FORM

6-K

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

of

the Securities Exchange Act of 1934

For the month of

April 2018

|

(Translation of registrant's name into English) |

|

Suite 3400 - 666 Burrard St.

Vancouver, British Columbia V6C 2X8 Canada |

(Address of Principal executive offices) |

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

| |

Note: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders. |

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ___

| |

Note: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of

the home country exchange on which the registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

GOLDCORP INC. |

| |

|

| Date: April 25, 2018 |

|

/s/ Anna M. Tudela |

| |

Name: Anna M. Tudela |

| |

Title: Vice-President, Regulatory Affairs

and

Corporate Secretary

|

Exhibit

Index

Exhibit 99.1

Goldcorp Provides First Quarter 2018 Exploration Update

VANCOUVER, April 25, 2018 /CNW/ - GOLDCORP INC. (TSX:

G, NYSE: GG) ("Goldcorp" or the "Company") is pleased to provide an update on its 2018 exploration program.

Representative drill results are provided below; website links to further information including full drill results, drill coordinates,

quality assurance and quality control information and relevant diagrams are provided at the end of each section.

Highlights

| · | Cerro Negro's Silica Cap target continues to return

positive results including 7.47 m at 121.75 g/t gold and 275.20 g/t silver (SCDD-18054). Expecting maiden mineral resource

estimate in 2018. 2018 exploration budget of $20 million will be used to continue accelerated testing of early-staged targets and

expansion of current known veins. Optimization study continues and is expected to be completed by the end of 2018. |

| · | Santa Rosa target initial drilling near Peñasquito

intersected mineralized intervals of 164 m at 1.06 g/t gold from 212 m (SRD-19-18) along with higher grade intercepts of skarn

mineralization of 22 m at 3.46 g/t gold from 408 m. Goldcorp has also signed a letter of intent with Minera Frisco, S.A.B. de C.V.

outlining a proposed joint venture to jointly explore key regional targets in the Mazapil Valley near Peñasquito. |

| · | Commencement of drilling at Norte Abierto. A

total of 13 holes for 11,868 meters have been completed. Drilling program is expected to confirm the geological model, provide

geotechnical data and metallurgical samples for Cerro Casale and Caspiche, and initiate a reconnaissance program on the Luciano

advanced target. |

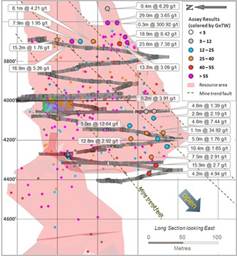

| · | Musselwhite continues to return positive drill

results to support mineral reserve growth in 2018 and identifies new exploration opportunities down-plunge at Lynx North and

Redwing. Recent holes from PQ Deeps included 10.6 m at 18.2 g/t gold (18-PQE-016) and 11.7 m at 18.40 g/t gold (18-PQE-017). |

| · | Continued underground drilling at HG Young (Red

Lake Camp) confirmed down plunge continuity of the deposit with mineralized intercepts including 0.91 m at 158.52 g/t gold

(D142074). Updated mineral resource estimate is expected in the third quarter of 2018 and starter mine plan by the end of 2019. |

| · | Coffee Mineral Resource Update: 2017 drill

programs added several new deposits to the Coffee mineral resource inventory and upgraded Kona North to indicated mineral resource

classification, resulting in an indicated mineral resource estimate of 4.65 Mt at 1.17 g/t gold for 180,000 ounces, and an inferred

mineral resource estimate of 9.6 Mt at 0.99 g/t gold for 300,000 ounces. 2018 drill programs are already underway with a focus

on expanding the known mineralized areas and converting mineral resources into mineral reserves. |

"We are very excited about the 2018 exploration program

which got underway during the first quarter. The exploration strategy remains unchanged with a focus on reserve replacement and

new target generation," said Paul Harbidge, Senior Vice-President, Exploration. "Leveraging the success we had in 2017

in advancing new targets such as Amerikona at Coffee, and Silica Cap at Cerro Negro, we have an aggressive program ahead of us

this year to advance targets from our core assets through conversion of resources into reserves. I'm very confident in our ability

to reach our targeted 20% increase in reserves by 2021."

Exploration at Goldcorp's operating and developing mines continued

with drilling programs primarily aimed towards updating mineral resource and mineral reserve estimates as part of our annual cycle

at the end of the third quarter 2018, and identification of additional mineral resource growth opportunities within near mine locations.

A renewed generative exploration focus is also underway at all sites towards making new discoveries on the Company's large, highly

prospective and under-explored regional landholdings which surround the Company's under-utilized industrial processing complexes.

The key exploration highlights from select operations are presented below.

Cerro Negro Camp

Exploration work at Cerro Negro (100% owned, Argentina)

during the first quarter of 2018 primarily concentrated on further drilling the advanced target of Silica Cap. A first drill program

was also initiated on the Vein Zone 'Deep' target, to test the continuity of high grade mineralization at depth.

By the end of the first quarter of 2018, a total of eight

diamond drill rigs and one reverse circulation ("RC") drill rig were operational on surface at Cerro Negro. A summary

of drilling completed during the first quarter is presented in Table 1.

Table 1: Summary of drilling completed by target

during Q1 2018

| Target |

Number of holes |

Meters |

Samples |

| Silica Cap |

97 |

29,298.0 |

6,221 |

| Vein Zone Deep |

2 |

1,469.0 |

123 |

| Mariana NEB |

2 |

650.0 |

233 |

| Mariana NEA |

1 |

360.0 |

216 |

| Eureka Norte |

2 |

550.0 |

407 |

| Total |

104 |

32,327.0 |

7,200 |

Additional exploration work during the first quarter comprised

detailed structural mapping, modelling of airborne electromagnetic geophysical data along with field campaigns of surface geochemistry

and ground geophysics.

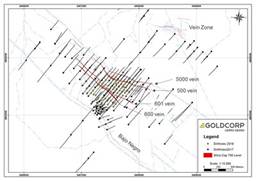

The Silica Cap complex is a northwest-trending vein

system 10.5 km southeast of the Mariana Central area and 3.6 km south of the processing plant. To date, three sub-parallel epithermal

veins, 500 (Silica Cap), 600 (Gato Salvaje), and 601, along with several ancillary subparallel and north-northwest-trending structures

have been defined within the Silica Cap complex (Figure 1).

The 500 vein has now been defined along a strike extent of

approximately 1,800 m, the 600 vein along a strike extent of approximately 1,100 m, and the 601 vein along a strike extent of approximately

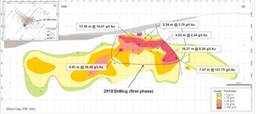

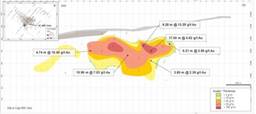

1,500 m. Mineralization is generally confined vertically between elevations of 450 m to 850 m. Within the 500 vein,

a 400 m by 100 m high-grade chute plunging roughly 30° to the south-east has been defined (Figure 2). Similarly, a 500

m by 100 m higher-grade area has been defined within the 600 vein (Figure 3).

The true width of the 500 vein is generally between 5 m and

10 m, although shallow intercepts have encountered high-grade mineralization across larger widths in areas where the structure

bifurcates and/or is cross-cut by syn-mineral, north-northwest-trending structures. The 600 and 601 veins, subparallel veins

to the south of the 500 vein, average approximately 8 m and 6 m in width, respectively.

Selection and dispatch of 32 samples for initial metallurgical

testing was completed during the first quarter. The geometallurgical samples are distributed across pertinent areas of the 500,

600, and 601 veins. The test work is being conducted by SGS Chile with final results expected in May, 2018.

Golder Associates Inc. began geotechnical work on the project

in February 2018 to support potential future mine development and data for resource calculations.

A selection of results from the first quarter of 2018 drilling

is presented in Figures 2 and 3; and Tables 2, 3, 4, 5 and 6 in the appendix.

Results during the first quarter have provided better definition

in the higher elevations of the target and have illuminated the importance of syn-mineral, north-northwest-trending structures

in having generated ancillary veining in the footwall and hangingwalls of the principal mineralized veins. Mineralized widths

and tenor of the 600, 601, and aforementioned ancillary structures outside of the 500 vein, have been more important than anticipated.

Figure 1: Plan map illustrating the Silica Cap

complex 600, 601, 500 and 5000 veins. (Link to figure)

Figure 2: Longitudinal section of the Silica

Cap 500 vein. (Link to figure)

Figure 3: Longitudinal section of the Silica

Cap 600 vein (Gato Salvaje). (Link to figure)

The down dip extension of the primary Vein Zone system

was a target for reserve and resource expansion drilling during the first quarter of 2018.

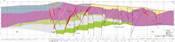

A cross section of the Bajo Negro – Silica Cap –

Vein Zone system is presented in Figure 4, with the Vein Zone system positioned at the northeast (NE) end of the section; a summary

table of significant intercepts is presented in Table 7.

Figure 4: SW-NE Section across the Bajo Negro

– Silica Cap – Vein Zone system. (Link to figure)

Resource drilling at Silica Cap, Vein Zone Deep, San Marcos

and Mariana Norte Este-B will continue during the second quarter of 2018. Exploration drilling on identified targets has

begun on a limited scale with one RC rig, and is scheduled to ramp up later in the second quarter as the cycle for the 2018 mineral

reserve and mineral resource drilling winds down. On the regional exploration front, soil sampling programs, as well as ground

magnetic surveys, are underway to provide additional data layers to generate and prioritize future targets.

Cerro Negro – Q1-2018 Drilling Results; Coordinates

(link)

Peñasquito Camp

The principal focus of exploration during the first quarter

of 2018 at Peñasquito (100% owned, Mexico) was the commencement of a first pass reconnaissance diamond drill program

over the Santa Rosa target, a follow-up exploration target 20 km to the east-southeast of the Peñasquito mine.

In February 2018, Goldcorp signed a letter of intent with

Minera Frisco, S.A.B. de C.V. outlining the general terms and conditions of a proposed joint venture. The objective of the

joint venture will be to amalgamate exploration ground in the Mazapil Valley, where numerous targets have been jointly defined.

Negotiations relating to the definitive joint venture agreement are underway.

In addition to concessions owned by Goldcorp, the Santa

Rosa project area consists of option agreements with J. Gonzalez (315 ha) and Maverix Metals Inc. (2,695 ha) where Goldcorp

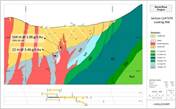

owns a majority interest. The Santa Rosa system is interpreted as a quartz porphyry complex intruding a contemporaneous volcanic

pile underlain by Lower Jurassic to Upper Cretaceous carbonate stratigraphy (Figure 5).

Historical mining at Santa Rosa exploited high grade carbonate

hosted mineralization from surface through to a depth of approximately 350 m. Based on estimates of historical information,

which is not compliant with National Instrument 43-101, roughly 150,000 tonnes of ore was treated with approximately 150,000 ounces

of gold and 1 million ounces of silver produced before closure of the operation in the early 1980's.

A seven hole, 5,000 m diamond drill program commenced in January

2018, and was mostly complete by the end of the first quarter of 2018. The drilling was designed to test the potential of

west-northwest trending dacite porphyry dykes to host mineralization along with their potential to have generated skarn mineralization

where they interface with favorable carbonate stratigraphy at depth (Figure 5). Assay results have been returned for four

holes (Table 8).

The mineralized intervals correspond to disseminated, intrusive

hosted mineralization within dacite porphyry dykes (SRD-20-18: 164 m at 1.06 g/t gold from 212 m) along with higher grade intercepts

of skarn mineralization (22 m at 3.46 g/t gold from 408 m). Currently, three holes have intersected mineralization and define

the following dimensions: 100 m to 400 m below surface and over a strike of 300 m. The zone is located 600 m west of historical

mine workings and remains open along strike and at depth.

Although the holes which have intersected mineralization were

targeted to intersect the dykes at perpendicular angles, further drilling will be required to determine extent, true width and

geometry of mineralization (Figure 6).

Figure 5: Santa Rosa geology map with 2018 drill

hole traces. (Link to figure)

Figure 6: Santa Rosa section 247370 with significant

apparent drill width intercepts marked. (Link to figure)

Peñasquito – Q1-2018 Drilling Results; Coordinates

(link)

Norte Abierto Camp

Norte Abierto (50% owned, Chile) commenced a first

drill program on its Chilean project during the first quarter of 2018. Nine diamond core rigs and one RC rig were operational at

the end of the quarter. A total of thirteen holes for 11,868 m have been completed; and a further eight holes for a total 2,785

m are in progress. The purpose of the drilling program is threefold: 1) to confirm the geological model; 2) to provide geotechnical

data and metallurgical samples for the two main deposits of Cerro Casale and Caspiche; and 3) to initiate a reconnaissance program

on the Luciano advanced target. Assay results for all holes are pending.

A relogging program of diamond drill core is progressing well

on both the Caspiche (52,620 m) and Cerro Casale (41,068 m) deposits to update the geological models. As well as the relogging

program, hand held Terraspec® and Corescan® technology are aiding the geological work especially

in developing the alteration model and the clay speciation. A detailed surface geological map has also been completed.

The Caspiche geological model is currently the most advanced.

The deposit is associated with a sequence of subvolcanic magmatic pulses of dioritic and quartz-dioritic composition that intrude

a stratigraphic sequence of volcanogenic rocks. The location of these intrusive bodies is controlled by northwest structures which

have been sinistrally reactivated creating dilation. The developing understanding of intrusive phases, alteration assemblages and

their relationship to mineralization will be used to inform mineral resource estimation and exploration decision-making.

At Luciano, a review of historical drill holes (2,965 m) has

revealed similarities in host rock, alteration and mineralization as both the Cerro Casale and Caspiche deposits. A phase

1 diamond drill hole program is underway to test this high priority exploration target.

Figure 7: Norte Abierto Geology and Exploration programs.

(Link to figure)

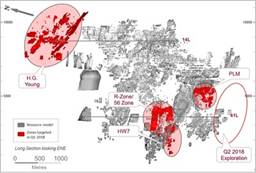

Red Lake Camp

Exploration activity in Red Lake (100% owned, Canada)

concentrated on three areas: Campbell-Red Lake, HG Young and Cochenour.

Underground exploration development at Campbell-Red Lake

during the fourth quarter of 2017 and during the first quarter of 2018 focused on creating improved access to the eastern portions

of the mine to further explore the PLM, Lower R and 56 zones, and the HW7 zone (Figure 8). Work on the PLM and HW7 targets

is at an early stage, with assays currently pending and work underway to update the geological model. Preliminary results

received to date indicate that the drilling has confirmed the geological model and extended potential mineralization in some areas.

Figure 8: Long section of all Campbell -

Red Lake mineralized zones, looking east-northeast, highlighting the PLM, Lower R/56 and HW7 zones drilled during Q1-2018. HG Young

is also shown, which is located 2.1 km to the northeast of the Campbell-Red Lake underground mine complex (Link to figure)

The Lower R and 56 Zones are located in the corridor between

the regional RL01 and Dickenson faults, hosted within basalt and komatiitic-basalt. The "R" Zone drilling is focused

on reserve conversion, while the "56" Zone, which is located in the footwall of the Dickenson Fault, remains open at

depth and drilling is underway to test the down-dip potential. Assay results from the fourth quarter 2017 drilling in the

R and 56 zones included numerous high grade intercepts and preliminary interpretation to support both potential conversion of resources

to reserves, and expansion of resources. Assays Assayare summarized in Table 9, with comprehensive assays provided at the

link below.

Exploration in the second quarter of 2018 will focus on completing

mineral reserve conversion drilling and continued extension of drill development access to enable step-out drilling in the eastern

portions of the mine which host favorable geologic and structural target zones, but which remain underexplored.

Campbell - Red Lake – Q1-2018 Exploration Results; Coordinates

(link)

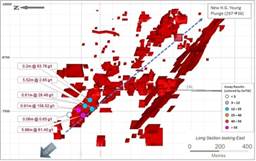

During the first quarter of 2018, work at HG Young

initially focused on the rehabilitation of underground mine access on 14 Level and the excavation of drill bays for infill drilling.

As rehabilitation was completed, geological teams were able to commence underground mapping and drilling to confirm the updated

geological model developed in 2017. The main focus of drilling is the delineation of the plunge control on mineralization

between 9 Level and 21 Level (400 m to 1,600 m below surface), which is defined by the intersection of the HG Young Shear and Mine

Trend Faults, and expansion of mineralization up and down-plunge.

By the end of the first quarter 2018, a total of 17 holes

for 4,494 m had been completed, comprising of infill drilling of the main plunge of the HG Young shear zone which tested an area

covering 140 m of strike and 90 m down dip (Figure 9). Results returned to date confirm the geological model and plunge continuity

of the system. Mineralization is hosted within a deformation corridor consisting of multiple northwest plunging pinch and swell

shear hosted mineralized envelopes. High grade mineralization is associated with stacked quartz-scheelite veins. Lesser

sulphide replacement style zones were also intersected outside of the main strain area and oriented parallel to Mine Trend Faults.

Highlight drill intercepts A selection of drill intercepts are summarized in Table 10 of the appendix, with comprehensive assays

provided at the link below.

Execution of the 2018 $11.5 million exploration budget at

HG Young will continue during the second quarter of 2018 with 65 holes and 23,800 m of drilling planned from surface and underground

in order to advance exploration and conceptual mining studies on this high priority target. The Company expects to commence

the development of the preferred material handling system to facilitate production and expects to provide parameters for a starter

mine plan by late 2019.

Figure 9: Long section of HG Young, looking

east, showing drill pierce points returned during Q1-2018. (Link to figure)

HG Young – Q1-2018 Exploration Results; Coordinates

(link)

In the first quarter of 2018 at Cochenour, infill drilling

within the UMZ South zone at Upper Cochenour was completed, as well as sub level definition drilling of future production stopes.

Drilling was also undertaken at Lower Cochenour with the objective of converting additional mineral resources into mineral reserves.

Gold assay results returned from the first quarter of 2018 definition drilling continue to confirm the geological model and

the project remains on track to increase the mineral reserve estimate ahead of planned commercial production in 2019. Drilling

assays are located at the link below.

Exploration of new zones, including the intersection of the

Cochenour Fault and Mine Trend Faults, returned encouraging results. Together with other targets, including the northern banded

iron formation, the down plunge extensions of the UMZ zone and exploration along the 'Gold Eagle Shear', these zones will be the

focus of future exploration programs. In the second quarter of 2018, exploration will continue to focus on infill and expansion

of the UMZ South zone in Upper Cochenour.

Figure 10: Upper Cochenour UMZ South long

section, looking east, showing Q1-2018 intercepts in UMZ1 mineralized zone. Intercepts are coloured by grade x true width

(m). (Link to figure)

Cochenour – Q1-2018 Drilling Results; Coordinates (link)

Musselwhite Camp

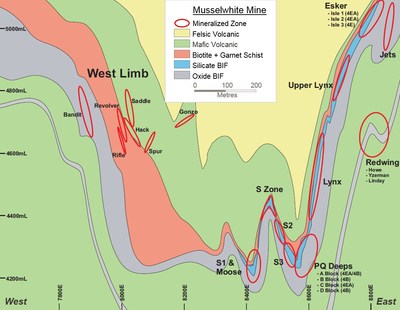

At Musselwhite (100% owned, Canada), the Company continued

evaluating near-mine targets with five drills testing mineral reserve and mineral resource extensions from underground infrastructure.

Drilling totalled 12,195 m during the first quarter of 2018, primarily completed in support of the 2018 mineral reserve replacement

target. In addition, data compilation and interpretation continued to develop and identify new targets in an underexplored

regional landholding.

During the first quarter of 2018, underground mine exploration

was focused on completing resource conversion drilling in the West Limb, C Block portion of PQ Deeps and the Lynx North area.

Figure 11: Musselwhite mine generalized cross

section looking north. (Link to figure)

Twenty-five infill and step out holes were drilled underground

during the first quarter of 2018 on the C-Block zone of PQ Deeps. Drilling has now tested a 150 m down plunge extension from

the 2017 mineral reserve cut-off point, with a further 1,100 m strike distance remaining to be fully explored towards the north

shore intercepts reported in 2017. Gold assays continued to return encouraging results, comprising wide mineralized intercepts

in the synform closure of the PQ limb fold. Drilling is nearing completion, following which, mine development will move forward

to prepare drill platforms for future down-plunge step-out and mineral resource definition drilling. Highlight drill intercepts

A selection of drill intercepts are summarized in Table 11 of the appendix, with comprehensive drill assays provided at the link

below.

Nine infill holes were completed at the Lynx North zone during

the first quarter. Drilling is now focussed on evaluating a 300 m down plunge extension of mineralization. A step out

drill hole located 350 m down plunge confirmed the potential of this zone, returning a true width intersection of 7.40 g/t gold

over 4.7 m (18-PQE-011).

The Redwing geological model was also completed during the

first quarter of 2018. The Redwing-Thunder Wolves–Southern Ironstone Formation ("SIF") stratigraphic horizon

offers the potential for over 3 km of continuous mineralization close to existing underground development on the northeast limb

of the main Musselwhite Synform. The Redwing portion of this horizon has now been defined over a plunge extent of 600 m.

Underground development is now in progress to open up additional mining fronts and exploration drill platforms. In addition

eight drillholes targeting the Lynx North zone were extended to intersect the deeper SIF horizon. Approximately 3 km down

plunge from previous drilling, drill hole 17-LNX-106 returned 5.0 m at 7.35 g/t gold thereby confirming the geological model and

plunge continuity. Further drilling is planned on this high priority mineralized structure.

Musselwhite regional exploration focused on geological

modelling of the Karl Zeemal target, located 8 km southeast of the Musselwhite mine, during the first quarter of 2018. Work

comprised relogging and re-assaying of the historic drill core. An updated geological estimate is in progress ahead of a Phase

1 drill campaign, scheduled for the second quarter of 2018, pending receipt of all regulatory permits for trail construction.

Drilling positioned from the north shore of Opapamiskin Lake,

targeting the deep down-plunge extensions of the Musselwhite mine trend, will re-commence during the second quarter of 2018.

This program will target both the PQ Deeps and the West Limb structural/stratigraphic positions. The PQ Deeps drilling will

step north to follow up on, and extend, the results from the 2017 program. The West Limb drilling will step 1 km north from

the previous most northerly section of known West Limb mineralization.

Review of three historical zones, West Anticline, Camp and

Bay, has also begun. These areas of mineralization are located within a 1.5 km corridor, to the west of current mine infrastructure

under Opapamiskin Lake. All three zones are hosted in recumbent folds of banded, chert magnetite iron formation. The

Camp/Bay areas will be tested with underground drilling during the third quarter of 2018, and the down-plunge extension of the

West Anticline will be tested from the ice during the first quarter of 2019.

Regional geologic data compilation and targeting on the Company's

landholding in the North Caribou Greenstone Belt is underway. The 2018 field program will consist of mapping and prospecting

with rock and soil sampling.

Musselwhite – Q1-2018 Drilling Results; Coordinates

(link)

Coffee Camp

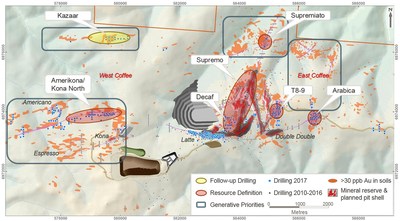

During the first quarter of 2018, the Coffee (100%

owned, Canada) exploration team prepared to execute an exploration budget of $11.4 million for 2018. Drilling activities recommenced

in early March with two RC drills currently operating on the property. The 2018 program will continue to explore a portfolio

of near-surface, oxide gold targets ranging from those within the planned mine footprint to new grassroots targets, and infill

drilling to potentially upgrade select portions of the inferred mineral resources to the indicated mineral resource classification

(Figure 12).

In 2017 Goldcorp completed its first full season of drilling

at Coffee, which resulted in the upgrade of the Latte open pit mineral resources from indicated to measured classification, and

the discovery of new 'satellite' open pit opportunities where follow-up exploration included step-out and infill drilling to generate

new mineral resource estimates. The five new deposits delineated from the 2017 drilling are Arabica, Supremo T8-9 and Supremiato

(which were included in the June 30, 2017 mineral resource update published October 25, 2017), and new discoveries at Amerikona

and Decaf which were modelled following conclusion of the 2017 drilling season. In addition, 2017 infill drilling at Kona

North, which lies along strike and connects with Amerikona, is included in this updated Coffee mineral resource, now upgraded to

predominantly indicated resources. The new deposits added in 2017, along with the Kona North infill drilling, generated a mineral

resource estimate of 4.65 Mt at 1.17 g/t gold for 180,000 ounces indicated and 9.6 Mt at 0.99 g/t gold for 300,000 ounces inferred

(all mineral resources contained within a $1,400/oz pit shell, compared to $1,500/oz in the previous resource estimate).

All new deposits comprise predominantly near surface oxide mineralization potentially amenable for future open pit extraction,

and remain the target of ongoing evaluation for mineral resource expansion along strike in 2018.

Table 12: Mineral Resource estimate for Coffee Gold

Project, effective April 25, 2018, including new mineral resource additions from 2017 drilling programs, constrained to $1,400/oz

open pit shell.

| Zone |

Measured |

Indicated |

Inferred |

| |

mt |

g/t |

m oz |

mt |

g/t |

m oz |

mt |

g/t |

m oz |

| Amerikona*/Kona North |

- |

- |

- |

1.33 |

2.19 |

0.09 |

3.69 |

1.27 |

0.15 |

| Arabica |

- |

- |

- |

1.58 |

0.66 |

0.03 |

3.76 |

0.64 |

0.08 |

| Decaf* |

- |

- |

- |

- |

- |

- |

1.28 |

1.39 |

0.06 |

| Double Double |

- |

- |

- |

0.84 |

1.74 |

0.05 |

0.50 |

2.18 |

0.04 |

| Kona |

- |

- |

- |

1.01 |

0.96 |

0.03 |

0.31 |

1.56 |

0.02 |

| Latte |

3.70 |

1.31 |

0.16 |

1.84 |

1.43 |

0.09 |

5.22 |

1.40 |

0.24 |

| Supremiato |

- |

- |

- |

1.33 |

0.95 |

0.04 |

- |

- |

- |

| Supremo |

- |

- |

- |

8.32 |

1.31 |

0.35 |

7.72 |

1.63 |

0.41 |

| Supremo T8-9 |

- |

- |

- |

0.42 |

0.69 |

0.01 |

0.76 |

0.65 |

0.02 |

| Total |

3.70 |

1.31 |

0.16 |

16.67 |

1.29 |

0.69 |

23.24 |

1.33 |

0.99 |

| |

|

| Notes: |

|

| 1) |

*Table contains maiden mineral resource estimates for Amerikona and Decaf. |

| 2) |

Coffee mineral resources are exclusive of mineral reserves; Coffee Probable Mineral Reserve as of 30 June 2017 totals 46.36Mt at 1.45g/t Au for 2.16Moz gold (published October 25, 2017). |

| 3) |

Mineral resources for Latte, Supremo, Double Double, Kona, Arabica, Decaf, Supremo T8-9 and Supremiato were estimated by Robert Sim, P.Geo., an external consultant and Qualified Person as defined under National Instrument 43-101. |

| 4) |

Mineral resources for Amerikona/Kona North were estimated by Erik Scheel P.Geo., Senior Geologist at Goldcorp and Qualified Person as defined under National Instrument 43-101. |

| 5) |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resource estimate will be converted into mineral reserves. |

| 6) |

All tonnes and ounces in figures in Table 12 have been rounded to the nearest thousand to reflect the relative accuracy of the estimates. |

The Coffee mineral reserve and mineral resource estimate will

again be updated in the third quarter of 2018. Geological re-interpretation and infill drilling is currently underway at

the Supremo deposit to provide additional confidence in the distribution and continuity of high grade breccia zones and classification

of the mineral reserves.

Exploration for additional mineral resources at Coffee will

continue to focus on defining and extending the new oxide mineralized zones discovered in West Coffee during 2017, including the

Amerikona zone which lies on the 4 km strike length Americano to Kona North structural corridor.

Generative exploration planned for 2018 over Coffee, in addition

to systematic VLF-EM surveying, will include up to 10,000 soil samples to follow-up on and expand new gold-in-soil anomalies which

were identified from the 2017 soil sampling program. Only approximately 30% of the Coffee property has been systematically

sampled, and soil sampling remains the primary tool in delineating zones of subsurface bedrock mineralization.

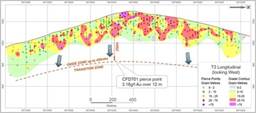

In addition to the focus on near surface open pit extractable

oxide gold mineralization, the Coffee team will also continue to test the down-dip potential of the mineral system. A single

diamond core drill hole, CFD701, which stepped-out 250 m down-dip beneath the Supremo T3 deposit in 2017, returned 3.16 g/t gold

over 12 m downhole width, with intersected mineralization completely oxidized at 450m vertical depth below surface (Figure 13).

Additional drilling is planned to continue exploration for high grade plunging mineralized shoots, and to determine the depth profile

of oxidation along strike on the T3 structure.

Figure 12: Coffee Project drilling location

map and planned future mine infrastructure. Drill collars highlighting drilling completed in 2017. (Link to figure)

Figure 13: Supremo T3 long section, looking

west. Drill hole pierce points and contouring is coloured by g/t gold x thickness (gram meters), indicating contiguous zones

of steeply plunging high grade mineralization. (Link to figure)

APPENDIX

Table 2: Intersections for the Silica Cap 600

(Gato Salvaje) vein.

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| SCDD-18021 |

SC-600 |

284.00 |

286.00 |

2.00 |

2.00 |

3.80 |

9.20 |

| SCDD-18021 |

SC-600 |

331.50 |

338.90 |

7.40 |

5.88 |

2.54 |

17.46 |

| SCDD-18021 |

SC-600 |

360.00 |

361.00 |

1.00 |

1.00 |

4.03 |

6.15 |

| SCDD-18045 |

SC-600 |

297.25 |

310.00 |

12.75 |

10.96 |

7.03 |

17.26 |

| SCDD-18061 |

SC-600 |

225.10 |

230.85 |

5.75 |

4.74 |

16.49 |

35.65 |

| SCDD-18066 |

SC-600 |

198.20 |

211.50 |

13.30 |

9.28 |

13.20 |

113.45 |

| SCDD-18067 |

SC-600 |

252.50 |

268.80 |

16.30 |

9.21 |

2.90 |

8.19 |

| SCDD-18071 |

SC-600 |

144.00 |

157.70 |

13.70 |

8.86 |

8.73 |

18.95 |

| SCDD-18074 |

SC-600 |

205.00 |

219.00 |

14.00 |

9.89 |

6.69 |

33.19 |

| SCDD-18075 |

SC-600 |

330.30 |

333.30 |

3.00 |

1.73 |

2.06 |

11.80 |

| SCDD-18077 |

SC-600 |

358.40 |

364.00 |

5.60 |

3.68 |

1.03 |

18.21 |

| SCDD-18079 |

SC-600 |

360.70 |

371.50 |

10.80 |

8.61 |

4.94 |

26.10 |

| SCDD-18084 |

SC-600 |

294.15 |

309.00 |

14.85 |

9.22 |

2.14 |

27.40 |

| SCDD-18090 |

SC-600 |

347.60 |

353.90 |

6.30 |

5.55 |

9.79 |

27.60 |

| SCRC-18023 |

SC-600 |

107.00 |

113.00 |

6.00 |

6.00 |

9.68 |

30.50 |

| SCRD-18027 |

SC-600 |

355.30 |

360.00 |

4.70 |

3.85 |

2.30 |

19.40 |

| SCRD-18038 |

SC-600 |

217.65 |

237.50 |

19.85 |

17.05 |

4.62 |

9.90 |

| SCRD-18041 |

SC-600 |

415.70 |

418.50 |

2.80 |

1.86 |

6.21 |

13.94 |

| SCRD-18044 |

SC-600 |

427.40 |

437.30 |

9.90 |

8.26 |

3.44 |

16.00 |

| SCRD-18046 |

SC-600 |

462.80 |

470.00 |

7.20 |

5.92 |

6.69 |

13.87 |

| SCRD-18068 |

SC-600 |

317.45 |

322.50 |

5.05 |

4.04 |

7.86 |

45.40 |

| SCRD-18079 |

SC-600 |

360.70 |

371.50 |

10.80 |

8.61 |

4.94 |

26.10 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

Table 3: Intersections for the Silica Cap 500

vein.

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| SCDD-18002 |

SC-500 |

141.00 |

150.35 |

9.35 |

8.91 |

2.51 |

31.88 |

| SCDD-18004 |

SC-500 |

141.40 |

145.40 |

4.00 |

3.28 |

8.40 |

8.62 |

| SCDD-18007 |

SC-500 |

159.95 |

169.00 |

9.05 |

8.09 |

6.14 |

34.60 |

| SCDD-18008 |

SC-500 |

238.35 |

248.00 |

9.65 |

8.94 |

1.28 |

6.44 |

| SCDD-18009 |

SC-500 |

138.00 |

146.30 |

8.30 |

6.10 |

2.11 |

45.20 |

| SCDD-18010 |

SC-500 |

140.50 |

144.65 |

4.15 |

4.01 |

1.45 |

30.27 |

| SCDD-18011 |

SC-500 |

150.60 |

151.65 |

1.05 |

0.81 |

3.58 |

9.95 |

| SCDD-18013 |

SC-500 |

92.00 |

98.00 |

6.00 |

4.60 |

2.93 |

25.65 |

| SCDD-18014 |

SC-500 |

48.00 |

48.75 |

0.75 |

0.68 |

1.27 |

12.66 |

| SCDD-18015 |

SC-500 |

235.90 |

244.00 |

8.10 |

6.98 |

6.25 |

43.33 |

| SCDD-18016 |

SC-500 |

229.00 |

234.40 |

5.40 |

4.53 |

2.54 |

12.68 |

| SCDD-18017 |

SC-500 |

275.20 |

287.40 |

12.20 |

10.21 |

2.55 |

11.12 |

| SCDD-18018 |

SC-500 |

184.00 |

190.05 |

6.05 |

4.72 |

21.01 |

68.38 |

| SCDD-18019 |

SC-500 |

79.00 |

92.65 |

13.65 |

10.19 |

3.34 |

45.57 |

| SCDD-18020 |

SC-500 |

237.10 |

244.80 |

7.70 |

6.83 |

18.49 |

60.49 |

| SCDD-18022 |

SC-500 |

304.50 |

309.30 |

4.80 |

4.07 |

3.84 |

20.72 |

| SCDD-18026 |

SC-500 |

228.45 |

233.00 |

4.55 |

3.54 |

15.74 |

34.20 |

| SCDD-18030 |

SC-500 |

167.60 |

183.60 |

16.00 |

13.38 |

14.47 |

92.84 |

| SCDD-18030 |

SC-500 |

171.8 |

177.45 |

5.65 |

4.73 |

25.38 |

196.45 |

| SCDD-18034 |

SC-500 |

122.40 |

126.10 |

3.70 |

3.34 |

3.79 |

21.18 |

| SCDD-18035 |

SC-500 |

72.40 |

86.00 |

13.60 |

13.30 |

8.01 |

59.96 |

| SCDD-18042 |

SC-500 |

341.00 |

358.15 |

17.15 |

16.37 |

8.30 |

31.42 |

| SCDD-18049 |

SC-500 |

295.60 |

297.70 |

2.10 |

1.74 |

6.53 |

22.40 |

| SCDD-18054 |

SC-500 |

353.00 |

361.10 |

8.10 |

7.47 |

121.75 |

275.20 |

| SCDD-18054 |

incl. |

354.2 |

355.70 |

1.50 |

1.38 |

623.31 |

1340.19 |

| SCDD-18063 |

SC-500 |

252.00 |

254.40 |

2.40 |

2.38 |

1.70 |

3.94 |

| SCDD-18069 |

SC-500 |

144.70 |

151.00 |

6.30 |

5.57 |

3.08 |

22.00 |

| SCRD-18052 |

SC-500 |

306.85 |

311.50 |

4.65 |

3.96 |

1.08 |

4.71 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

Table 4: Intersections for the Silica Cap 501

vein.

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| SCDD-18004 |

SC-501 |

170.00 |

180.00 |

10.00 |

8.91 |

7.51 |

28.29 |

| SCDD-18007 |

SC-501 |

169.80 |

175.25 |

5.45 |

4.73 |

5.46 |

60.09 |

| SCDD-18009 |

SC-501 |

188.35 |

196.00 |

7.65 |

6.60 |

1.11 |

8.40 |

| SCDD-18015 |

SC-501 |

248.30 |

257.00 |

8.70 |

7.54 |

5.50 |

55.49 |

| SCDD-18017 |

SC-501 |

287.40 |

291.80 |

4.40 |

3.68 |

1.47 |

14.82 |

| SCDD-18018 |

SC-501 |

194.30 |

201.40 |

7.10 |

5.20 |

4.28 |

16.80 |

| SCDD-18019 |

SC-501 |

95.00 |

103.15 |

8.15 |

6.42 |

59.58 |

335.49 |

| SCDD-18020 |

SC-501 |

246.70 |

249.90 |

3.20 |

2.84 |

6.54 |

60.94 |

| SCDD-18026 |

SC-501 |

237.60 |

240.30 |

2.70 |

2.23 |

5.95 |

98.20 |

| SCDD-18033 |

SC-501 |

85.60 |

88.00 |

2.40 |

2.25 |

2.37 |

20.75 |

| SCDD-18034 |

SC-501 |

130.10 |

135.00 |

4.90 |

4.23 |

5.38 |

58.49 |

| SCDD-18035 |

SC-501 |

87.40 |

90.00 |

2.60 |

2.40 |

4.16 |

76.62 |

| SCDD-18069 |

SC-501 |

154.80 |

160.00 |

5.20 |

4.58 |

1.73 |

17.20 |

| SCRD-18052 |

SC-501 |

314.00 |

319.75 |

5.75 |

5.06 |

5.00 |

15.10 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

Table 5: Intersections for the Silica Cap 5000

vein.

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| SCDD-18001 |

SC-5000 |

244.85 |

253.35 |

8.50 |

4.77 |

2.87 |

15.81 |

| SCDD-18003 |

SC-5000 |

143.15 |

146.30 |

3.15 |

1.75 |

0.77 |

2.98 |

| SCDD-18013 |

SC-5000 |

190.00 |

206.00 |

16.00 |

* |

5.39 |

14.63 |

| SCDD-18034 |

SC-5000 |

241.00 |

258.15 |

17.15 |

8.65 |

16.76 |

82.68 |

| SCDD-18035 |

SC-5000 |

127.35 |

129.00 |

1.65 |

0.91 |

7.12 |

24.01 |

| SCDD-18039 |

SC-5000 |

292.80 |

293.80 |

1.00 |

* |

15.37 |

37.33 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization (*apparent width, true width undetermined) |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

Table 6: Intersections for the Silica Cap FW

& HW veins.

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| SCDD-18071 |

SC-FW |

198.00 |

215.20 |

17.20 |

6.06 |

2.92 |

14.59 |

| SCDD-18074 |

SC-FW |

232.20 |

257.30 |

25.10 |

4.83 |

2.37 |

13.90 |

| SCDD-18078 |

SC-FW |

203.10 |

240.70 |

37.60 |

12.38 |

3.96 |

24.06 |

| SCDD-18078 |

incl. |

227.55 |

236.85 |

9.30 |

3.06 |

5.89 |

47.78 |

| SCDD-18007 |

SC-HW |

47.45 |

51.25 |

3.80 |

2.58 |

4.10 |

34.10 |

| SCDD-18011 |

SC-HW |

138.75 |

139.70 |

0.95 |

* |

64.75 |

227.79 |

| SCDD-18013 |

SC-HW |

83.00 |

87.00 |

4.00 |

* |

7.45 |

18.62 |

| SCDD-18015 |

SC-HW |

227.00 |

230.20 |

3.20 |

* |

6.90 |

33.57 |

| SCDD-18069 |

SC-HW |

119.70 |

120.90 |

1.20 |

* |

458.20 |

2,915.00 |

| SCDD-18071 |

SC-HW |

137.45 |

140.20 |

2.75 |

* |

7.02 |

65.63 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization (*apparent width, true width undetermined) |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

Table 7: Intervals from the Bajo Negro –

Silica Cap – Vein Zone System (Alpha vein).

| Hole ID |

Deposit |

From (m) |

To (m) |

Intercept (m) |

True Width (m) |

Au g/t |

Ag g/t |

| VBDD-17001 |

|

|

|

|

|

NSV |

|

| VBDD-17002 |

BN-SC-VZ |

313.40 |

314.40 |

1.00 |

* |

2.65 |

25.20 |

| VBDD-17011 |

|

|

|

|

|

NSV |

|

| VBDD-17015 |

|

|

|

|

|

NSV |

|

| VDD-17004 |

Alpha vein |

27.00 |

29.00 |

2.00 |

2.00 |

2.07 |

3.17 |

| VDD-17004 |

Alpha vein |

35.00 |

36.00 |

1.00 |

1.00 |

1.51 |

2.04 |

| VDD-17004 |

Alpha vein |

41.00 |

41.85 |

0.85 |

0.85 |

1.57 |

3.98 |

| VDD-17013 |

|

|

|

|

|

NSV |

|

| VDD-17015 |

Alpha vein |

102.30 |

106.00 |

3.70 |

* |

1.87 |

25.26 |

| VRD-18001 |

VZ Deep |

274.00 |

278.70 |

4.70 |

* |

2.32 |

7.82 |

| VRD-18001 |

VZ Deep |

440.00 |

445.90 |

5.90 |

4.93 |

1.46 |

2.76 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut. NSV = no significant value |

| 2. |

True widths are estimated based on drill angle and interpreted geometry of mineralization (*apparent width, true width undetermined) |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Drill results were reviewed and approved by Cesar Riveros-MAusIMM (CP Geo), Exploration Superintendant, Cerro Negro |

| 5. |

Data is for the quarter ended March 31, 2018 |

| 6. |

n/m = vein not yet modelled |

| 7. |

Holes numbers beginning with 17 were drilled in Q4 2017; results were received in Q1 2018. |

Table 8: Mineralized intersections for the Santa

Rosa Project (drilled in Q1-2018).

| Hole ID |

Target |

From (m) |

To (m) |

Intercept (m) |

Au g/t |

Ag g/t |

Zn (%) |

| SRD-19-18 |

Santa Rosa |

84.00 |

128.00 |

44.00 |

0.59 |

1.73 |

0.65 |

| SRD-19-18 |

Santa Rosa |

154.00 |

174.00 |

20.00 |

0.47 |

1.02 |

0.01 |

| SRD-20-18 |

Santa Rosa |

182.00 |

194.00 |

12.00 |

0.42 |

3.95 |

0.04 |

| SRD-20-18 |

Santa Rosa |

212.00 |

376.00 |

164.00 |

1.06 |

3.22 |

0.10 |

| SRD-20-18 |

Santa Rosa |

408.00 |

430.00 |

22.00 |

3.46 |

1.33 |

0.45 |

| incl. |

Santa Rosa |

408.00 |

414.00 |

6.00 |

6.66 |

1.83 |

1.32 |

| SRD-20-18 |

Santa Rosa |

500.00 |

504.00 |

4.00 |

4.51 |

11.80 |

0.68 |

| SRD-21-18 |

Santa Rosa |

NSV |

| SRD-22-18 |

Santa Rosa |

13.75 |

50.00 |

36.25 |

0.42 |

6.59 |

0.06 |

| SRD-22-18 |

Santa Rosa |

180.00 |

430.00 |

250.00 |

0.43 |

1.13 |

0.02 |

| SRD-22-18 |

Santa Rosa |

502.00 |

530.00 |

28.00 |

0.41 |

0.74 |

0.13 |

| SRD-23-18 |

Santa Rosa |

14.00 |

28.00 |

14.00 |

0.62 |

5.93 |

0.03 |

| SRD-23-18 |

Santa Rosa |

64.00 |

94.00 |

30.00 |

0.39 |

3.08 |

0.03 |

| SRD-23-18 |

Santa Rosa |

234.00 |

296.00 |

62.00 |

0.55 |

0.56 |

0.01 |

| incl. |

Santa Rosa |

250.00 |

252.00 |

2.00 |

8.41 |

0.70 |

0.00 |

| |

|

| Footnotes: |

|

| 1. |

All gold and silver values are uncut. NSV = no significant value |

| 2. |

Intercept widths are apparent, true width undetermined |

| 3. |

Details of analytical procedures including quality assurance / quality control can be found in the 2016 Technical Report filed on Sedar |

| 4. |

Data is for the quarter ended March 31, 2018 |

Table 9: Summary of Campbell-Red Lake assay results

returned during the first quarter of 2018.

| Hole ID |

Level |

Zone |

From (m) |

To (m) |

Drilled Width (m) |

True Width (m) |

Au g/t |

| 41L981 |

41 |

R |

49.93 |

52.43 |

2.5 |

2.16 |

1,702.31 |

| Including |

|

50.70 |

51.50 |

0.8 |

0.25 |

5,408.16 |

| 41L983 |

41 |

R |

46.12 |

48.28 |

2.16 |

1.87 |

21.44 |

| Including |

|

|

46.54 |

47.00 |

0.46 |

0.40 |

72.41 |

| 41L983 |

41 |

56 Zone |

141.43 |

142.10 |

0.67 |

0.58 |

40.74 |

| Including |

|

141.91 |

142.10 |

0.19 |

0.16 |

128.71 |

| 44L778 |

45 |

R |

42.46 |

44.01 |

1.55 |

1.46 |

393.31 |

| Including |

|

42.46 |

42.58 |

0.12 |

0.12 |

4,891.23 |

| 44L778 |

46 |

56 Zone |

126.19 |

127.65 |

1.46 |

1.15 |

65.86 |

| Including |

|

|

127.35 |

127.65 |

0.3 |

0.24 |

167.18 |

| 44L782A |

46 |

56 Zone |

121.92 |

122.47 |

0.55 |

0.52 |

54.67 |

| 44L785 |

46 |

56 Zone |

112.93 |

113.45 |

0.52 |

0.52 |

84.42 |

| 44L786 |

46 |

56 Zone |

103.33 |

104.39 |

1.06 |

0.98 |

58.54 |

| 44L786 |

46 |

R Zone |

162.25 |

162.46 |

0.21 |

0.19 |

1,046.38 |

| 44L787 |

46 |

56 Zone |

158.59 |

159.23 |

0.64 |

0.60 |

40.94 |

| Including |

|

159.01 |

159.23 |

0.22 |

0.20 |

115.09 |

| 47L388 |

47 |

56 Zone |

50.60 |

51.51 |

0.91 |

0.88 |

22.49 |

| 47L407 |

47 |

56 Zone |

138.68 |

138.93 |

0.25 |

0.21 |

83.01 |

| 47L416 |

47 |

56 Zone |

128.69 |

129.33 |

0.64 |

0.49 |

49.11 |

| 47L417 |

47 |

56 Zone |

143.26 |

143.87 |

0.61 |

0.53 |

358.67 |

| 47L420 |

47 |

56 Zone |

140.36 |

141.00 |

0.64 |

0.52 |

37.27 |

| 47L432 |

46 |

56 Zone |

195.99 |

196.60 |

0.61 |

0.50 |

44.50 |

| 47L456 |

46 |

56 Zone |

173.13 |

174.35 |

1.22 |

1.00 |

27.47 |

| Including |

|

173.74 |

174.04 |

0.3 |

0.25 |

73.98 |

| 47L456 |

46 |

56 Zone |

178.37 |

178.61 |

0.24 |

0.20 |

231.53 |

| |

|

| Footnotes: |

|

| 1. |

Data is for the quarter ended March 31, 2017 |

| 2. |

All gold values are uncut |

| 3. |

True widths are estimated based on drill angle and interpreted geometry of mineralization |

| 4. |

All samples were submitted for analysis to Activation Laboratories in Thunder Bay, Ontario, Canada. All samples were analyzed using a 30g charge fire assay with AA finish. Samples over 10ppm gold were reanalyzed using 30g fire assay with gravimetric finish. One in 20 samples was blank, one in 20 samples was a certified reference material and one in 20 samples was a field duplicate. |

| 5. |

Maura Kolb, P.Geo, Exploration Manager, Red Lake, is the Qualified Person responsible for the Red Lake Exploration program |

Table 10: Drill results from Q1 drilling at HG Young.

| Hole No. |

Zone |

From (m) |

To (m) |

Drilled Width (m) |

True Width (m) |

Au g/t |

| D142068 |

HG Young Main |

259.8 |

260.5 |

0.70 |

0.61 |

28.48 |

| D142070 |

HG Young Main |

194.19 |

194.40 |

0.21 |

0.20 |

63.78 |

| D142074 |

HG Young Main |

324.98 |

326.26 |

1.28 |

0.91 |

158.52 |

| Including |

|

325.62 |

326.26 |

0.64 |

0.45 |

307.83 |

| D142074 |

HG Young Main |

327.66 |

330.10 |

2.44 |

2.29 |

32.21 |

| Including |

|

327.96 |

328.39 |

0.43 |

0.40 |

149.60 |

| D142075 |

HG Young Sulphide |

93.85 |

100.22 |

6.37 |

5.52 |

2.85 |

| D142076 |

HG Young Main |

199.28 |

206.04 |

6.76 |

5.86 |

61.45 |

| D142076 |

HG Young Main |

211.41 |

211.68 |

0.27 |

0.21 |

155.82 |

| |

|

| Footnotes: |

|

| 1. |

Data is for the quarter ended March 31, 2017 |

| 2. |

All gold values are uncut |

| 3. |

True widths are estimated based on drill angle and interpreted geometry of mineralization |

| 4. |

All samples were submitted for analysis to Activation Laboratories in Thunder Bay, Ontario, Canada. All samples were analyzed using a 30g charge fire assay with AA finish. Samples over 10ppm gold were reanalyzed using 30g fire assay with gravimetric finish. One in 20 samples was blank, one in 20 samples was a certified reference material and one in 20 samples was a field duplicate. |

| 5. |

Maura Kolb, P.Geo, Exploration Manager, Red Lake, is the Qualified Person responsible for the Red Lake Exploration program |

| Hole No. |

Zone |

From (m) |

To (m) |

Drilled Width (m) |

True Width

(m) |

Au g/t |

| 17-PQE-047 |

C Block |

205.7 |

213.7 |

8.0 |

5.6 |

7.05 |

| 17-PQE-048 |

C Block |

182.2 |

189.6 |

7.4 |

7.3 |

15.87 |

| 17-PQE-048 |

C2 |

195.5 |

203.0 |

7.5 |

7.2 |

13.42 |

| 17-PQE-049 |

C Block |

174.3 |

188.7 |

14.4 |

14.4 |

18.25 |

| 17-PQE-050 |

C Block |

175.2 |

181.5 |

6.3 |

5.8 |

9.45 |

| 17-PQE-058 |

C Block |

192.7 |

208.4 |

15.7 |

15.6 |

8.90 |

| 17-PQE-058 |

C2 |

220.0 |

236.8 |

16.8 |

12.0 |

18.15 |

| 17-PQE-059 |

C2 |

198.2 |

205.9 |

7.7 |

6.1 |

14.66 |

| 18-PQE-005 |

C Block |

183.2 |

191.4 |

8.2 |

8.2 |

11.97 |

| 18-PQE-007 |

C Block |

173.6 |

177.0 |

3.4 |

3.2 |

8.92 |

| 18-PQE-016 |

C Block |

203.7 |

215.0 |

11.3 |

10.6 |

18.20 |

| 18-PQE-017 |

C Block |

194.7 |

208.0 |

13.3 |

11.7 |

18.40 |

| 18-PQE-018 |

C Block |

188.6 |

201.3 |

12.7 |

11.2 |

8.90 |

Table 11: Musselwhite drill results from Q1-2018 drilling

on C Block of PQ Deeps.

| Footnotes: |

|

| 1. |

Data is for the quarter ended March 31, 2017. |

| 2. |

All gold values are uncut. |

| 3. |

True widths are estimated based on drill angle and interpreted geometry of mineralization. |

| 4. |

All samples were submitted for analysis to Activation Laboratories in Dryden, Ontario, Canada. All samples were analyzed using a 30g charge fire assay with AA finish. Samples over 10ppm gold were reanalyzed using gravimetric finish. One in 20 samples was blank and one in 20 samples was certified reference material. |

| 5. |

Katie McCormack, P.Geo, Geology Manager, Musselwhite, is the Qualified Person responsible for the Musselwhite Exploration program. |

About Goldcorp

Goldcorp is a senior gold producer focused on responsible

mining practices with safe, low-cost production from a high-quality portfolio of mines.

Scientific and technical information in this press release

relating to Canadian exploration results was reviewed and approved by Tim Smith, MSc, P.Geo., Director Exploration Canada for Goldcorp,

and a "qualified person" as defined by National Instrument 43-101. Scientific and technical information in this press

release relating to Latin American exploration results was reviewed and approved by Iain Kelso, P.Geo., Director Exploration Latam

for Goldcorp, and a "qualified person" as defined by NI 43-101. Scientific and technical information contained

in this presentation was reviewed and approved by Ivan Mullany, FAusIMM, Senior Vice President, Technical Services for Goldcorp,

and a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects

("NI 43-101"). Information on data verification performed on the mineral properties mentioned in this news release

that are considered to be material mineral properties to the Company are contained in Goldcorp's most recently filed annual information

form and the current technical report for each of those properties, all available at www.sedar.com.

Quality Assurance/Quality Control

Quality assurance and quality control procedures include the

systematic insertion of blanks, standards and duplicates into the core and reverse circulation sample strings. The results of the

control samples are evaluated on a regular basis with batches re-analysed and/or resubmitted as needed. All results stated in this

announcement have passed Goldcorp's quality assurance and quality control protocols.

Cautionary Note Regarding Forward Looking Statements

This press release contains "forward-looking statements"

within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange

Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United

States Securities and Exchange Commission, all as may be amended from time to time, and "forward-looking information"

under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance

and condition of Goldcorp. Forward-looking statements include, but are not limited to, the future price of gold, silver, zinc,

copper and lead, the estimation of mineral reserves and mineral resources, the realization of mineral reserve estimates, the timing

and amount of estimated future production, costs of production, targeted cost reductions, capital expenditures, free cash flow,

costs and timing of the development of new deposits, success of exploration activities, permitting and certification time lines,

hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations,

environmental risks, unanticipated reclamation expenses, health, safety and diversity initiatives, timing and possible outcome

of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements

can be identified by the use of words such as "plans", "expects" , "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" , "believes",

or variations or comparable language of such words and phrases or statements that certain actions, events or results "may",

"could", "would", "should", "might" or "will", "occur" or "be

achieved" or the negative connotation thereof.

Forward-looking statements are necessarily based upon a number

of factors and assumptions that, if untrue, could cause the actual results, performances or achievements of Goldcorp to be materially

different from future results, performances or achievements expressed or implied by such statements. Such statements and information

are based on numerous assumptions regarding Goldcorp's present and future business strategies and the environment in which Goldcorp

will operate in the future, including the price of gold, anticipated costs and ability to achieve goals. Certain important factors

that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements

include, among others, gold price volatility, discrepancies between actual and estimated production, mineral reserves and mineral

resources and metallurgical recoveries, mining operational and development risks, litigation risks, regulatory restrictions (including

environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls

or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property

and political or economic developments in Canada, the United States, Mexico, Argentina, the Dominican Republic, Chile or other

jurisdictions in which the Company does or may carry on business in the future, delays, suspension and technical challenges associated

with capital projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative

nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees,

additional funding requirements and defective title to mineral claims or property. Although Goldcorp believes its expectations

are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or

results to differ materially from those described in forward-looking statements, there may be other factors that cause actions,

events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to known and unknown

risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements

of Goldcorp to be materially different from those expressed or implied by such forward-looking statements, including but not limited

to: future prices of gold, silver, zinc, copper and lead; mine development and operating risks; possible variations in ore reserves,

grade or recovery rates; risks related to international operations, including economic and political instability in foreign jurisdictions

in which Goldcorp operates; risks related to current global financial conditions; risks related to joint venture operations; actual

results of current exploration activities; actual results of current reclamation activities; environmental risks; conclusions of

economic evaluations; changes in project parameters as plans continue to be refined; failure of plant, equipment or processes to

operate as anticipated; accidents, labour disputes and other risks of the mining industry; risks associated with restructuring

and cost-efficiency initiatives; delays in obtaining governmental approvals or financing or in the completion of development or

construction activities; risks related to the integration of acquisitions; risks related to indebtedness and the service of such

indebtedness, as well as those factors discussed in the section entitled "Description of the Business – Risk Factors"

in Goldcorp's most recent annual information form available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Although

Goldcorp has attempted to identify important factors that could cause actual results to differ materially from those contained

in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There

can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially

from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Except as otherwise

indicated by Goldcorp, these statements do not reflect the potential impact of any non-recurring or other special items or of any

disposition, monetization, merger, acquisition, other business combination or other transaction that may be announced or that may

occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management's

current expectations and plans and allowing investors and others to get a better understanding of Goldcorp's operating environment.

Goldcorp does not intend or undertake to publicly update any forward-looking statements that are included in this document, whether

as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

Cautionary Note Regarding Reserves and Resources:

All Mineral Reserves and Mineral Resources have been estimated

in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") and NI 43-101,

or the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves equivalent ("JORC").

All Mineral Resources are reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated

economic viability. Information on data verification performed on the mineral properties mentioned in this table that are considered

to be material mineral properties to the Company are contained in Goldcorp's annual information form for the year ended December

31, 2017 and the current technical report for each of those properties, all available at www.sedar.com. The Mineral Resource and

Mineral Reserve estimates contained in this presentation have been prepared in accordance with the requirements of Canadian securities

laws, which differ from the requirements of United States securities laws and uses terms that are not recognized by the SEC. Canadian

reporting requirements for disclosure of mineral properties are governed by the Canadian Securities Administrators' NI 43-101.

The definitions used in NI 43-101 are incorporated by reference from the Canadian Institute of Mining, Metallurgy and Petroleum

("CIM") — Definition Standards adopted by CIM Council on May 10, 2014 (the "CIM Definition Standards").

U.S. reporting requirements are governed by the SEC Industry Guide 7 ("Industry Guide 7") under the United States Securities

Act of 1933, as amended. These reporting standards have similar goals in terms of conveying an appropriate level of confidence

in the disclosures being reported, but embody different approaches and definitions. For example, the terms "Mineral Reserve",

"Proven Mineral Reserve" and "Probable Mineral Reserve" are Canadian mining terms as defined in NI 43-101,

and these definitions differ from the definitions in Industry Guide 7. Under Industry Guide 7 standards, a "final" or

"bankable" feasibility study is required to report reserves and the primary environmental analysis or report must be

filed with the appropriate governmental authority. Further, under Industry Guide 7, mineralization may not be classified as a "reserve"

unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time

the reserve determination is made. While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated

Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101, these

terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements

filed with the SEC. United States readers are cautioned not to assume that any part or all of mineral deposits in these categories

will ever be converted into reserves. In addition, "Inferred Mineral Resources" have a great amount of uncertainty as

to their existence and their economic and legal feasibility. A significant amount of exploration must be completed in order to

determine whether an Inferred Mineral Resource may be upgraded to a higher category. Under Canadian regulations, estimates of Inferred

Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. United States readers

are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable.

Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations if such disclosure

includes the grade or quality and the quantity for each category of Mineral Resource and Mineral Reserve; however, the SEC normally

only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage

and grade without reference to unit measures. Accordingly, information contained in this presentation containing descriptions

of the Company's mineral deposits may not be comparable to similar information made public by United States companies subject to

the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

View original content with multimedia:http://www.prnewswire.com/news-releases/goldcorp-provides-first-quarter-2018-exploration-update-300636729.html

SOURCE Goldcorp Inc.

View original content with multimedia: http://www.newswire.ca/en/releases/archive/April2018/25/c4642.html

%CIK: 0000919239

For further information: please contact: INVESTOR CONTACT:

Shawn Campbell, Director, Investor Relations, (800) 567-6223, E-mail: info@goldcorp.com; MEDIA CONTACT: Christine Marks, Director,

Corporate Communications, Telephone: (604) 696-3050, E-mail: media@goldcorp.com

CO: Goldcorp Inc.

CNW 16:50e 25-APR-18

This regulatory filing also includes additional resources:

ex991.pdf

Goldcorp (NYSE:GG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldcorp (NYSE:GG)

Historical Stock Chart

From Apr 2023 to Apr 2024