Novartis Deal to Help Drug Pipeline -- WSJ

April 10 2018 - 3:02AM

Dow Jones News

By Alberto Delclaux

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 10, 2018).

Novartis AG agreed to buy U.S.-based gene-therapy company AveXis

Inc. for $8.7 billion, marking the first big bet by the Swiss

pharmaceutical giant's new chief as he looks to the deal table to

refresh his drug-development pipeline.

Novartis said Monday it will pay $218 for each share in

Illinois-based AveXis, an 88% premium to its closing price on April

6. Earlier this year, Novartis Chief Executive Vasant Narasimhan

agreed to cash out of its consumer health joint venture with

GlaxoSmithKline PLC -- a deal that gives him cash for what he

describes as "bolt on" deals to replenish Novartis' drug pipeline,

his key focus since taking the reins earlier this year.

That deal gives it the cash to be more flexible acquiring

promising outside medicines. Dr. Narasimhan has promised to refocus

Novartis on drug development. In a conference call Monday, he said

the AveXis deal will be partly funded by the GSK joint-venture

sale.

The deal is a bet that at least one promising drug that AveXis

is developing for therapies aimed at spinal muscular atrophy will

translate into a blockbuster. AveXis is a gene-therapy company

conducting several clinical studies for the treatment of spinal

muscular atrophy or SMA, an inherited neurodegenerative disease

caused by a defect in a single gene, Novartis said. Some form of

SMA affects an estimated one out of every 6,000 to 10,000 children

born, it said.

It is also a further endorsement of gene therapy, a treatment

type Novartis has already spearheaded in the field of cancer.

"We would gain with the team at AveXis another gene-therapy

platform, in addition to our CAR-T platform for cancer, to advance

a growing pipeline of gene therapies across therapeutic areas,"

said Dr. Narasimhan.

Novartis launched last year a first-of-its kind cancer therapy,

known as CAR-T treatment, which involves extracting a patient's

disease-fighting blood cells, modifying them to attack cancer cells

more vigorously and then reinfecting them in the patient.

AveXis' gene-therapy candidate AVXS-101 has the potential to be

the first one-time gene-replacement therapy for SMA, according to

Novartis. Dr. Narasimhan said on the conference call the drug

promised multibillion-dollar sales potential. AveXis expects to

file in the second half of this year for approval from U.S.

regulators, with a launch expected in 2019.

"The price tag is higher than what Novartis previously has

called bolt-on acquisitions, but if AVXS-101 trumps other SMA

agents, we believe there is some sense to this," said UBS analyst

Michael Leuchten. The first treatment for the disease, Ionis

Pharmaceuticals Inc.'s Spinraza, won approval a year ago.

The payoff isn't a sure thing. Even drugs that are showing

promise in late state trials can stumble, failing to live up to

sales forecasts.

Novartis said it expects the deal to slightly hit core operating

income in 2018 and 2019, due to R&D investments. It said the

acquisition should strongly benefit core operating income and core

earnings a share as of 2020, however, driven by an increase in

sales. Novartis said it expects the deal to close by the middle of

the year.

Noemie Bisserbe contributed to this article.

(END) Dow Jones Newswires

April 10, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

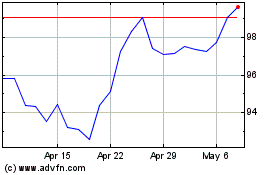

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

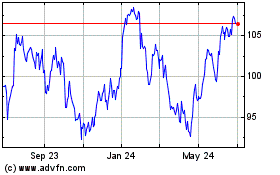

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024