Stocks Lose Steam After Strong Start to Week

April 19 2018 - 9:10AM

Dow Jones News

By Riva Gold and Joanne Chiu

-- S&P 500 futures edge lower

-- Hang Seng climbs

-- Crude oil rally continues

European stocks and S&P 500 futures cooled Thursday after a

strong start to the week as investors continued to parse corporate

results and a climb in oil prices.

Futures suggested the S&P 500 would edge down 0.3% after

three straight days of advances while the Stoxx Europe 600 was flat

in afternoon trading. That followed modest gains in Asian markets,

where a rally in commodity prices continued to boost shares of

oil-and-gas companies.

While index-level moves were muted, individual shares swung in

response to a fresh batch of corporate earnings.

Among Thursday's movers, shares of American Express Co. were up

3.9% in premarket trading after the company reported a 31% increase

in first-quarter profit, driven by a pickup in card holder spending

and borrowing. Bank of New York Mellon Corp. also rose 3.3% after

the bank reported net income that topped analysts' forecasts.

Shares of Philip Morris International fell 3.6% meanwhile after

its revenue fell short of analysts' expectations.

A solid start to the reporting season helped eased investors'

worries about trade tensions, technology regulation and

geopolitical uncertainties earlier this week.

"With the recent jitteriness of markets...the earnings season

should remind people that companies are still growing," said

Caroline Simmons, deputy head of the U.K. investment office at UBS

Wealth Management.

In Europe, shares in Publicis Groupe rose 8.7% after the

advertising agency reported solid revenue figures and reaffirmed

its 2018 targets, while Swiss conglomerate ABB rose 4.4% on

encouraging signs of order growth.

A post-earnings decline in shares of Novartis and Unilever

weighed down the broader Stoxx Europe 600 index, with the

companies' shares down 2.4% and 1.7% respectively, while index

heavyweight Nestlé rose just 0.54% after announcing results.

Unilever and Nestlé both struggled to raise prices in the first

quarter as some of the world's largest consumer goods companies

face increasingly fierce competition.

"Consumers are still very price conscious -- it's a reason we

don't think inflation will get out of hand," said Guy Miller, chief

market strategist at Zurich Insurance Group.

Shares of Shire rose 4.1% following reports of an offer from

Japan's Takeda Pharmaceutical Co.

Oil-and-gas companies were among the best performing stocks

globally on Thursday, with Brent crude oil last up 1.5% at $74.58 a

barrel after settling Wednesday at its highest since November 2014

when U.S. stockpiles fell by more than analysts were expecting.

"It's allowing commodity companies to make money and business

investment to pick up," said Zurich's Mr. Miller.

Some analysts also noted, however, that higher commodity prices

typically push up raw materials costs for other companies, can put

pressure on consumers and ultimately exert upward pressure on

inflation.

"Consumers are more sensitive to rises in the price of gas than

they are to declines in price of gas, so we have to watch that to

see if that weighs on broader consumer confidence out there and if

that has any impact on growth," said William Delwiche, investment

strategist at Baird.

Yields on 10-year Treasurys rose to 2.894% from 2.867% late

Wednesday, which was their highest in nearly a month. Yields move

inversely to prices.

Earlier, Asia-Pacific stocks mostly rose Wednesday, supported by

gains in energy companies and Chinese markets.

Hong Kong's China Enterprises Index, made up of Chinese-based

firms with listings in Hong Kong, climbed 2.1%, while the benchmark

Hang Seng Index rose 1.4%. Oil-related stocks helped fuel gains, as

PetroChina jumped 5.7% and peer Cnooc gained 4.4%.

Australia's S&P ASX 200 edged up 0.3%, the Shanghai

Composite Index rose 0.8% and Japan's Nikkei Stock Average edged up

0.2% in its fifth straight session of advances.

--Nathan Allen contributed to this article.

Write to Riva Gold at riva.gold@wsj.com and Joanne Chiu at

joanne.chiu@wsj.com

(END) Dow Jones Newswires

April 19, 2018 08:55 ET (12:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

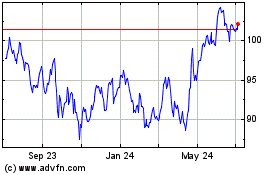

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

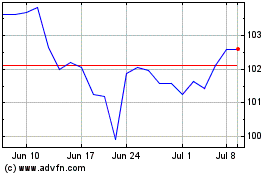

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024