By Akane Otani, Michael Wursthorn and Ben Eisen

Shares of the biggest names in the technology industry extended

their three-week decline Monday, raising fears among investors that

cracks could finally be appearing in what had been one of the most

enduring trades of the past year.

All together, the so-called FAANG stocks -- Facebook Inc.,

Amazon.com Inc., Apple Inc., Netflix Inc. and Google parent

Alphabet Inc. -- which powered major indexes to repeated highs last

year, lost $78.7 billion in market value Monday, bringing their

declines since the Nasdaq Composite's March 12 peak to $397

billion.

As the rout intensified, shares of companies ranging from chip

makers to electronic-payment providers to biotechnology firms

tumbled too, highlighting the indiscriminate selling spreading

across the technology industry. Every stock in the S&P 500

technology sector ended lower for the day.

The losses spilled over into other segments of the market as

well, with all 11 sectors of the S&P 500 and 28 of the 30

components in the Dow Jones Industrial Average dropping. The

S&P 500 fell 2.2%, while the blue-chip index fell 1.9% and the

tech-heavy Nasdaq Composite lost 2.7%.

"Facebook was a golden child, the one everyone on the Street

knows," said Paul Karrlsson-Willis, a managing director and head of

global equity sales and trading at Cabrera Capital. But Facebook's

recent admission that a third-party firm with ties to the Trump

administration had improperly kept its users' data has sparked

concerns among many investors -- from Wall Street to mom and pop --

that other tech companies, such as Google or Amazon, could be

suffering from similar, if not bigger, issues, Mr. Karrlsson-Willis

and other money managers said.

Monday's selling extended a streak of rough trading for the

technology sector, which after leading the stock market higher for

much of the past year has tumbled as negative news surrounding

several industry giants has snowballed.

Amazon shed 5.2% on Monday after President Donald Trump took to

Twitter to blast the company's business practices. Tesla Inc.

slipped 5.1% following rebukes from the National Transportation

Safety Board over the disclosures it made about a fatal crash

involving one of its vehicles, while Facebook fell 2.8%.

Among the other names in the red, chip maker Advanced Micro

Devices Inc. fell 5.2%, while videogame firm Activision Blizzard

Inc. lost 3.5% and networking-gear maker Cisco Systems Inc. shed

4.4%.

"Whenever you think there's some relief in sight, we get some

political noise that comes out and it spooks the entire technology

sector," said Mohit Bajaj, director of ETF trading solutions at

brokerage WallachBeth Capital.

At the same time, traders said a series of technical factors

helped reinforce the concern that momentum in the market is waning.

The S&P 500 on Monday closed below its 200-day moving average

for the first time since June 2016, shortly after the British vote

to leave the European Union. That signals there could be more

market turbulence ahead, especially after the index resisted

closing below that level multiple times during the recent

volatility, traders said.

Short sellers, who bet on a stock's decline, also have large

bets against the tech sector, with technology-focused stocks making

up seven of the 10 most-shorted names, according to S3 Partners, a

financial analytics firm. Investors made $1 billion in paper

profits on Monday betting against the FAANG stocks.

"This tech wreck is not a new story. But we've gotten a

crescendo of bad news, and it seems like this one is lingering

longer because we've had more questions crop up that haven't been

answered yet," said Art Hogan, managing director and chief market

strategist at B. Riley FBR.

Monday's selling came on the heels of broader shakiness in the

stock market, which has struggled for traction this year as

investors have contended with the prospect of rising interest

rates, global trade tensions and sliding technology shares.

Still, many investors remain optimistic about the tech

industry's growth potential. Technology companies in the S&P

500 are expected to post year-over-year earnings growth of 22% in

the first quarter, according to FactSet, eclipsing the broader

S&P 500's expected 17% earnings growth rate and building on a

strong fourth quarter.

But the recent volatility in tech stocks has investors

questioning whether impressive growth will be enough for a sector

that many had feared had run up too far, too fast.

Technology stocks soared last year, with Facebook jumping 53%,

Apple running up 46% and Alphabet ending the year up 33%. The

sector's rally sparked fears among some analysts that tech could be

headed toward a repeat of March 2000, when highflying dot-com

stocks crashed, leading to a broader market selloff.

The FAANG shares are now mixed for 2018 -- only Amazon and

Netflix remain in the black, while all three major stock indexes

are lower. The Nasdaq Composite gave up its gains for the year on

Monday and is down 9.5% from its high three weeks ago.

When asked to identify the trades they felt had been overplayed

in the market, 38% of fund managers named FAANG stocks as well as

their Chinese counterparts -- Baidu Inc., Alibaba Group Holding

Ltd. and Tencent Holdings Ltd. -- according to a Bank of America

Merrill Lynch survey conducted last month.

Yet investors are more pessimistic than they were during the

height of the dot-com era in 2000, something analysts say

distinguishes the run-up in technology shares then with the tech

sector's more recent dominance.

Just 31% of individuals expect stocks to rise over the next six

months, according to a survey released last week by the American

Association of Individual Investors -- compared with 58% just

before the Nasdaq peaked in March 2000.

Write to Akane Otani at akane.otani@wsj.com, Michael Wursthorn

at Michael.Wursthorn@wsj.com and Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

April 02, 2018 19:43 ET (23:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

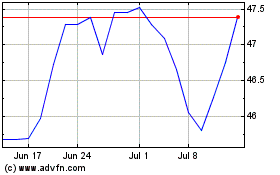

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024