Diet Coke Gets Lift From Flavors -- WSJ

April 25 2018 - 3:02AM

Dow Jones News

By Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 25, 2018).

New flavors of Diet Coke in skinny, redesigned cans have added

some pop to Coca-Cola Co.'s recent sales of the drink.

Coca-Cola sold more Diet Coke in North America in its latest

quarter, returning the product to quarterly volume growth for the

first time since 2010, the company said Tuesday. Though the gain

was modest and the new drinks haven't been on shelves very long,

Coca-Cola said early results suggest its plan to reinvigorate the

brand is working.

Analysts have been skeptical that adding flavors such as Zesty

Blood Orange and Twisted Mango, which are artificially sweetened,

will win back former soda drinkers who have moved on to

healthier-seeming options such as ice tea and flavored seltzer

waters.

The launch, helped by a strong marketing push, was "bold enough

and interesting enough" to engage lapsed Diet Coke fans, Chief

Executive James Quincey told analysts on an earnings call. But the

modest improvement reflects only the first several weeks of sales,

and Mr. Quincey warned sales could soften.

The last time Diet Coke's quarterly volumes increased in North

America, its largest region by sales, was the fourth quarter of

2010, a company spokesman said. Diet Coke's sales volume in the

U.S. has declined every year since 2006, according to industry

publication Beverage Digest.

About one-third of the volume improvement came from the new

flavors, which aren't available in as many package sizes as regular

Diet Coke, Mr. Quincey said on a call with media. He said sales

were roughly equally split among the flavors, which also include

Ginger Lime and Feisty Cherry.

Across its portfolio, Coca-Cola's drink volume rose 3% in its

first quarter, compared with a year earlier, including a 4% rise in

soda and a 5% rise in coffee and tea. Volumes improved for all

Coke- and Coca-Cola-branded products, including a 3% increase for

the company's namesake cola and a double-digit increase for

Coca-Cola Zero Sugar.

Volumes declined in juice, where higher costs have caused

Coca-Cola and others to shrink packages.

The drinks company's first-quarter organic revenue, which

excludes currency swings, acquisitions and divestitures, increased

5% from a year earlier. Overall, revenue fell 16% to $7.6 billion,

because of the divestiture of bottling operations. Analysts polled

by Thomson Reuters had expected $7.34 billion in revenue.

The Atlanta-based company posted a profit of $1.37 billion,

compared with $1.2 billion a year earlier.

On an adjusted basis, the company earned 47 cents a share, just

above the 46 cents that analysts expected.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

April 25, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

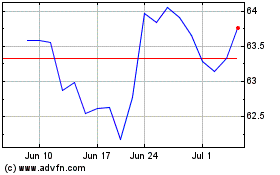

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024