Reported profit before tax (PBT) CHF 2.0bn, +17% YoY, +24% in

USD

Adjusted1 RoTE excluding DTAs2

17.8%, diluted EPS CHF 0.39

CHF 1.1bn adjusted1 PBT in Global Wealth

Management, +7% YoY, +14% in USD

CHF 50bn net new money in wealth and asset management

businesses

CET1 capital ratio 13.1% and CET1 leverage ratio

3.76%

World's first 100% sustainable cross-asset portfolio for

private clients launched

Regulatory News:

UBS (NYSE:UBS) (SWX:UBSN) delivered strong first-quarter 2018

results with reported PBT up 17% year over year to CHF 1,973m

(up 24% in USD) and adjusted1 PBT down 3% to CHF 1,876m (up 3%

in USD). Net profit attributable to shareholders was

CHF 1,514m, up 19% from the first quarter of 2017.

Global Wealth Management had a very strong quarter with

year-on-year profit growth and positive net new money in all

regions. Adjusted1 PBT rose 7% year over year to CHF 1,126m

(up 14% in USD), with new records in the Americas and Asia Pacific.

Personal & Corporate Banking adjusted1 PBT was CHF 393m;

transaction-based income and recurring net fee income increased,

and net new business volume showed strong growth. Asset Management

had strong net new money of CHF 27bn excluding money markets,

taking invested assets to CHF 792bn, the highest in a decade;

adjusted1 PBT was CHF 108m. The Investment Bank delivered a

strong adjusted1 PBT of CHF 629m and an adjusted1 return on

attributed equity of 25%, driven by strong revenues in Equities and

Corporate Client Solutions. Corporate Center adjusted1 loss before

tax was CHF 380m.

UBS’s capital position remains strong, with a CET1 capital ratio

of 13.1%, a CET1 leverage ratio of 3.76% and total loss-absorbing

capacity of CHF 79bn under Swiss SRB rules applicable as of 1

January 2020. Risk-weighted assets rose to CHF 254bn on

increased market volatility during the quarter and regulatory,

methodology and model updates/changes, while the leverage ratio

denominator decreased to CHF 882bn. During the second quarter, UBS

will commence buying back its shares under the program announced in

the first quarter.

“We had an excellent start to 2018, with our results once again

showing the power of our diversified business. Momentum in our

business is good and we continue to invest for growth and

efficiency.”Sergio P. Ermotti, Group Chief Executive

Officer

Outlook

We remain confident that global economic growth prospects will

continue to provide a supportive backdrop to markets, even though

geopolitical tensions and the rise of protectionism remain a threat

to investor confidence.

All of UBS's businesses are affected by economic growth

expectations, interest rates, equity market levels and foreign

exchange rates. While higher compared with last year's historic

lows, market volatility remains muted overall which is usually less

conducive to client activity. Due to seasonal factors, second

quarter transaction-based income in our Investment Bank and Global

Wealth Management businesses is also typically lower than in the

first quarter.

In the second quarter, funding costs related to long-term debt

and capital instruments issued to comply with regulatory funding

and liquidity requirements will be higher compared with the same

period in 2017.

We continue to expect US dollar interest rates to rise gradually

and the US economy to further improve, both of which will likely be

supportive of US dollar net interest income. Momentum in our

businesses is good, and we expect our results in the second quarter

to provide further evidence of the strengths of our diversified

business model, as well as our progress towards achieving our

strategic and financial targets.

First quarter 2018 performance overview

UBS’s first quarter adjusted1 PBT was CHF 1,876m, and

reported PBT was CHF 1,973m. The first quarter of 2018

included a gain of CHF 225m related to changes to the pension

fund of UBS in Switzerland, which is treated as an adjusting1 item

and had no impact on CET1 capital. Results were also adjusted1 for

CHF 128m of restructuring expenses. The adjusted1 cost/income

ratio was 75%. Net profit attributable to shareholders was

CHF 1,514m, with diluted earnings per share of CHF 0.39.

Annualized adjusted1 return on tangible equity excluding DTAs2 was

17.8%.

Global Wealth Management (GWM) adjusted1 PBT

CHF 1,126m, +7% YoY (+14% in USD)Higher invested asset

levels and net interest margins, together with further progress on

mandate penetration and loan growth, as well as increased client

activity, led to an improvement in all revenue lines. Costs

increased on higher financial advisor variable compensation, which

was partly offset by lower expenses for compensation commitments

with recruited financial advisors in the Americas. The adjusted1

cost/income ratio improved to 73%. Mandate and managed account

penetration increased to a record 33.1% of invested assets, and

loans increased by 10% (up 16% in USD). Net new money was

CHF 19.0bn for the quarter, with positive contributions from

all regions. Adjusted1 net margin was 19bps.

Personal & Corporate Banking (P&C)

adjusted1 PBT CHF 393m, (10%)

YoYTransaction-based income and recurring net fee income

increased, offset by funding cost and interest rate headwinds, as

well as higher expenses. The first quarter of 2017 included a CHF

20m one-time gain on the sale of a real estate loan portfolio.

Credit losses expenses were CHF 13m with no material effect from

the adoption of IFRS 9, compared with a credit loss recovery of CHF

7m in the first quarter of 2017. The adjusted1 cost/income ratio

was 58%. Annualized net new business volume growth for personal

banking was 6.3%, the second best quarter since 2007.

Asset Management (AM) adjusted1 PBT

CHF 108m, (12%) YoYIncreased net management fees on higher

average invested assets were offset by lower performance fees and

higher personnel costs. The adjusted1 cost/income ratio was 76%.

Net new money excluding money market flows was strong at

CHF 26.6bn, and invested assets reached CHF 792bn, the

highest in a decade.

Investment Bank (IB) adjusted1 PBT

CHF 629m, +13% YoY (+20% in USD)Equities revenues were up

17% (up 25% in USD), with all regions and product lines improving.

Corporate Client Solutions revenues increased 15% (up 22% in USD),

driven by APAC. FX, Rates and Credit revenues were down 11% (down

6% in USD) from a strong first quarter of 2017. While performance

in FX was resilient, market conditions for rates and credit flow

products were challenging. Costs increased, reflecting higher

personnel expenses as a result of improved performance. The

adjusted1 cost/income ratio improved to 72%.

Corporate Center – Services recorded an adjusted1 loss

before tax of CHF 147m. Group Asset and Liability

Management adjusted1 loss before tax was CHF 222m, mainly

due to the widening of US Treasury-OIS spreads, as well as

increased retained costs from higher outstanding long-term debt and

higher levels of high-quality liquid assets. Non-core and Legacy

Portfolio posted an adjusted1 loss before tax of

CHF 11m.

Commitment to sustainable performance

UBS is committed to creating long-term positive impact for its

clients, employees, investors and society. This is illustrated by

the ongoing recognition UBS has received for its activities and

capabilities related to sustainable investing, philanthropy,

environmental and human rights policies, the firm's environmental

footprint and community investment.

Sustainable and impact investingIn January 2018, UBS

launched the world's first 100% sustainable cross-asset portfolios

for private clients, targeting a market rate-risk-adjusted return

as well as positive social and environmental outcomes. These

portfolios include an exclusive partnership with the World Bank on

an allocation to World Bank debt instruments, as well as a new

best-in-class shareholder engagement strategy to focus on

generating additional social and/or environmental impact through

public rather than private equity.

In the first quarter, UBS announced and started work on

integrating environmental, social and governance (ESG) criteria

into nearly all of Asset Management's actively managed equity and

fixed income portfolios. The firm also announced the launch of the

UBS Global Gender Equality ETF, a joint collaboration between Asset

Management and Global Wealth Management as part of UBS's commitment

to sustainable and impact investing. The ETF is the first of its

kind combining gender equality and sustainability. It will dedicate

5% of its management fee to philanthropic projects via the UBS

Optimus Foundation to support the empowerment of women and

girls.

Climate changeWith its 2017 reporting, UBS has begun to

align its disclosure with the Financial Stability Board's Task

Force on Climate-related Financial Disclosures' recommendations.

The firm plans to further do so over the five-year implementation

pathway.

RecognitionFor the third consecutive year, UBS has been

ranked first in the "Best Private Banking Services Overall –

Global" category in Euromoney's annual Private Banking Survey. UBS

also retained its leading position in all segment-specific

categories on a global level and took the top spot in four regions,

including Western Europe and Asia.

Information in this news release is presented for UBS Group AG

on a consolidated basis unless otherwise specified. Financial

information for UBS AG (consolidated) does not differ materially

from UBS Group AG (consolidated) and a comparison between UBS Group

AG (consolidated) and UBS AG (consolidated) is provided at the end

of this news release.

1 Refer to the “Performance by business division and Corporate

Center unit – reported and adjusted“ table in this news release.2

Adjusted return on tangible equity excluding deferred tax

expense/benefit and DTAs; calculated as adjusted net profit/loss

attributable to shareholders excluding deferred tax

expense/benefit, divided by average tangible equity attributable to

shareholders excluding any DTAs that do not qualify as CET1

capital.

Performance by business division and Corporate Center

unit – reported and adjusted1,2

For the quarter ended 31.3.18 CHF million

GlobalWealthManagement

Personal

&CorporateBanking

AssetManage-ment

InvestmentBank

CC –Services3

CC –GroupALM

CC –Non-coreand

LegacyPortfolio

UBS

Operating income as reported 4,195

947 441 2,308 (38)

(204) 49 7,698 Operating

income (adjusted) 4,195 947

441 2,308 (38)

(204) 49 7,698

Operating expenses as reported

3,067 528 335

1,719 (2) 18 61

5,725 of which: personnel-related restructuring expenses4

3 1 1

11 47 0 0

64 of which: non-personnel-related restructuring expenses4

9 0 3

2 50 0 0

64 of which: restructuring expenses allocated from CC

Services4 47 9 7

32 (96) 1 1

0 of which: gain related to changes to the Swiss

pension plan5 (61) (35)

(10) (5) (114)

(225) Operating expenses

(adjusted) 3,069 553

333 1,679 110 18

60 5,822 of which: net expenses for

litigation, regulatory and similar matters6 31

0 0 (2)

(24) 0 (16) (11)

Operating profit / (loss) before tax as reported

1,129 419

106 589 (35)

(222) (12)

1,973 Operating profit / (loss) before tax (adjusted)

1,126 393

108 629

(147) (222) (11)

1,876 For the quarter ended

31.3.17 CHF million

GlobalWealthManagement

Personal &CorporateBanking

AssetManage-ment

InvestmentBank

CC –Services3

CC –GroupALM

CC –Non-coreand

LegacyPortfolio

UBS Operating income as reported

3,979 958 450 2,098

(18) 65 0

7,532 Operating income (adjusted) 3,979

958 450 2,098 (18)

65 0 7,532

Operating expenses as reported 3,039

540 347 1,619 204

2 93 5,842 of which:

personnel-related restructuring expenses4 2

2 2 18 92

0 0 116 of which:

non-personnel-related restructuring expenses4

11 0 5 2

110 (1) 0 127 of which:

restructuring expenses allocated from CC Services4

98 17 13 57

(188) 0 2 0

Operating expenses (adjusted) 2,929

521 327 1,541 189

2 91 5,598 of which: net

expenses for litigation, regulatory and similar matters6

36 0 0 0

(4) 0 1 33

Operating profit / (loss) before tax as reported

940 418

103 480

(222) 63 (93)

1,690 Operating profit / (loss) before tax

(adjusted) 1,050

437 123 558

(207) 63

(91) 1,934 1 Adjusted results are

non-GAAP financial measures as defined by SEC regulations. 2

Comparative figures in this table may differ from those originally

published in quarterly and annual reports due to adjustments

following organizational changes, restatements due to the

retrospective adoption of new accounting standards or changes in

accounting policies, and events after the reporting period. 3

Corporate Center Services operating expenses presented in this

table are after service allocations to business divisions and other

Corporate Center units. 4 Reflects restructuring expenses related

to legacy cost programs. 5 Refer to “Note 5 Personnel expenses” in

the “Consolidated financial statements” section of the UBS Group

first quarter 2018 report for more information. 6 Includes

recoveries from third parties (first quarter of 2018: CHF 17

million; first quarter of 2017: CHF 1 million).

Our key figures

As of or for the quarter ended CHF million, except

where indicated

31.3.18

31.12.17 31.3.17

Group results

Operating income

7,698

7,122 7,532 Operating expenses

5,725 6,266 5,842 Operating

profit / (loss) before tax

1,973

855 1,690 Net profit / (loss) attributable to

shareholders

1,514

(2,336) 1,269 Diluted earnings per share (CHF)1

0.39 (0.63)

0.33

Key performance indicators2

Profitability and growth

Return on tangible equity (%)

13.6 (20.2)

10.9 Adjusted return on tangible equity excluding deferred tax

expense / benefit and deferred tax assets (%)

17.8 8.6 17.4 Cost / income

ratio (%)

74.1 86.9

77.6 Net profit growth (%)

19.4 79.5

Resources

Common equity tier 1 capital ratio (%)3

13.1 13.8 14.1

Common equity tier 1 leverage ratio (%)3

3.76 3.69 3.55 Going concern

leverage ratio (%)3

5.0

4.7 4.6

Additional information

Profitability

Return on equity (%)

11.8 (17.8) 9.5 Return on

risk-weighted assets, gross (%)4

12.6

12.1 13.6 Return on leverage ratio

denominator, gross (%)4

3.5

3.3 3.4

Resources

Total assets

919,361 915,642

909,608 Equity attributable to shareholders

51,243 51,214 53,661

Common equity tier 1 capital3

33,151

32,671 31,311 Risk-weighted assets3

253,753 237,494

221,785 Going concern capital ratio (%)3

17.3 17.6 18.2 Total

loss-absorbing capacity ratio (%)3

31.2

33.0 33.2 Leverage ratio denominator3

882,469 886,116

881,183 Total loss-absorbing capacity leverage ratio (%)3

9.0 8.8 8.4

Liquidity coverage ratio (%)5

136

143 128

Other

Invested

assets (CHF billion)6,7

3,155

3,179 2,922 Personnel (full-time equivalents)

62,537 61,253

59,416 Market capitalization8

64,752 69,125 61,736 Total book

value per share (CHF)8

13.62

13.76 14.45 Tangible book value per share

(CHF)8

11.97 12.04

12.71 1 Refer to “Note 8 Earnings per share (EPS) and shares

outstanding” in the “Consolidated financial statements” section of

the UBS Group first quarter 2018 report for more information. 2

Refer to the “Measurement of performance” section of our Annual

Report 2017 for the definitions of our key performance indicators.

3 Based on the Swiss systemically relevant bank framework as of 1

January 2020. Refer to the “Capital management” section of the UBS

Group first quarter 2018 report for more information. 4 Calculated

as operating income before credit loss (annualized as applicable) /

average risk-weighted assets and average leverage ratio

denominator, respectively. 5 Refer to the “Balance sheet, liquidity

and funding management” section of the UBS Group first quarter 2018

report for more information. 6 Includes invested assets for

Personal & Corporate Banking. 7 Certain account types were

corrected during the fourth quarter of 2017. As a result, invested

assets as of 31 March 2017 were corrected by CHF 12 billion. 8

Refer to “UBS shares” in the “Capital management” section of the

UBS Group first quarter 2018 report for more information.

Income statement

For the quarter ended % change from CHF

million

31.3.18 31.12.17

31.3.17 4Q17 1Q17 Net

interest income

1,743

1,672 1,696 4 3 Fee and

commission income

4,882

4,772 4,789 2 2 Fee and

commission expense

(409)

(478) (436) (14) (6) Net

fee and commission income

4,473

4,294 4,353 4 3

Other net income from fair value changes on financial instruments

1,466 987

1,440 49 2 Credit loss (expense) /

recovery

(25) (89)

0 (72) Other income

40 257 43

(84) (6) Total operating income

7,698 7,122 7,532

8 2 of which: net interest income and

other net income from fair value changes on financial instruments

3,210 2,659

3,136 21 2 Personnel expenses

4,014 3,923 4,060

2 (1) General and administrative

expenses

1,424 2,054

1,506 (31) (5)

Depreciation and impairment of property, equipment and software

272 272 255

0 6 Amortization and impairment of

intangible assets

16 17

21 (9) (26) Total

operating expenses

5,725

6,266 5,842 (9) (2)

Operating profit / (loss) before tax

1,973 855 1,690

131 17 Tax expense / (benefit)

457 3,165 375 (86)

22 Net profit / (loss)

1,516 (2,310) 1,315

15 Net profit / (loss) attributable to

non-controlling interests

1

27 47 (95) (97)

Net profit / (loss) attributable to shareholders

1,514 (2,336)

1,269 19

Comprehensive

income

Total

comprehensive income

696

(2,125) 666 4

Total comprehensive income attributable to non-controlling

interests

1 336

47 (100) (98)

Total

comprehensive income attributable to shareholders

695 (2,461) 620

12

Comparison UBS Group AG (consolidated) versus UBS

AG (consolidated)

As of or for

the quarter ended 31.3.18 As of or for the quarter ended

31.12.17 CHF million, except where indicated

UBS Group AG

(consolidated)

UBS AG

(consolidated)

Difference

(absolute)

UBS Group AG

(consolidated)

UBS AG

(consolidated)

Difference

(absolute)

Income statement

Operating

income

7,698 7,823

(125) 7,122 7,242

(120) Operating expenses

5,725

6,040 (315) 6,266

6,487 (221) Operating profit / (loss)

before tax

1,973

1,783 190 855 755

100 of which: Global Wealth Management

1,129 1,117 12

782 778 4 of which:

Personal & Corporate Banking

419

420 (1) 392

393 (1) of which: Asset Management

106 106 0

238 238 0 of which:

Investment Bank

589

577 12 49 50

(1) of which: Corporate Center

(270) (437) 167

(605) (704) 99 of which:

Services

(35)

(210) 175 (155)

(252) 97 of which: Group ALM

(222) (214) (8)

(214) (217) 3 of which: Non-core

and Legacy Portfolio

(12)

(13) 1 (236) (236)

0 Net profit / (loss)

1,516 1,371 144

(2,310) (2,385) 75 of which: net

profit / (loss) attributable to shareholders

1,514 1,370 144

(2,336) (2,412) 76 of which: net

profit / (loss) attributable to preferred noteholders

0 0

26 (26) of which: net profit /

(loss) attributable to non-controlling interests

1 1 0

27 0 27

Statement of

comprehensive income

Other comprehensive income

(819) (732)

(87) 184 187 (3) of

which: attributable to shareholders

(820) (732) (88)

(124) (122) (2) of which:

attributable to preferred noteholders

0 0

307 (307) of which: attributable to

non-controlling interests

0

0 0 309 2

307 Total comprehensive income

696 639 57

(2,125) (2,198) 73 of which:

attributable to shareholders

695

638 57 (2,461)

(2,534) 73 of which: attributable to preferred

noteholders

0

0 333

(333) of which: attributable to non-controlling interests

1 1

0 336 3 333

Balance sheet

Total assets

919,361 920,280 (919)

915,642 916,363 (721)

Total liabilities

868,056

869,430 (1,374) 864,371

865,588 (1,217) Total equity

51,305 50,850 455

51,271 50,775 496 of

which: equity attributable to shareholders

51,243 50,788 455

51,214 50,718 496 of which:

equity attributable to preferred noteholders

0 0

0 0 of which: equity attributable to

non-controlling interests

62

62 0 57 57

0

Capital information

Common

equity tier 1 capital

33,151

33,424 (273) 32,671

33,240 (569) Going concern capital

44,026 40,335

3,691 41,911 36,906

5,005 Risk-weighted assets

253,753 253,784 (32)

237,494 236,606 888

Common equity tier 1 capital ratio (%)

13.1 13.2 (0.1)

13.8 14.0 (0.2) Going concern

capital ratio (%)

17.3

15.9 1.5 17.6 15.6

2.0 Total loss-absorbing capacity ratio (%)

31.2 30.7

0.5 33.0 31.4 1.6

Leverage ratio denominator

882,469

883,676 (1,207)

886,116 887,189 (1,073) Common equity

tier 1 leverage ratio (%)

3.76

3.78 (0.03) 3.69

3.75 (0.06) Going concern leverage ratio (%)

5.0 4.6

0.4 4.7 4.2 0.5

Total loss-absorbing capacity leverage ratio (%)

9.0 8.8 0.2

8.8 8.4 0.4

UBS’s first quarter 2018 report, news release and slide

presentation will be available from 06:45 CEST on Monday, 23 April

2018, at www.ubs.com/quarterlyreporting.

UBS will hold a presentation of its first quarter 2018 results

on Monday, 23 April 2018. The results will be presented by Sergio

P. Ermotti, Group Chief Executive Officer, Kirt Gardner, Group

Chief Financial Officer, Caroline Stewart, Global Head Investor

Relations, and Hubertus Kuelps, Group Head Communications &

Branding.

Time

- 09:00–11:00 CEST

- 08:00–10:00 BST

- 03:00–05:00 US EDT

Audio webcastThe presentation for analysts can be

followed live on www.ubs.com/quarterlyreporting with a simultaneous

slide show.

Webcast playbackAn audio playback of the results

presentation will be made available at www.ubs.com/investors later

in the day.

Conference call for media Q&A sessionImmediately

following the presentation and analyst Q&A, there will be a

separate media Q&A session. Please note: This session will be

held via conference call only.

Switzerland/Europe: +41-58-310 50 07 UK: +44-121-281

80 12 Americas: +1-213-799 17 25 Other locations: +41-58-310 50 07

Cautionary Statement Regarding Forward-Looking

StatementsThis news release contains statements that constitute

“forward-looking statements,” including but not limited to

management’s outlook for UBS’s financial performance and statements

relating to the anticipated effect of transactions and strategic

initiatives on UBS’s business and future development. While these

forward-looking statements represent UBS’s judgments and

expectations concerning the matters described, a number of risks,

uncertainties and other important factors could cause actual

developments and results to differ materially from UBS’s

expectations. These factors include, but are not limited to: (i)

the degree to which UBS is successful in the ongoing execution of

its strategic plans, including its cost reduction and efficiency

initiatives and its ability to manage its levels of risk-weighted

assets (RWA), including to counteract regulatory-driven increases,

leverage ratio denominator, liquidity coverage ratio and other

financial resources, and the degree to which UBS is successful in

implementing changes to its businesses to meet changing market,

regulatory and other conditions; (ii) continuing low or negative

interest rate environment, developments in the macroeconomic

climate and in the markets in which UBS operates or to which it is

exposed, including movements in securities prices or liquidity,

credit spreads, and currency exchange rates, and the effects of

economic conditions, market developments, and geopolitical tensions

on the financial position or creditworthiness of UBS’s clients and

counterparties as well as on client sentiment and levels of

activity; (iii) changes in the availability of capital and funding,

including any changes in UBS’s credit spreads and ratings, as well

as availability and cost of funding to meet requirements for debt

eligible for total loss-absorbing capacity (TLAC); (iv) changes in

or the implementation of financial legislation and regulation in

Switzerland, the US, the UK and other financial centers that have

imposed, or resulted in, or may do so in the future, more stringent

or entity-specific capital, TLAC, leverage ratio, liquidity and

funding requirements, incremental tax requirements, additional

levies, limitations on permitted activities, constraints on

remuneration, constraints on transfers of capital and liquidity and

sharing of operational costs across the Group or other measures,

and the effect these will or would have on UBS’s business

activities; (v) the degree to which UBS is successful in

implementing further changes to its legal structure to improve its

resolvability and meet related regulatory requirements and the

potential need to make further changes to the legal structure or

booking model of UBS Group in response to legal and regulatory

requirements, to proposals in Switzerland and other jurisdictions

for mandatory structural reform of banks or systemically important

institutions or to other external developments, and the extent to

which such changes will have the intended effects; (vi) uncertainty

as to the extent to which the Swiss Financial Market Supervisory

Authority (FINMA) will confirm limited reductions of gone concern

requirements due to measures to reduce resolvability risk; (vii)

the uncertainty arising from the timing and nature of the UK exit

from the EU and the potential need to make changes in UBS’s legal

structure and operations as a result of it; (viii) changes in UBS’s

competitive position, including whether differences in regulatory

capital and other requirements among the major financial centers

will adversely affect UBS’s ability to compete in certain lines of

business; (ix) changes in the standards of conduct applicable to

our businesses that may result from new regulation or new

enforcement of existing standards, including recently enacted and

proposed measures to impose new and enhanced duties when

interacting with customers and in the execution and handling of

customer transactions; (x) the liability to which UBS may be

exposed, or possible constraints or sanctions that regulatory

authorities might impose on UBS, due to litigation, contractual

claims and regulatory investigations, including the potential for

disqualification from certain businesses or loss of licenses or

privileges as a result of regulatory or other governmental

sanctions, as well as the effect that litigation, regulatory and

similar matters have on the operational risk component of our RWA;

(xi) the effects on UBS’s cross-border banking business of tax or

regulatory developments and of possible changes in UBS’s policies

and practices relating to this business; (xii) UBS’s ability to

retain and attract the employees necessary to generate revenues and

to manage, support and control its businesses, which may be

affected by competitive factors including differences in

compensation practices; (xiii) changes in accounting or tax

standards or policies, and determinations or interpretations

affecting the recognition of gain or loss, the valuation of

goodwill, the recognition of deferred tax assets and other matters,

including from changes to US taxation under the Tax Cuts and Jobs

Act; (xiv) UBS’s ability to implement new technologies and business

methods, including digital services and technologies and ability to

successfully compete with both existing and new financial service

providers, some of which may not be regulated to the same extent;

(xv) limitations on the effectiveness of UBS’s internal processes

for risk management, risk control, measurement and modeling, and of

financial models generally; (xvi) the occurrence of operational

failures, such as fraud, misconduct, unauthorized trading,

financial crime, cyberattacks, and systems failures; (xvii)

restrictions on the ability of UBS Group AG to make payments or

distributions, including due to restrictions on the ability of its

subsidiaries to make loans or distributions, directly or

indirectly, or, in the case of financial difficulties, due to the

exercise by FINMA or the regulators of UBS’s operations in other

countries of their broad statutory powers in relation to protective

measures, restructuring and liquidation proceedings; (xviii) the

degree to which changes in regulation, capital or legal structure,

financial results or other factors may affect UBS’s ability to

maintain its stated capital return objective; and (xix) the effect

that these or other factors or unanticipated events may have on our

reputation and the additional consequences that this may have on

our business and performance. The sequence in which the factors

above are presented is not indicative of their likelihood of

occurrence or the potential magnitude of their consequences. Our

business and financial performance could be affected by other

factors identified in our past and future filings and reports,

including those filed with the SEC. More detailed information about

those factors is set forth in documents furnished by UBS and

filings made by UBS with the SEC, including UBS’s Annual Report on

Form 20-F for the year ended 31 December 2017. UBS is not under any

obligation to (and expressly disclaims any obligation to) update or

alter its forward-looking statements, whether as a result of new

information, future events, or otherwise.

RoundingNumbers presented throughout this news release

may not add up precisely to the totals provided in the tables and

text. Starting in 2018, percentages, percent changes and adjusted

results presented in the tables and text are calculated on the

basis of unrounded figures, with the exception of movement

information provided in text that can be derived from figures

displayed in the tables, which is calculated on a rounded basis.

For prior periods, these values are calculated on the basis of

rounded figures displayed in the tables and text.

TablesWithin tables, blank fields generally indicate that

the field is not applicable or not meaningful, or that information

is not available as of the relevant date or for the relevant

period. Zero values generally indicate that the respective figure

is zero on an actual or rounded basis. Percentage changes are

presented as a mathematical calculation of the change between

periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180422005088/en/

UBS Group AG and UBS AGInvestorsSwitzerland: +41-44-234

41 00orMediaSwitzerland: +41-44-234 85 00UK: +44-207-567 47

14Americas: +1-212-882 58 57APAC: +852-297-1 82 00www.ubs.com

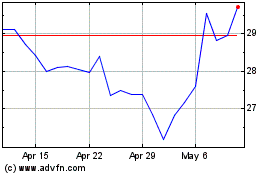

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

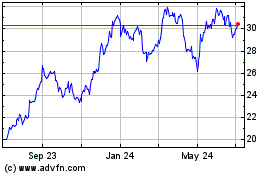

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024