Tariff Uncertainties Rattle Steel, Aluminum Producers

May 01 2018 - 2:54PM

Dow Jones News

By Andrew Tangel and Bob Tita

Shares in U.S. steel producers fell Tuesday after the Trump

administration pushed back a deadline to impose tariffs on imports

of steel and aluminum from some U.S. allies.

U.S. Steel Corp.'s shares fell more than 6% while Nucor Corp.

was off more than 2%.

Executives from both firms lobbied for duties on foreign steel

and aluminum, which they said they needed to compete with cheap

imports.

"Frankly we're disappointed. We were hoping for the action to be

taken last night," John Ferriola, chief executive of Nucor Corp,

told reporters in Washington. He said the exemptions apply to

countries that account for about two-thirds of steel imports and

this extension gives them "another month to get their steel into

the country."

Mr. Ferriola added that he was pleased that the administration

has said it won't extend the tariff exemption beyond this one

month

U.S. Steel didn't respond to a request for comment.

Shares in aluminum maker Alcoa Corp., meanwhile, were up about

2%. The Pittsburgh-based company made 14% of the aluminum it

produced last year in the U.S. and imports some of the metal it

sells here from Canada.

"We believe vital trading partners should be permanently exempt

from any tariff or quota on aluminum," the company said. "The

aluminum industry has an integrated supply chain and actions should

not penalize those that abide by the rules."

The White House said late Monday that tariffs of 25% on steel

and 10% on aluminum from the European Union wouldn't go into effect

as planned on Tuesday. Instead, the EU has another month to

continue negotiating with the U.S. about a new pact to avoid the

tariffs, which are already in effect against China, Russia, Japan

and others. Canada and Mexico were given an extension until June 1

while the North American Free Trade Agreement is renegotiated.

The delay is fueling uncertainty for metal producers in the U.S.

"Clearly more must be done to provide certainty to the market,"

said Heidi Brock, chief executive of the Aluminum Association trade

group. "We continue to call for permanent, quota-free

exemptions...for all countries designated as market economies."

Steel executives consider the tariffs on foreign steel as matter

of fairness. They said opponents to the duties fail to acknowledge

that U.S. steel exports face a variety of tariffs and taxes that

effectively keep U.S-made products from penetrating foreign

markets.

"I'm proud of the president that he finally stepped forward to

do something about this," said Tracy Porter, chief operating

officer for Commercial Metals Co. in Texas.

Metal-consuming companies will have to wait longer to know which

countries' imported steel and aluminum could face tariffs -- and

which of their suppliers might be selling metal at higher

prices.

The American Institute for International Steel, a manufacturing

trade group, said its members are already paying sharply more for

steel and seeing longer delivery times.

"A tariff -- or the threat of a tariff -- on the imports of a

product not only raises the price of the imported product, but also

allows the domestic industry to raise the price of its products,"

the group said.

Roger Newport, CEO of AK Steel Holding, said a combination of

quotas and tariffs are needed to block importers that are willing

to pay the tariff to get their steel into the U.S.

"Quotas are very important," he said. "We've seen trade cases

that there are countries that will pay through it."

Steel-industry executives stressed that imports have driven down

utilization of U.S. steel-making capacity. That has provided a

disincentive for U.S. steel makers to invest in their plants and

workforce expansions. The administration has set a target of 80%

capacity utilization as a goal of the tariff. Industry-wide

utilization has been in the mid-70% range.

"The industry can't reinvest in its facilities It can't grow, "

said Mark Millett, CEO of Steel Dynamics Inc.

Some steelmakers were heartened by the decision by South Korean

officials to accepted limits on exports as part of their

negotiations to avoid the blanket tariffs.

"We're hoping more of these quota deals are being negotiated,"

said Barry Zekelman, chief executive of Zekelman Industries Inc., a

steel-pipe maker in Chicago.

"The main uncertainty for the pipe sector was the status of

Korea and that's now been cleared up," added Piotr Galitzine, CEO

of Houston-based steel pipe producer TMK IPSCO.

--Josh Zumbrun contributed to this article.

(END) Dow Jones Newswires

May 01, 2018 14:39 ET (18:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

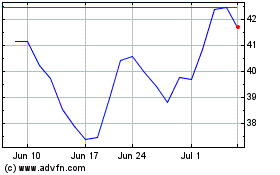

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

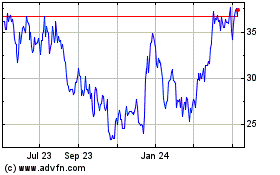

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024