In ZTE Battle, U.S. Suppliers Are Collateral Damage

April 24 2018 - 5:59AM

Dow Jones News

By Jay Greene

American companies that supply chips, antennas and other gear to

ZTE Corp. are bracing for a sizable revenue loss after the U.S.

last week said they no longer would be able to sell components to

the Chinese telecommunications giant.

Several ZTE vendors watched their stock prices stumble in recent

days, collateral damage after the Commerce Department put in place

a seven-year ban, as national-security and trade-related tensions

flare up between the U.S. and China. Giants such as San Diego chip

maker Qualcomm Inc. and niche companies such as Acacia

Communications Inc., a Maynard, Mass.-based maker of fiber-optic

networking components, are among U.S. companies affected.

U.S. chip makers sold about $1.5 billion worth of products to

ZTE, according to Handel Jones, chief executive of the technology

consultancy International Business Strategies Inc., which tracks

China's high-tech sector. ZTE made 3.8% of smartphones world-wide

in 2017, he estimates.

The pinch is particularly acute for Acacia, which noted in a

February filing that ZTE accounted for 30% of its $385.17 million

in revenue last year. Acacia, which had 354 employees at the end of

2017, said "the loss or temporary loss of a major customer for any

reason could harm our financial condition."

Acacia, a roughly $1.1 billion company whose stock has slid 31%

since the ban was announced on April 16, said it was "taking steps

to suspend affected transactions and is assessing the impact of

these developments." It declined to comment further.

Qualcomm's shares have tumbled 9%. ZTE contributed between 1.5%

and 2.5% of Qualcomm's $22.3 billion of revenue in 2017, according

to Stacy Rasgon, an analyst at Bernstein Research.

Two years ago, the Commerce Department placed similar export

restrictions on ZTE but quickly suspended them. In a regulatory

filing last May, Xilinx Inc., a San Jose, Calif., maker of

programmable chips, said if those sanctions hadn't been lifted "the

restrictions could have caused a material adverse effect" on its

business.

A spokeswoman said Xilinx, whose shares have fallen 7% since the

ban's announcement, is "obviously aware of the situation and will

be addressing it during our earnings call" Wednesday.

After the ban was announced, ZTE warned the order "will not only

severely impact the survival and development of ZTE, but will also

cause damages to all partners of ZTE including a large number of

U.S. companies."

More than a dozen U.S. companies listed ZTE as a customer in

previous financial filings.

NeoPhotonics Corp. said ZTE directly or indirectly accounted for

4% of the $292.89 million in revenue it posted last year. The San

Jose-based maker of optical gear had been counting on that business

to jump to 5% of annualized revenue. Now those expectations "will

not be realized," the company said in a statement April 17.

Moreover, NeoPhotonics said it is sitting on $1.5 million in

inventory "designated for ZTE" that it will write off. Its shares

have fallen 13% since the ban's announcement.

Oclaro Inc. has said ZTE accounted for 18% of the $600.97

million it posted in fiscal 2017 revenue. The San Jose maker of

optical components is in the process of being acquired by Lumentum

Holdings Inc. in a $1.8 billion transaction.

The Sunnyvale, Calif., memory-chip maker GSI Technology Inc. has

said ZTE "directly or indirectly purchased more than $500,000" of

its products in the previous fiscal year. Skyworks Solutions Inc.,

of Woburn, Mass., has listed ZTE as a "key customer" along with

Amazon.com Inc., Cisco Systems Inc. and Microsoft Corp.

Lumentum and Skyworks representatives declined to comment.

Oclaro and GSI didn't respond to requests for comment.

Corning Inc., which makes screens called Gorilla Glass used in

smartphones from ZTE and others, said it was assessing whether the

order applies to its products made at its factories in Taiwan,

Japan and South Korea. The company said it wasn't sure whether

Gorilla Glass includes content that falls under U.S. export

controls.

"We are continuing to monitor the situation and determine if the

order impacts products made in foreign destinations," spokesman

Daniel Collins said.

A Commerce Department spokesman said ZTE won't be able purchase

goods, software or technology subject to the agency's Export

Administration Regulations, regardless of where they might be

manufactured.

--Ted Greenwald in San Francisco, Liza Lin in Beijing and John

McKinnon in Washington contributed to this article.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

April 24, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

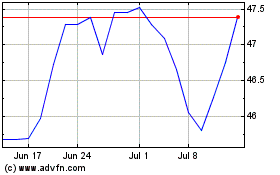

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024