J&J Shakes Off Pricing Pressure, Plans Cost Cuts -- WSJ

April 18 2018 - 3:02AM

Dow Jones News

By Jonathan D. Rockoff and Imani Moise

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 18, 2018).

Johnson & Johnson reported higher-than-expected sales in its

latest quarter and boosted its sales outlook for the year despite

ongoing pricing pressures for its prescription drugs and medical

devices.

J&J said it planned to cut costs in its supply chain by $600

million to $800 million a year by 2022. To carry out the changes,

J&J expects it will take $1.9 billion to $2.3 billion in

charges over the next several years.

The New Brunswick, N.J., company said it planned to invest more

than $30 billion in capital projects and research-and-development

in the U.S. through 2021, 15% more than the company invested over

the previous four years. The company said U.S. tax reform played a

role in the increase.

Chief Financial Officer Dominic Caruso played down the prospects

of J&J making a major pharmaceutical acquisition, indicating

the company would probably rely instead on its strong pipeline of

new drugs and its collaborations with other companies.

J&J is one of the biggest health-products companies in the

world by sales, and Wall Street considers its results a harbinger

for the rest of the health-care industry.

The company upped its financial forecast for the year largely

because of the performance of its pharmaceutical business, Mr.

Caruso said. Sales of key drugs like cancer therapies Darzalex and

Imbruvica rose by double digits in the quarter.

J&J now expects 2018 sales of $81 billion to $81.8 billion

and earnings in the range of $8 to $8.20 a share.

"We're off to a strong start this year," Mr. Caruso said in a

conference call with analysts and investors.

Pricing and competitive pressures remain a threat. In March,

J&J reported the average price paid for its medicines in the

U.S. fell by 4.6% last year due to the company's discounts. The

company said it expected competition in the pharmaceutical business

to continue throughout the year.

During the quarter, world-wide sales of autoimmune therapy

Remicade, the company's top-selling product, fell 16.9% as a result

of competition from lower-priced copies, known as biosimilars, and

J&J's own discounting.

Another of the company's top-selling drugs, prostate-cancer

treatment Zytiga, will probably face generic competition late this

year or early next year, according to J.P. Morgan.

President Trump is expected to speak next week about high drug

prices, but analysts expect proposals that won't hurt

pharmaceutical companies, such as efforts to reduce the

out-of-pocket costs borne by patients.

Pricing pressures also impacted sales of the company's spine,

trauma and knee parts, which fell in the quarter.

"We remain focused on making improvements across our medical

devices," Mr. Caruso said.

Sales in J&J's pharmaceutical business jumped 19% to $9.84

billion in the first quarter while sales in its consumer and

medical-devices segments rose 5.3% and 7.5%, respectively.

Results were bolstered by foreign exchange rates, which the

company said had a 4.2% positive impact.

Overall for the quarter the company reported a profit of $4.37

billion, or $1.60 a share, down from $4.42 billion, or $1.61 a

share, a year earlier. Excluding special items profit rose 13% to

$2.06 a share.

Revenue grew 13% to $20.01 billion. Analysts had forecast

earnings of $2.02 a share on $19.46 billion in revenue.

J&J's shares edged down 0.9% in trading on the New York

Stock Exchange. Before Tuesday, the stock had fallen 5.7% for the

year, while the S&P 500 has gained 0.2%.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

April 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

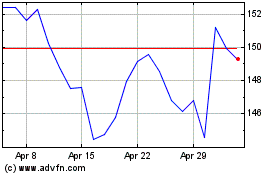

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

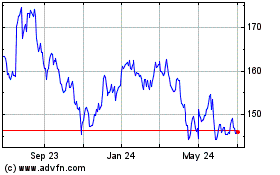

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024