By Ted Greenwald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 27, 2018).

Intel Corp.'s quarterly profit surged as the chip giant showed

no impact of revelations earlier this year of critical security

flaws in its processors.

Profit in the first quarter grew by 50% from a year earlier to

$4.45 billion. Revenue rose 9% to $16.07 billion.

Sales in the division responsible for server chips and other

data-center gear rose 24%, notching important growth in the highly

profitable segment. Intel is leaning on the unit, which typically

makes up around one-third of its revenue, as sales of personal

computers give way to mobile devices and smart speakers.

Sales of data-center equipment to cloud providers grew 45% from

a year earlier, while sales to network operators were up more than

30%. Enterprise sales edged up 3%, the company said.

Executives on its conference call attributed that growth to

corporate spending to keep proprietary data on-site rather than in

the cloud.

Revenue from the division that sells chips for PCs, which

generally makes up more than half of revenue, rose by 3%, despite

declining PC shipments in the quarter, according to Gartner

Inc.

Intel's shares were up 5.3% to $55.86 after hours. The stock has

gained 15% this year and 44% over the past 12 months.

The chip giant raised its full-year revenue forecast nearly 4%

to $67.5 billion, and raised its earnings outlook based on strong

revenue growth, lower spending and a lower tax rate. It also

boosted its operating margin projection to 29% from its prior

forecast of 28%.

The quarter's results and raised forecast show "the acceleration

of our transformation from a PC-centric company to a data-centric

company," Intel finance chief Bob Swan said in an interview.

Intel's progress has hit a snag, though, as it has slowed its

shift to a next-generation manufacturing recipe designed to produce

smaller, more powerful circuitry. The company now expects the new

10-nanometer process to reach volume production in 2019, instead of

this year.

"Yields are improving," Mr. Swan said, but they are "not

improving at the rate we anticipated." The delay has let competing

chip foundries narrow a manufacturing lead that long has been a key

Intel advantage.

The otherwise positive results came despite the revelation in

January of security flaws that afflict a wide variety of

processors, including virtually all the ones Intel made in the past

decade.

The flaws hit Intel especially hard, as it holds around 95%

market share in chips for PCs and servers, according to Mercury

Research.

Intel has said the problem would have no material impact on its

finances, and it would fix the vulnerabilities in new chips due

this year. The chip maker earlier in April said it had issued

firmware updates addressing two of the three known flaws, known as

Spectre and Meltdown, for all its affected processors introduced in

the last nine years.

Intel's overwhelming dominance in processor chips makes it a

target for Advanced Micro Devices Inc., which has been rolling out

competitive products for the first time in years, recently shipping

its second generation of desktop chips.

AMD reported Wednesday revenue in its division that sells PC

chips ballooned 95% in the first three months of 2018, a sign the

business is gaining traction. AMD said profit came to $81 million,

compared with a $33 million loss a year ago.

Intel scored a coup against its rival, though. Jim Keller,

architect of AMD's latest chips as well as heading Tesla's

Autopilot system and developing chips for Apple Inc.'s iPhones, is

joining Intel as head of hardware engineering. He will be reunited

at Intel with Raja Koduri, his partner at AMD and Apple, who joined

as chief chip architect in November.

And with PC sales in persistent decline, Intel is forging into

new markets in search of faster growth.

Memory-chip revenue grew 20% from a year ago, but the division

failed to notch its second consecutive quarter of profit largely

because of investments in manufacturing capacity, Mr. Swan said.

Intel's finance chief said he expects the memory division would be

profitable for the full year.

Revenue in the internet-of-things segment, which sells chips

that outfit a variety of devices with computing and communications

capabilities, was up 17%, while sales in the division that sells

programmable chips rose by the same margin.

Excluding items such as restructuring and acquisition-related

costs, Intel reported per-share earnings of 87 cents. Analysts

surveyed by Thomson Reuters had expected adjusted earnings of 72

cents a share on revenue of $15.07 billion for the quarter.

For the current quarter ending in June, the company forecast

adjusted per-share earnings of 85 cents on revenue of $16.3

billion.

Corrections & Amplifications Sales in the division

responsible for server chips and other data-center gear rose 24%,

notching important growth in the highly profitable segment. An

earlier version of this article incorrectly stated the rise was

25%. (April 26, 2018)

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

April 27, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

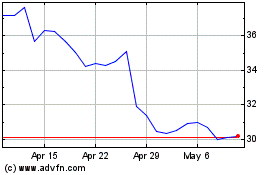

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

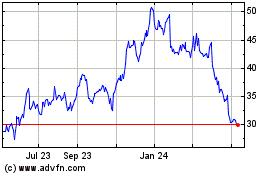

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024