Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-216316

PROSPECTUS SUPPLEMENT

BABCOCK & WILCOX ENTERPRISES, INC.

The Harris Building

13024 Ballantyne Corporate Place

Suite 700

Charlotte, North Carolina 28777

Common Stock, par value $0.01 per share

Subscription Rights to Purchase up to

124,256,280 Shares of Common Stock at $2.00 per Share

___________________________

Babcock & Wilcox Enterprises, Inc. (“

B&W

,” which is also referred to in this prospectus supplement as “

we

,” “

our

,” or the “

Company

”) is a leading technology-based provider of advanced fossil and renewable power generation and environmental equipment that includes a broad suite of boiler products, environmental systems, and services for power and industrial uses. On March 19, 2018 (the “

Rights Distribution Date

”), we distributed (the “

Rights Distribution

”) to holders of our common stock, par value $0.01 per share (the “

Common Shares

”), one nontransferable subscription right (a “

Right

”) to purchase Common Shares (the “

Rights Offering

”) for each Common Share held as of 5:00 p.m., New York City time, on March 15, 2018 (the “

Rights Distribution Record Date

”), and mailed subscription materials, including a prospectus supplement and rights certificates, to holders of our Common Shares as of the Rights Distribution Record Date. On April 10, 2018, we announced that we were extending the expiration date for the Rights Offering and amending certain other terms regarding the Rights Offering.

This prospectus supplement describes the amended terms of the Rights Offering and amends and restates in its entirety the prior prospectus supplement dated March 19, 2018.

On the Rights Distribution Date, we issued a total of 44,377,243 Rights. Each Right now entitles the holder to purchase 2.8 Common Shares at a subscription price of $2.00 per Common Share (the “

Subscription Price

”), which is equal to an approximate 27.6% discount to the trading day volume weighted average trading price of our Common Shares on April 10, 2018. We will not issue any fractional Common Shares in the Rights Offering and exercises of Rights will be rounded down to the nearest whole Common Share. You will not be entitled to exercise an oversubscription privilege to purchase additional Common Shares that may remain unsubscribed as a result of any unexercised Rights.

The Rights Offering will now expire at 5:00 p.m., New York City time, on April 30, 2018, unless we extend it, with the length of such extension to be determined by us in our sole discretion. Holders may revoke their election to exercise their Rights at any time on or before 5:00 p.m., New York City time, on April 27, 2018. Holders of Rights who exercised their Rights on or before April 10, 2018 must complete and submit a new rights certificate in order to participate in the Rights Offering. Any amounts previously submitted by such holders to cover the applicable Subscription Price will be returned.

Vintage Capital Management, LLC (“

Vintage

”), a significant shareholder of the Company, will serve as a backstop purchaser and will be entitled to purchase any unsubscribed shares at the Subscription Price. Vintage will also be entitled to exercise its subscription privilege. Vintage will not receive any fee for acting as backstop purchaser. The commitment of Vintage is subject to the satisfaction of certain conditions. See “The Rights Offering – Backstop Purchaser.” Vintage beneficially owned 6,600,000 Common Shares, or approximately 14.9% of our outstanding Common Shares, as of the Rights Distribution Record Date.

No vote of B&W’s shareholders is being sought in connection with the Rights Offering. See “The Rights Offering – Financial Viability Exception.” No action is required of you to receive your Rights.

Neither we nor our board of directors has made any recommendation as to whether you should exercise your Rights, although directors and executive officers may exercise their Rights in their individual capacities. You are urged to carefully review the subscription materials we will provide and consult with your own legal and financial advisors in deciding whether or not to exercise the Rights.

Our Common Shares trade on the New York Stock Exchange under the symbol “BW”. We do not expect to list the Rights on the New York Stock Exchange as the Rights are nontransferable.

In reviewing this prospectus supplement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page S-11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has passed upon the adequacy or accuracy of this prospectus supplement as truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 11, 2018.

Prospectus Supplement

ABOUT THIS PROSPECTUS SUPPLEMENT S-1

WHERE YOU CAN FIND MORE INFORMATION S-1

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE S-1

SUMMARY S-3

RISK FACTORS S-11

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS S-14

THE RIGHTS OFFERING S-15

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE RIGHTS DISTRIBUTION

AND THE RIGHTS OFFERING S-25

USE OF PROCEEDS FROM THE RIGHTS OFFERING S-29

PLAN OF DISTRIBUTION S-30

LEGAL MATTERS S-31

EXPERTS S-31

Prospectus

ABOUT THIS PROSPECTUS 1

WHERE YOU CAN FIND MORE INFORMATION 1

INFORMATION WE INCORPORATE BY REFERENCE 1

THE COMPANY 3

RISK FACTORS 4

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS 4

USE OF PROCEEDS 6

RATIO OF EARNINGS TO FIXED CHARGES 6

DESCRIPTION OF CAPITAL STOCK 7

DESCRIPTION OF DEPOSITARY SHARES 12

DESCRIPTION OF WARRANTS 14

DESCRIPTION OF SUBSCRIPTION RIGHTS 17

DESCRIPTION OF DEBT SECURITIES 18

DESCRIPTION OF PURCHASE CONTRACTS 27

DESCRIPTION OF UNITS 27

PLAN OF DISTRIBUTION 28

LEGAL MATTERS 31

EXPERTS 31

ABOUT THIS PROSPECTUS SUPPLEMENT

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus supplement to “B&W,” the “Company,” “we,” “us,” “our,” or similar references, mean Babcock & Wilcox Enterprises, Inc.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement. We have not authorized any person to provide information other than that provided in this prospectus supplement and the documents incorporated by reference. You should assume that the information appearing in this prospectus supplement is accurate only as of the date on its cover page and that any information previously filed with the Securities and Exchange Commission (the “SEC”) that is incorporated by reference is accurate only as of the date such document is incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement is a part of a registration statement we have filed with the SEC under the Securities Act of 1933, as amended (the “

Securities Act

”). As permitted by SEC rules, this prospectus supplement does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and the securities. The registration statement, exhibits and schedules are available through the SEC’s website or at its Public Reference Room, as discussed below.

We are required to comply with the reporting requirements of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), and, in accordance with those requirements, we file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC’s toll-free number at 1-800-SEC-0330 for further information about the Public Reference Room. Our SEC filings are also available to the public from the SEC’s website at

www.sec.gov

and can be found by searching the EDGAR archives on the website. In addition, our SEC filings and other information about us may also be obtained from our website at

www.babcock.com

, although information on our website is not incorporated by reference into and does not constitute a part of this prospectus supplement. Our Common Shares are listed on the New York Stock Exchange under the symbol “BW” and you can read and inspect our filings at the offices of the New York Stock Exchange at 11 Wall Street, New York, New York, 10005.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to other documents. The information incorporated by reference is an important part of this prospectus supplement, and is deemed to be part of this prospectus supplement except for any information superseded by this prospectus supplement or any other document incorporated by reference into this prospectus supplement. Any statement, including financial statements, contained in our Annual Report on Form 10-K for the year ended December 31, 2017, shall be deemed to be modified or superseded to the extent that a statement, including financial statements, contained in this prospectus supplement or in any other later incorporated document modifies or supersedes that statement.

We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering described herein (other than any filing or portion thereof that is furnished, rather than filed, under applicable SEC rules):

|

|

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2017, filed on March 1, 2018 (the “

10-K

”), as amended by Amendment No. 1 to the 10-K on Form 10-K/A, filed on March 5, 2018;

|

|

|

|

|

•

|

our Current Reports (other than any portion thereof furnished or deemed furnished) on Form 8-K filed on January 3, 2018, February 1, 2018, February 6, 2018, March 5, 2018, March 15, 2018, March 19, 2018, April 10, 2018 and April 11, 2018; and

|

|

|

|

|

•

|

the description of our capital stock contained in our Information Statement, filed as Exhibit 99.1 to Amendment No. 4 to our Registration Statement on Form 10 (File No. 001-36876), filed on June 9, 2016, including any amendment or report filed for the purpose of updating such description.

|

Any statement contained in the filings (or portions of filings) incorporated by reference in this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in any filing by us with the SEC prior to the completion of this offering modifies, conflicts with or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address or phone number:

Babcock & Wilcox Enterprises, Inc.

The Harris Building

13024 Ballantyne Corporate Place, Suite 700

Charlotte, North Carolina 28277

(704) 625-4900

Attention: Investor Relations

SUMMARY

The following is a summary of material information discussed in this prospectus supplement. It is included for convenience only and should not be considered complete. You should carefully review this entire prospectus supplement, including the risk factors and the documents incorporated by reference into this prospectus supplement, to better understand the Rights Offering and our business and financial position.

Our Company

B&W is a leading technology-based provider of advanced fossil and renewable power generation and environmental equipment that includes a broad suite of boiler products, environmental systems, and services for power and industrial uses. We specialize in technology and engineering for power generation and various other industries, including the procurement, erection and specialty manufacturing of related equipment, and services, including:

|

|

|

|

•

|

high-pressure equipment for energy conversion, such as boilers fueled by coal, oil, bitumen, natural gas, and renewables including municipal solid waste and biomass fuels;

|

|

|

|

|

•

|

environmental control systems for both power generation and industrial applications to incinerate, filter, capture, recover and/or purify air, liquid and vapor-phase effluents from a variety of power generation and specialty manufacturing processes;

|

|

|

|

|

•

|

aftermarket support for the global installed base of operating plants with a wide variety of products and technical services including replacement parts, retrofit and upgrade capabilities, field engineering, construction, inspection, operations and maintenance, condition assessment and other technical support;

|

|

|

|

|

•

|

custom-engineered comprehensive dry and wet cooling solutions;

|

|

|

|

|

•

|

gas turbine inlet and exhaust systems, custom silencers, filters and custom enclosures; and

|

|

|

|

|

•

|

engineered-to-order services, products and systems for energy conversion worldwide and related auxiliary equipment, such as burners, pulverizers, soot blowers and ash and material handling systems.

|

Our overall activity depends significantly on the capital expenditures and operations and maintenance expenditures of global electric power generating companies, other steam-using industries and industrial facilities with environmental compliance and noise abatement needs. Several factors influence these expenditures, including:

|

|

|

|

•

|

prices for electricity, along with the cost of production and distribution including the cost of fuel within the United States or internationally;

|

|

|

|

|

•

|

demand for electricity and other end products of steam-generating facilities;

|

|

|

|

|

•

|

requirements for environmental and noise abatement improvements;

|

|

|

|

|

•

|

expectation of future requirements to further limit or reduce greenhouse gas and other emissions in the United States and internationally;

|

|

|

|

|

•

|

environmental policies which include waste-to-energy or biomass as options to meet legislative requirements and clean energy portfolio standards;

|

|

|

|

|

•

|

level of capacity utilization at operating power plants and other industrial uses of steam production;

|

|

|

|

|

•

|

requirements for maintenance and upkeep at operating power plants to combat the accumulated effects of usage;

|

|

|

|

|

•

|

overall strength of the industrial industry; and

|

|

|

|

|

•

|

ability of electric power generating companies and other steam users to raise capital.

|

Customer demand is heavily affected by the variations in our customers' business cycles and by the overall economies and energy, environmental and noise abatement needs of the countries in which they operate.

Corporate Information

Our principal executive offices are located at The Harris Building, 13024 Ballantyne Corporate Place, Suite 700, Charlotte, North Carolina 28277. Our telephone number is (704) 625-4900. Our website is http://www.babcock.com. The information contained on or accessible through our website is not part of this prospectus supplement, other than the documents that we file with the SEC that are incorporated by reference into this prospectus supplement.

Additional Information

For additional information regarding our business, financial condition, results of operations and other important information regarding our Company, we refer you to our filings with the SEC incorporated by reference in this prospectus supplement. For instructions on how to find copies of these documents, see “Where You Can Find More Information.”

The Rights Offering

The following is a brief summary of the terms of the Rights Offering. Please see “The Rights Offering” for a more detailed description of the matters described below.

|

|

|

|

Q:

|

What is a rights offering?

|

|

|

|

|

A:

|

A rights offering is a distribution of subscription rights on a pro rata basis to shareholders of a company. On March 19, 2018, we distributed (the “

Rights Distribution

”) to holders of our common stock, par value $0.01 per share (the “

Common Shares

”), one nontransferable subscription right (a “

Right

”) to purchase Common Shares (the “

Rights Offering

”) for each Common Share held as of 5:00 p.m., New York City time, on March 15, 2018, and mailed subscription materials, including a prospectus supplement and rights certificates, to holders of our Common Shares on March 19, 2018. On April 10, 2018, we announced that we were extending the expiration date for the Rights Offering and amending certain other terms regarding the Rights Offering.

|

|

|

|

|

Q.

|

What are the record and distribution dates for the Rights Offering?

|

|

|

|

|

A.

|

Each holder of record of Common Shares as of 5:00 p.m., New York City time, on March 15, 2018 (the “

Rights Distribution Record Date

”) received Rights on the Rights Distribution Date, which was as of 5:00 p.m., New York City time, on March 19, 2018.

|

|

|

|

|

Q.

|

Are there other key dates relating to the Rights Offering?

|

|

|

|

|

A.

|

Yes. Below is a list of the key dates for the Rights Offering of which you should be aware. With the exception of the Rights Distribution Record Date and Rights Distribution Date, such dates are subject to change in the event we determine to extend the Rights Offering (as discussed herein).

For more information regarding these dates, we encourage you to review “The Rights Offering” below, as that section of the prospectus supplement describes other timing considerations of which you should be aware regarding the Rights Offering (for example, dates by which different forms of payment upon the exercise of Rights are deemed received).

|

|

|

|

|

|

|

Date

|

Event / Action

|

|

5:00 p.m., New York City time, on

March 15, 2018

|

Rights Distribution Record Date.

|

|

5:00 p.m., New York City time, on

March 19, 2018

|

Rights Distribution Date.

|

|

5:00 p.m., New York City time, on April 27, 2018

|

Date by which the subscription agent must have received appropriate materials from holders of Rights in order to exercise (or withdraw) all or a portion of such holder’s Rights.

|

|

5:00 p.m., New York City time, on April 30, 2018

|

Expiration of the Rights Offering.

|

|

|

|

|

A.

|

Each whole Right entitles its holder to purchase 2.8 Common Shares from us, at a subscription price of $2.00 per Common Share (the “

Subscription Price

”), which is equal to an approximate 27.6% discount to the trading day volume weighted average trading price of our Common Shares on April 10, 2018.

|

|

|

|

|

Q.

|

Why are you conducting the Rights Offering and how will you use the proceeds received from the Rights Offering?

|

|

|

|

|

A.

|

We are conducting the Rights Offering to raise proceeds to repay in full all of the indebtedness outstanding and our other obligations under our second lien term loan and for working capital purposes. As a result of additional losses we recognized in the fourth quarter of 2017 related to an increase in structural steel repair costs on one of our European renewable energy contracts, we were not in compliance with certain financial covenants under our first lien revolving credit agreement and our second lien term loan. In March 2018, we obtained an amendment to our first lien revolving credit facility that temporarily waived the covenant defaults. Pursuant to this temporary waiver, we were required to complete the Rights Offering on or prior to April 15, 2018 and, if we failed to do so, the temporary waiver would automatically terminate.

|

On April 10, 2018, we announced that we had preliminarily identified approximately $51 million of additional estimated costs to complete our renewable energy projects in Europe to be incurred in the first quarter of 2018. These additional costs are expected to cause us to be out of compliance with certain financial covenants under our first lien revolving credit facility for the quarter ending March 31, 2018. Accordingly, on April 10, 2018, we entered into an additional amendment to our first lien revolving credit facility to, among other things, extend the temporary waiver of the financial covenant violations until May 22, 2018 to allow us additional time to complete the Rights Offering and continue to allow us to access our revolving line of credit to meet liquidity needs. As a condition to obtaining the additional amendment, we were required to upsize the Rights Offering.

We currently remain in default under our second lien term loan. Although the second lien term loan contains a 180-day standstill period with respect to enforcement rights against collateral secured by the loan, the lenders may pursue other remedies, including accelerating the repayment of the underlying debt.

|

|

|

|

Q.

|

How was the Subscription Price determined?

|

|

|

|

|

A.

|

The Subscription Price was initially established at $3.00 per Common Share following negotiations with Vintage Capital Management, LLC (“

Vintage

”), the backstop purchaser, and after considering, among other things, the Subscription Price necessary to obtain Vintage’s initial backstop commitment. On April 10, 2018, we announced that we had preliminarily identified approximately $51 million of additional estimated costs to complete renewable energy projects in Europe, that we had entered into an additional amendment to our first lien revolving credit facility and that we were upsizing the Rights Offering. In connection with these events, following negotiations with Vintage, and after considering, among other things, the Subscription Price necessary to obtain an increased backstop commitment and the additional renewable energy project costs to

|

be incurred in the first quarter of 2018, our board of directors determined that the Subscription Price should be reduced to $2.00 per Common Share. This Subscription Price was not intended to bear any relationship to the historical price of our Common Shares or our past or future operations, cash flows, net income, current financial condition, the book value of our assets or any other established criteria for value. As a result, the Subscription Price should not be considered an indication of the actual value of our Company or of our Common Shares.

|

|

|

|

Q.

|

What do I have to do to receive Rights?

|

|

|

|

|

A.

|

Nothing. Holders of our Common Shares on the Rights Distribution Record Date are not required to pay any cash or deliver any other consideration, or give up any Common Shares, to receive the Rights distributable to them in the Rights Distribution.

|

|

|

|

|

Q.

|

What is the subscription privilege?

|

|

|

|

|

A.

|

The subscription privilege entitles each holder of a whole Right to purchase 2.8 Common Shares at the Subscription Price of $2.00 per Common Share.

|

|

|

|

|

Q.

|

Will the Rights Offering include an oversubscription privilege?

|

|

|

|

|

A.

|

No. You will not be entitled to an oversubscription privilege to acquire the Common Shares remaining unpurchased after the expiration of all subscription rights. Vintage, the backstop purchaser, will be entitled to purchase at the Subscription Price up to that number of Common Shares that are offered in the Rights Offering but are not purchased by the holders of Rights under their subscription privilege.

|

|

|

|

|

Q.

|

Will the Company issue fractional Rights in the Rights Offering?

|

|

|

|

|

A.

|

No. Holders of our Common Shares as of the Rights Distribution Record Date received one Right for each Common Share held as of the Rights Distribution Record Date. We will not issue fractional Rights, or pay cash in lieu of fractional Rights.

|

|

|

|

|

Q.

|

How will fractional Common Shares be treated in the Rights Offering?

|

|

|

|

|

A.

|

The subscription privilege entitles each holder of a whole Right to purchase 2.8 Common Shares at the Subscription Price of $2.00 per Common Share. However, we will not issue any fractional Common Shares in the Rights Offering. You may only exercise your Rights to purchase Common Shares in whole numbers. Any excess funds insufficient to purchase one whole Common Share will be returned to you by the subscription agent without penalty or interest.

|

|

|

|

|

Q.

|

When did the Rights Offering commence and when will it expire?

|

|

|

|

|

A.

|

The Rights Offering commenced on March 19, 2018. The Rights Offering will expire at 5:00 p.m., New York City time, on April 30, 2018 (such date and time, the “

Expiration Time

”), unless we extend it. We may extend the Expiration Time for any reason and for any length of time at our discretion.

|

|

|

|

|

Q.

|

If I submitted a rights certificate and the applicable subscription payment on or prior to April 10, 2018, will my subscription payment be refunded to me?

|

|

|

|

|

A.

|

Yes. Because we have amended the terms of the Rights Offering, rights certificates submitted to the subscription agent on or prior to April 10, 2018 are no longer valid. The subscription agent will return promptly all subscription payments received by it. We will not pay interest on, or deduct any amounts from, such subscription payments.

|

|

|

|

|

Q.

|

Who is the backstop purchaser in the Rights Offering?

|

|

|

|

|

A.

|

Vintage, a significant shareholder of our Company, will serve as a backstop purchaser in the Rights Offering. Vintage beneficially owned 6,600,000 Common Shares, or approximately 14.9% of our outstanding Common Shares, as of the Rights Distribution Record Date.

|

|

|

|

|

Q.

|

How does the backstop commitment work?

|

|

|

|

|

A.

|

Vintage has agreed with us as part of the backstop commitment that it will purchase from us, at $2.00 per Common Share, all of the Common Shares offered pursuant to the Rights Offering that are not issued pursuant to the exercise of Rights in the Rights Offering, up to a total commitment of $245.0 million. Vintage will also be entitled to exercise its subscription privilege. See “The Rights Offering – Backstop Purchaser.”

|

|

|

|

|

Q.

|

Why is there a backstop purchaser?

|

|

|

|

|

A.

|

As described above in greater detail under “Why are you conducting the Rights Offering and how will you use the proceeds received from the Rights Offering,” as of December 31, 2017, we were not in compliance with certain financial covenants under our first lien revolving credit agreement and our second lien term loan. Additionally, because of additional estimated costs to complete our renewable energy projects in Europe to be incurred in the first quarter of 2018, we are expected to be out of compliance with certain financial covenants under our first lien revolving credit facility for the quarter ending March 31, 2018. Accordingly, on April 10, 2018, we entered into an additional amendment to our first lien revolving credit facility to, among other things, extend the temporary waiver of the financial covenant violations until May 22, 2018 to allow us additional time to complete the Rights Offering and continue to allow us to access our revolving line of credit to meet liquidity needs. In order to obtain these waivers and amendments under our first lien revolving credit agreement, our first lien lenders required that we obtain the backstop commitment to ensure that, subject to the conditions of the backstop commitment, all Common Shares are either purchased in the Rights Offering or purchased subsequent to the Rights Offering at the same Subscription Price at which the Rights were exercisable. Through this arrangement, we and our lenders have a high degree of certainty that we will raise gross proceeds of at least $245 million through the Rights Offering and the backstop commitment.

|

|

|

|

|

Q.

|

Is the backstop purchaser being compensated?

|

|

|

|

|

A.

|

No. See “The Rights Offering – Backstop Purchaser.”

|

|

|

|

|

Q.

|

When do the obligations of the backstop purchaser expire?

|

|

|

|

|

A.

|

Unless extended by us, the backstop commitment will expire if the Rights Offering has not been concluded prior to October 31, 2018.

|

|

|

|

|

Q.

|

Are there any conditions on the backstop purchaser’s obligations to purchase Common Shares?

|

|

|

|

|

A.

|

Yes. The backstop purchaser’s obligations under the backstop commitment are subject to the satisfaction of specified conditions, including the Company providing notice to Vintage that it is exercising its rights to require Vintage to fund its backstop commitment. Vintage’s obligations as backstop purchaser are not, however, subject to the absence of a material adverse change in our business, financial condition or results of operations or a material deterioration in the financial markets.

|

|

|

|

|

Q.

|

How will the backstop commitment be secured?

|

|

|

|

|

A.

|

As part of the backstop commitment, Vintage entered into an agreement with a third party pursuant to which the third party has agreed to backstop Vintage’s obligations under the equity commitment agreement entered into between us and Vintage.

|

|

|

|

|

Q.

|

Can you change or terminate the Rights Offering?

|

|

|

|

|

A.

|

We reserve the right to amend, extend or cancel the Rights Offering on or prior to the Expiration Time for any reason in our sole discretion. We may cancel the Rights Offering if at any time before completion of the Rights

|

Offering there is any judgment, order, decree, injunction, statute, law or regulation entered, enacted, amended or held to be applicable to the Rights Offering that in our sole judgment would or might make the Rights Offering or its completion, whether in whole or in part, illegal or otherwise restrict or prohibit completion of the Rights Offering. If we cancel the Rights Offering, in whole or in part, all affected subscription Rights will expire without value, and all subscription payments received by the subscription agent will be returned, without interest or penalty, as soon as practicable.

|

|

|

|

Q.

|

If you terminate the Rights Offering, will my subscription payment be refunded to me?

|

|

|

|

|

A.

|

Yes. If we terminate the Rights Offering, the subscription agent will return promptly all subscription payments received by it. We will not pay interest on, or deduct any amounts from, subscription payments if we terminate the Rights Offering.

|

|

|

|

|

Q.

|

How many Common Shares do you expect to be outstanding following the Rights Offering?

|

|

|

|

|

A.

|

Assuming the Rights Offering is fully subscribed, and without giving effect to any anti-dilution adjustments associated with outstanding equity awards, we estimate that we would have approximately 168,637,384 Common Shares outstanding immediately following the completion of the Rights Offering.

|

|

|

|

|

Q.

|

How might the Rights Offering affect the trading price of your Common Shares?

|

|

|

|

|

A.

|

We cannot assure you as to how the Rights Offering will impact the trading price of our Common Shares. Historically, due to the inclusion of a discounted subscription price and the resulting dilution, rights offerings have adversely impacted the trading price of the underlying shares, especially during the period the rights offerings remain open.

|

|

|

|

|

Q.

|

How do I exercise my Rights?

|

|

|

|

|

A.

|

Revised subscription materials, including new rights certificates, will be made available to holders beginning on or about April 11, 2018. Each holder who wishes to exercise the subscription privilege under its Rights should properly complete and sign the applicable rights certificate and deliver the rights certificate together with payment of the Subscription Price for each Common Share subscribed for to the subscription agent before the Expiration Time. We recommend that any holder of Rights who uses the United States mail to effect delivery to the subscription agent use insured, registered mail with return receipt requested. We will not pay interest on subscription payments. We have provided more detailed instructions on how to exercise the Rights under the heading “The Rights Offering” beginning with the section entitled “—Exercising Your Rights,” in the rights certificates themselves and in the document entitled “Instructions for Use of Babcock & Wilcox Enterprises, Inc. Rights Certificates” that accompanies this prospectus supplement.

|

|

|

|

|

Q.

|

How may I pay the Subscription Price?

|

|

|

|

|

A.

|

Your cash payment of the Subscription Price must be made by either check or bank draft drawn upon a U.S. bank payable to the subscription agent, which is Computershare Trust Company, N.A. Payments should be made payable to “Computershare Trust Company, N.A.” Please see “The Rights Offering—Delivery of Subscription Materials and Payment.”

|

|

|

|

|

Q.

|

What should I do if I want to participate in the Rights Offering but my Common Shares will be held in the name of my broker or a custodian bank on the Rights Distribution Record Date?

|

|

|

|

|

A.

|

We will ask brokers, dealers and nominees holding Common Shares on behalf of other persons to notify these persons of the Rights Offering. Any beneficial owner wishing to exercise its Rights will need to have its broker, dealer or nominee act on its behalf. Each beneficial owner should complete and return to its broker, dealer or nominee the form entitled “Beneficial Owner Election Form.” This form will be available with the other subscription materials from brokers, dealers and nominees holding Common Shares on behalf of other persons on the Rights Distribution Record Date.

|

|

|

|

|

Q.

|

Will I receive subscription materials by mail if my address is outside the United States?

|

|

|

|

|

A.

|

No. We will not mail rights certificates to any person with an address outside the United States. Instead, the subscription agent will hold rights certificates for the account of all foreign holders. To exercise those Rights, each such holder must notify the subscription agent on or before 11:00 a.m., New York City time, on the fifth business day before the Expiration Time, and establish to the satisfaction of the subscription agent that it is permitted to exercise its Rights under applicable law.

|

|

|

|

|

Q.

|

Will I receive subscription rights for shares I own through the Company’s 401(k) plan, non-qualified defined contribution retirement plan or Supplemental Executive Retirement Plan (collectively, the “Benefit Plans”)?

|

|

|

|

|

A.

|

No. Certain retirement plans, like the Benefit Plans, are not permitted to acquire, hold or dispose of subscription rights unless the U.S. Department of Labor issues a prohibited transaction exemption. We have determined that it would not be prudent or cost-effective to request an exemption to permit the Benefit Plans to acquire and hold Rights that the Benefit Plans would be unable to exercise. Accordingly, the Benefit Plans have been excluded from receiving any Rights under this Rights Offering.

|

|

|

|

|

Q.

|

Will I be charged any fees if I exercise my Rights?

|

|

|

|

|

A.

|

We will not charge a fee to holders for exercising their Rights. However, any holder exercising its Rights through a broker, dealer or nominee will be responsible for any fees charged by its broker, dealer or nominee.

|

|

|

|

|

Q.

|

May I transfer my Rights if I do not want to purchase any shares?

|

|

|

|

|

A.

|

No. The Rights are nontransferable.

|

|

|

|

|

Q.

|

Am I required to subscribe in the Rights Offering?

|

|

|

|

|

A.

|

No. However, any holder of Rights who chooses not to exercise its Rights will experience dilution to its equity interest in our Common Shares and our Company.

|

|

|

|

|

Q.

|

If I exercise Rights in the Rights Offering, may I withdraw the exercise?

|

|

|

|

|

A.

|

Yes. Once you have exercised your Rights, you may withdraw your exercise at any time prior to the deadline for withdrawal, but not thereafter, by following the procedures described under “The Rights Offering – Withdrawal of Exercise of Rights,” subject to applicable law. The deadline for withdrawal is 5:00 p.m., New York City time, on the business day prior to the Expiration Time. Unless the Rights Offering is extended, the deadline for withdrawal will be 5:00 p.m., New York City time, on April 27, 2018.

|

|

|

|

|

Q.

|

Will I be charged any fees if I withdraw my Rights?

|

|

|

|

|

A.

|

We will not charge a fee to holders for withdrawing their Rights. However, any holder withdrawing its

|

Rights through a broker, dealer or nominee will be responsible for any fees charged by its broker, dealer or

nominee.

|

|

|

|

Q.

|

If

I exercise my Rights, when will I receive the shares for which I have subscribed?

|

|

|

|

|

A.

|

We will issue the Common Shares for which subscriptions have been properly delivered to the subscription agent prior to the Expiration Time, as soon as practicable following the Expiration Time. We will not be able to calculate the number of Common Shares to be issued to each exercising holder of Rights until the Expiration Time, which is the latest time by which rights certificates may be delivered to the subscription agent.

|

|

|

|

|

Q.

|

Have you or your board of directors made a recommendation as to whether I should exercise my Rights or how I should pay my Subscription Price?

|

|

|

|

|

A.

|

No. Neither we nor our board of directors has made any recommendation as to whether you should exercise your Rights. You should decide whether to subscribe for Common Shares or simply take no action with respect to your Rights, based on your own assessment of your best interests. However, if you do not exercise your Rights, you will lose any value inherent in the Rights and your percentage ownership interest in us will be diluted. As of the date of this prospectus supplement, none of our directors or executive officers has definitively indicated an intention with respect to participation in the Rights Offering. Some of our executive officers and directors may exercise some or all of their Rights.

|

|

|

|

|

Q.

|

What are the U.S. federal income tax consequences of the Rights Distribution and the Rights Offering to me?

|

|

|

|

|

A.

|

We have received an opinion of counsel to the effect that, among other things, for U.S. federal income tax purposes, (i) no gain or loss should be recognized by the Company as a result of the Rights Distribution, and (ii) no gain or loss should be recognized by, and no amount should be included in the income of, holders of our Common Shares upon the receipt of Rights in the Rights Distribution. Shareholders who receive Rights in the Rights Distribution should not recognize taxable income, gain or loss in connection with the exercise of such Rights pursuant to the Rights Offering. For a more complete summary of the material U.S. federal income tax consequences of the Rights Distribution and the Rights Offering to holders of our Common Shares, please see the section entitled “Material U.S. Federal Income Tax Consequences of the Rights Distribution and the Rights Offering.”

|

|

|

|

|

Q.

|

Does the Rights Offering require a vote of the Company’s shareholders?

|

|

|

|

|

A.

|

No. The Audit and Finance Committee of the Board of Directors of the Company determined that the delay that would result from obtaining shareholder approval prior to the completion of the Rights Offering would seriously jeopardize the financial viability of the Company. Because of that determination, the Audit and Compliance Committee, pursuant to an exception provided in the New York Stock Exchange’s (the “NYSE”) shareholder approval policy for such a situation, expressly approved the transaction and the Company's reliance on the NYSE financial viability exception. On March 19, 2018, the NYSE granted the Company's request. See “The Rights Offering – Financial Viability Exception.” No action is required of you to receive your Rights.

|

|

|

|

|

Q.

|

What should I do if I have other questions?

|

|

|

|

|

A.

|

If you have questions or need assistance, please contact D.F. King & Co., Inc., the information agent for the Rights Offering, at (212) 269-5550 (for banks and brokers) or (800) 283-3192 (toll free), or email at bw@dfking.com.

|

RISK FACTORS

An investment in our Common Shares involves risk. You should consider carefully the risks described below relating to the Rights Offering, along with the information discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference into this prospectus supplement, and subsequent periodic filings we may make containing updated disclosures of such factors, together with all the other information included in this prospectus supplement and in the documents we have incorporated by reference. The occurrence of any of the events described as possible risks could have a material adverse effect on the value of our Common Shares. These risks are not the only ones facing our Company. Additional risks not currently known to us or that we currently deem immaterial also may impair our business. See “Where to Find More Information.”

Factors Relating to the Rights Offering

If we terminate the Rights Offering, neither we nor the subscription agent will have any obligation to you except to return your subscription payments.

There can be no assurance that the Rights Offering will be completed, as we may determine to terminate the Rights Offering following its commencement at any time prior to the Expiration Time. If we terminate the Rights Offering, neither we nor the subscription agent will have any obligation to you with respect to the Rights, except to return your subscription payments, without interest or deduction.

The Subscription Price may not reflect the value of the Company.

Following negotiations with Vintage, the backstop purchaser, and after considering, among other things, the Subscription Price necessary to obtain an increased backstop commitment and the additional renewable energy project costs to be incurred in the first quarter of 2018, our board of directors determined that the Subscription Price for Common Shares distributed pursuant to the Rights Offering should be decreased from $3.00 to $2.00 per Common Share. This Subscription Price was not intended to bear any relationship to the historical price of our Common Shares or our past or future operations, cash flows, net income, current financial condition, the book value of our assets or any other established criteria for value. As a result, you should not consider the Subscription Price as an indication of the actual value of our Company or of our Common Shares.

Shareholders who do not exercise their Rights will experience dilution.

The Rights will permit holders of Rights to acquire an aggregate number of our Common Shares equal to approximately 280% of the aggregate number of Common Shares outstanding prior to the Rights Distribution Record Date. If you do not exercise your subscription privilege in full and the Rights Offering is fully subscribed and completed, you will experience material dilution in your proportionate interest in the equity ownership of our Common Shares and our Company. If you do not exercise your Rights, you will relinquish any value inherent in the Rights.

A small number of our shareholders could be able to significantly influence our business and affairs.

On the Rights Distribution Record Date, Vintage and Steel Partners Holdings, L.P. beneficially owned approximately 14.9% and 15.8% of our outstanding Common Shares, respectively. If all of the Rights covered by this prospectus supplement are exercised, Vintage’s and Steel Partners’ beneficial ownership percentage will remain the same. If some of the Rights are not exercised prior to the expiration of the Rights Offering, those Rights will expire and the Common Shares that are not issued as a result of the failure to exercise those Rights will be acquired by Vintage. Vintage and Steel Partners, either acting alone or in cooperation with other of our significant stockholders, could be able to significantly influence our business and affairs. Based on filings made with the SEC, as of March 1, 2018, six individuals or organizations collectively controlled over 50% of our Common Shares.

Accordingly, a small number of our shareholders could be able to control matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other business combination transactions.

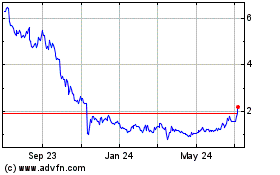

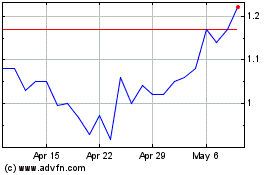

The price of our Common Shares may decline before or after the expiration of the Rights Offering.

We cannot assure you that the public trading market price of our Common Shares will not decline below the Subscription Price after you elect to exercise your Rights. Moreover, we cannot assure you that following the exercise of Rights you will be able to sell your Common Shares at a price equal to or greater than the Subscription Price.

As a result of operating losses and negative cash flows from operations, together with other factors, including the possibility that a covenant default or other event of default could cause certain of our indebtedness to become immediately due and payable (after the expiration of any applicable grace period), we may not have sufficient liquidity to sustain operations and to continue as a going concern.

We have experienced losses from operations in each of the past two years, had negative operating cash flows during the year ended December 31, 2017 and are dependent on our ability to raise capital in the time frame required in our first lien revolving credit facility in order to avoid an event of default under our lending agreements. As a result of additional losses we recognized in the fourth quarter of 2017 related to an increase in structural steel repair costs on one of our European renewable energy contracts, we were not in compliance with certain financial covenants under our first lien revolving credit facility and second lien term loan as of December 31, 2017. On March 1, 2018, we obtained an amendment under our first lien revolving credit facility that waived the financial covenant defaults that existed at December 31, 2017, consented to the Rights Offering and made certain other modifications.

On April 10, 2018, we announced that we had preliminarily identified approximately $51 million of additional estimated costs to complete our renewable energy projects in Europe to be incurred in the first quarter of 2018. These additional costs are expected to cause us to be out of compliance with certain financial covenants under our first lien revolving credit facility for the quarter ending March 31, 2018. Accordingly, on April 10, 2018, we entered into an additional amendment to our first lien revolving credit facility to, among other things, extend the temporary waiver of the financial covenant violations until May 22, 2018 to allow us additional time to complete the Rights Offering and continue to allow us to access our revolving line of credit to meet liquidity needs.

We remain in default under our second lien term loan. Although the second lien term loan contains a 180-day standstill period with respect to enforcement rights against collateral secured by the loan, the lenders may pursue other remedies, including accelerating the repayment of the underlying debt. We expect to use a substantial portion of the net proceeds from the Rights Offering to repay in full all of the indebtedness outstanding and our other obligations under our second lien term loan. We intend to use the remaining proceeds for working capital purposes.

As a result of these factors, there exists substantial doubt about our ability to continue as a going concern. Our consolidated financial statements for the year ended December 31, 2017 that are incorporated by reference in this prospectus supplement are prepared on a going concern basis and do not include any adjustments that might result from uncertainty about our ability to continue as a going concern, other than the reclassification of certain long-term debt to current liabilities. The report from our independent registered public accounting firm on our consolidated financial statements for the year ended December 31, 2017 includes a paragraph that summarizes the salient facts and conditions that raise substantial doubt about our ability to continue as a going concern.

There can be no assurance that our plan to improve our operating performance and financial position will be successful or that we will be able to obtain additional financing on commercially reasonable terms or at all including, without limitation, our ability to successfully complete the Rights Offering and satisfy all of our obligations under our second lien term loan. As a result, our liquidity and ability to timely pay our obligations when due could be adversely affected. Furthermore, our creditors may resist renegotiation or lengthening of payment and other terms through legal action or otherwise. If we are not able to timely, successfully or efficiently implement the strategies that we are pursuing to improve our operating performance and financial position, we may not have sufficient liquidity to sustain operations and to continue as a going concern.

Our ability to use net operating loss carryforwards to offset future taxable income may be subject to certain limitations.

We have net operating loss carryforwards (“NOLs”) that we may use in future years to offset against taxable income for U.S. federal income tax purposes. In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” can be subject to limitations on the use of its NOLs (and other tax attributes) to offset future taxable income. We are currently in the process of evaluating whether

an ownership change has occurred that would limit the use of our NOLs. The issuance of our common stock in this offering, alone or taken together with other transactions, as well as future offerings or sales of our Common Shares (including in transactions involving our Common Shares that are outside of our control) could cause an ownership change and result in an annual limitation on the use of our NOLs. In addition, under the Tax Cuts and Jobs Act (the “Tax Act”), which was signed into law on December 22, 2017, (i) the amount of post-2017 NOLs that we are permitted to deduct in any taxable year is limited to 80% of our taxable income in such taxable year, where taxable income is determined without regard to the deduction for NOLs, and (ii) post-2017 NOLs can no longer be carried back to prior taxable years. There is a risk that due to the triggering of an ownership change, changes under the Tax Act, regulatory changes, or other unforeseen reasons, our existing NOLs could be unavailable to reduce future income tax liabilities. For these reasons, we may not be able to realize a tax benefit from the use of our NOLs.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. You should not place undue reliance on these statements. Statements that include the words "expect," "intend," "plan," "believe," "project," "forecast," "estimate," "may," "should," "anticipate" and similar statements of a future or forward-looking nature identify forward-looking statements.

These forward-looking statements address matters that involve risks and uncertainties and include statements that reflect the current views of our senior management with respect to our financial performance and future events with respect to our business and industry in general. There are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Differences between actual results and any future performance suggested in our forward-looking statements could result from a variety of factors, including the following: our ability to continue as a going concern; our ability to obtain and maintain sufficient financing to provide liquidity to meet our business objectives, surety bonds, letters of credit and similar financing, and to successfully complete our amended rights offering and repay our second-lien term loan, or otherwise; the highly competitive nature of our businesses; general economic and business conditions, including changes in interest rates and currency exchange rates; general developments in the industries in which we are involved; cancellations of and adjustments to backlog and the resulting impact from using backlog as an indicator of future earnings; our ability to perform contracts on time and on budget, in accordance with the schedules and terms established by the applicable contracts with customers; failure by third-party subcontractors, joint venture partners or suppliers to perform their obligations on time and as specified; our ability to realize anticipated savings and operational benefits from our restructuring plans and other cost-savings initiatives; our ability to successfully integrate and realize the expected synergies from acquisitions; our ability to successfully address productivity and schedule issues in our Renewable segment, including the ability to complete our Renewable energy projects within the expected timeframe and at the estimated costs; willingness of customers to waive liquidated damages or agree to bonus opportunities; our ability to successfully partner with third parties to win and execute renewable projects; changes in our effective tax rate and tax positions; our ability to maintain operational support for our information systems against service outages and data corruption, as well as protection against cyber-based network security breaches and theft of data; our ability to protect our intellectual property and renew licenses to use intellectual property of third parties; our use of the percentage-of-completion method of accounting; the risks associated with integrating businesses we acquire; our ability to successfully manage research and development projects and costs, including our efforts to successfully develop and commercialize new technologies and products; the operating risks normally incident to our lines of business, including professional liability, product liability, warranty and other claims against us; changes in, or our failure or inability to comply with, laws and government regulations; difficulties we may encounter in obtaining regulatory or other necessary permits or approvals; changes in, and liabilities relating to, existing or future environmental regulatory matters; our limited ability to influence and direct the operations of our joint ventures; potential violations of the Foreign Corrupt Practices Act; our ability to successfully compete with current and future competitors; the loss of key personnel and the continued availability of qualified personnel; our ability to negotiate and maintain good relationships with labor unions; changes in pension and medical expenses associated with our retirement benefit programs; social, political, competitive and economic situations in foreign countries where we do business or seek new business; the possibilities of war, other armed conflicts or terrorist attacks; our ability to successfully consummate strategic alternatives for our MEGTEC and Universal businesses if we determine to pursue them; and the other risks set forth under the heading “Risk Factors” in this prospectus supplement and in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated herein by reference.

These factors are not necessarily all the factors that could affect us. We assume no obligation to revise or update any forward-looking statement included in this prospectus supplement for any reason, except as required by law.

THE RIGHTS OFFERING

General

On March 19, 2018 (the “

Rights Distribution Date

”), we distributed (the “

Rights Distribution

”) to holders of our common stock, par value $0.01 per share (the “

Common Shares

”), one nontransferable subscription right (a “

Right

”) to purchase Common Shares (the “

Rights Offering

”) for each Common Share held as of 5:00 p.m., New York City time, on March 15, 2018 (the “

Rights Distribution Record Date

”), and mailed subscription materials, including a prospectus supplement and rights certificates, to holders of our Common Shares as of the Rights Distribution Record Date. On April 10, 2018, we announced that we were extending the expiration date for the Rights Offering and amending certain other terms regarding the Rights Offering.

Each Right entitles the holder to a subscription privilege. Under the subscription privilege, each whole Right entitles the holder to purchase 2.8 Common Shares at a Subscription Price of $2.00 per Common Share. You will not be entitled to exercise an oversubscription privilege to purchase additional Common Shares that may remain unsubscribed as a result of any unexercised Rights. We will not issue any fractional Common Shares in the Rights Offering. Holders of Rights may only exercise Rights to purchase Common Shares in whole numbers. Vintage, a significant shareholder of our Company, will serve as a backstop purchaser in the Rights Offering.

The following describes the Rights Offering in general and assumes (unless specifically provided otherwise) that you were a holder of our Common Shares as of the Rights Distribution Record Date. If you held your Common Shares in a brokerage account or through a dealer or other nominee as of the Rights Distribution Record Date, please see the information included below under the heading “—Delivery of Subscription Materials and Payment—Beneficial Owners.” As used in this prospectus supplement, the term “business day” means any day on which securities may be traded on the NYSE.

Reasons for the Rights Offering

We are conducting the Rights Offering to raise proceeds to repay in full all of the indebtedness outstanding and our other obligations under our second lien term loan and for working capital purposes. As a result of additional losses we recognized in the fourth quarter of 2017 related to an increase in structural steel repair costs on one of our European renewable energy contracts, we were not in compliance with certain financial covenants under our first lien revolving credit agreement and our second lien term loan. In March 2018, we obtained an amendment to our first lien revolving credit facility that temporarily waived the covenant defaults. Pursuant to this temporary waiver, we were required to complete the Rights Offering on or prior to April 15, 2018 and, if we failed to do so, the temporary waiver would automatically terminate.

On April 10, 2018, we announced that we had preliminarily identified approximately $51 million of additional estimated costs to complete our renewable energy projects in Europe to be incurred in the first quarter of 2018. These additional costs are expected to cause us to be out of compliance with certain financial covenants under our first lien revolving credit facility for the quarter ending March 31, 2018. Accordingly, on April 10, 2018, we entered into an additional amendment to our first lien revolving credit facility to, among other things, extend the temporary waiver of the financial covenant violations until May 22, 2018 to allow us additional time to complete the Rights Offering and continue to allow us to access our revolving line of credit to meet liquidity needs. As a condition to obtaining the additional amendment, we were required to upsize the Rights Offering.

We currently remain in default under our second lien term loan. Although the second lien term loan contains a 180-day standstill period with respect to enforcement rights against collateral secured by the loan, the lenders may pursue other remedies, including accelerating the repayment of the underlying debt. See “Use of Proceeds From the Rights Offering.”

Conditions to the Rights Distribution

We reserve the right to amend, extend or cancel the Rights Offering on or prior to the Expiration Time for any reason. We may cancel the Rights Offering if at any time before completion of the Rights Offering there is any judgment,

order, decree, injunction, statute, law or regulation entered, enacted, amended or held to be applicable to the Rights Offering that in our sole judgment would or might make the Rights Offering or its completion, whether in whole or in part, illegal or otherwise restrict or prohibit completion of the Rights Offering. We may waive any of these conditions and choose to proceed with the Rights Offering even if one or more of these events occur. If we cancel the Rights Offering, in whole or in part, all affected Subscription Rights will expire without value, and all subscription payments received by the Subscription Agent will be returned, without interest or penalty, as soon as practicable.

Determination of Subscription Price and Distribution Ratio

The Subscription Price was initially established at $3.00 per Common Share following negotiations with Vintage, the backstop purchaser, and after considering, among other things, the Subscription Price necessary to obtain Vintage’s initial backstop commitment. On April 10, 2018, we announced that we had preliminarily identified approximately $51 million of additional estimated costs to complete renewable energy projects in Europe, that we had entered into an additional amendment to our first lien revolving credit facility and that we were upsizing the Rights Offering. In connection with these events, following negotiations with Vintage, and after considering, among other things, the Subscription Price necessary to obtain an increased backstop commitment and the additional renewable energy project costs to be incurred in the first quarter of 2018, our board of directors determined that the Subscription Price should be reduced to $2.00 per Common Share. This Subscription Price was not intended to bear any relationship to the historical price of our Common Shares or our past or future operations, cash flows, net income, current financial condition, the book value of our assets or any other established criteria for value. As a result, the Subscription Price should not be considered an indication of the actual value of our Company or of our Common Shares.

No Fractional Rights or Common Shares

Holders of our Common Shares as of the Rights Distribution Record Date received one Right for each Common Share held as of the Rights Distribution Record Date. We will not issue fractional Rights, or pay cash in lieu of fractional Rights.

The subscription privilege entitles each holder of a whole Right to purchase 2.8 Common Shares at the Subscription Price of $2.00 per Common Share. However, we will not issue any fractional Common Shares in the Rights Offering. Holders of Rights may only exercise Rights to purchase Common Shares in whole numbers. Any excess funds insufficient to purchase one whole Common Share will be returned to the sender by the subscription agent without penalty or interest.

Benefit Plans

Certain retirement plans, like the Benefit Plans, are not permitted to acquire, hold or dispose of subscription rights unless the U.S. Department of Labor issues a prohibited transaction exemption. We have determined that it would not be prudent or cost-effective to request an exemption to permit the Benefit Plans to acquire and hold Rights that the Benefit Plans would be unable to exercise. Accordingly, the Benefit Plans have been excluded from receiving any Rights under this Rights Offering.

Financial Viability Exception

The Rights Offering, including the issuance of Common Shares purchased in the Rights Offering and the backstop, may require shareholder approval pursuant to the shareholder approval policy of the NYSE. However, the NYSE may grant, upon application, a Financial Viability Exception, which provides that an exception may be granted when (i) the delay in securing shareholder approval would seriously jeopardize the financial viability of the enterprise and (ii) reliance by the listed company on this exception has been expressly approved by the audit committee of the board of directors of the listed company. The Audit and Finance Committee of the Board of Directors of the Company determined that the delay that would result from obtaining shareholder approval prior to the completion of the Rights Offering would seriously jeopardize the financial viability of the Company. Because of that determination, the Audit and Compliance Committee, pursuant to an exception provided in the NYSE’s shareholder approval policy for such a situation, expressly approved the transaction and the Company's reliance on the NYSE financial viability exception.

On March 19, 2018, the NYSE granted the Company's request. In accordance with NYSE requirements, the Company mailed a letter to shareholders notifying them of its intention to close the Rights Offering without obtaining shareholder approval.

Commencement of the Rights Offering

The Rights Offering commenced on March 19, 2018.

Backstop Purchaser

Backstop Commitment

Vintage will serve as a backstop purchaser and will be entitled to purchase any unsubscribed shares at the Subscription Price. Vintage will also be entitled to exercise its subscription privilege. Vintage will not receive any fee for acting as backstop purchaser. The commitment of Vintage is subject to the satisfaction of certain conditions. Vintage beneficially owned 6,600,000 Common Shares, or approximately 14.9% of our outstanding Common Shares, as of the Rights Distribution Record Date.

Vintage has agreed with us as part of the backstop commitment that it will purchase from us, at $2.00 per Common Share, all of the Common Shares offered pursuant to the Rights Offering that are not issued pursuant to the exercise of Rights in the Rights Offering, up to a total commitment of $245 million. Vintage is not being paid a fee for serving as a backstop purchaser in the Rights Offering.

We obtained the backstop commitment in order to obtain amendments and waivers under our first lien revolving credit facility. Accordingly, the backstop commitment ensures that, subject to the conditions of the backstop commitment, all Common Shares are either purchased in the Rights Offering or purchased subsequent to the Rights Offering at the same Subscription Price at which the Rights were exercisable. Through this arrangement, we have a very high degree of certainty that we will raise gross proceeds of at least $245 million through the Rights Offering and the backstop commitment.

Unless extended by us, the backstop commitment will expire if the Rights Offering has not been concluded prior to October 31, 2018.

The backstop purchaser’s obligations under the backstop commitment are subject to the satisfaction of specified conditions, including the Company providing notice to Vintage that it is exercising its rights to require Vintage to fund its backstop commitment. Vintage’s obligations as backstop purchaser are not, however, subject to the absence of a material adverse change in our business, financial condition or results of operations or a material deterioration in the financial markets.

As part of the backstop commitment, Vintage has entered into an agreement with a third party pursuant to which the third party has agreed to backstop Vintage’s obligation under the equity commitment agreement entered into between us and Vintage. In addition, we expect that we will grant Vintage customary registration rights with respect to any Common Shares issued to Vintage in the Rights Offering.

Vintage Agreement

Unrelated to Vintage’s backstop commitment, on January 3, 2018, we entered into an agreement (as amended, the “

Vintage Agreement

”) with Vintage and certain related parties (each a “

Vintage Shareholder

” and, collectively, the “

Vintage Shareholders

”). Pursuant to the Vintage Agreement, the Company agreed, among other things, to increase the size of our board of directors to ten members (which was subsequently increased, with Vintage’s approval, to no more than eleven members until June 30, 2018) by adding three additional directors, and to appoint each of Henry E. Bartoli, Matthew E. Avril and Brian R. Kahn (collectively, the “

Vintage Shareholder Nominees

”) to our board of directors to serve as Class I, Class II and Class III directors, respectively. Pursuant to the Vintage Agreement, and so long as Vintage’s beneficial ownership has not decreased below 5% of the then-outstanding Common Shares (other than as a result of an increase in the number of Outstanding Shares), if any Vintage Shareholder Nominee is unable or unwilling to serve as a director, resigns as a director or is removed as a director prior to the expiration of the Nomination

Period (as defined below), Vintage may recommend a substitute person to fill the resulting vacancy, and the appointment of any such person to our board of directors will be subject to the approval of the Governance Committee of our board of directors.

Pursuant to the Vintage Agreement, until the first date on which Company shareholders may nominate individuals for election to our board of directors at our 2019 annual meeting of shareholders or, if earlier, the first date on which our shareholders may nominate individuals for election to our board of directors if we announce that we will hold a shareholder meeting at which directors will be elected other than the annual meetings of shareholders in 2018 and 2019 (the “

Nomination Period

”), the Vintage Shareholders will not engage in certain proxy solicitations, make certain shareholder proposals, call meetings of shareholders or solicit or publicly comment on certain proposals or consents from shareholders regarding any merger, acquisition, recapitalization, restructuring, disposition or other business combination with respect to the Company.

The Vintage Agreement further provides that, during the Nomination Period, each Vintage Shareholder will cause Common Shares then beneficially owned by such Vintage Shareholder or its affiliates to appear in person or by proxy at all annual meetings and to be voted in favor of the nominees of our board of directors for director, in accordance with our board’s recommendation with respect to the ratification of our independent registered public accounting firm, in accordance with our board’s recommendation with respect to our “say-on-pay” proposal, in accordance with our board’s recommendation with respect to the frequency of our “say-on-pay” proposals and in favor of the declassification of board terms.

Pursuant to the terms of Vintage’s backstop commitment, in the event that the Vintage Shareholders acquire or otherwise possess beneficial ownership of 30% or more of the Company’s outstanding Common Shares solely as a result of purchases of Common Shares in the Rights Offering and/or the backstop commitment, such shares in excess of 30% will be voted in proportion to the way in which Common Shares owned by the shareholders who are not Vintage Shareholders are voted.

Expiration Time

You may exercise the subscription privilege at any time before the Expiration Time, which is 5:00 p.m., New York City time, on April 30, 2018, unless the Rights Offering is extended. Any Rights not exercised before the Expiration Time will expire and become null and void.

We will not be obligated to honor your exercise of Rights if the subscription agent receives any of the required documents relating to your exercise after the Expiration Time, regardless of when you transmitted the documents.

We may extend the Expiration Time for any reason. If we elect to extend the date the Rights expire, we will issue a press release announcing the extension before 9:00 a.m., New York City time, on the first business day after the most recently announced Expiration Time.

Subscription Privileges

Your Rights entitle you to a subscription privilege. You will not be entitled to exercise an oversubscription privilege to purchase additional Common Shares that may remain unsubscribed as a result of any unexercised Rights.

Subscription Privilege

. The subscription privilege entitles you to purchase 2.8 Common Shares per whole right, upon delivery of the required documents and payment of the Subscription Price of $2.00 per Common Share, prior to the Expiration Time. You are not required to exercise your subscription privilege, in full or in part.

Return of Excess Payment.

If you exercise your subscription privilege and, due to rounding, are allocated less than all of the Common Shares for which you subscribed, the funds you paid for those Common Shares that are not allocated to you will be returned by mail or similarly prompt means, without interest or deduction, as soon as practicable after the Expiration Time.

Exercising Your Rights

Subscription materials, including rights certificates, will be made available to holders upon the commencement of the Rights Offering. You may exercise your Rights by delivering the following to the subscription agent before the Expiration Time:

|

|

|

|

•

|

your properly completed and executed rights certificate evidencing the exercised Rights with any required signature guarantees or other supplemental documentation; and

|

|

|

|

|

•

|