Woodward Reports Net Sales Growth, Revises Fiscal Year 2018 Outlook

April 23 2018 - 5:19PM

Dow Jones News

By Aisha Al-Muslim

Woodward Inc. (WWD) reported its second-quarter net sales rose

as the manufacturer had strong growth in its aerospace segment.

The Fort Collins, Colo.-based aerospace-parts maker said net

sales jumped 10% from a year earlier to $548.2 million, driven by

growth in new aircraft production, aftermarket sales and continued

strength in smart weapons.

Aerospace segment net sales rose 21% to $386.3 million, while

sales in Woodward's industrial segment fell 10% to $161.9 million.

The company said industrial sales declined as it faced continued

weakness in industrial gas turbines and renewables, partially

offset by improving demand for large engines.

Woodward had a profit of $38.5 million, or 60 cents a share in

the latest quarter, slightly up from $38.1 million, or 60 cents a

share, a year earlier.

Woodward recorded a total of $19 million of pretax special

charges, or 22 cents share, primarily due to its decision to move

its operations located in Duarte, Calif. to the recently renovated

Drake Campus in Fort Collins, Colo. The Duarte facility is unable

to support new business awarded to the company, including a

contract with Airbus SE, the company said.

Excluding one-time items, Woodward earned 82 cents a share.

Analysts polled by Thomson Reuters had forecast earnings of 74

cents a share on $528 million in revenue.

For fiscal 2018, Woodward revised its net sales guidance to

about $2.2 billion, compared with a prior forecast between $2.2

billion to $2.3 billion. Adjusted earnings per share are now

expected to be between $3.60 to $3.80, up from $3.35 and $3.60, the

company said Monday.

Woodward manufactures products for commercial and military

aircraft, including engine parts, pumps and valves. The company

also has an industrial-machinery business focused on the energy and

utility sectors.

Earlier this month, Rolls-Royce Holdings PLC (RR.LN) signed an

agreement to sell its German fuel-injection systems supplier

L'Orange to Woodward for an enterprise value of 700 million euros

($859.5 million). The deal is expected to close by the end of the

second quarter of 2018 and is subject to approval from German

antitrust authorities, the companies had said. The acquisition is

expected to be accretive to Woodward in fiscal 2019, the company

said.

The stock has remained mostly unchanged at $74.20 in after-hours

trading Monday. Shares are up more than 10% in the last year.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

April 23, 2018 17:04 ET (21:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

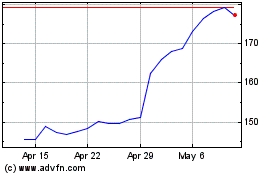

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

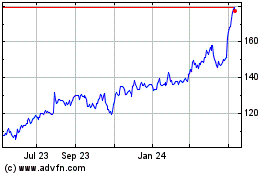

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Apr 2023 to Apr 2024