Fox Rejected Bid on Antitrust Fear -- WSJ

April 19 2018 - 3:02AM

Dow Jones News

By Shalini Ramachandran and Ben Fritz

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 19, 2018).

21st Century Fox Inc. rejected an acquisition offer for its

entertainment assets from cable giant Comcast Corp. largely over

antitrust concerns, a regulatory filing said, even though the bid

was 16% higher on a per-share basis than what Walt Disney Co.

ultimately agreed to pay.

After extended discussions, Fox's board decided that Comcast's

offer was too risky to accept, according to the filing. Fox was

concerned such a deal might not pass muster in Washington, and even

if it did, it would require divestiture of valuable assets that

would reduce the value of the deal to Fox. Comcast also didn't

offer Fox a breakup fee in the event regulators didn't bless the

deal, according to the filing.

Disney's all-stock deal with Fox, reached in December, valued

the Fox assets at $29.54 a share based on the last trading day

before it was announced. The filing said a company described as

"Party B" offered an all-stock deal valued at $34.41 per share as

of November. A person familiar with the matter confirmed that Party

B is Comcast.

Verizon Communications Inc. also showed interest in making an

all-stock bid for Fox assets, according to the filing, but Fox said

it would have been without "any meaningful premium" to Fox

shareholders. Verizon was described in the filing as Party A, the

person said.

Fox didn't set a date for a shareholder vote in the filing.

By laying out the back-and-forth with Comcast, Fox is spelling

out for shareholders why it rejected a higher-value offer. In its

$52.4 billion deal with Disney, Fox agreed to sell its television

and film studios; cable networks; international assets including

Star India and its stake in European operator Sky PLC; its stake in

streaming service Hulu; and its 22 regional sports networks. The

Disney deal valued Hulu at $8.73 billion, the filing said.

The Wall Street Journal reported in February that Comcast had

submitted a bid for Fox's assets that was more than 15% higher than

Disney's.

21st Century Fox and Wall Street Journal parent News Corp share

common ownership.

Details of Comcast's bid add to the intrigue as media companies

seek to expand their holdings globally in a consolidating industry

and better compete against tech giants such as Netflix Inc.

Fox and Comcast are tussling over control of European pay-TV

operator Sky. Fox, which owns 39% of Sky, has been seeking to take

full control but has faced a lengthy regulatory review. In

February, Comcast launched an informal $31 billion offer for all of

Sky that would top Fox's, but Comcast has yet to formalize its bid.

The cable company has been waiting to do so for regulatory and

strategic reasons, and because it is keeping its options open about

continuing to pursue Fox, people familiar with Comcast's thinking

said.

Earlier this month, Fox told U.K. regulators that Disney has

offered to buy Sky News to help Fox win regulatory approval.

21st Century Fox Executive Chairman Rupert Murdoch and Disney

Chief Executive Robert Iger first discussed the possibility of a

combination in early August 2017, while talking about media trends

during a meeting in Los Angeles, according to the filing. A first

round of talks stalled over price. When reports of the Disney-Fox

talks surfaced in November, Comcast Chief Executive Brian Roberts

jumped in, reaching out to Mr. Murdoch to propose a deal of his

own. Talks between Fox and Disney restarted soon after that.

Fox's lawyers advised that Comcast's track record with antitrust

authorities could mean a deal would run into significant hurdles in

Washington, according to the filing. Comcast sought to assuage

Fox's concerns by offering that any assets that raised red flags to

regulators, along with the corresponding tax burden, would be

allocated to New Fox, the company left behind after the sale. That

raised concerns for Fox executives and advisers, who felt that such

a plan could incentivize Comcast to agree to divestitures that

would ultimately narrow the scope of the deal and potentially

reduce the return for Fox shareholders.

As talks progressed, Comcast offered other carrots, including

that it would agree to any proposed behavioral remedies offered to

regulators by AT&T Inc. in its pursuit of Time Warner Inc., and

that it would bear 50% of some tax costs of potential divestitures.

It even offered to allow Fox a "unilateral termination right" if

the AT&T-Time Warner deal was enjoined in court. Mr. Roberts

made a last-ditch effort to save the deal in a New York City

meeting with Mr. Murdoch on Dec. 4, but continued to hold firm that

Comcast wouldn't agree to pay a breakup fee.

After considering the antitrust risks at a Dec. 6 board meeting,

Fox decided to cease talks with Comcast. A week later, Fox sealed

its deal with Disney.

Corrections & Amplifications Disney's all-stock deal with

Fox valued the Fox assets at $29.54 a share based on the last

trading day before it was announced. An earlier version of this

article incorrectly stated the deal valued the entire company at

$29.54 a share.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and Ben Fritz at ben.fritz@wsj.com

(END) Dow Jones Newswires

April 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

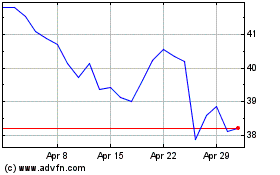

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024