Coca-Cola Earnings Could Tick Up on New Diet Flavors, Smaller Packaging -- Earnings Preview

April 23 2018 - 12:18PM

Dow Jones News

By Cara Lombardo

Coca-Cola Co. is scheduled to report its first-quarter earnings

before the market opens Tuesday. Here's what you need to know:

EARNINGS FORECAST: Adjusted earnings per share of 46 cents is

the consensus of analysts surveyed by Thomson Reuters, up from 43

cents a year ago.

REVENUE FORECAST: Analysts expect revenue of $7.34 billion, down

from $9.1 billion a year earlier. The drop reflects the divestiture

of bottling operations.

WHAT TO WATCH:

-- DIET COKE FLAVORS: The Atlanta-based company hopes four new

Diet Coke flavors including Zesty Blood Orange and Twisted Mango

will help stem a slide in soda volumes. Some analysts are skeptical

that drinks made with artificial sweeteners will appeal to

health-conscious consumers who have moved on to flavored sparkling

waters, while others say their prospects are encouraging. The

company is expected to share early results from the new flavors,

which it launched during the quarter in brightly colored slim

cans.

-- SMALLER PACKAGING: A key component of Coke's plan to boost

its top line this year involves pushing 7.5-ounce cans of soda and

other downsized offerings that typically cost more per ounce. Chief

Executive James Quincey has said smaller packages account for

between 10% and 20% of Coke's sales by volume and continue to gain

share, even as Coke's overall drink volumes were flat last quarter.

Coke is aiming to increase organic revenue, which excludes currency

swings, acquisitions and sales, by 4% in 2018, which some analysts

say could be unrealistic.

-- REFRANCHISING: Coca-Cola is nearing the final step of its

process to refranchise its North American bottling system and move

to an asset-light model. It plans to close a deal to sell its

Canadian bottling and distribution business in the second half of

the year. Analysts have been closely tracking improvements in the

company's operating margins throughout the refranchising efforts,

especially as freight, labor and input costs for Coke and its

competitors rise.

-- TAX LAWSUIT: Coca-Cola and the IRS are currently in U.S. Tax

Court battling over a $3.3 billion tax bill related to income from

the company's foreign affiliates. The dispute involves the

company's transfer pricing methodology and how much it should

charge overseas affiliates to use its trademarks and formulas. The

trial, which concerns income from 2007 to 2009, started in March

and is slated to end in mid-May, but could take longer. Coke has

said that its transfer pricing methodology hasn't changed since the

IRS signed off on it years ago, and it intends to pursue all

available remedies to resolve the matter.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

April 23, 2018 12:03 ET (16:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

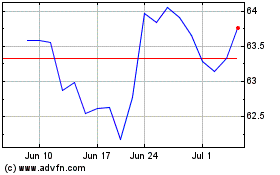

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024