By Shalini Ramachandran, Amol Sharma and David Benoit

Comcast Corp. lobbed an official $31 billion proposal to buy

European pay-TV operator Sky PLC -- but it may have a much bigger

deal in mind down the road.

Comcast's official bid to buy Sky tops an existing offer from

21st Century Fox, which already owns a 39% stake in Sky. Comcast

said it was considering such an offer in February.

The official Comcast offer sent Sky shares more than 2% higher

-- and above the Comcast bid, suggesting investors are positioning

for a bidding war.

The formal bid kicks off what has been a long-expected corporate

takeover battle pitting Comcast against Rupert Murdoch's 21st Fox

over the European TV giant. Sky said in response to the offer

Wednesday that it was terminating its previous pact agreeing to the

21st Century Fox takeover. It said its board would also withdraw

its recommendation for the Fox bid. 21st Century Fox, meanwhile,

said Wednesday it remained committed to buying all of Sky.

Separately, Comcast is weighing whether to play interloper on

the pending Walt Disney Co. acquisition of 21st Century Fox's

entertainment assets, people familiar with the situation say.

Comcast is gaming out the possibility of making a public case to

the company's shareholders that they should reject the Disney deal,

which is expected to come to a vote this summer, and opt for a

Comcast tie-up instead, people familiar with the situation say.

Comcast lost out to Disney in December when Fox rejected its

bid, which was 16% higher, according to a Fox regulatory filing

last week. Fox cited concerns about regulatory risk. The assets in

play include Fox's film and TV studio, cable networks and

international properties including Star India and the Sky

stake.

Comcast may choose to leave the Disney-Fox deal alone, and it

doesn't expect to make a decision in the near term, the people

familiar with the situation said.

The company's pursuit of potentially transformative deals comes

as the company posted strong first-quarter earnings growth, despite

continuing cable TV subscriber losses.

Comcast reported 21% profit growth compared with the

year-earlier period. Revenue at its NBCUniversal media unit rose

21% to $9.5 billion, boosted by its Winter Olympics and Super Bowl

broadcasts, which offset a weak performance in the film division.

Comcast lost 96,000 cable TV customers, compared with a gain of

42,000 in the prior-year quarter, as it continues to feel the

impact of rising competition from streaming services. This was its

fourth consecutive quarter of subscriber losses.

If Comcast chooses to go hostile for the Fox assets, Comcast

would need to woo Fox investors, which may not be easy. Comcast has

had conversations with several shareholders in the wake of its Sky

bid, including British investor TCI Fund Management, known for its

activism, people familiar with the situation said.

TCI has been building a significant stake in Fox, people close

to the situation say. As of December, the firm held 0.7% of Fox's

class A common shares. Including Class B shares, its voting power

on a merger proposal would have been 0.46%. The size of its current

stake isn't clear; the next disclosure would likely come in a May

filing. As of December, TCI also was among the top holders of

Comcast shares, with a 1.5% stake, according to FactSet.

In recent weeks, TCI founder Chris Hohn spoke on the phone with

Comcast Chief Executive Brian Roberts and probed about Comcast's

interest in launching a public bid for Fox's assets, people

familiar with the situation said. Mr. Roberts didn't respond, the

people said. Other TCI officials have also had conversations with

Comcast's investor relations team that left Comcast executives with

the clear indication that TCI wants the cable giant to continue its

pursuit of Fox, the people said.

In an email, Mr. Hohn said he didn't urge Mr. Roberts to go

hostile in pursuit of Fox's assets.

Mr. Hohn is one of the best-known activists in Europe and has

historically not shied from being aggressive with big companies and

significant shareholders. In 2016, Mr. Hohn took a stake in

SABMiller PLC and got Anheuser-Busch InBev to up its offer for the

brewer even when more than 40% was in the hands of two

investors.

Rupert Murdoch and his family have a 39% voting interest in Fox.

Their economic interest, which is what would count in a shareholder

vote on the Disney-Fox merger, is roughly 17%. (The Murdoch family

is also a major shareholder in Wall Street Journal-parent News

Corp)

Besides lining up investor backing, there are other

considerations for Comcast in whether to go to war over the Fox

assets. One is its stock price, since its shares would likely be

used to help pay for a major acquisition, the people familiar with

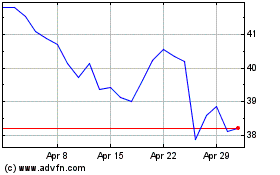

the situation said. Comcast shares have declined 22% since late

January, wiping out more than $40 billion in market value.

Comcast is also watching closely the government's antitrust case

against AT&T and Time Warner, which is playing out in court. If

AT&T wins, Comcast would feel more emboldened to make a move,

the people said.

As it weighs big deals, Comcast is continuing to invest in areas

to help its existing business offset the challenges of traditional

TV. It has expanded its "X1" smart-video platform, raised internet

speeds and launched a new wireless cellphone service.

Though broadband customer growth slowed in the first quarter to

379,000 additions from 429,000 in the prior-year quarter, revenue

for the unit grew 8%.

Quarterly profit rose to $3.1 billion, or 66 cents a share, up

from $2.6 billion, or 53 cents a share, a year ago. Adjusted profit

per share for the latest quarter was 62 cents. Revenue grew 11% to

$22.79 billion. Both figures exceeded estimates from analysts, who

were projecting adjusted earnings of 59 cents a share on $22.74

billion in revenue, according to Thomson Reuters.

In its official offer for Sky, Comcast didn't change the terms

of its informal offer, which it first disclosed in February. It

said it is offering GBP12.50 ($17.46) a share for Sky, or 16% more

than Fox's GBP10.75-a-share bid. That is the price Comcast said it

would offer when it announced its intention to bid for Sky in

February.

Fox, which owns 39% of Sky, originally proposed buying the 61%

of the British pay-TV company it doesn't already own in December

2016, but British regulators have held up the takeover bid as it

examines whether it would give Mr. Murdoch and his family too much

influence in U.K. media.

Mr. Murdoch and his family are major shareholders in Fox and in

News Corp, which publishes three major British newspapers, as well

as The Wall Street Journal. Regulators are expected to deliver a

final recommendation on Fox's proposal on May 1, and then the

British government will decide whether to approve the merger

outright, approve it with conditions, or reject it.

Sky and Disney have both offered the U.K. government assurances

that both would protect the independence of Sky News. On Wednesday,

Comcast offered similar assurances.

Comcast said in a statement that it would establish an

independent board for Sky's news channel, and would commit to

funding it for 10 years. Fox has also offered to create an

independent board for the channel, which it would fund for 15

years.

--Ben Dummett contributed to this article.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com,

Amol Sharma at amol.sharma@wsj.com and David Benoit at

david.benoit@wsj.com

(END) Dow Jones Newswires

April 25, 2018 08:43 ET (12:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024