By Richard Rubin

WASHINGTON -- The IRS issued a one-day, penalty-free extension

for tax filers after suffering an all-day computer breakdown on

Tuesday that prevented taxpayers from filing returns electronically

on the day 2017 payments were due.

The Internal Revenue Service blamed the problem on a hardware

error, and the glitch exposed the information-technology challenges

that agency officials have been warning about for years. The

systems were back up and running late Tuesday.

The IRS said taxpayers don't need to do anything to receive the

extra day. They now have until midnight Wednesday night to file and

pay their 2017 income taxes. They can also seek a routine six-month

extension that is normally available. But for those people payments

are still due in April.

"This is the busiest tax day of the year, and the IRS apologizes

for the inconvenience this system issue caused for taxpayers," said

the agency's acting commissioner, David Kautter. "The IRS

appreciates everyone's patience during this period. The extra time

will help taxpayers affected by this situation."

During Tuesday's outage, the IRS said taxpayers should continue

filing returns as usual. The agency was having difficulty receiving

returns from tax preparers, including large companies such as

TurboTax maker Intuit Inc. and H&R Block Inc., Mr. Kautter told

House subcommittees on Tuesday.

Rep. Kevin Brady (R., Texas), chairman of the House Ways and

Means Committee, said the agency's problems show the need for the

series of bipartisan bills that House members aim to pass this

week, including one aimed at creating a strategic plan for IRS

technology needs.

"Tax Day is always a frustrating day for hardworking Americans,

and the IRS issues today certainly heighten that frustration for

taxpayers," Mr. Brady said. "It's another reminder of the critical

need to modernize the IRS and refocus them to become a 'Taxpayer

First' agency."

Earlier in the day, the committee's top Democrat, Rep. Richard

Neal of Massachusetts, called on the agency to ensure that

taxpayers wouldn't be penalized for the outage.

"Tax Day is already a stressful time for millions of Americans,

even when everything goes right," Mr. Neal said. "Given this news,

I hope that the IRS will make accommodations so that every taxpayer

attempting to file today has a fair shot to do so without

penalty."

TurboTax on Tuesday was still receiving returns and was holding

them until the IRS is ready to accept them again, said Ashley

McMahon, a company spokeswoman. H&R Block issued a similar

statement.

Most Americans have already filed their 2017 income taxes, but

millions do so as the deadline nears for filing or seeking an

extension. Last year, the IRS received about five million returns

on the final day of the filing season.

The deadline this year was April 17, not April 15, because of

the weekend and the Emancipation Day holiday in the District of

Columbia.

The agency sent an email at 8:46 a.m. ET Tuesday notifying

accountants and other tax professionals that parts of the

Modernized eFile system, which receives tax returns electronically,

were "unavailable." By Tuesday evening the IRS announced the

systems had been restored.

The IRS has long operated aging computer systems. Agency leaders

for years have warned about potential malfunctions and said they

are guarding closely against external threats.

Former IRS Commissioner John Koskinen said the agency's hardware

is two or three generations out of date, stressed by budget cuts

and especially vulnerable in the final week of the filing season as

millions of returns come in.

"The question was becoming not whether the system would just

shut down one day, but when," he said in an interview on Tuesday.

"Each year, there have been more glitches that get handled so

nobody sees them, but the system gets more rickety every year."

The main systems are in Martinsburg, W.Va., Mr. Koskinen said.

The first goal would have been to get those computers working

again, but there are also backup systems that are tested annually,

he said.

"In the case of significant failure, you can move the system

from a major site to the backup site," said Mr. Koskinen, who left

the IRS in 2017 after his term expired. "But that doesn't

necessarily work quickly."

In a report last year, the Treasury Inspector General for Tax

Administration identified areas for improvement in the agency's

information-technology systems.

"The IRS could better protect IRS systems and data by improving

disaster recovery planning and testing, general support system

security controls, transfers of data to external partners, email

records management, and external network perimeter security," the

report said.

Congress has been steadily cutting the IRS budget or holding it

flat for the past few years, partly in a broader austerity effort

and partly in response to the agency's treatment of conservative

groups seeking tax-exempt status.

Those cuts have reduced the frequency of audits and at times

lowered the IRS's ability to respond to taxpayers' queries.

Congress just approved $320 million for the IRS to implement the

tax law that passed last year.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

April 17, 2018 19:43 ET (23:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

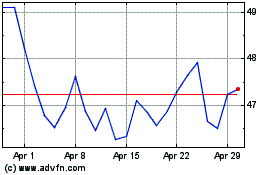

H and R Block (NYSE:HRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

H and R Block (NYSE:HRB)

Historical Stock Chart

From Apr 2023 to Apr 2024