IRS Experiencing Computer Problems--3rd Update

April 17 2018 - 2:48PM

Dow Jones News

By Richard Rubin

WASHINGTON -- Some IRS computer systems are "experiencing

technical difficulties" on the deadline to pay individual income

taxes for 2017, the U.S. tax agency said Tuesday.

In a statement that didn't specify the extent or cause of the

outage, the Internal Revenue Service said taxpayers should continue

filing returns as usual. The agency is having difficulty receiving

returns from tax preparers, including large companies such as

TurboTax maker Intuit Inc. and H&R Block Inc., acting IRS

commissioner David Kautter told House subcommittees on Tuesday.

Rep. Richard Neal (D., Mass.), said the problem was related, in

part, to the transmission of direct payments to the agency.

"Tax Day is already a stressful time for millions of Americans,

even when everything goes right," said Mr. Neal, the top Democrat

on the House Ways and Means Committee. "Given this news, I hope

that the IRS will make accommodations so that every taxpayer

attempting to file today has a fair shot to do so without

penalty."

TurboTax is still receiving returns and will hold them until the

IRS is ready to accept them again, said Ashley McMahon, a company

spokeswoman.

Most Americans have already filed their 2017 income taxes, but

millions do so in the final days of the filing season. Last year,

between April 14 and April 21, the IRS received more than 17

million returns.

The deadline this year is April 17, not April 15, because of the

weekend and the Emancipation Day holiday in the District of

Columbia.

The IRS has been trying to update its outdated computer systems

for several years, and agency leaders have warned about potential

malfunctions and said they are guarding closely against external

threats.

The problem is believed to be a hardware failure, and the IRS is

rebooting its systems, said a congressional aide familiar with the

matter.

The IRS sent an email at 8:46 a.m. ET Tuesday notifying

accountants and other tax professionals that parts of the

Modernized eFile system, which receives tax returns electronically,

were "unavailable."

The IRS has long operated aging computer systems, and the

agency's leaders have been pressing for updates.

"It is important to point out that the IRS is the world's

largest financial accounting institution, and that is a

tremendously risky operation to run with outdated equipment and

applications," then-commissioner John Koskinen told Congress in

2015. "Our situation is analogous to driving a Model T automobile

that has satellite radio and the latest GPS system. Even with all

the bells and whistles, it is still a Model T."

In a report last year, the Treasury Inspector General for Tax

Administration identified areas for improvement in the agency's

information-technology systems.

"The IRS could better protect IRS systems and data by improving

disaster recovery planning and testing, general support system

security controls, transfers of data to external partners, email

records management, and external network perimeter security," the

report said.

Congress has been steadily cutting the IRS budget or holding it

flat for the past few years, partly in a broader austerity effort

and partly in response to the agency's treatment of conservative

groups seeking tax-exempt status.

Those cuts have reduced the frequency of audits and at times

lowered the IRS's ability to respond to taxpayers' queries.

Congress just approved $320 million for the IRS to implement the

tax law that passed last year.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

April 17, 2018 14:33 ET (18:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

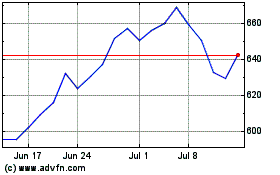

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024