Cable TV's Cord-Cutting Woes Deepen, Highlighting Divergence With Netflix

April 27 2018 - 2:05PM

Dow Jones News

By Shalini Ramachandran

Cable provider Charter Communications Inc.'s sour first-quarter

results delivered further evidence for Wall Street that stepped-up

cord-cutting and slower broadband customer growth are putting U.S.

telecommunications companies at a meaningful disadvantage to tech

giants like Netflix Inc.

The third-largest American pay-TV provider by subscribers said

it lost 122,000 video customers in the first quarter, a far worse

outcome than the roughly 40,000 subscriber losses Wall Street

analysts expected. In the year-earlier period, Charter lost 100,000

customers.

The results triggered an investor selloff, with Charter shares

down as much as 16% in late morning trading, the largest single-day

percentage decline since 2009. Shares recovered slightly and were

down 13% in early afternoon trading.

Charter's results follow similarly negative reports on

subscriber cord-cutting from its bigger rivals, Comcast Corp. and

AT&T Inc., this week. Comcast said Wednesday it lost cable TV

customers for the fourth-straight quarter due to heightened

competition from cheaper online TV services, and AT&T reported

video revenue declines as growth to its streaming service DirecTV

Now didn't offset higher-value satellite TV customer

defections.

The results have shaken investors' confidence that big telecom

companies' broadband customer growth will offset declines from

cord-cutting as time goes on. Charter reported Friday that its

broadband customer growth decelerated, echoing a similar trend at

Comcast and AT&T. Charter added 331,000 high-speed internet

customers, compared with an addition of 428,000 a year ago.

Investors are concerned that the troubling subscriber trends and

Comcast's recent bid for European pay-TV operator Sky PLC signal a

more fundamental problem: That American cable and telecom giants

don't have the assets and scale to hold their own against global

tech giants.

Netflix, which is a prime draw for cord-cutters and has been

expanding rapidly overseas, has been routinely beating Wall

Street's expectations for subscriber growth. Its already pricey

shares have soared 63% this year.

"Cable is currently out of favor, in large measure due to

Comcast's extracurricular activities," wrote veteran Wall Street

analyst Craig Moffett in a Friday research note.

The growing worries about cable and telecom firms have erased

chunks from the market values of Comcast, Charter and AT&T.

Since the beginning of February, Charter has lost more than $30

billion in market value, and AT&T has shed nearly $50 billion.

Comcast's market value has declined nearly $50 billion since late

January. Meanwhile, Netflix has gained more than $50 billion this

year.

Charter's results Friday weighed down other industry stocks.

Dish Network Corp. shares fell 3%, while Comcast and Liberty Global

PLC each fell 4%.

On a call with analysts Friday morning, Charter Chief Executive

Tom Rutledge said the company's optimistic vision for its future

growth hasn't changed. Charter executives continue to point to the

ongoing integration of Time Warner Cable and Bright House Networks,

both of which Charter bought in 2016, as a major source for much of

the weakness in subscriber results.

Mr. Rutledge said the integration has some "lumpy aspects to it

as we combine the companies in various ways," but he added "that

integration is actually going quite well and pretty much as

planned."

While subscriber results disappointed investors, Charter

increased earnings 8% to $168 million in the quarter, and overall

revenue grew 5% to $10.7 billion, helped by broadband revenue

growth, cable bill increases and ad revenue growth. Earnings per

share grew to 70 cents from 57 cents a year ago. Profit and revenue

fell short of Wall Street estimates of 98 cents a share on $10.8

billion in revenue, according to analysts polled by Thomson

Reuters.

(END) Dow Jones Newswires

April 27, 2018 13:50 ET (17:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

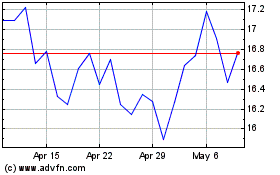

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

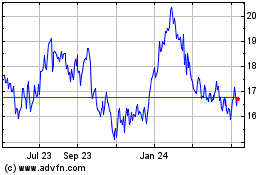

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024