as co-promotion fees paid to the company's U.S.

co-promotion partner, selling, general and administrative expenses

were $31,134 and $26,111 for the three months ended March 31, 2018

and 2017, respectively. |

|

| |

|

|

|

|

|

| |

|

|

| |

RECONCILIATION OF NON-GAAP NET

LOSS |

|

| |

Unaudited |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Three months ended March 31, |

|

| |

|

|

|

(in thousands, except per share

amounts) |

|

| |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

| |

Net loss for EPS1 - GAAP |

|

$ |

(24,095 |

) |

|

|

$ |

(20,941 |

) |

|

| |

|

Non-cash

stock-based compensation expense |

|

|

3,762 |

|

|

|

|

3,351 |

|

|

| |

Adjusted net loss for EPS1 - non-GAAP |

|

$ |

(20,333 |

) |

|

|

$ |

(17,590 |

) |

|

| |

|

|

|

|

|

|

|

|

| |

1basic and diluted |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Loss per share: |

|

|

|

|

|

|

| |

Basic and diluted - non-GAAP |

|

$ |

(0.07 |

) |

|

|

$ |

(0.07 |

) |

|

| |

|

|

|

|

|

|

|

|

| |

Weighted average shares: |

|

|

|

|

|

|

| |

Basic and diluted |

|

|

285,207 |

|

|

|

|

270,163 |

|

|

| |

|

|

|

|

|

|

|

|

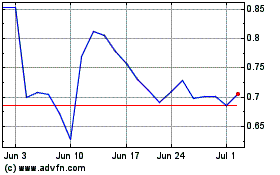

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

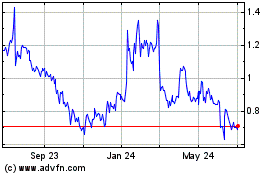

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024