Freeport is Worst Performer in S&P 500 as Indonesia Troubles Pound Shares

April 24 2018 - 3:34PM

Dow Jones News

By Amrith Ramkumar

Freeport-McMoRan Inc.'s shares had their worst day in two years

Tuesday after the company said that its troubles mining copper in

Indonesia were dragging on.

The shares tumbled 16%, their steepest slide since January 2016,

while copper prices rose. Freeport was also the worst performer in

the S&P 500.

Moves in copper tend to swing the shares of Freeport and other

miners. But on Tuesday, investors were focused on Freeport's

first-quarter results. The Phoenix-based company reported

weaker-than-expected sales and profits, and gave lower guidance for

future production.

Freeport is dealing with issues in Indonesia, where the giant

copper and gold mine Grasberg is located. The company and the

Indonesian government have been jostling for years over control of

the world's second-largest copper mine.

On the earnings call with analysts, Chief Executive Richard

Adkerson said ongoing negotiations over a sale of Freeport's

majority stake to the government were taking longer than expected.

Freeport previously said it wanted to complete a deal in the first

half of the year.

The results are "certainly pouring cold water on some of the

expectations that we are in the final innings of a very long,

drawn-out negotiating process," said Lucas Pipes, an analyst at B.

Riley. "Investors will have to deal with this. There's uncertainty

and anxiety."

Adding to investor worries, Freeport said it is addressing new

claims from Indonesia's Ministry of Environment and Forestry about

how it handles the byproducts left over from extracting resources

at Grasberg, which is located in the mountains of Indonesia.

Mr. Adkerson called the claims "really shocking and

disappointing" and said they dictate Freeport meet standards in six

months that realistically can't be achieved. He said the company

received them last week but doesn't expect them to disrupt

operations. He said they could add a distraction to the continuing

negotiations over Grasberg.

"I'm concerned that behind it was political motivations," Mr.

Adkerson said. "It has no impact on our view of the value of our

asset."

The company also cut its 2019 copper-production projection,

citing in part unexpected seismic activity from trying to ramp up

operations in the Deep Mill Level Zone of Grasberg. Still, some

analysts don't expect any delays to affect the company's long-term

output.

Freeport plans to finish mining the available aboveground

Grasberg resources this year before extracting metal underground in

the future, a main reason analysts are waiting to see what form a

possible deal with the government takes.

Investors pushed up the price of Freeport's shares after the

company last August said it would give up its majority stake in

Grasberg, reducing it to 49% from about 90%.

Analysts were further encouraged late last year when reports

emerged that Indonesia wanted to evaluate acquiring the roughly 40%

stake of global mining giant Rio Tinto in Freeport's future

Grasberg production. Some said a possible agreement between

Indonesia and Rio Tinto could limit Freeport's sale to a roughly 9%

stake and make negotiations on overall price much easier.

But Mr. Adkerson said on Tuesday that Indonesia's evaluation of

a possible deal with Rio Tinto took longer than expected. Some

observers are worried that negotiations could stall ahead of next

year's Indonesian presidential election.

Campaigning has already begun, and Mr. Adkerson said that

Indonesian President Joko Widodo's political priorities could

hinder progress on negotiations.

"A final resolution may have to wait until the second half of

2019," said Bill Sullivan, a Jakarta-based legal adviser to mining

companies.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

April 24, 2018 15:19 ET (19:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

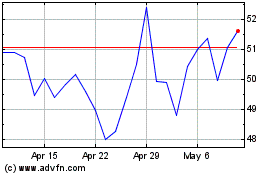

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024