Tencent Music Readies Big IPO -- WSJ

April 23 2018 - 3:02AM

Dow Jones News

By Maureen Farrell and Julie Steinberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2018).

Tencent Music Entertainment Group, China's largest

music-streaming company, is preparing what would be one of the

biggest technology IPOs ever following the successful debut of its

European counterpart, Spotify Technology SA.

The digital-music business of Chinese internet giant Tencent

Holdings Ltd. plans to interview potential underwriting banks over

roughly the next month, according to people familiar with the

matter.

The initial public offering, potentially coming in the second

half of 2018, would be one of the largest deals of the year and is

expected to raise billions in proceeds, some of the people said.

Tencent Music is expected to list in the U.S., but it is unlikely

to make a final venue decision for several months, they said.

Tencent Music's move toward going public is the latest sign that

the IPO market is gaining steam.

Tencent Music's offering could value the business in excess of

$25 billion, some of the people said. This was the company's value

in recent private transactions, The Wall Street Journal reported

last month. That was a sharp jump from its $12.5 billion valuation

in late 2017 when Swedish music-streaming company Spotify bought a

9% stake in the company as part of a share swap.

Should investors give it that valuation in its IPO pricing, it

would be the fourth-biggest U.S.-listed tech IPO on record,

measured by valuation at the time of the offering, according to

Dealogic. That doesn't include Spotify, which didn't raise capital

in its public offering but was valued at about $29.5 billion at its

first trade.

Still, there is no guarantee the company will proceed with a

share sale in New York or elsewhere, and pre-IPO valuations can

fluctuate until a company prices its shares.

Investors are excited about Tencent Music because of its

connection to Tencent Holdings, which has a stake of more than 50%

in Tencent Music, as well as its position in the marketplace:

Tencent Music, which operates the popular music app known as QQ

Music and others, recently had 700 million monthly active users

across personal computer and mobile platforms largely in China,

according to the company. Investors have also been hungry for big

technology IPOs since they typically offer potential for

significant growth.

Tencent Music was created in mid-2016 after Tencent Holdings

bought a controlling stake in China Music Corp. and combined it

with Tencent's existing streaming business. Last month, Tencent

Holdings President Martin Lau said Tencent Music could be a

candidate for a future spinoff.

The possible Tencent Music offering could come as the IPO market

has come surging back, particularly among technology companies

listing on U.S. exchanges. After the worst year for IPOs in more

than a decade, IPO activity jumped in 2017 and has continued to

increase in volume and number of companies seeking public offerings

on U.S. exchanges this year.

Based on their pipeline, underwriters have said they expect

activity in the second half of 2018 to be busier than this year's

already elevated levels.

Still, shares of other Tencent-backed companies that have listed

in New York have traded down since their IPOs on

weaker-than-expected performance. Shares of Chinese search engine

Sogou Inc. are down 35% since November, while shares of

Singapore-based gaming and e-commerce company Sea Ltd. are down

more than 20% since October. Tencent Holdings itself, which is

listed in Hong Kong, is up sharply from a year earlier even after

its share price has dropped over the last month.

Spotify went public on the New York Stock Exchange in early

April in an unusual offering in which it didn't raise money. Late

last year, ahead of the listing, Tencent Music and Spotify swapped

stakes in each other's companies. The deal valued Tencent Music at

$12.5 billion based on Spotify's 9% stake. Tencent's nearly 10% of

Spotify valued it at nearly $20 billion.

Unlike Spotify, Tencent is expected to go with a traditional

IPO.

As a public stock, Spotify's shares have so far traded largely

above its private-market prices, which had already more than

doubled from its pre-IPO share price a year ago. That could bode

well for investors in Tencent Music when the stock hits the public

markets.

--Wayne Ma contributed to this article.

Write to Maureen Farrell at maureen.farrell@wsj.com and Julie

Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

April 23, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

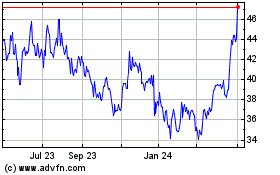

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

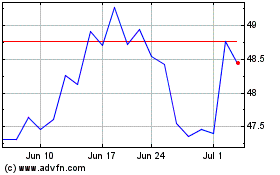

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024