UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: April 23, 2018

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants'

Names)

Bahnhofstrasse 45, Zurich, Switzerland

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20‑F or Form 40-F.

Form 20-F

x

Form

40-F

o

This

Form 6-K consists of the presentation materials related to the First Quarter

2018 Results of UBS Group AG and UBS AG, and the related speaker notes, which

appear immediately following this page.

First

quarter

2018

results

23 April

2018

Speeches

by

Sergio

P.

Ermotti

,

Group

Chief

Executive

Officer

and

Kirt

Gardner

,

Group

Chief

Financial

Officer

Sergio

P.

Ermotti

Slide 1 – Cautionary statement

Thank

you, Caroline. Good morning everyone.

Slide 2 – Net profit +19% YoY to 1.5bn

We

started 2018 on a positive note with strong net profit growth, higher returns,

and a strong capital position. The quarter turned out to be a tale of two

halves, with an exuberant start in January that went well beyond typical

seasonality, followed by a more muted finish.

Once

again, our results showed the power of our diversified business, with strong

divisional results in the Investment Bank and Global Wealth Management, and

strong regional performances in the Americas and Asia Pacific. Net profit

increased by 19% to over 1.5 billion francs and we reported nearly 2 billion

francs in pre-tax profit. Our adjusted return on tangible equity ex-DTAs

reached a three-year high of almost 18%.

The

CET1 leverage ratio, which we currently view as our binding constraint,

increased to 3.76%. As anticipated, our CET1 capital ratio is strong at 13.1%

and our loss absorbing capacity remained around 80 billion francs.

Slide 3 – Very strong underlying operating

performance

Our

excellent headline earnings went hand in hand with very strong underlying

operating performance, which improved by 20%, or 27% in US dollars – all while

continuing to invest for growth and efficiency. Bear in mind that all of our

businesses are affected by continued headwinds from higher funding and Swiss

franc and euro interest rates.

Slide 4 – 1Q18 highlights and strategic

priorities

There

are a few highlights of our first quarter performance I'd like to draw out.

Global

Wealth Management delivered growth across all revenue lines and in all regions.

Adjusted pre-tax profit increased 14% in dollars, which I will come back to

shortly.

Our

Swiss Personal & Corporate business delivered strong underlying results

increasing transaction-based and recurring fee income, amid persistent

headwinds from low interest rates. I'm also pleased about the continued good

net new business volume growth.

With

over 30 billion in inflows, Asset Management had another very strong net new

money quarter and its invested assets reached a decade-high.

The

IB delivered a strong 25% return on attributable equity. The result

demonstrates that we are very competitive in all market conditions. The best

performances came from our traditional areas of strength: Equities and Corporate

Client Solutions, while FRC recovered from last year's challenging second half.

Our

businesses' strong performance was partially offset by Group Asset and

Liability Management results, which were affected by the widening of US

Treasury–OIS spreads on our HQLA, which we report through the P&L rather

than OCI, like many of our peers. These market factors are most likely

temporary, but we also saw the higher funding costs we have highlighted in the

past, and these are likely to remain elevated. Kirt will explain the details

later.

Throughout

the quarter we continued to invest in technology. In line with our earlier

announcement, our spend increased by over 100 million francs year on year.

We

also completed the processes necessary to launch our 3 year buyback program, so

we will start buying this quarter, with a target of 550 million for the year.

Slide 5 – Global WM – Unique strategic growth

drivers

As

I mentioned earlier, Global Wealth Management had an excellent first quarter.

The results were driven by particularly strong performances in our areas of

strategic focus. The Americas and APAC saw double-digit growth to record

levels, underlining our unique positioning in these large and fast growing

markets. In addition, profit from our unrivaled global Ultra High Net Worth

business grew by a third.

Slide 6 – Global WM – driving profitable

growth

As

well as our strong pre-tax growth, we also saw good momentum in net new money

and our cost/income ratio improved. In addition we delivered a further increase

in mandate penetration and growth in loans. So overall, we're in a great

position to sustain high quality, long-term growth.

We

are also pleased with the progress we are making in creating a new

organization. In the first 80 days, our focus was on aligning support and

control functions, establishing a more global Ultra High Net Worth

organization, redesigning our operations in Latin America and streamlining

marketing to further increase client acquisition and retention, just to name a

few examples. We are also combining technology roadmaps to deliver the best

global solutions for our clients, where possible and economically sensible.

There

are a number of other areas that we're looking at to support our priorities

over the next few years. In a nutshell, with more [efficient] resource usage

and by globalizing best in class processes, products and services, we will

support the strong growth expectations we have for the business.

So

to conclude, I'm very pleased with the first quarter. The business is in good

shape. Looking ahead, our momentum is positive. We expect the strengths of our

balanced business model to remain evident in the second quarter's performance.

So

with this, I'd like to hand over to Kirt.

Kirt Gardner

Thank

you, Sergio. Good morning everyone.

Slide 7 –

UBS Group AG results (consolidated)

As usual,

my comments will compare year-on-year quarters and reference adjusted results

unless otherwise stated.

We have

adjusted for restructuring expenses of 128 million that relate to our legacy

cost reduction programs. In principle, we are not expecting to make

adjustments for restructuring expenses related to new cost initiatives. And as

you know, we expect our reported and adjusted results to gradually converge,

with restructuring cost adjustments declining to about half a billion this year

and under 200 million next year.

As of Jan

1st, we adopted IFRS 9, which substantially changes how we calculate credit

losses, and classify and measure financial assets. This has resulted in a

reduction in our IFRS equity of about 600 million and 300 million in our CET1

capital.

Our taxes

this quarter include a 13 million provision for BEAT effects, in line with the

60 million potential impact for 2018 that I referenced last quarter. We are

working to mitigate these effects.

Slide 8 –

Global Wealth Management

This is

the first quarter we've reported results for our combined Global Wealth

Management division. I will refer to US dollars, given how significant the

foreign currency translation movement was for the business, with roughly 70% of

invested assets and revenues based in dollars, as you clearly see on slide 21.

PBT was

up a very strong 14%. Our performance was high quality and broad-based, as we

saw growth in all regions and all revenue lines, another quarter of loan

growth, record mandate penetration, and positive net new money in all regions.

Operating

income rose 12%. Recurring net fee income was up 14%, benefiting from higher

invested assets and record mandate penetration, which stands at one-third of

our invested assets. It is the first time in two years that we’ve seen growth

in recurring fee income outstrip invested assets, as we have put the

cross-border effects substantially behind us.

Net

interest income improved 11%, on net interest margin and 16% higher loan

balances, partly offset by lower net interest from Group ALM, which I'll come

to later.

Transaction-based

income was 7% higher. We saw increases in all regions outside of the Americas,

which had a strong first quarter last year.

Costs

increased by 11%, partly on better revenues, but also on higher IT investments,

mostly related to migrating our international businesses onto one platform and

launching a new digital offering in the Americas, as well as higher regulatory

costs.

Despite

this, the cost/income ratio improved, in part as we are benefiting from the

changes we have made in our Americas' operating model in 2016, and we're

confident that we'll see continued efficiency improvements.

Slide 9 –

Global Wealth Management – regional performance

The

regional split on this slide reflects how Global Wealth Management is managed.

I just want to pick out a few highlights here.

We've had

record profits in the Americas with a 19% increase. Reducing our reliance on

recruiting, while focusing on retention and productivity, is clearly paying

off. We saw a 150 million annualized reduction in costs related to recruitment

loans versus a year ago. And FA compensation was up in line with revenues, and

as we have fully absorbed the increase in pay grids related to our new

operating model.

We are

also seeing results in our net new money, where same store advisors delivered a

record 11 billion. In the second quarter, we’re anticipating the typical

seasonal outflows for tax payments in the US, which were in the 3 to 4 billion

range in previous second quarters.

Our

investment in the munis space is showing promising results, as year-to-date

sales increased five-fold, along with a significant improvement in our league

table position.

APAC

profits also reached a new high, up 14%, with record transaction revenues,

continued strong mandate sales, and lending growth. We further strengthened

our #1 leadership position in Asia as measured by invested assets, where we are

50% larger than the #2 player. Not only that, we delivered higher 1-year and

5-year growth in invested assets than the next 3 competitors.

With

cross-border effects largely behind us, we see strong momentum in EMEA that

should drive QoQ growth going forward. Loans are up 16% year-on-year, net new

money was nearly 5 billion, a 4% annualized growth rate, and we had

double-digit transaction-based income growth.

We are

also pleased with our consistent performance in Switzerland, where net new

money growth was 3% on an annualized basis, and PBT was up a very strong 8% in

francs.

In short,

a very strong, well-balanced performance for our Global Wealth Management, with

positive momentum.

Slide 10

– Personal & Corporate Banking

Personal

and Corporate PBT was 393 million Swiss francs, a very solid result, including

a number of one-off effects.

We

continued to see very strong growth in recurring net fees and transaction-based

income on higher referral, FX, custody and mandate fees. Net interest income

decreased only slightly, as increased deposit revenues were more than offset by

lower GALM allocations, which again, I'll come back to later.

Other

income was about 20 million lower, as we booked a one-time gain of 20 million

related to the sale of a mortgage portfolio in first quarter '17. Credit loss

expense increased by 20 million year over year, as we had a net recovery of 7

million last year versus a build of 13 million in 1Q18. The implementation of

IFRS 9 had a minimal impact on provisions for the quarter.

As

mentioned last year, we initiated a multi-year program to digitize our Swiss

universal bank and expect to see elevated technology investments as a result,

with both revenue and cost benefits beginning to accrue in 2019.

Net new business volume growth

was very strong at 6.3%, the second best quarter since 2007.

Slide 11

– Asset Management

PBT for

Asset Management was 108 million, with the decrease from last year primarily

reflecting the sale of our fund administration business in Q4, which

contributed around 10 million of profits per quarter. Operating income

reflects higher management fees on higher average invested assets, offset by

lower performance fees.

Expenses

increased on higher personnel costs related to variable compensation

accounting.

Once

again, Asset Management recorded excellent net new money of 27 billion

excluding money markets. At 792 billion, invested assets were at the highest

level we’ve seen for a decade.

Absent

any one-time items, we expect PBT to trend around current levels for the next

few quarters.

Slide 12 –

Investment Bank

Our

Investment Bank delivered an excellent quarter, with 20% PBT growth in dollars,

a cost/income of 72%, and return on attributed equity of 25%. As with GWM,

I'll refer to dollar growth rates.

On a

regional basis, we had particularly strong performance in Asia Pacific, where

profits more than doubled.

Corporate

Client Solutions was up 22%, with strong performance across ECM, DCM, and

Advisory, where the global M&A fee pool was down.

Within

ICS, Equities increased 25%, with higher revenues across all regions and

products, but mostly in Derivatives. This doesn't include corporate

derivatives, which we report in CCS. If we were to report them in Equities,

like many of our peers do, growth would have been an even stronger 32%. FRC,

at 400 million francs, was down from a strong first quarter last year, but

recovered from the latter half of 2017.

Costs

were up 15%, mostly on higher variable comp, as well as IT investments and

regulatory expenses.

Risk-weighted

assets increased from the prior quarter, mainly as the spikes in volatility in

February led to increased market risk RWA, although from historically low

levels. Without any major volatility spikes, we expect market risk RWA to come

down.

We keep

investing for growth, while managing costs and resources prudently. To name a

few examples, we have created scope to grow our M&A business, particularly

in the US. In FX, investments into our e-trading platform last year have

benefited our clients and we have captured increased volumes. In Equities, we

continue to invest in electronic execution. Our goal remains to be the best

Investment Bank, not the biggest, by focusing on these areas where we choose to

compete, and by delivering sustainable performance over the cycle.

Slide 13

– Corporate Center

The

Corporate Center loss before tax was 380 million. Services’ PBT improved by 60

million and Group ALM posted a 222 million loss.

Non-core

and Legacy Portfolio posted a small loss of 11 million, helped by small one-off

items, and its LRD is now down to just 13 billion.

Slide 14

– Workforce management

In the

past six months, we have insourced around two thousand jobs, mostly contractors

in technology, with the primary objective of improving effectiveness and

efficiency. Overall, we've reduced our total workforce by nearly 600.

Looking

at costs more generally, we have commenced a number of programs to support

improved operating leverage. Aside from general hygiene around headcount,

consulting, recruitment and contractor spend, we are more closely aligning

Corporate Center with the business divisions they support, and I’ve created a

new team to drive ongoing Group cost management and efficiency. All of this

gives us confidence we can take our Group cost/income ratio below 75%.

Slide 15

– Corporate Center – Group ALM

Group

Asset and Liability Management results are under pressure from a combination of

market and previously highlighted regulatory factors, including the build-out

of our legal entity structure.

Revenue

lines that are fully allocated to the businesses declined 113 million

year-on-year, impacting their net interest income. This was driven by factors

we've previously highlighted, such as persistently low or negative interest

rates and higher volumes of AT1 and TLAC. In addition, a portfolio of interest

rate hedges that expired in 4Q17, contributed to lower banking book income.

We saw a

120 million year-on-year negative variance due to Treasury / OIS basis

movements, as you can see on slide 22 in the appendix. During the quarter, the

widening of this basis resulted in a roughly 40 million loss reflected in our

P&L on our portfolio of US Treasuries that are hedged by OIS instruments.

During the first quarter '17, we saw the opposite effect, leading to an 80

million gain. Banks that account for any mark-to-market gains or losses on

HQLA through OCI see a direct impact on shareholders' equity, bypassing the

P&L, especially to the extent that their HQLA portfolios are unhedged in

whole or in part.

Apart

from this effect, we also saw an incremental 85 million of losses retained in

GALM. Firstly, interest rate expense of 37 million related to FX hedging was

reclassified from accounting asymmetries to risk management net income.

Secondly, the remainder is driven by increased levels of long-term funding and

HQLA held by GALM in response to the build-out of our legal entity structure to

meet regulatory requirements, while the business divisions are consuming less.

Given

current market conditions and financial resource consumption, we expect that

our retained Group ALM negative income will be around 100 million per quarter

for the remainder of the year. We are planning and executing a number of

optimization actions with the aim of bringing us back towards the negative 50

million a quarter.

Slide 16 –

RWA 1Q18

Our

risk-weighted assets grew by 16 billion in the quarter to 254 billion.

We had

flagged increases in credit and market risk RWA related to the regulatory and

methodology changes we expected for the quarter.

As I

previously mentioned, the largest increase came from IB Equities market risk.

Of the

roughly 11 billion RWA increase we expect from regulatory changes over the next

3 quarters, about 4 billion will come in the second quarter.

Slide 17

– Capital and leverage ratios (fully applied)

Our capital

position remains very strong, with TLAC above 79 billion, and our CET1 ratios

are comfortably above the 2020 requirements.

Year-over-year,

we kept our LRD flat, while increasing CET1 capital by 1.8 billion, which drove

the improvement to a 3.76% CET1 leverage ratio.

To wrap

up, 2018 started well, the business has good momentum and we are in good shape

to deliver on our financial targets.

With

that, Sergio and I will open up for questions.

Cautionary

statement regarding forward-looking statements:

This

document contains statements that constitute “forward-looking statements,”

including but not limited to management’s outlook for UBS’s financial

performance and statements relating to the anticipated effect of transactions

and strategic initiatives on UBS’s business and future development. While these

forward-looking statements represent UBS’s judgments and expectations

concerning the matters described, a number of risks, uncertainties and other

important factors could cause actual developments and results to differ

materially from UBS’s expectations. These factors include, but are not limited

to: (i) the degree to which UBS is successful in the ongoing execution of its

strategic plans, including its cost reduction and efficiency initiatives and

its ability to manage its levels of risk-weighted assets (RWA), including to

counteract regulatory-driven increases, leverage ratio denominator, liquidity

coverage ratio and other financial resources, and the degree to which UBS is

successful in implementing changes to its businesses to meet changing market,

regulatory and other conditions; (ii) continuing low or negative interest rate

environment, developments in the macroeconomic climate and in the markets in

which UBS operates or to which it is exposed, including movements in securities

prices or liquidity, credit spreads, and currency exchange rates, and the

effects of economic conditions, market developments, and geopolitical tensions

on the financial position or creditworthiness of UBS’s clients and counterparties

as well as on client sentiment and levels of activity; (iii) changes in the

availability of capital and funding, including any changes in UBS’s credit

spreads and ratings, as well as availability and cost of funding to meet

requirements for debt eligible for total loss-absorbing capacity (TLAC); (iv)

changes in or the implementation of financial legislation and regulation in

Switzerland, the US, the UK and other financial centers that have imposed, or

resulted in, or may do so in the future, more stringent or entity-specific

capital, TLAC, leverage ratio, liquidity and funding requirements, incremental

tax requirements, additional levies, limitations on permitted activities,

constraints on remuneration, constraints on transfers of capital and liquidity

and sharing of operational costs across the Group or other measures, and the

effect these will or would have on UBS’s business activities; (v) the degree to

which UBS is successful in implementing further changes to its legal structure

to improve its resolvability and meet related regulatory requirements and the

potential need to make further changes to the legal structure or booking model

of UBS Group in response to legal and regulatory requirements, to proposals in

Switzerland and other jurisdictions for mandatory structural reform of banks or

systemically important institutions or to other external developments, and the

extent to which such changes will have the intended effects; (vi) uncertainty

as to the extent to which the Swiss Financial Market Supervisory Authority

(FINMA) will confirm limited reductions of gone concern requirements due to

measures to reduce resolvability risk; (vii) the uncertainty arising from the

timing and nature of the UK exit from the EU and the potential need to make

changes in UBS’s legal structure and operations as a result of it; (viii)

changes in UBS’s competitive position, including whether differences in

regulatory capital and other requirements among the major financial centers

will adversely affect UBS’s ability to compete in certain lines of business;

(ix) changes in the standards of conduct applicable to our businesses that may

result from new regulation or new enforcement of existing standards, including

recently enacted and proposed measures to impose new and enhanced duties when

interacting with customers and in the execution and handling of customer

transactions; (x) the liability to which UBS may be exposed, or possible

constraints or sanctions that regulatory authorities might impose on UBS, due

to litigation, contractual claims and regulatory investigations, including the

potential for disqualification from certain businesses or loss of licenses or

privileges as a result of regulatory or other governmental sanctions, as well

as the effect that litigation, regulatory and similar matters have on the

operational risk component of our RWA; (xi) the effects on UBS’s cross-border

banking business of tax or regulatory developments and of possible changes in

UBS’s policies and practices relating to this business; (xii) UBS’s ability to

retain and attract the employees necessary to generate revenues and to manage,

support and control its businesses, which may be affected by competitive

factors including differences in compensation practices; (xiii) changes in

accounting or tax standards or policies, and determinations or interpretations

affecting the recognition of gain or loss, the valuation of goodwill, the

recognition of deferred tax assets and other matters, including from changes to

US taxation under the Tax Cuts and Jobs Act; (xiv) UBS’s ability to implement

new technologies and business methods, including digital services and

technologies and ability to successfully compete with both existing and new

financial service providers, some of which may not be regulated to the same

extent; (xv) limitations on the effectiveness of UBS’s internal processes for

risk management, risk control, measurement and modeling, and of financial

models generally; (xvi) the occurrence of operational failures, such as fraud,

misconduct, unauthorized trading, financial crime, cyberattacks, and systems

failures; (xvii) restrictions on the ability of UBS Group AG to make payments

or distributions, including due to restrictions on the ability of its

subsidiaries to make loans or distributions, directly or indirectly, or, in the

case of financial difficulties, due to the exercise by FINMA or the regulators

of UBS’s operations in other countries of their broad statutory powers in

relation to protective measures, restructuring and liquidation proceedings;

(xviii) the degree to which changes in regulation, capital or legal structure,

financial results or other factors may affect UBS’s ability to maintain its

stated capital return objective; and (xix) the effect that these or other

factors or unanticipated events may have on our reputation and the additional

consequences that this may have on our business and performance. The sequence

in which the factors above are presented is not indicative of their likelihood

of occurrence or the potential magnitude of their consequences. Our business

and financial performance could be affected by other factors identified in our

past and future filings and reports, including those filed with the SEC. More

detailed information about those factors is set forth in documents furnished by

UBS and filings made by UBS with the SEC, including UBS’s Annual Report on Form

20-F for the year ended 31 December 2017. UBS is not under any obligation to

(and expressly disclaims any obligation to) update or alter its forward-looking

statements, whether as a result of new information, future events, or

otherwise.

Disclaimer:

This

document and the information contained herein are provided solely for

information purposes, and are not to be construed as a solicitation of an offer

to buy or sell any securities or other financial instruments in Switzerland,

the United States or any other jurisdiction. No investment decision relating to

securities of or relating to UBS Group AG, UBS AG or their affiliates should be

made on the basis of this document. Refer to UBS's Annual Report on Form 20-F

for the year ended 31 December 2017. No representation or warranty is made or

implied concerning, and UBS assumes no responsibility for, the accuracy, completeness,

reliability or comparability of the information contained herein relating to

third parties, which is based solely on publicly available information. UBS

undertakes no obligation to update the information contained herein.

Use

of adjusted numbers

Unless

otherwise indicated, “adjusted” figures exclude the adjustment items listed on

the previous slide, to the extent applicable, on a Group and business division

level. Adjusted results are a non-GAAP financial measure as defined by SEC

regulations. Refer to pages 7-8 of the 1Q18 report which is available in the

section "Quarterly reporting" at www.ubs.com/investors for an

overview of adjusted numbers.

If

applicable for a given adjusted KPI (i.e., adjusted return on tangible equity),

adjustment items are calculated on an after-tax basis by applying an indicative

tax rate.

Refer to page 14 of the 1Q18 report for more information.

© UBS 2018. The key symbol and UBS are

among the registered and unregistered trademarks of UBS. All rights reserved.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrants

have duly caused this report to be signed on their behalf by the undersigned,

thereunto duly authorized.

UBS

Group AG

By:

_/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By:

_/s/ Ella Campi_____________ ____

Name: Ella Campi

Title: Executive Director

UBS

AG

By:

_/s/ David Kelly________________

Name: David Kelly

Title: Managing Director

By:

_/s/ Ella Campi____________ ____

Name: Ella Campi

Title: Executive Director

Date: April 23, 2018

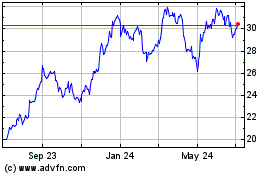

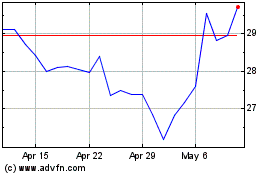

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024