American Express Advances in Effort to Access China Market

April 25 2018 - 11:02AM

Dow Jones News

By Lingling Wei and Chao Deng

BEIJING -- American Express Co. cleared a hurdle in its

yearslong effort to operate in China, potentially becoming the

first U.S. card network to receive permission to offer services in

the Chinese market.

China's central bank informed the New York-based card issuer

that it will "formally accept" its application to clear and settle

domestic bank-card transactions, an Amex spokesman said. The firm

has applied to do so by forming a joint venture with a Chinese

mobile-payment provider, Lianlian Group, said the spokesman, Fritz

Quinn. People close to the central bank confirmed officials have

given "verbal acceptance" to AmEx's application.

Obtaining such regulatory consent marks an important, if only an

initial step toward gaining a foothold in China's fast-growing

electronic-payment market. Chinese authorities hope to tout AmEx's

application as an example of progress in opening its markets when

President Donald Trump's top economic advisers travel to Beijing

next week to try to settle escalating trade disputes, according to

people involved in China's decision-making.

AmEx's decision to take on a Chinese partner -- instead of

forming a wholly owned entity -- shows the difficulties foreign

firms face in going solo in a market where the government holds

sway, said analysts and industry experts. Barriers to foreigners

have been high for so long that Chinese institutions now thoroughly

dominate many sectors, especially in finance -- be they for payment

services, credit rating, brokerages or banking -- sectors where

China has said greater foreign participation would be allowed.

Authorities "aren't establishing a level playing field," said

Lester Ross, a Beijing-based lawyer at WilmerHale, who advises U.S.

businesses operating in China. Instead, he said, they're "opening a

door but only for firms to crawl through."

Opening the market to foreign card companies was a pledge

Beijing made a dozen years ago. It still hadn't done so when

Beijing promised "full and prompt" market access as part of a quick

"100-day" market-opening package made after a summit between

President Donald Trump and President Xi Jinping a year ago.

Credit-rating, brokerage and financial firms are all areas Beijing

has over the past year said greater foreign participation would be

allowed, but where foreign executives complain that licensing and

other regulatory roadblocks leave those promises unfulfilled.

China already has 6.7 billion bank cards in circulation, with

government-owned China UnionPay Co. commanding more than 90% of the

domestic market.

Joint ventures, like the one being formed by AmEx, have drawn

particular ire from some Trump administration officials who see

them as a tool China uses to reduce American companies' profits and

siphon off their technical know-how.

The AmEx spokesman, Mr. Quinn, said the firm's strategy has

always been to form a joint venture in China. AmEx has worked with

Lianlian as far back as 2012, providing technologies to power

Lianlian's digital wallets, which Chinese consumers can use to top

up mobile phone minutes and pay bills with. "For any foreign

business doing business, it's nice to have some help," Mr. Quinn

said.

In addition to AmEx, Mastercard Inc. has also formed a

partnership with three Chinese entities and has applied with the

central bank to conduct card-clearing and settlement transactions

in the country, according to people with knowledge of the matter.

Its joint-venture application so far hasn't been accepted by the

People's Bank of China, the people said.

"Do they have a preference?" one of the people said, referring

to the question of whether the government prefers that foreign

companies find local partners. "You have to feel it for

yourself."

Visa Inc. recently has withdrawn and resubmitted its application

to form a wholly owned entity in China, according to people

familiar with the matter. The refiling came after senior Visa

executives met with People's Bank governor Yi Gang in late March,

the people said. So far, the firm's application hasn't been

accepted by the central bank, the people added, and Visa is also

weighing potentially teaming up with Chinese banks as way to get

into Chinese market if it doesn't get the green light to proceed

with the application.

A Visa spokeswoman said the company would continue to work

through the application process and is committed to China for the

long run. She declined to elaborate.

Even with the informal acceptance of its application by the

central bank, AmEx still needs to overcome other hurdles to be able

to start operating in China. It has to go through a rather-murky

national-security review process, the people with knowledge of its

application procedure said. The firm could face more than a year

before it can get its local business running, because the

government also requires the joint-venture company to put data

centers and other processing systems in place before seeking a

final approval.

Meanwhile, another group promised fast progress as part of the

Trump-Xi "100-day" plan- -- global credit-rating companies -- are

still struggling with local barriers. As part of that agreement,

China was supposed to allow wholly owned foreign rating firms to

provide credit assessment services in the country by July 2017. So

far, none of the big three raters -- S&P Global Inc., Moody's

Investors Service and Fitch Ratings -- has applied, according to

people with knowledge of the process.

One major obstacle is a request that they adopt domestic rating

standards that tend to give local companies loftier grades than

they would likely receive under the foreign firms' global

standards, these people said. S&P declined to comment. Moody's

and Fitch said they welcomed the regulatory changes.

--

Yang Jie

and AnnaMaria Andriotis contributed to this article.

Write to Lingling Wei at lingling.wei@wsj.com and Chao Deng at

Chao.Deng@wsj.com

(END) Dow Jones Newswires

April 25, 2018 10:47 ET (14:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

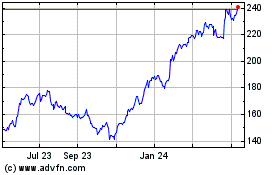

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

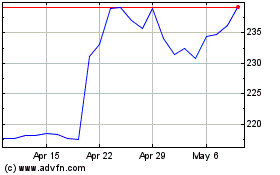

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024