Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

April 2018

Vale S.A.

Avenida das Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

|

(Check One) Form 20-F

x

Form 40-F

o

|

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

KPMG Auditores Independentes

Rua do Passeio, 38 - Setor 2 - 17º andar - Centro

20021-290 - Rio de Janeiro/RJ - Brasil

Caixa Postal 2888 - CEP 20001-970 - Rio de Janeiro/RJ - Brasil

Telefone +55 (21) 2207-9400, Fax +55 (21) 2207-9000

www.kpmg.com.br

Report of independent registered public accou

nting firm

To the Stockholders and Board of Directors of

Vale S.A.

Rio de Janeiro - RJ

Results of review of interim financial information

We have reviewed the accompanying condensed consolidated statement of financial position of Vale S.A. and subsidiaries (“the Company”)as of March 31, 2018, the related condensed consolidated statements of income and comprehensive income, changes in equity and cash flows for the three-month periods ended March 31, 2018 and 2017, and the related notes (collectively, the consolidated interim financial information). Based on our reviews, we are not aware of any material modifications that should be made to the consolidated interim financial information for it to be in conformity with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated statement of financial position of the Company as of December 31, 2017, and the related consolidated statements of income and comprehensive income, changes in equity and cash flows for the year then ended (not presented herein); and in our report dated February 27, 2018, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated statement of financial position as of December 31, 2017, is fairly stated, in all material respects, in relation to the consolidated statement of financial position from which it has been derived.

Basis for review results

This consolidated interim financial information is the responsibility of the Company’s management. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our reviews in accordance with the standards of the PCAOB. A review of consolidated interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

|

KPMG Auditores Independentes

|

|

|

|

|

|

|

|

|

Rio de Janeiro, Brazil

|

|

|

|

|

|

April 25, 2018

|

|

|

KPMG Auditores Independentes, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça.

|

|

KPMG Auditores Independentes, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity.

|

3

Table of Contents

Consolidated Income Statement

In millions of United States dollars, except earnings per share data

|

|

|

|

|

Three-month period ended March 31,

|

|

|

|

|

Notes

|

|

2018

|

|

2017

|

|

|

Continuing operations

|

|

|

|

|

|

|

|

|

Net operating revenue

|

|

3(c)

|

|

8,603

|

|

8,515

|

|

|

Cost of goods sold and services rendered

|

|

5(a)

|

|

(5,224

|

)

|

(4,734

|

)

|

|

Gross profit

|

|

|

|

3,379

|

|

3,781

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

Selling and administrative expenses

|

|

5(b)

|

|

(124

|

)

|

(124

|

)

|

|

Research and evaluation expenses

|

|

|

|

(69

|

)

|

(65

|

)

|

|

Pre operating and operational stoppage

|

|

|

|

(78

|

)

|

(115

|

)

|

|

Other operating expenses, net

|

|

5(c)

|

|

(125

|

)

|

(77

|

)

|

|

|

|

|

|

(396

|

)

|

(381

|

)

|

|

Impairment and other results on non-current assets

|

|

4

|

|

(18

|

)

|

512

|

|

|

Operating income

|

|

|

|

2,965

|

|

3,912

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

6

|

|

237

|

|

379

|

|

|

Financial expenses

|

|

6

|

|

(676

|

)

|

(1,150

|

)

|

|

Other financial items

|

|

6

|

|

(185

|

)

|

158

|

|

|

Equity results in associates and joint ventures

|

|

13

|

|

85

|

|

73

|

|

|

Impairment and other results in associates and joint ventures

|

|

17

|

|

(14

|

)

|

(61

|

)

|

|

Income before income taxes

|

|

|

|

2,412

|

|

3,311

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

7

|

|

|

|

|

|

|

Current tax

|

|

|

|

(93

|

)

|

(501

|

)

|

|

Deferred tax

|

|

|

|

(628

|

)

|

(222

|

)

|

|

|

|

|

|

(721

|

)

|

(723

|

)

|

|

|

|

|

|

|

|

|

|

|

Net income from continuing operations

|

|

|

|

1,691

|

|

2,588

|

|

|

Net income attributable to noncontrolling interests

|

|

|

|

19

|

|

15

|

|

|

Net income from continuing operations attributable to Vale’s stockholders

|

|

|

|

1,672

|

|

2,573

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

12

|

|

|

|

|

|

|

Loss from discontinued operations

|

|

|

|

(82

|

)

|

(82

|

)

|

|

Net income attributable to noncontrolling interests

|

|

|

|

—

|

|

1

|

|

|

Loss from discontinued operations attributable to Vale’s stockholders

|

|

|

|

(82

|

)

|

(83

|

)

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

1,609

|

|

2,506

|

|

|

Net income attributable to noncontrolling interests

|

|

|

|

19

|

|

16

|

|

|

Net income attributable to Vale’s stockholders

|

|

|

|

1,590

|

|

2,490

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Vale’s stockholders:

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share (restated):

|

|

8

|

|

|

|

|

|

|

Common share (US$)

|

|

|

|

0.30

|

|

0.48

|

|

The accompanying notes are an integral part of these interim financial statements.

4

Table of Contents

Consolidated Statement of Comprehensive Income

In millions of United States dollars

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Net income

|

|

1,609

|

|

2,506

|

|

|

Other comprehensive income:

|

|

|

|

|

|

|

Items that will not be reclassified subsequently to the income statement

|

|

|

|

|

|

|

Translation adjustments

|

|

(230

|

)

|

1,114

|

|

|

Retirement benefit obligations

|

|

53

|

|

(23

|

)

|

|

Fair value adjustment to investment in equity securities

|

|

(35

|

)

|

—

|

|

|

Transfer to retained earnings

|

|

(20

|

)

|

—

|

|

|

Total items that will not be reclassified subsequently to the income statement, net of tax

|

|

(232

|

)

|

1,091

|

|

|

|

|

|

|

|

|

|

Items that may be reclassified subsequently to the income statement

|

|

|

|

|

|

|

Translation adjustments

|

|

(11

|

)

|

(617

|

)

|

|

Net investments hedge

|

|

(27

|

)

|

157

|

|

|

Transfer of realized results to net income

|

|

(78

|

)

|

—

|

|

|

Total of items that may be reclassified subsequently to the income statement, net of tax

|

|

(116

|

)

|

(460

|

)

|

|

Total comprehensive income

|

|

1,261

|

|

3,137

|

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to noncontrolling interests

|

|

17

|

|

37

|

|

|

Comprehensive income attributable to Vale’s stockholders

|

|

1,244

|

|

3,100

|

|

|

From continuing operations

|

|

1,239

|

|

3,109

|

|

|

From discontinued operations

|

|

5

|

|

(9

|

)

|

|

|

|

1,244

|

|

3,100

|

|

Items above are stated net of tax and the related taxes are disclosed in note 7.

The accompanying notes are an integral part of these interim financial statements.

5

Table of Contents

Consolidated Statement of Cash Flows

In millions of United States dollars

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Cash flow from operating activities:

|

|

|

|

|

|

|

Income before income taxes from continuing operations

|

|

2,412

|

|

3,311

|

|

|

Continuing operations adjustments for:

|

|

|

|

|

|

|

Equity results in associates and joint ventures

|

|

(85

|

)

|

(73

|

)

|

|

Impairment and other results on non-current assets and associates and joint ventures

|

|

32

|

|

(451

|

)

|

|

Depreciation, amortization and depletion

|

|

873

|

|

908

|

|

|

Financial results, net

|

|

624

|

|

613

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

Accounts receivable

|

|

17

|

|

298

|

|

|

Inventories

|

|

56

|

|

(221

|

)

|

|

Suppliers and contractors

|

|

(340

|

)

|

82

|

|

|

Provision - Payroll, related charges and others remunerations

|

|

(541

|

)

|

(242

|

)

|

|

Other assets and liabilities, net

|

|

(105

|

)

|

(169

|

)

|

|

|

|

2,943

|

|

4,056

|

|

|

Interest on loans and borrowings paid

|

|

(381

|

)

|

(515

|

)

|

|

Derivatives paid, net

|

|

(25

|

)

|

(107

|

)

|

|

Income taxes

|

|

(240

|

)

|

(368

|

)

|

|

Income taxes - Settlement program

|

|

(125

|

)

|

(121

|

)

|

|

Net cash provided by operating activities from continuing operations

|

|

2,172

|

|

2,945

|

|

|

|

|

|

|

|

|

|

Cash flow from investing activities:

|

|

|

|

|

|

|

Financial investments redeemed (invested)

|

|

(16

|

)

|

(53

|

)

|

|

Loans and advances - net receipts (payments) (note 25)

|

|

2,640

|

|

(144

|

)

|

|

Additions to property, plant and equipment, intangibles and investments

|

|

(907

|

)

|

(1,116

|

)

|

|

Proceeds from disposal of assets and investments (note 12)

|

|

1,101

|

|

515

|

|

|

Dividends and interest on capital received from associates and joint ventures

|

|

10

|

|

—

|

|

|

Others investments activities

|

|

15

|

|

(2

|

)

|

|

Net cash provided by (used in) investing activities from continuing operations

|

|

2,843

|

|

(800

|

)

|

|

|

|

|

|

|

|

|

Cash flow from financing activities:

|

|

|

|

|

|

|

Loans and borrowings

|

|

|

|

|

|

|

Additions

|

|

—

|

|

1,150

|

|

|

Repayments

|

|

(2,277

|

)

|

(1,118

|

)

|

|

Transactions with stockholders:

|

|

|

|

|

|

|

Dividends and interest on capital paid to stockholders

|

|

(1,437

|

)

|

—

|

|

|

Dividends and interest on capital paid to noncontrolling interest

|

|

(91

|

)

|

(3

|

)

|

|

Transactions with noncontrolling stockholders

|

|

(17

|

)

|

255

|

|

|

Net cash provided by (used in) financing activities from continuing operations

|

|

(3,822

|

)

|

284

|

|

|

|

|

|

|

|

|

|

Net cash used in discontinued operations (note 12)

|

|

(44

|

)

|

(5

|

)

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents

|

|

1,149

|

|

2,424

|

|

|

Cash and cash equivalents in the beginning of the period

|

|

4,328

|

|

4,262

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

(6

|

)

|

44

|

|

|

Effects of disposals of subsidiaries and merger, net on cash and cash equivalents

|

|

(103

|

)

|

(14

|

)

|

|

Cash and cash equivalents at end of the period

|

|

5,368

|

|

6,716

|

|

|

|

|

|

|

|

|

|

Non-cash transactions:

|

|

|

|

|

|

|

Additions to property, plant and equipment - capitalized loans and borrowing costs

|

|

60

|

|

103

|

|

The accompanying notes are an integral part of these interim financial statements.

6

Table of Contents

Consolidated Statement of Financial Position

In millions of United States dollars

|

|

|

Notes

|

|

March 31, 2018

|

|

December 31,

2017

|

|

|

Assets

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

16

|

|

5,368

|

|

4,328

|

|

|

Accounts receivable

|

|

9

|

|

2,689

|

|

2,600

|

|

|

Other financial assets

|

|

11

|

|

376

|

|

2,022

|

|

|

Inventories

|

|

10

|

|

3,967

|

|

3,926

|

|

|

Prepaid income taxes

|

|

|

|

722

|

|

781

|

|

|

Recoverable taxes

|

|

|

|

1,055

|

|

1,172

|

|

|

Others

|

|

|

|

602

|

|

538

|

|

|

|

|

|

|

14,779

|

|

15,367

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets held for sale

|

|

12

|

|

460

|

|

3,587

|

|

|

|

|

|

|

15,239

|

|

18,954

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

Judicial deposits

|

|

22(c)

|

|

1,993

|

|

1,986

|

|

|

Other financial assets

|

|

11

|

|

3,047

|

|

3,232

|

|

|

Prepaid income taxes

|

|

|

|

587

|

|

530

|

|

|

Recoverable taxes

|

|

|

|

667

|

|

638

|

|

|

Deferred income taxes

|

|

7(a)

|

|

6,106

|

|

6,638

|

|

|

Others

|

|

|

|

282

|

|

267

|

|

|

|

|

|

|

12,682

|

|

13,291

|

|

|

|

|

|

|

|

|

|

|

|

Investments in associates and joint ventures

|

|

13

|

|

3,722

|

|

3,568

|

|

|

Intangibles

|

|

14

|

|

8,592

|

|

8,493

|

|

|

Property, plant and equipment

|

|

15

|

|

54,149

|

|

54,878

|

|

|

|

|

|

|

79,145

|

|

80,230

|

|

|

Total assets

|

|

|

|

94,384

|

|

99,184

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

Suppliers and contractors

|

|

|

|

3,598

|

|

4,041

|

|

|

Loans and borrowings

|

|

16

|

|

1,966

|

|

1,703

|

|

|

Other financial liabilities

|

|

11

|

|

1,008

|

|

986

|

|

|

Taxes payable

|

|

7(c)

|

|

703

|

|

697

|

|

|

Provision for income taxes

|

|

|

|

227

|

|

355

|

|

|

Liabilities related to associates and joint ventures

|

|

17

|

|

369

|

|

326

|

|

|

Provisions

|

|

21

|

|

868

|

|

1,394

|

|

|

Dividends and interest on capital

|

|

|

|

—

|

|

1,441

|

|

|

Others

|

|

|

|

1,038

|

|

992

|

|

|

|

|

|

|

9,777

|

|

11,935

|

|

|

Liabilities associated with non-current assets held for sale

|

|

12

|

|

213

|

|

1,179

|

|

|

|

|

|

|

9,990

|

|

13,114

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

Loans and borrowings

|

|

16

|

|

18,310

|

|

20,786

|

|

|

Other financial liabilities

|

|

11

|

|

2,901

|

|

2,894

|

|

|

Taxes payable

|

|

7(c)

|

|

4,796

|

|

4,890

|

|

|

Deferred income taxes

|

|

7(a)

|

|

1,704

|

|

1,719

|

|

|

Provisions

|

|

21

|

|

6,984

|

|

7,027

|

|

|

Liabilities related to associates and joint ventures

|

|

17

|

|

633

|

|

670

|

|

|

Deferred revenue - Gold stream

|

|

|

|

1,793

|

|

1,849

|

|

|

Others

|

|

|

|

1,466

|

|

1,463

|

|

|

|

|

|

|

38,587

|

|

41,298

|

|

|

Total liabilities

|

|

|

|

48,577

|

|

54,412

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

24

|

|

|

|

|

|

|

Equity attributable to Vale’s stockholders

|

|

|

|

44,702

|

|

43,458

|

|

|

Equity attributable to noncontrolling interests

|

|

|

|

1,105

|

|

1,314

|

|

|

Total stockholders’ equity

|

|

|

|

45,807

|

|

44,772

|

|

|

Total liabilities and stockholders’ equity

|

|

|

|

94,384

|

|

99,184

|

|

The accompanying notes are an integral part of these interim financial statements.

7

Table of Contents

Consolidated Statement of Changes in Equity

In millions of United States dollars

|

|

|

Share capital

|

|

Results on

conversion of

shares

|

|

Capital reserve

|

|

Results from

operation with

noncontrolling

interest

|

|

Profit

reserves

|

|

Treasury

stocks

|

|

Unrealized

fair value

gain (losses)

|

|

Cumulative

translation

adjustments

|

|

Retained

earnings

|

|

Equity

attributable to

Vale’s

stockholders

|

|

Equity

attributable to

noncontrolling

interests

|

|

Total

stockholders’

equity

|

|

|

Balance at December 31, 2017

|

|

61,614

|

|

(152

|

)

|

1,139

|

|

(954

|

)

|

7,419

|

|

(1,477

|

)

|

(1,183

|

)

|

(22,948

|

)

|

—

|

|

43,458

|

|

1,314

|

|

44,772

|

|

|

Net income

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,590

|

|

1,590

|

|

19

|

|

1,609

|

|

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement benefit obligations

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

53

|

|

—

|

|

(20

|

)

|

33

|

|

—

|

|

33

|

|

|

Net investments hedge (note 20c)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(27

|

)

|

—

|

|

(27

|

)

|

—

|

|

(27

|

)

|

|

Fair value adjustment to investment in equity securities

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(35

|

)

|

—

|

|

—

|

|

(35

|

)

|

—

|

|

(35

|

)

|

|

Translation adjustments

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(35

|

)

|

—

|

|

—

|

|

(282

|

)

|

—

|

|

(317

|

)

|

(2

|

)

|

(319

|

)

|

|

Transactions with stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends of noncontrolling interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1

|

)

|

(1

|

)

|

|

Acquisitions and disposal of noncontrolling interest

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(225

|

)

|

(225

|

)

|

|

Balance at March 31, 2018

|

|

61,614

|

|

(152

|

)

|

1,139

|

|

(954

|

)

|

7,384

|

|

(1,477

|

)

|

(1,165

|

)

|

(23,257

|

)

|

1,570

|

|

44,702

|

|

1,105

|

|

45,807

|

|

|

|

|

Share capital

|

|

Results on

conversion of

shares

|

|

Capital reserve

|

|

Results from

operation with

noncontrolling

interest

|

|

Profit

reserves

|

|

Treasury

stocks

|

|

Unrealized

fair value

gain (losses)

|

|

Cumulative

translation

adjustments

|

|

Retained

earnings

|

|

Equity

attributable to

Vale’s

stockholders

|

|

Equity

attributable to

noncontrolling

interests

|

|

Total

stockholders’

equity

|

|

|

Balance at December 31, 2016

|

|

61,614

|

|

(152

|

)

|

—

|

|

(699

|

)

|

4,203

|

|

(1,477

|

)

|

(1,147

|

)

|

(23,300

|

)

|

—

|

|

39,042

|

|

1,982

|

|

41,024

|

|

|

Net income

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,490

|

|

2,490

|

|

16

|

|

2,506

|

|

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement benefit obligations

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(23

|

)

|

—

|

|

—

|

|

(23

|

)

|

—

|

|

(23

|

)

|

|

Net investments hedge (note 20c)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

174

|

|

—

|

|

174

|

|

—

|

|

174

|

|

|

Translation adjustments

|

|

—

|

|

—

|

|

—

|

|

—

|

|

120

|

|

—

|

|

(18

|

)

|

356

|

|

1

|

|

459

|

|

21

|

|

480

|

|

|

Transactions with stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends of noncontrolling interest

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(2

|

)

|

(2

|

)

|

|

Acquisitions and disposal of noncontrolling interest

|

|

—

|

|

—

|

|

—

|

|

(105

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

(105

|

)

|

(508

|

)

|

(613

|

)

|

|

Capitalization of noncontrolling interest advances

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

25

|

|

25

|

|

|

Balance at March 31, 2017

|

|

61,614

|

|

(152

|

)

|

—

|

|

(804

|

)

|

4,323

|

|

(1,477

|

)

|

(1,188

|

)

|

(22,770

|

)

|

2,491

|

|

42,037

|

|

1,534

|

|

43,571

|

|

The accompanying notes are an integral part of these interim financial statements.

8

Table of Contents

Selected Notes to the Interim Financial Statements

Expressed in millions of United States dollar, unless otherwise stated

1.

Corporate information

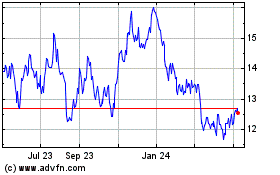

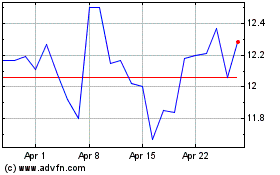

Vale S.A. (the “Parent Company”) is a public company headquartered in the city of Rio de Janeiro, Brazil with securities traded on the stock exchanges of São Paulo — B3 S.A. (Vale3), New York - NYSE (VALE), Paris - NYSE Euronext (Vale3) and Madrid — LATIBEX (XVALO).

Vale S.A. and its direct and indirect subsidiaries (“Vale” or “Company”) are global producers of iron ore and iron ore pellets, key raw materials for steelmaking, and producers of nickel, which is used to produce stainless steel and metal alloys employed in the production of several products. The Company also produces copper, metallurgical and thermal coal, manganese ore, ferroalloys, platinum group metals, gold, silver and cobalt. The information by segment is presented in note 3.

2.

Basis for preparation of the interim financial statements

a)

Statement of compliance

The condensed consolidated interim financial statements of the Company (“interim financial statements”) have been prepared and are being presented in accordance with IAS 34 Interim Financial Reporting of the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

b)

Basis of presentation

The interim financial statements have been prepared to update users about relevant events and transactions occurred in the period and should be read in conjunction with the financial statements for the year ended December 31, 2017. The accounting policies, accounting estimates and judgments, risk management and measurement methods are the same as those applied when preparing the last annual financial statements, except for new accounting policies related to the application of IFRS 9 — Financial instrument and IFRS 15 — Revenue from contracts with customers, which are described in note 2(c). The accounting policy for recognizing and measuring income taxes in the interim period is described in note 7.

The interim financial statements of the Company and its associates and joint ventures are measured using the currency of the primary economic environment in which the entity operates (“functional currency”), which in the case of the Parent Company is the Brazilian real (“R$”). For presentation purposes, these interim financial statements are presented in United States dollars (“US$”) as the Company believes that this is the relevant currency used by international investors.

The exchange rates used by the Company to translate its foreign operations are as follows

:

|

|

|

|

|

|

|

Average rate

|

|

|

|

|

Closing rate

|

|

Three-month period ended

|

|

|

|

|

March 31, 2018

|

|

December 31, 2017

|

|

March 31, 2018

|

|

March 31, 2017

|

|

|

US Dollar (“US$”)

|

|

3.3238

|

|

3.3080

|

|

3.2433

|

|

3.1451

|

|

|

Canadian dollar (“CAD”)

|

|

2.5778

|

|

2.6344

|

|

2.5649

|

|

2.3760

|

|

|

Australian dollar (“AUD”)

|

|

2.5497

|

|

2.5849

|

|

2.5505

|

|

2.3824

|

|

|

Euro (“EUR” or “€”)

|

|

4.0850

|

|

3.9693

|

|

3.9866

|

|

3.3510

|

|

The issue of these interim financial statements was authorized by the Board of Directors on April 25, 2018.

c) Changes in significant accounting policies

(i) IFRS 9 Financial instrument —

The Company has adopted IFRS 9

Financial Instruments

starting January 1, 2018. This standard addresses the classification and measurement of financial assets and liabilities, new impairment model and new rules for hedge accounting. The main changes are described below:

·

Classification and measurement - Under IFRS 9, the Company’s financial assets are initially measured at fair value (plus transaction costs if is not measured at fair value through profit or loss).

The investments in debt financial instruments are subsequently measured at fair value through profit or loss (“FVTPL”), amortized cost, or fair value through other comprehensive income (“FVOCI”). The classification is based on two conditions: the Company´s business model in which the asset is held; and whether the contractual terms give rise on specified dates to cash flows that are ‘solely payments of principal and interest’ on the principal amount outstanding (“SPPI”).

9

Table of Contents

The FVOCI category only includes equity instruments, which is not held for trading and the Company has irrevocably elected to designate upon initial recognition. The gains or losses from equity instruments at FVOCI are not recycled to income statement on derecognition and these financial assets are not subject to an impairment assessment under IFRS 9.

The Company has assessed its business models as of the date of IFRS 9 initial application, 1 January 2018, and no significant impact were identified in the financial statements.

·

Impairment - IFRS 9 has replaced the IAS 39’s incurred loss approach with a forward-looking expected credit loss (ECL) approach.

For accounts receivables, the Company has applied the standard’s simplified approach and has calculated ECLs based on lifetime expected credit losses. The Company has established a provision matrix that is based on its historical credit loss experience, adjusted for forward-looking factors specific to the economic environment and by any financial guarantees related to these accounts receivables.

For other financial assets, the ECL is based on the 12-month ECL. The 12-month ECL is the proportion of lifetime ECLs that results from default events on a financial instrument that are possible within 12 months after the reporting date. However, when there has been a significant increase in credit risk since origination, the allowance will be based on the lifetime ECL.

When determining whether the credit risk of a financial asset has increased significantly since initial recognition and when estimating ECLs, the Company considers reasonable and supportable information that is relevant and available without undue cost or effort. This includes both quantitative and qualitative information and analysis, based on the Company’s historical experience and informed credit assessment including forward-looking information.

At each reporting date, the Company assesses whether financial assets carried at amortized cost are credit-impaired. A financial asset is ‘credit-impaired’ when one or more events that have a detrimental impact on the estimated future cash flows of the financial asset have occurred.

There is no significant impact on its financial statements resulting from this new impairment approach given Vale’s credit rating and risk management policies in place.

·

Hedge accounting - The Company has elected to adopt the new general hedge accounting model in IFRS 9. The changes introduced by IFRS 9 relating to hedge accounting currently have no impact, as the Company does not currently apply cash flow or fair value hedge accounting. The Company currently applies the net investment hedge for which there are no changes introduced by this new standard.

(ii) IFRS 15 Revenue from contracts with customers -

The Company has adopted IFRS 15

Revenue from contracts with customers

starting January 1, 2018. IFRS 15 establishes a comprehensive framework for revenue recognition and replaced IAS 18 Revenue, IAS 11 Construction Contracts and related interpretations. The Company has adopted IFRS 15 using the modified retrospective method. Accordingly, the information presented for 2017 has not been restated.

·

Sales of commodities

-

IFRS 15 introduced the five-step model for revenue recognition from contracts with customers. The new standard is based on the core principle that revenue is recognized when the control of a good or service transfers to a customer of an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

There is no significant impact on the timing of commodities revenue recognition under IFRS 15, since usually the transfer of risks and rewards and the transfer of control under the sales contracts are at the same point in time.

The disaggregated revenue information is disclosed in note 3.

·

Shipping services

-

A proportion of Vale’s sales are under Cost and Freight (“CFR”) or Cost, Insurance and Freight (“CIF”) Incoterms, in which the Company is responsible for providing shipping services after the date that Vale transfers control of the goods to the customers. According to the previous standard (IAS 18), the revenue from shipping services was recognized upon loading, as well as the related costs, and was not considered a separate service.

Under IFRS 15, the provision of shipping services for CFR and CIF contracts should be considered as a separate performance obligation in which a proportion of the transaction price would be allocated and recognized over time as the shipping services are provided. The impact on the timing of revenue recognition of the proportion allocated to the shipping service is not significant to the Company’s quarter-end results ended March 31, 2018. Therefore, such revenue has not been presented separately in these interim financial statements.

10

Table of Contents

·

Provisionally priced commodities sales - Under IFRS 9 and 15, the treatment of the provisional pricing mechanisms embedded within the provisionally priced commodities sales remains unmodified. Therefore, these revenues are recognized based on the estimated fair value of the total consideration receivable, and the provisionally priced sales mechanism embedded within these sale arrangements has the character of a derivative.

The Company is mostly exposed to the fluctuations in the iron ore and copper price.

The selling price of these products can be measured reliably at each period, since the price is quoted on an active market. The fair value of the sales price adjustment, in the amount of US$162 in the period ended March 31, 2018, were recognized as operational revenue in the income statement.

d) Accounting standards issued but not yet effective

The standards and interpretations issued by IASB relevant to the Company but not yet effective are the same as those applicable when preparing the financial statements for the year ended December 31, 2017. The other new standards effective from January 1, 2018 do not have a material effect on the Company’s interim financial statements.

3. Information by business segment and by geographic area

The information presented to the Executive Board on the performance of each segment is derived from the accounting records, adjusted for reclassifications between segments.

a)

Adjusted EBITDA

Management uses adjusted EBITDA to assess each segment’s contribution to the Company’s performance and to support the decision making process. Adjusted EBITDA is calculated for each segment using operating income or loss plus dividends received and interest from associates and joint ventures, and adding back the amounts charged as (i) depreciation, depletion and amortization and (ii) special events (additional information can be found in note 4).

In 2018, the Company has allocated general and corporate expenses to “Others” as these expenses are not directly related to the performance of each business segment. Therefore, “Others” includes unallocated corporate expenses. The comparative period was restated in order to reflect this change in the criteria for allocation.

|

|

|

Three-month period ended March 31, 2018

|

|

|

|

|

Net operating

revenue

|

|

Cost of goods

sold and

services

rendered

|

|

Sales,

administrative

and other

operating

expenses (i)

|

|

Research and

evaluation

|

|

Pre operating

and operational

stoppage

|

|

Dividends

received and

interest from

associates and

joint ventures

|

|

Adjusted

EBITDA

|

|

|

Ferrous minerals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iron ore

|

|

4,703

|

|

(2,078

|

)

|

(13

|

)

|

(20

|

)

|

(35

|

)

|

—

|

|

2,557

|

|

|

Iron ore Pellets

|

|

1,585

|

|

(813

|

)

|

(1

|

)

|

(5

|

)

|

(3

|

)

|

—

|

|

763

|

|

|

Ferroalloys and manganese

|

|

124

|

|

(74

|

)

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

49

|

|

|

Other ferrous products and services

|

|

115

|

|

(73

|

)

|

(3

|

)

|

—

|

|

—

|

|

—

|

|

39

|

|

|

|

|

6,527

|

|

(3,038

|

)

|

(18

|

)

|

(25

|

)

|

(38

|

)

|

—

|

|

3,408

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal

|

|

380

|

|

(335

|

)

|

2

|

|

(3

|

)

|

—

|

|

60

|

|

104

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base metals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nickel and other products

|

|

1,132

|

|

(705

|

)

|

(15

|

)

|

(9

|

)

|

(8

|

)

|

—

|

|

395

|

|

|

Copper

|

|

502

|

|

(248

|

)

|

(1

|

)

|

(4

|

)

|

—

|

|

—

|

|

249

|

|

|

|

|

1,634

|

|

(953

|

)

|

(16

|

)

|

(13

|

)

|

(8

|

)

|

—

|

|

644

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others

|

|

62

|

|

(70

|

)

|

(153

|

)

|

(28

|

)

|

(6

|

)

|

10

|

|

(185

|

)

|

|

Total of continuing operations

|

|

8,603

|

|

(4,396

|

)

|

(185

|

)

|

(69

|

)

|

(52

|

)

|

70

|

|

3,971

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations (Fertilizers)

|

|

89

|

|

(84

|

)

|

(1

|

)

|

—

|

|

—

|

|

—

|

|

4

|

|

|

Total

|

|

8,692

|

|

(4,480

|

)

|

(186

|

)

|

(69

|

)

|

(52

|

)

|

70

|

|

3,975

|

|

(i) Adjusted for the special events occurred in the period.

11

Table of Contents

|

|

|

Three-month period ended March 31, 2017

|

|

|

|

|

Net operating

revenue

|

|

Cost of goods sold

and services

rendered

|

|

Sales,

administrative and

other operating

expenses

|

|

Research and

evaluation

|

|

Pre operating and

operational

stoppage

|

|

Adjusted EBITDA

|

|

|

Ferrous minerals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iron ore

|

|

4,826

|

|

(1,677

|

)

|

69

|

|

(16

|

)

|

(41

|

)

|

3,161

|

|

|

Iron ore Pellets

|

|

1,459

|

|

(652

|

)

|

—

|

|

(3

|

)

|

(1

|

)

|

803

|

|

|

Ferroalloys and manganese

|

|

86

|

|

(44

|

)

|

(1

|

)

|

—

|

|

(3

|

)

|

38

|

|

|

Other ferrous products and services

|

|

126

|

|

(76

|

)

|

(3

|

)

|

(1

|

)

|

—

|

|

46

|

|

|

|

|

6,497

|

|

(2,449

|

)

|

65

|

|

(20

|

)

|

(45

|

)

|

4,048

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal

|

|

324

|

|

(248

|

)

|

(4

|

)

|

(3

|

)

|

—

|

|

69

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base metals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nickel and other products

|

|

1,132

|

|

(862

|

)

|

(14

|

)

|

(9

|

)

|

(38

|

)

|

209

|

|

|

Copper

|

|

465

|

|

(230

|

)

|

—

|

|

(2

|

)

|

—

|

|

233

|

|

|

|

|

1,597

|

|

(1,092

|

)

|

(14

|

)

|

(11

|

)

|

(38

|

)

|

442

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others

|

|

97

|

|

(99

|

)

|

(217

|

)

|

(31

|

)

|

(1

|

)

|

(251

|

)

|

|

Total of continuing operations

|

|

8,515

|

|

(3,888

|

)

|

(170

|

)

|

(65

|

)

|

(84

|

)

|

4,308

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations (Fertilizers)

|

|

370

|

|

(339

|

)

|

(15

|

)

|

(2

|

)

|

(11

|

)

|

3

|

|

|

Total

|

|

8,885

|

|

(4,227

|

)

|

(185

|

)

|

(67

|

)

|

(95

|

)

|

4,311

|

|

Adjusted EBITDA is reconciled to net income (loss) as follows:

From Continuing operations

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Adjusted EBITDA from continuing operations

|

|

3,971

|

|

4,308

|

|

|

Depreciation, depletion and amortization

|

|

(873

|

)

|

(908

|

)

|

|

Dividends received and interest from associates and joint ventures

|

|

(70

|

)

|

—

|

|

|

Special events (note 4)

|

|

(63

|

)

|

512

|

|

|

Operating income

|

|

2,965

|

|

3,912

|

|

|

Financial results, net

|

|

(624

|

)

|

(613

|

)

|

|

Equity results in associates and joint ventures

|

|

85

|

|

73

|

|

|

Impairment and other results in associates and joint ventures

|

|

(14

|

)

|

(61

|

)

|

|

Income taxes

|

|

(721

|

)

|

(723

|

)

|

|

Net income from continuing operations

|

|

1,691

|

|

2,588

|

|

|

Net income attributable to noncontrolling interests

|

|

19

|

|

15

|

|

|

Net income attributable to Vale’s stockholders

|

|

1,672

|

|

2,573

|

|

From Discontinued operations

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Adjusted EBITDA from discontinued operations

|

|

4

|

|

3

|

|

|

Impairment of non-current assets

|

|

(113

|

)

|

(111

|

)

|

|

Operating loss

|

|

(109

|

)

|

(108

|

)

|

|

Financial results, net

|

|

(4

|

)

|

(4

|

)

|

|

Income taxes

|

|

31

|

|

30

|

|

|

Loss from discontinued operations

|

|

(82

|

)

|

(82

|

)

|

|

Net income attributable to noncontrolling interests

|

|

—

|

|

1

|

|

|

Loss attributable to Vale’s stockholders

|

|

(82

|

)

|

(83

|

)

|

b)

Assets by segment

|

|

|

March 31, 2018

|

|

Three-month period ended March 31, 2018

|

|

|

|

|

Product inventory

|

|

Investments in

associates and joint

ventures

|

|

Property, plant and

equipment and

intangible (i)

|

|

Additions to

property, plant and

equipment and

intangible (ii)

|

|

Depreciation,

depletion and

amortization (iii)

|

|

|

Ferrous minerals

|

|

1,723

|

|

1,988

|

|

36,078

|

|

654

|

|

432

|

|

|

Coal

|

|

70

|

|

336

|

|

1,683

|

|

33

|

|

65

|

|

|

Base metals

|

|

1,146

|

|

14

|

|

23,136

|

|

197

|

|

350

|

|

|

Others

|

|

16

|

|

1,384

|

|

1,844

|

|

6

|

|

26

|

|

|

Total

|

|

2,955

|

|

3,722

|

|

62,741

|

|

890

|

|

873

|

|

12

Table of Contents

|

|

|

December 31, 2017

|

|

Three-month period ended March 31, 2017

|

|

|

|

|

Product inventory

|

|

Investments in

associates and joint

ventures

|

|

Property, plant and

equipment and

intangible (i)

|

|

Additions to

property, plant and

equipment and

intangible (ii)

|

|

Depreciation,

depletion and

amortization (iii)

|

|

|

Ferrous minerals

|

|

1,770

|

|

1,922

|

|

36,103

|

|

830

|

|

417

|

|

|

Coal

|

|

82

|

|

317

|

|

1,719

|

|

56

|

|

105

|

|

|

Base metals

|

|

1,009

|

|

13

|

|

23,603

|

|

211

|

|

381

|

|

|

Others

|

|

6

|

|

1,316

|

|

1,946

|

|

10

|

|

5

|

|

|

Total

|

|

2,867

|

|

3,568

|

|

63,371

|

|

1,107

|

|

908

|

|

(i)

Goodwill is allocated mainly to ferrous minerals and base metals segments in the amount of US$2,146 and US$1,906 in March 31, 2018 and US$2,157 and US$1,953 in December 31, 2017, respectively.

(ii) Includes only cash outflows.

(iii) Refers to amounts recognized in the income statement.

In September 2017, the Federal Court granted an injunction suspending certain of nickel mining operations at Onça Puma (base metals segment). The Company has appealed this decision to seek a suspension of this injunction, but it is not possible to antecipate when Onça Puma activities will resume. The Company has assessed the impairment risk related to this specific cash-generating unit and concluded that no loss should be recognized in the income statement for the period ended March 31, 2018.

c)

Net operating revenue by geographic area

|

|

|

Three-month period ended March 31, 2018

|

|

|

|

|

Ferrous

minerals

|

|

Coal

|

|

Base metals

|

|

Others

|

|

Total

|

|

|

Americas, except United States and Brazil

|

|

219

|

|

—

|

|

157

|

|

—

|

|

376

|

|

|

United States of America

|

|

82

|

|

—

|

|

244

|

|

8

|

|

334

|

|

|

Germany

|

|

325

|

|

—

|

|

71

|

|

—

|

|

396

|

|

|

Europe, except Germany

|

|

471

|

|

102

|

|

499

|

|

—

|

|

1,072

|

|

|

Middle East/Africa/Oceania

|

|

593

|

|

43

|

|

4

|

|

—

|

|

640

|

|

|

Japan

|

|

457

|

|

33

|

|

115

|

|

—

|

|

605

|

|

|

China

|

|

3,386

|

|

—

|

|

208

|

|

—

|

|

3,594

|

|

|

Asia, except Japan and China

|

|

346

|

|

150

|

|

249

|

|

—

|

|

745

|

|

|

Brazil

|

|

648

|

|

52

|

|

87

|

|

54

|

|

841

|

|

|

Net operating revenue

|

|

6,527

|

|

380

|

|

1,634

|

|

62

|

|

8,603

|

|

|

|

|

Three-month period ended March 31, 2017

|

|

|

|

|

Ferrous

minerals

|

|

Coal

|

|

Base metals

|

|

Others

|

|

Total

|

|

|

Americas, except United States and Brazil

|

|

142

|

|

—

|

|

304

|

|

—

|

|

446

|

|

|

United States of America

|

|

53

|

|

—

|

|

186

|

|

45

|

|

284

|

|

|

Germany

|

|

309

|

|

—

|

|

52

|

|

16

|

|

377

|

|

|

Europe, except Germany

|

|

581

|

|

89

|

|

453

|

|

—

|

|

1,123

|

|

|

Middle East/Africa/Oceania

|

|

427

|

|

51

|

|

3

|

|

—

|

|

481

|

|

|

Japan

|

|

390

|

|

33

|

|

88

|

|

—

|

|

511

|

|

|

China

|

|

3,658

|

|

—

|

|

160

|

|

—

|

|

3,818

|

|

|

Asia, except Japan and China

|

|

255

|

|

101

|

|

311

|

|

—

|

|

667

|

|

|

Brazil

|

|

682

|

|

50

|

|

40

|

|

36

|

|

808

|

|

|

Net operating revenue

|

|

6,497

|

|

324

|

|

1,597

|

|

97

|

|

8,515

|

|

Provisionally priced commodities sales -

As at March 31, 2018, there were 29 million metric tons of iron ore (2017: 33 million metric tons) and 73 thousand metric tons of copper (2017: 106 thousand metric tons) provisionally priced based on forward prices. The final price of these sales will be determined during the second quarter of 2018. A 10% change in the realized prices compared to the provisionally priced sales, all other factors held constant, would increase or reduce iron ore net income by US$183 and copper net income by US$58.

13

Table of Contents

4.

Special events occurred during the period

The special events occurred during the period are those that, in the Company’s judgment, have non-operational effect on the performance of the period due to their size and nature. To determine whether an event or transaction should be disclosed as “special events”, the Company considers quantitative and qualitative factors, such as frequency and magnitude.

The special events identified by the Company are as follows:

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Disposals of assets

|

|

(18

|

)

|

(3

|

)

|

|

Provision for litigation

|

|

(45

|

)

|

—

|

|

|

Nacala Logistic Corridor

|

|

—

|

|

515

|

|

|

Total

|

|

(63

|

)

|

512

|

|

Disposals of assets -

The Company recognized a loss of US$18 in the income statement during the period ended March 31, 2018 as “Impairment and other results on noncurrent assets” due to non-viable projects and operating assets written off through sale or obsolescence.

Provision for litigation —

During the period ended March 31, 2018, the Company’s assessment of the likelihood of loss for various labor litigations have been updated and a net impact of US$45 was charged to the income statement.

Nacala Logistic Corridor —

In March 2017, the Company concluded the transaction with Mitsui to sell 15% of its stake in Vale Moçambique and 50% of its stake in the Nacala Logistics Corridor and recognized a gain in the income statement of US$515.

5.

Costs and expenses by nature

a)

Cost of goods sold and services rendered

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Personnel

|

|

553

|

|

547

|

|

|

Materials and services

|

|

884

|

|

782

|

|

|

Fuel oil and gas

|

|

353

|

|

309

|

|

|

Maintenance

|

|

737

|

|

723

|

|

|

Energy

|

|

238

|

|

215

|

|

|

Acquisition of products

|

|

123

|

|

164

|

|

|

Depreciation and depletion

|

|

828

|

|

846

|

|

|

Freight

|

|

901

|

|

659

|

|

|

Others

|

|

607

|

|

489

|

|

|

Total

|

|

5,224

|

|

4,734

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

5,077

|

|

4,595

|

|

|

Cost of services rendered

|

|

147

|

|

139

|

|

|

Total

|

|

5,224

|

|

4,734

|

|

b)

Selling and administrative expenses

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Personnel

|

|

62

|

|

54

|

|

|

Services

|

|

19

|

|

12

|

|

|

Depreciation and amortization

|

|

19

|

|

29

|

|

|

Others

|

|

24

|

|

29

|

|

|

Total

|

|

124

|

|

124

|

|

c)

Other operating expenses, net

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Provision for litigation

|

|

45

|

|

12

|

|

|

Profit sharing program

|

|

47

|

|

39

|

|

|

Others

|

|

33

|

|

26

|

|

|

Total

|

|

125

|

|

77

|

|

14

Table of Contents

6.

Financial result

|

|

|

Three-month period ended March 31,

|

|

|

|

|

2018

|

|

2017

|

|

|

Financial income

|

|

|

|

|

|

|

Short-term investments

|

|

25

|

|

36

|

|

|

Derivative financial instruments

|

|

119

|

|

315

|

|

|

Others

|

|

93

|

|

28

|

|

|

|

|

237

|

|

379

|

|

|

Financial expenses

|

|

|

|

|

|

|

Loans and borrowings gross interest

|

|

(336

|