By Jennifer Smith

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 14, 2018).

More big trucking companies are looking to cash in on home

delivery of bulky items as consumers grow more comfortable shopping

online for furniture and other goods too big for conventional

parcel networks.

Ryder System Inc. is the latest operator to jump into the

business, paying $120 million this month to buy MXD Group, a

logistics firm that specializes in "final mile" delivery of big

items to consumers' doorsteps.

The deal extends Ryder's bid to move into areas beyond its

well-known truck-leasing business, and reflects the growing

attraction of a sector that has been transformed by e-commerce.

Shoppers accustomed to getting online purchases in days, not

weeks, and tracking those packages, now look for similar service

when they buy big items like couches, washing machines and exercise

equipment. Such objects often require installation or special

handling, and may not fit in the highly automated systems that

carriers like United Parcel Service Inc. and FedEx Corp. use to

sort millions of packages each day.

That has drawn in large trucking operators who want to use their

scale to lure large retailers as customers for home-delivery

services.

Furniture is one of the fastest-growing segments of U.S. online

retail, with Amazon.com Inc., Wayfair Inc. and other e-commerce

firms competing for market share with big-box stores and furniture

chains like Crate and Barrel.

"Last-mile has taken off like crazy," says Daniel Sayne,

director of sales at Fidelitone Inc., which delivers furniture for

Amazon, Wayfair, and others. Newer entrants to the segment include

Green Bay, Wis.-based Schneider National Inc., one of the largest

U.S. truckload operators, as well as Richmond, Va.-based

less-than-truckload carrier Estes Express Lines.

Home delivery poses big challenges for trucking companies,

however.

Operators with business models built on delivering goods by the

pallet or truckload to industrial loading docks must send drivers

on irregular routes down residential streets to hit specific

delivery times. Workers may have to enter homes and take the time

to install products.

"Home delivery is more finicky, more risky and more costly,"

said Paul Thompson, chairman of Transportation Insight LLC, a

supply-chain management and logistics firm. "To really have a

cost-efficient last-mile network, you have to have density."

For the trucking companies, however, the service helps them move

into one area in the retail world that is growing rapidly as

digital sales carve away business from brick-and-mortar stores.

"Our strategy is to penetrate all six of those big-box retailers

that have a lot of density and a lot of delivery on big and bulky

products," Nicholas Hobbs, president of dedicated contract services

at J.B. Hunt Transport Services Inc., said at an investor

conference last month.

J.B. Hunt, which has long offered last-mile delivery to

customers such as appliance-maker Whirlpool Inc., expanded its

reach last year by buying provider Special Logistics Dedicated LLC

for $136 million. The company expects between $300 million to $350

million in final-mile revenue this year, up from about $250 million

in 2017.

Ryder was already doing a small number of consumer deliveries

for customers in its supply-chain and dedicated trucking segments.

The MXD deal gives Ryder a national network of 109 e-commerce

fulfillment facilities, including 21 cross-docking hubs. The

carrier also inherits MXD's customers -- retailers selling

furniture and appliances online and by catalog -- providing an

opportunity for selling those companies other Ryder services.

"We saw this as a space where we could be a leader," Ryder Chief

Executive Robert Sanchez said in an interview. "Customers that we

are currently running distribution centers for, customers where

we're doing delivery to retail stores, this is another piece of

that puzzle."

XPO Logistics Inc., the U.S. market leader in big-and-bulky home

delivery, is now rolling that service out in Europe, where many

urban consumers lack cars and depend on delivery to get big

purchases such as refrigerators home.

Much of the sector is made up of smaller carriers. Bigger fleets

often rely on a combination of company trucks and networks of

contractors to deliver bulky goods across wide swaths of the

country.

Noël Perry, a transportation economist and principal at

consulting firm Transport Futures, estimates the final-mile market

for bulky items, currently about $3.7 billion to $4 billion, will

expand to about $12 billion over the next decade. That's still just

a niche in a U.S. trucking industry that counts around $676 billion

in annual gross freight revenue.

"It's too early for this kind of thing to have the kind of

growth or profitability that acquirers are expecting," said Mr.

Perry.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

April 14, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

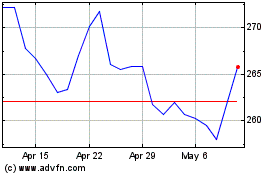

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

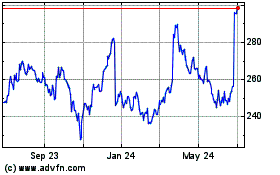

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024