Current Report Filing (8-k)

April 24 2018 - 9:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): April 24, 2018 (March 7, 2018)

Drone USA, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

000-55789

|

|

30-0967943

|

(state or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

16 Hamilton Street, West Haven, CT 06516

(address of principal executive offices) (zip

code)

(203)

220-2296

(registrant’s telephone number, including

area code)

(former name or former address, if changed since

last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive

Agreement.

On

March 7, 2018, the registrant, Drone USA, Inc. (“Drone USA”), entered into a Placement Agent and Advisory Services

Agreement (“Placement Agent Agreement”) with Scottsdale Capital Advisors Corporation (“Scottsdale”) under

which Scottsdale agreed to secure an investor to purchase bona fide and outstanding and unpaid creditor claims of Drone in exchange

for shares of Drone’s common stock in a state court approved transaction in compliance with the terms of section 3(a)(10)

of the Securities Act of 1933, as amended. Under the terms of the Placement Agent Agreement, Drone will issue a six month convertible

note (the “Convertible Note”) in the principal amount of $15,000 bearing annual interest of 10% that converts into

Drone common stock at a per share price of 70% of the lowest closing bid price for 20 trading days prior to the conversion.

Under

the terms of the Liability Purchase Term Sheet discussed below, Drone USA entered into a letter settlement of 3a10 claims

dated March 13, 2018 for 1,500,000 shares for purchase of $1,000,000 of debt we owed to TCA Global. The purchase of the debt

allows Drone USA to reduce the accrued monthly interest payments to TCA Global on the unpaid principal balance of the note

held by TCA Global. As set forth in our Form 10-K filed December 29, 2017, on November 15, 2017, we executed a Liability

Purchase Term Sheet with Livingston Asset Management (“Livingston”) under which Livingston agreed to purchase up

to $10,000,000 that we owe to our creditors through direct purchase of the debts from our creditors in return for (i) a

convertible note issued by the Company in the principal amount of $50,000 bearing interest of 10% per year to cover certain

legal fees and other expenses of Livingston that matures in six months and is convertible into shares of our common stock at

a 30% reduction off the lowest closing bid price for 20 trading days prior to the date of conversion, (ii) a convertible note

subject to these same terms as the convertible note issued to Livingston and payable to Scottsdale Capital Advisors in the

principal amount of $15,000 as a placement agent fee and (iii) the right of Livingston to retain 30% of any negotiated

reduction off the face amount of the liability we owe to such creditors. Following a court judgment for the liabilities

purchased by Livingston, we may issue free trading shares of our common stock under section 3(a)(10) of the Securities Act

to Livingston in the amount of such judgment in a series of tranches so that Livingston will not own more than 9.99% of our

outstanding shares per tranche.

The

foregoing is a summary of the terms of the Placement Agent and Advisory Services Agreement and is qualified in its entirety by

the Placement Agent and Advisory Services Agreement attached hereto and incorporated herein as Exhibit 10.1.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits: The following exhibits are filed with this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date: April 24, 2018

|

Drone USA, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Michael Bannon

|

|

|

|

Name: Michael Bannon

|

|

|

|

Title: President and CEO

|

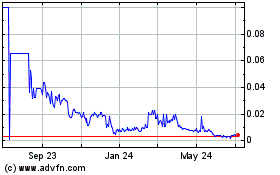

Bantec (PK) (USOTC:BANT)

Historical Stock Chart

From Mar 2024 to Apr 2024

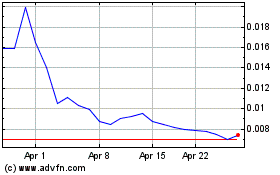

Bantec (PK) (USOTC:BANT)

Historical Stock Chart

From Apr 2023 to Apr 2024