ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this rights offering.

The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this rights

offering. To the extent there is a conflict between the information contained in this prospectus supplement and the information

contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus,

and any free writing prospectus that we authorize to be distributed to you. We have not authorized anyone to provide you with

different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should

assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by

reference into this prospectus supplement and the accompanying prospectus, and any free writing prospectus is accurate only as

of the date of those respective documents. Our business, financial condition, results of operations, and prospects may have changed

since such dates.

Unless

otherwise indicated, all references to “Zion Oil & Gas”, “Zion”, “Company”, “our”,

“we”, “us”, and similar terms refer to Zion Oil & Gas, Inc.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement

and the accompanying prospectus. This summary does not contain all the information about us that you should consider before investing

in our securities. You should carefully read this entire prospectus supplement, the accompanying prospectus and any free writing

prospectus, including the “Risk Factors” section beginning on page S-12 of this prospectus supplement and, the financial

statements and related notes and other information included or incorporated by reference in this prospectus supplement and the

accompanying prospectus, before making an investment decision.

Zion

Oil & Gas, Inc.

Zion

Oil and Gas, Inc., a Delaware corporation, is an initial stage oil and gas exploration company with a history of over 18 years

of oil and gas exploration in Israel. We have no revenues or operating income. We were incorporated in Florida on April 6, 2000

and reincorporated in Delaware on July 9, 2003. We completed our initial public offering in January 2007. Our common stock currently

trades on the NASDAQ Global Market under the symbol “ZN” and our warrant trades on the NASDAQ Global Market under

the symbol “ZNWAA.”

We

are distributing through American Stock Transfer & Trust Company, LLC (the “Subscription Agent”), at no cost,

non-transferable subscription rights to purchase Rights (each “Right” and collectively the “Rights”) of

its securities to persons who owned shares of our Common Stock on March 12, 2018, with each Right consisting of one (1) share

of our Common Stock, par value $0.01 per share (the “Common Stock”) and one (1) Common Stock Purchase Warrant to purchase

an additional one (1) share of Common Stock. Each Right may be purchased at a per Right subscription price of $5.00.

Each

Warrant affords the investor the opportunity to purchase one share of our Common Stock at a warrant exercise price of $3.00. The

warrants have the symbol “ZNWAI.” The warrants will become exercisable on June 29, 2018 (the “Warrant Exercise

Date”) and will continue to be exercisable for one (1) year after the Warrant Exercise date.

You

will receive 0.10 (one tenth) of a subscription right (i.e.,

ONE

subscription right for each

TEN

shares) for each

share of Common Stock that you owned on March 12, 2018. For example, if you own 100 shares of Zion Common Stock, you will be entitled

to purchase up to 10 Rights under this rights offering. This gives you the right to buy (up to) 10 Rights for $50.00 ($5.00 per

Right) with 10 Rights being comprised of 10 shares of Common Stock (10 Rights x 1 share). A total of 11,300,000 shares of Common

Stock have been set aside by Zion Oil & Gas, Inc. for this Subscription Rights Offering.

The

subscription rights will expire, if they are not exercised by 5:00 p.m., Eastern Standard Time, on May 31, 2018. The shares of

Common Stock will be issuable and tradable as soon as practicable by the Subscription Agent after the close of the Rights Offering

on the Expiration Date. To participate in the rights offering, you must submit your subscription documents to us before that deadline.

If you hold shares through a broker or a bank, we recommend that you submit your subscription documents to your broker or bank

at least 10 days before that May 31, 2018 deadline. If you exercise your rights in full, you may also exercise an over-subscription

right to purchase additional Rights that remain unsubscribed at the expiration of the rights offering, subject to availability

and allocation of Rights among persons exercising this over-subscription right. Subscription rights that are not exercised by

the expiration date will expire and have no value. Shareholders who do not participate in the rights offering will continue to

own the same number of shares, but will own a smaller percentage of the total shares outstanding to the extent that other shareholders

participate in the rights offering.

Exploratory

License and Activities

Zion

currently holds one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (“MJL”), comprising

approximately 99,000 acres. Under Israeli law, Zion has the exclusive right to oil and gas exploration within its license

area in that no other company is authorized to drill there.

Megiddo-Jezreel

Petroleum License

The

MJL was awarded on December 3, 2013 for a three-year primary term through December 2, 2016, with the possibility of additional

one-year extensions up to an aggregate maximum of seven years. The MJL is onshore, south and west of the Sea of Galilee and the

Company continues its exploration focus here as it appears to possess the key geologic ingredients of an active petroleum system

with significant exploration potential.

On

October 30, 2017, Zion sought a multi-year extension to its existing license. After receiving feedback from Israel’s Petroleum

Commissioner, Zion submitted a revised extension request on November 9, 2017. On November 20, 2017, Israel’s Petroleum Commissioner

officially approved Zion’s multi-year extension request on its Megiddo-Jezreel License No. 401, extending its validity to

December 2, 2019. The Company now remains subject to the following updated key license terms:

|

Number

|

|

Activity

Description

|

|

Execution

by:

|

|

1

|

|

Submit

final report on the results of drilling

|

|

31

May 2018

|

|

2

|

|

Submit

program for continuation of work under license

|

|

30

June 2018

|

Zion’s

Former Jordan Valley, Asher-Menashe and Joseph Licenses

On

March 29, 2015, the Energy Ministry formally approved the Company’s application to merge the southernmost portion of the

Jordan Valley License into the Megiddo-Jezreel License. The Company has plugged all of its exploratory wells (in the former Joseph

and Asher-Menashe License areas) but acknowledges its obligation to complete the abandonment of these well sites in accordance

with guidance from the Environmental Ministry and local officials (see note 10B).

Exploration

Plans Going Forward

The

Megiddo-Jezreel #1 (“MJ #1”) was spud on June 5, 2017. The MJ #1 well was drilled to a total depth (“TD”)

of 5,060 meters (approximately 16,600 feet). Zion also obtained several wireline log suites and the well has been cased and cemented

in preparation for upcoming testing operations. However, as of the date of this Prospectus Supplement, the Company is not able

to confirm whether the well will be commercially productive and will not be able to do so until after testing and fully evaluating

the MJ#1 well.

Depending

on the final outcome and results of the currently active MJ #1 well and having adequate cash resources, multiple wells could be

drilled from this pad site as several subsurface geologic targets are reachable using directional well trajectories.

We

hold 100% of the working interest in our license, which means we are responsible for 100% of the costs of exploration and, if

established, production. From the gross proceeds from the sale of oil and gas from the license area upon conversion to production

leases, if there is any commercial production, Zion must deduct a 12.5% royalty reserved by the State of Israel. Additionally,

we would deduct an overriding royalty interest (or equivalent net operating profits interest) of 6% of gross revenue from production

given over to two charitable foundations. No royalty would be payable to any landowner with respect to production from our license

area as the State of Israel owns all the mineral rights. Effective March 2011, a special levy on income from oil and gas production

was enacted in Israel. The new law provides that royalties on hydrocarbon discoveries will remain at 12.5%, while taxation of

profits will begin only after the developers have reached payback on their investment plus a return. The levy will be 20% after

a payback of 150% on the investment, and will rise gradually, reaching 50% after a return of 230% on the investment. The Israeli

government also repealed the percentage depletion deduction and made certain changes to the rules for deducting tangible and intangible

development. These rules will only become germane to us when, and if, we commence production of oil and/or gas.

Rights

Offering Summary

|

The

Rights Offering

|

We

are distributing to you, at no charge, non-transferable subscription rights to purchase Rights of our securities. You will

receive 0.10 of a subscription right (i.e.,

ONE

subscription right for each

TEN

shares) for each share of common

stock that you owned on March 12, 2018.

|

|

|

|

|

Subscription

Privilege

|

Each

whole subscription right entitles you to purchase one Right at the subscription price of $5.00 per Right. Each Right is

comprised of one (1) share of our Common Stock and one (1) Common Stock Purchase Warrant.

Subscription

rights may only be exercised for whole numbers of Rights; no fractional Rights will be issued in this offering. No fractional

subscription rights will be issued. Instead, the number of subscription rights will be rounded down to the next lowest

whole number.

|

|

|

|

|

Warrant

|

Each

Warrant affords the investor the opportunity to purchase one share of our Common Stock at a warrant exercise price of $3.00. The

Warrants will become exercisable on June 29, 2018 and continue to be exercisable for one (1) year after the exercise date.

|

|

Rights

offered by us in this rights offering

|

We

are offering Rights comprised of an aggregate of 11,440,000 shares of Common Stock.

|

|

|

|

|

Common

stock outstanding before this rights offering

|

57,200,000

shares (approximately).

|

|

|

|

|

Common

stock to be outstanding immediately after this rights offering (assuming all rights to purchase Rights are exercised and

all warrants

exercised)

|

68,640,000

shares (approximately).

|

|

|

|

|

|

|

|

Record

Date

|

5:00

p.m., Eastern Standard Time, on March 12, 2018.

|

|

|

|

|

Commencement

Date of Subscription Period

|

5:00

p.m., Eastern Standard Time, on April 2, 2018.

|

|

|

|

|

Expiration

Date

|

5:00

p.m., Eastern Standard Time, on May 31, 2018, unless extended by us, in our sole discretion. Any rights not exercised on or

before the expiration date will expire without any payment to the holders of those unexercised rights.

|

|

|

|

|

Subscription

Price Per Right

|

$5.00

per Right, payable in immediately available funds. To be effective, any payment related to the exercise of the subscription

right must clear prior to the expiration of the rights offering. Payments sent by bank wire or bank transfer by the expiration

of the rights offering will be effective as long as the funds are received and cleared within normal banking days of our accounts.

|

|

|

|

|

Oversubscription

Rights

|

We

do not expect that all of our stockholders will exercise all of their basic subscription rights. If you fully exercise

your basic subscription right, your oversubscription right entitles you to subscribe for additional Rights unclaimed by

other rights holders in this offering at the same subscription price per Right. If there are not enough Rights available

to satisfy all of the properly exercised oversubscription rights requests, then the available Rights will be prorated

among those who properly exercised oversubscription rights based on the number of Rights each rights holder subscribed

for under the basic subscription right.

We

will return any excess payments without interest or deduction promptly after the expiration of the subscription period

|

|

Use

of proceeds

|

We

intend to use the net proceeds from sale of the Rights under this offering for (i) the production testing and production of

wells in the Megiddo-Jezreel License area, (ii) further exploration, facilities and midstream construction, (iii) carrying

out geological and geophysical studies furthering our oil and gas exploration program in the License area and (iv) general

corporate purposes. See “Use of Proceeds” on page S-24.

|

|

|

|

|

Non-transferability

of Subscription Rights

|

The

subscription rights may not be sold, transferred or assigned and will not be listed for trading on the NASDAQ Global Market

or on any other stock exchange or market.

|

|

|

|

|

No

Revocation

|

If

you exercise any of your subscription rights, you will not be permitted to revoke or change the exercise or request a refund

of money paid.

|

|

|

|

|

Extension

and Cancellation

|

Extension

.

We may extend the expiration date for exercising your subscription rights in our sole discretion. Any extension of this offering

will be followed as promptly as practicable by an announcement, and in no event later than 9:00 a.m., Eastern Standard time,

on the next business day following the previously scheduled expiration date.

|

|

|

|

|

|

Cancellation

.

We may cancel the rights offering at any time and for any reason prior to the expiration date. Any cancellation of this offering

will be followed as promptly as practicable by announcement thereof, and in no event later than 9:00 a.m., Eastern Standard

time, on the next business day following the cancellation. In the event that we cancel this rights offering, all subscription

payments will be returned, without interest or deduction, as soon as practicable.

|

|

|

|

|

Trading

Symbols

|

Common

Stock

. Our common stock is quoted on the NASDAQ Global Market under the symbol “ZN.”

Subscription

Rights.

The subscription rights are not transferable either during or after the subscription period.

|

|

|

|

|

U.S.

Federal Income Tax Considerations

|

Generally,

a holder should not recognize income or loss for United States federal income tax purposes in connection with the receipt

or exercise of subscription rights in the rights offering. However, you should consult your tax advisor as to the particular

consequences to you of the rights offering. For a detailed discussion, see “Federal Income Tax Considerations.”

|

QUESTIONS

AND ANSWERS ABOUT THE RIGHTS OFFERING

What

is a rights offering?

A

rights offering is ordinarily a distribution of subscription rights to a company’s existing shareholders to buy a proportional

number of additional securities at a given price (usually at a discount) within a fixed period. A rights offering is an opportunity

for you to purchase securities at a fixed price and in an amount at least proportional to your existing interest, which enables

you to maintain, and possibly increase, your current percentage ownership.

Unless

otherwise indicated in the prospectus supplement applicable to an offering, we intend to use any net proceeds from the sale of

our securities to fund our exploration and production operations and for other general corporate purposes, such as additions to

working capital, expansion of our drilling and other exploration program. We have not determined the amount of net proceeds to

be used specifically for the foregoing purposes.

Why

are we engaging in a rights offering?

The

purpose of this rights offering is to raise equity capital in a cost-effective manner that gives all of our stockholders the opportunity

to participate. The net proceeds from the sale of Rights will be used for our testing operations and to further our oil and gas

exploration and production program and allow us to drill additional exploration and/or production wells on our license areas.

We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. See “Use of Proceeds”

on page S-24.

What

is the basic subscription right?

You

will receive 0.10 (one tenth) of a subscription right (i.e.,

ONE

subscription right for each

TEN

shares) for each

share of common stock that you owned on March 12, 2018. Each whole basic subscription right entitles you to purchase one Right

at a per Right subscription price of $5.00. Each Right is comprised of one (1) share of our Common Stock and one (1) Common

Stock Purchase Warrant to purchase an additional one (1) share of Common Stock.

For

example, if you own 100 shares of Zion common stock, you will be entitled to 10 Rights under this rights offering. This gives

you the right to buy (up to) 10 Rights for $50.00 (10 x $5.00), which would be comprised of 10 shares of Common Stock and 10 Common

Stock Purchase Warrants at an exercise price of $3 per warrant for a total of 10 shares of Common Stock.

You

may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. You will not receive

any fractional rights; instead the number of subscription rights you receive will be rounded down to the next lowest whole number.

What

is the over-subscription right?

We

do not expect all of the basic subscription rights to be exercised. The over-subscription right provides shareholders that exercise

all of their basic subscription rights the opportunity to purchase Rights that are not purchased by other shareholders. If you

fully exercise your basic subscription right, the over-subscription right entitles you to subscribe for additional Rights unclaimed

by other holders of rights in this offering at the same subscription price per Right. If an insufficient number of Rights are

available to fully satisfy all over-subscription right requests, then the available Rights will be distributed proportionately

among rights holders who exercise their over-subscription right based on the number of Rights each rights holder subscribed for

under the basic subscription right. We will return any excess payments by mail without interest or deduction promptly after the

expiration of the subscription period.

Will

the shares of Common Stock that I receive upon exercise of my subscription rights be tradable on the NASDAQ Global Market?

Our

common stock is currently traded on the NASDAQ Global Market under the symbol “ZN.” The subscription rights are non-transferable

and will not be traded. The Common Stock included in the Rights will be immediately tradable upon issuance and are listed for

quotation on the NASDAQ Global Market under the symbol “ZN.”

Who

may participate in this offering?

Only

holders of record of our Common Stock as of March 12, 2018 are entitled to participate in this offering.

Am

I required to subscribe in this offering?

No. However,

shareholders who choose not to exercise their rights will experience dilution to their equity interest in our company.

How

long will the rights offering last?

You

will be able to exercise your subscription rights only during a limited period. To exercise a subscription right, you must do

so by 5:00 p.m., Eastern Standard Time, on May 31, 2018, unless we extend the rights offering. We may, in our sole discretion,

extend the offering for any reason. Accordingly, if a rights holder desires to exercise their subscription rights, we must

actually receive all required documents and payments for that rights holder before the expiration date and time. If we elect to

extend the scheduled termination date, we will issue a press release announcing such decision no later than 9:00 a.m., Eastern

Standard Time, on the next business day after the decision has been taken.

May

the Board of Directors cancel or terminate the rights offering?

Yes.

Zion’s Board of Directors may decide to cancel or terminate the rights offering at any time and for any reason before the

expiration date. If our Board cancels or terminates the rights offering, we will issue a press release notifying shareholders

of the cancellation or termination, and any money received from subscribing holders of rights will be returned as soon as practicable,

without interest or deduction.

May I

transfer, sell or give away my subscription rights?

No.

Should you choose not to exercise your subscription rights, you may not sell, give away or otherwise transfer your rights. However,

subscription rights will be transferable to affiliates of the recipient and by operation of law, for example, upon death of the

recipient.

How

many Rights may I purchase?

You

will receive 0.10 (one tenth) of a subscription right (i.e.

ONE

subscription right for each

TEN

shares) for each

share of Common Stock that you owned as a holder of record on March 12, 2018. Each whole subscription right entitles you to purchase

one Right at a per Right subscription price of $5.00. Each Right is comprised of one (1) share of our Common Stock and one (1)

Common Stock Purchase Warrant. We will not distribute fractional subscription rights, but will round down the number of subscription

rights you are to receive to the next lowest whole number.

If

you fully exercise all of your basic subscription rights, your over-subscription rights entitle you to subscribe for additional

Rights unclaimed by other holders of rights in this offering at the same subscription price per Right. If an insufficient number

of Rights are available to fully satisfy all properly exercised over-subscription right requests, then the available Rights will

be prorated among those who properly exercised over-subscription right based on the number of Rights each rights holder subscribed

for under the basic subscription right pursuant to the allocation procedures described below in “The Rights Offering”

on page S-27.

How

do I exercise my subscription rights?

You

may exercise your subscription rights by properly completing and signing your subscription form and delivering it, with full payment

of the $5.00 per Right price, including any over-subscription right, to us on or prior to 5:00 pm Eastern Standard Time, on May

31, 2018. If you use the mail, we recommend that you use insured, registered mail, return receipt requested. If you cannot deliver

your subscription agreement to us on time, you may follow the guaranteed delivery procedures described under “The Offering

- Guaranteed Delivery Procedures.” Payments sent by bank wire or bank transfer by the expiration of the rights offering

will be effective as long as the funds are received and cleared within normal banking days of our accounts.

Is

exercising my subscription rights risky?

The

exercise of your subscription rights involves risks. Exercising your subscription rights means buying additional shares of our

Common Stock and should be considered as carefully as you would consider any other equity investment. Among other things, you

should carefully consider the risks described under the heading “RISK FACTORS,” beginning on page S-12.

After

I exercise my subscription rights, may I change my mind and cancel my purchase?

No. Once

you send in your subscription agreement and payment, you cannot revoke the exercise of your subscription rights, even if you later

learn information about us that you consider to be unfavorable. You should not exercise your subscription rights, unless you are

certain that you wish to purchase additional shares of our Common Stock at a price of $5.00 per Right.

What

happens if I choose not to exercise my subscription rights?

You

will retain your current number of shares of common stock even if you do not exercise your subscription rights. However, if other

shareholders exercise their subscription rights and you do not, the percentage of our company that you own will diminish and your

voting and other rights will be diluted. Your rights will expire and have no value, if they are not exercised by the expiration

date.

Will

I be charged any fees if I exercise my rights?

We

will not charge a fee to holders for exercising their rights. However, any holder exercising their rights through a broker, dealer

or nominee will be responsible for any fees charged by their broker, dealer or nominee.

If

I exercise my rights, when will I receive the securities for which I have subscribed?

We

will issue the certificates representing the shares of Common Stock for which subscriptions have been properly received as soon

as practicable after the expiration date of this rights offering, whether or not you exercise your subscription rights immediately

prior to that date or earlier. Upon issuance, the shares of Common Stock in the Rights are detachable and separately tradable.

What

if my shares are not held in my name?

If

you hold your shares of our common stock in the name of a broker, dealer or other nominee, then your broker, dealer or other nominee

is the record holder of the shares you own. The record holder must exercise the rights on your behalf for the Rights you wish

to purchase. Therefore, you will need to have your record holder act for you.

If

you wish to participate in this rights offering and purchase Rights at the per Right subscription price of $5.00, please promptly

contact the record holder of your shares. We will ask your broker, dealer or other nominee to notify you of this rights offering.

If you hold your shares through a brokerage account, you should note that most brokerages permit the beneficial owner to exercise

their rights on one occasion only. Accordingly, if you plan to exercise your over-subscription right, you should do so at the

time that you submit your subscription to your broker. If you wish to exercise your Rights through this Rights Offering, you should

contact your broker, dealer, custodian bank or nominee as soon as possible. Please follow the instructions of your nominee. Your

nominee may establish an earlier deadline

before

the Expiration Date of this Rights Offering.

How

did we arrive at the $5.00 per Right subscription price?

Our

Board of Directors determined that the per-Right subscription price should be designed to provide an incentive to our current

stockholders to exercise their rights in the rights offering. Other factors considered in setting the subscription price included

the amount of proceeds desired, our need for equity capital, the historic and current market price of our Common Stock, the historic

volatility of the market price of our Common Stock, our business prospects, alternatives available to us for raising equity capital,

and the liquidity of our Common Stock. The subscription price of the Right does not necessarily bear any relationship to our past

operations, cash flows, book value, current financial condition, or any other established criteria for value. You should not consider

the subscription price as an indication of the value of Zion Oil & Gas, Inc. or our Common Stock.

How

much money will we receive from the rights offering?

If

we sell all the Rights being offered, we will receive gross proceeds of $28,600,000. After deduction of approximately

$250,000 in estimated expenses, we will have net proceeds of approximately $28,350,000. We are offering Rights in the

rights offering with no minimum purchase requirement. As a result, there is no assurance we will be able to sell all or any of

the Rights being offered, and it is not likely that all of our shareholders will purchase all the Rights offered in the rights

offering.

What

are the United States federal income tax consequences to me of exercising my subscription rights?

The

receipt and exercise of your subscription rights are intended to be nontaxable events for U.S. shareholders. However, you should

seek specific tax advice from your personal certified public accountant or tax attorney. See the section entitled “FEDERAL

INCOME TAX CONSIDERATIONS” on page S-33.

Has

the Board of Directors made a recommendation as to whether I should exercise my rights?

No. Neither

the Company’s management nor our Board has made any recommendation as to whether you should exercise your rights for the

Rights (assuming you purchase any Rights). You should decide whether to subscribe for Rights, or simply take no action with respect

to your rights, based upon your own assessment of your best interests.

What

if I have other questions?

If

you have other questions about the rights offering, please contact D.F. King & C., Inc., the Information Agent by telephone

at (866) 796-1292, or if you are bank or broker at (212) 269-5550. D.F. King can also be reached by e-mail (zion@dfking.com).

GOING

CONCERN CONSIDERATIONS

We

are a company with limited capital resources, no revenue and a loss from operations. We incurred net losses of $9,989,000, $8,513,000

and $7,306,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Since we have limited capital resources, no

revenue to date and a loss from operations, our financial statements have been prepared on a going concern basis, which contemplates

realization of assets and liquidation of liabilities in the ordinary course of business. The appropriateness of using the going

concern basis is dependent upon our ability to obtain additional financing or equity capital and, ultimately, to achieve profitable

operations. Therefore, there is substantial doubt about our ability to continue as a going concern. The financial statements

do not include any adjustments that might result from the outcome of this uncertainty. See “RISK FACTORS” on page S-12

relating to our ability to continue as a ‘going concern’ and our need to raise additional funds to realize our business

plans.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents included or incorporated by reference in this prospectus contain statements concerning our expectations,

beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that

are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. You generally can identify our forward-looking statements by the words “anticipate,”

“believe,” “budgeted,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “goal,” “intend,” “may,” “objective,” “plan,”

“potential,” “predict,” “projection,” “scheduled,” “should,” “will”

or other similar words. These forward-looking statements include, among others, statements regarding:

|

|

●

|

Our

ability to raise sufficient capital to successfully test, complete and produce the well if applicable and continue with exploratory

efforts within our license area;

|

|

|

●

|

the

going concern qualification in our financial statements;

|

|

|

●

|

our

ability to explore for and develop natural gas and oil resources successfully and economically within our license areas;

|

|

|

●

|

our

liquidity and our ability to raise capital to finance our overall exploration and development activities;

|

|

|

●

|

our

ability to maintain the exploration license rights to continue our petroleum exploration program;

|

|

|

●

|

the

availability of equipment, such as testing and production equipment and the personnel to operate such equipment;

|

|

|

●

|

the

impact of governmental regulations, permitting and other legal requirements in Israel relating to onshore exploratory drilling

and production;

|

|

|

●

|

our

estimates of the time frame within which the testing of our exploratory well and the exploratory and possible production activities

will be undertaken;

|

|

|

●

|

changes

in our exploration plans and related budgets;

|

|

|

●

|

the

quality of existing and future license areas with regard to, among other things, the existence of reserves in economic quantities;

|

|

|

●

|

anticipated

trends in our business;

|

|

|

●

|

our

future results of operations;

|

|

|

●

|

our

capital expenditure program;

|

|

|

●

|

future

market conditions in the oil and gas industry; and

|

|

|

●

|

the

demand for oil and natural gas, both locally in Israel and globally.

|

More

specifically, our forward-looking statements include, among others, statements relating to our schedule, business plan, targets,

estimates or results of our applications for new exploration rights and future exploration plans, including the number, timing

and results of wells, the timing and risk involved in drilling follow-up wells, planned expenditures, prospects budgeted and other

future capital expenditures, risk profile of oil and gas exploration, acquisition of seismic data (including number, timing and

size of projects), planned evaluation of prospects, probability of prospects having oil and natural gas, expected production or

reserves, acreage, working capital requirements, hedging activities, the ability of expected sources of liquidity to implement

our business strategy, future hiring, future exploration activity, production rates, all and any other statements regarding future

operations, financial results, business plans and cash needs and other statements that are not historical fact.

Such

statements involve risks and uncertainties, including, but not limited to, those relating to the uncertainties inherent in exploratory

drilling activities, the volatility of oil and natural gas prices, operating risks of oil and natural gas operations, our dependence

on our key personnel, factors that affect our ability to manage our growth and achieve our business strategy, risks relating to

our limited operating history, technological changes, our significant capital requirements, the potential impact of government

regulations, adverse regulatory determinations, litigation, competition, the uncertainty of reserve information and future net

revenue estimates, property acquisition risks, industry partner issues, availability of equipment, weather and other factors detailed

herein and in our other filings with the Securities and Exchange Commission (the “SEC”).

We

have based our forward-looking statements on our management’s beliefs and assumptions based on information available to

our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections

about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results

will not differ materially from those expressed or implied by our forward-looking statements.

Some

of the factors that could cause actual results to differ from those expressed or implied in forward-looking statements are described

under “Risk Factors” in this Prospectus Supplement and in our other periodic reports filed with the SEC. Should one

or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary

materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or persons acting

on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue

reliance on our forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement,

and we undertake no duty to update any forward-looking statement.

RISK

FACTORS

You

should carefully consider the risks described below before making a decision to buy our securities. Investing in our securities

involves a number of risks. If any of the following risks actually occurs, our business, financial condition and results of operations

could be harmed. In that case, the trading price of our securities could decline and you might lose part or all of your investment.

Before you decide to buy our securities, you should carefully consider the risk factors set forth below and those that may be

included in any applicable prospectus supplement. Risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business operations.

Risks

Related to our Business

Risks

Associated with our Company

We

are a company with no current source of revenue. Our ability to continue in business depends upon our continued ability to obtain

significant financing from external sources and the ultimate success of our petroleum exploration efforts in onshore Israel, none

of which can be assured.

We

were incorporated in April 2000, and we have incurred negative cash flows from our operations, and presently all exploration activities

and overhead expenses are financed solely by way of the issue and sale of equity securities or debt instruments. The recoverability

of the costs we have incurred to date is uncertain and is dependent upon achieving commercial production or sale, none of which

can be assured. Our operations are subject to all of the risks inherent in exploration companies with no revenues or operating

income. Our potential for success must be considered in light of the problems, expenses, difficulties, complications and delays

frequently encountered in connection with a new business, especially the oil and gas exploration business, and in particular the

deep, wildcat exploratory wells in which we are engaged in Israel. We cannot warrant or provide any assurance that our business

objectives will be accomplished.

Our

ability to continue in business depends upon our continued ability to obtain the necessary financing from external sources to

undertake further exploration and development activities and generate profitable operations from oil and natural gas interests

in the future. We incurred net losses of $9,989,000 for the year ended December 31, 2017, $8,513,000 for the year ended December

31, 2016 and $7,306,000 for the year ended December 31, 2015. The audited financial statements have contained a statement by the

auditors that raises substantial doubt about us being able to continue as a “going concern” unless we are able to

raise additional capital.

We

expect to incur substantial expenditures in our exploration and development programs. Our existing cash balances will not

be sufficient to satisfy our exploration and development plans going forward. We are considering various alternatives to

remedy any future shortfall in capital. We may deem it necessary to raise capital through equity markets, debt markets or

other financing arrangements, including participation arrangements that may be available. Because of the current absence of any

oil and natural gas reserves and revenues in our license areas, there can be no assurance that our capital will be available on

commercially acceptable terms (or at all) and if it is not, we may be forced to substantially curtail or cease exploration expenditures

which could lead to our inability to meet all of our commitments.

Our

financial statements do not reflect the adjustments or reclassifications of assets and liabilities that would be necessary if

we are unable to continue as a going concern.

The

Company’s ongoing exploration and development efforts are subject to many contingencies outside of our control, and any

considerable delay in obtaining all of the needed licenses, approvals and authorizations may severely impair our business.

After

reaching total depth of 5,060 meters (approximately 16,600 feet) on the MJ#1 well on February 14, 2018, the Company plans to finalize

its testing program, which it must submit for approval to Israel’s Energy Ministry for their final approval. While Zion

does not expect objections to the testing procedure, there is no assurance that we will ultimately be granted such final permission

to test.

For

these reasons, although our testing program is currently planned to commence in the second quarter of 2018, we cannot provide

full assurance that we will in fact be able to test our MJ#1 well in the desired or planned time-frame.

We

require significant capital to realize our business plan.

Our

ongoing work program is expensive. We believe that our current cash resources are sufficient to allow us to undertake testing

and exploratory activities in our current license area through May 31, 2018. We estimate that, when we are not actively drilling

a well, our monthly expenditure is approximately $500,000 per month. However, when we are drilling or testing, we estimate that

there is an additional cost of approximately $2,500,000 per month. Additionally, the newly enacted onshore licensing and environmental

and safety related regulations promulgated by the various energy related ministries in Israel during 2016-2017 are likely to render

obtaining new explorations licenses increasingly expensive. For example, at the time of the award of any new exploration license,

we will be required to submit performance bank guarantees in the form of a restricted Israel cash deposits for 10% of the cost

of the planned drilling program as well as other amounts to cover potential environmental damages.

We

have no commitments for any financing, and no assurance can be provided that we will be able to raise funds when needed. Further,

we cannot assure you that our actual cash requirements will not exceed our estimates. Even if we were to discover hydrocarbons

in commercial quantities, we will require additional financing to bring our interests into commercial operation and pay for operating

expenses until we achieve a positive cash flow. Additional capital also may be required in the event we incur any significant

unanticipated expenses.

Under

the current capital and credit market conditions, we may not be able to obtain additional equity or debt financing on acceptable

terms. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy

our requirements.

If

we are unable to obtain additional financing, we may be unable to implement our business plan and our growth strategies, respond

to changing business or economic conditions and withstand adverse operating results. If we are unable to raise further financing

when required, our planned exploration activities may need to be scaled down or even ceased, and our ability to generate revenues

in the future would be negatively affected.

Additional

financing could cause your relative interest in our assets and potential earnings to be significantly diluted. Even if we have

exploration success, we may not be able to generate sufficient revenues to offset the cost of dry holes and general and administrative

expenses.

We

rely on independent experts and technical or operational service providers over whom we may have limited control.

The

success of our oil and gas exploration efforts is dependent upon the efforts of various third parties that we do not control.

These third parties provide critical drilling, engineering, logging, pressure pumping, geological, geophysical and other scientific

analytical services, including seismic imaging technology to explore for and develop oil and gas prospects. Given our small size

and limited resources, we do not have all the required expertise on staff. As a result, we rely upon various companies and other

third parties to assist us in identifying desirable hydrocarbon prospects to acquire and to provide us with technical assistance

and services. In addition, we rely upon the owners and operators of drilling rigs and related equipment.

If

any of these relationships with third-party service providers are terminated or are unavailable on commercially acceptable terms,

we may not be able to execute our business plan. Our limited control over the activities and business practices of these third

parties, any inability on our part to maintain satisfactory commercial relationships with them, their limited availability or

their failure to provide quality services could materially and adversely affect our business, results of operations and financial

condition.

We

have historically commenced exploration drilling operations without 3-D seismic surveys, thereby potentially increasing the risk

of drilling a non-producing or non-commercial well.

Larger

oil and gas exploration companies may choose to conduct extensive analytical pre-drilling testing such as 3-D seismic imaging,

the drilling of an expendable “pilot” well or “stratigraphic test” to collect data (logs, cores, fluid

samples, pressure data) to determine if drilling a well capable of producing oil or gas (full completion with casing and well

testing) is justified. The use of pilot or stratigraphic tests is often used in areas where there is little or no offset well

data, like Israel, where our exploration license area is located. While 3-D seismic imaging data is more useful than 2-D data

in identifying potential new drilling prospects, its acquisition and processing costs are many multiples greater than that for

2-D data, and the Geophysical Institute of Israel (“GII”), our primary provider of geophysical data, has limited ability

to acquire and process onshore 3-D data in Israel. In addition to using 2-D seismic technology prior to drilling, we have historically

also utilized gravity and magnetic data, built cross section maps from offset wells and utilized geophysical analysis from similar

geologic targets. We believe that the additional months, delays and costs associated with more extensive pre-drilling testing

typically undertaken by larger oil and gas exploration companies is not necessarily justified when drilling vertical or near-vertical

exploration wells (as we have historically been doing). Nonetheless, the absence of more extensive pre-drilling testing may potentially

increase the risk of drilling a non-producing well, which would in turn result in increased costs and expenses. Additionally,

we are typically engaged in drilling deep onshore wildcat wells in Israel where only approximately 500 total wells have ever been

drilled, the vast majority of which are relatively shallow. As such, exploration risks are inherently very substantial.

Exploratory

well drilling locations that we decide to drill may not yield oil or natural gas in commercially viable quantities.

There

is no way to predict in advance of drilling and testing whether any particular location will yield oil or natural gas in sufficient

quantities to recover drilling or completion costs or to be economically viable. The use of technologies and the study of producing

fields in the same area will not enable us to know conclusively prior to drilling whether oil, natural gas liquids (NGLs) or natural

gas will be present or, if present, whether oil or natural gas will be present in sufficient quantities to be economically viable.

Even if sufficient amounts of oil, NGLs or natural gas exist, we may inadvertently damage the potentially productive hydrocarbon

bearing formation or experience mechanical difficulties while drilling or completing a well, resulting in a reduction in production

from the well or abandonment of the well. If we drill exploratory wells that we identify as dry holes in our future drilling locations,

our business may be materially harmed. We cannot assure you that the analogies we draw from available data from other wells, more

fully explored locations or producing fields will be applicable to our drilling locations. Ultimately, the cost of drilling, completing

and operating any well is often uncertain, and new wells may not be productive.

Deterioration

of political, economic and security conditions in Israel may adversely affect our operations.

Any

major hostilities involving Israel, a substantial decline in the prevailing regional security situation or the interruption or

curtailment of trade between Israel and its present trading partners could have a material adverse effect on our operations. See

the prior discussion on Political Climate.

Prolonged

and/or widespread regional conflict in the Middle East could have the following results, among others:

|

|

●

|

capital

market reassessment of risk and subsequent redeployment of capital to more stable areas making it more difficult for us to

obtain financing for potential development projects;

|

|

|

●

|

security

concerns in Israel, making it more difficult for our personnel or supplies to enter or exit the country;

|

|

|

●

|

security

concerns leading to evacuation of our personnel;

|

|

|

●

|

damage

to or destruction of our wells, production facilities, receiving terminals or other operating assets;

|

|

|

●

|

inability

of our service and equipment providers to deliver items necessary for us to conduct our operations in Israel, resulting

in delays; and

|

|

|

●

|

the

lack of availability of drilling rig and experienced crew, oilfield equipment or services if third party providers decide

to exit the region.

|

Loss

of property and/or interruption of our business plans resulting from hostile acts could have a significant negative impact on

our earnings and cash flow. In addition, we may not have enough insurance to cover any loss of property or other claims resulting

from these risks.

We

have a history of losses and we cannot assure you that we will ever be profitable.

We

incurred net losses of $9,989,000 for the year ended December 31, 2017, $8,513,000 for the year ended December 31, 2016, and $7,306,000

for the year ended December 31, 2015. We cannot provide any assurance that we will ever be profitable.

Earnings,

if any, will be diluted due to governmental royalty and charitable contributions.

We

are legally bound to pay a government royalty of 12.5% of gross sales revenues. Additionally, we are legally required to pay 6%

of gross sales revenue to two separate foundations (3% each to two separate foundations – see the separate section on foundations).

As our expenses increase with respect to the amount of sales, these donations and allocation could significantly dilute future

earnings and, thus, depress the price of the common stock.

Risks

Associated with our Business

We

are subject to increasing Israeli governmental regulations and environmental requirements that may cause us to incur substantial

incremental costs and/or delays in our drilling program.

Our

business is subject to laws and regulations promulgated by the State of Israel relating to the exploration for, and the development,

production and marketing of, crude oil and natural gas, as well as safety matters. Legal requirements are frequently changed and

subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect

on our operations. We may be required to make substantial expenditures to comply with governmental laws and regulations.

Environmental

laws and regulations change frequently, and the implementation of new, or the modification of existing, laws or regulations could

adversely impact our operations. The discharge of natural gas, crude oil, or other pollutants into the air, soil or water may

give rise to substantial liabilities on our part to government agencies and third parties and may require us to incur substantial

costs of remediation. In addition, we may incur costs and penalties in addressing regulatory agency procedures regarding possible

non-compliance.

Our

lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate

if we fail to diversify.

Our

business focus is on oil and gas exploration on a limited number of properties in Israel and exploitation of any significant reserves

that are found within our license areas. As a result, we lack diversification, in terms of both the nature and geographic scope

of our business. We will likely be impacted more acutely by factors affecting our industry or the regions in which we operate

than we would if our business were more diversified. If we are unable to diversify our operations, our financial condition and

results of operations could deteriorate.

We

currently have no proved reserves or current production and we may never have any.

We

do not have any proved reserves or current production of oil or gas. We cannot assure you that any wells will be completed or

produce oil or gas in commercially profitable quantities.

Oil

and gas exploration is an inherently risky business.

Exploratory

drilling involves enormous risks, including the risk that no commercially productive oil or natural gas reservoirs will be discovered.

Even when properly used and interpreted, seismic data analysis and other computer simulation techniques are only tools used to

assist geoscientists in trying to identify subsurface structures and the presence of an active petroleum system. They do not allow

the interpreter to know conclusively if hydrocarbons are present or economically available. The risk analysis techniques we use

in evaluating potential drilling sites rely on subjective judgments of our personnel and consultants. Additionally, we are typically

engaged in drilling deep onshore wildcat exploratory wells in Israel where only approximately 500 total wells have ever been drilled,

the vast majority of which are relatively shallower. As such, exploration risks are inherently very substantial.

A

substantial and extended decline in oil or natural gas prices could adversely impact our future rate of growth and the carrying

value of our unproved oil and gas assets.

Prices

for oil and natural gas fluctuate widely. Fluctuations in the prices of oil and natural gas will affect many aspects of our business,

including our ability to attract capital to finance our operations, our cost of capital, and the value of our unproved oil and

natural gas properties. Prices for oil and natural gas may fluctuate widely in response to relatively minor changes in the supply

of and demand for oil and natural gas, market uncertainty and a wide variety of additional factors that are beyond our control,

such as the domestic and foreign supply of oil and natural gas, technological advances affecting energy consumption, and domestic

and foreign governmental regulations. Significant and extended reductions in oil and natural gas prices could require us to reduce

our capital expenditures and impair the carrying value of our assets.

The

price of oil has fallen precipitously since June 2014, when it was over $100 per barrel. During February 2016, the price

of a barrel of oil dipped under $30 for the first time in 12 years but has increased since then to a level of approximately $60

per barrel.

While

there is much analysis and speculation as to the cause of this fluctuation in the price and its predicted future course, there

are many factors that contribute to the price of oil, none of which the Company controls. The oil price is also impacted by actual

supply and demand, as well as by expectation. Demand for energy is closely related to economic activity, which is compounded by

key advances and innovation in exploration techniques in recent years. Significant geopolitical events such as heightened conflict

in the Middle East and large scale terrorist activities can also impact the price of oil tremendously.

If

we are successful in finding commercial quantities of oil and/or gas, our revenues, operating results, financial condition and

ability to borrow funds or obtain additional capital will depend substantially on prevailing prices for oil and natural gas. Declines

in oil and gas prices may materially adversely affect our financial condition, liquidity, ability to obtain financing and operating

results. Lower oil and gas prices also may reduce the amount of oil and gas that we could produce economically.

Historically,

oil and gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to continue to be volatile,

making it impossible to predict with any certainty the future prices of oil and gas. The bottom line is that there are many and

varied causes for the fluctuation in the price of oil and natural gas, and we have no control over these factors.

The

insurance we carry is insufficient to cover all of the risks we face, which could result in significant financial exposure.

Exploration

for and production of crude oil and natural gas can be hazardous, involving natural disasters and other unplanned events such

as blowouts, well cratering, fire and explosion and loss of well control which can result in damage to or destruction of wells,

injury to persons, loss of life, or damage to property and the environment. Exploration and production activities are also subject

to risk from political developments such as terrorist acts, piracy, civil disturbances, war, expropriation or nationalization

of assets, which can cause loss of or damage to our property.

As

is customary within our industry, we maintain insurance against many, but not all, potential perils confronting our operations

and in coverage amounts and deductible levels that we believe to be economic. Consistent with that profile, our insurance program

is structured to provide us financial protection from unfavorable loss resulting from damages to or the loss of physical assets

or loss of human life, liability claims of third parties, and exploratory drilling interruption attributed to certain assets and

including such occurrences as well blowouts and resulting oil spills, at a level that balances cost of insurance with our assessment

of risk and our ability to achieve a reasonable rate of return on our investments. Although we believe the coverage and amounts

of insurance carried are adequate and consistent with industry practice, we do not have insurance protection against all the risks

we face. Because we chose not to insure certain risks, insurance may not be available at a level that balances the cost of insurance

and our desired rates of return, or actual losses exceed coverage limits. We regularly review our risks of loss and the cost and

availability of insurance and revise our insurance program accordingly.

If

an event occurs that is not covered by insurance or not fully protected by insured limits, it could have a significant adverse

impact on our financial condition, results of operations and cash flows.

We

face various risks associated with the trend toward increased activism against oil and gas exploration and development activities.

Opposition

toward oil and gas drilling and development activity has been growing globally and is particularly pronounced in Organization

for Economic Co-operation and Development (“OECD”) countries which include the U.S., the U.K and Israel. Companies

in the oil and gas industry, such as us, are often the target of activist efforts from both individuals and non-governmental organizations

regarding environmental compliance and business practices, potential damage to fresh water sources, and safety, among other topics.

Future activist efforts could result in the following:

|

|

●

|

delay

or denial of drilling permits;

|

|

|

●

|

shortening

of lease terms or reduction in lease size;

|

|

|

●

|

restrictions

on installation or operation of gathering or processing facilities;

|

|

|

●

|

restrictions

on the use of certain operating practices, such as hydraulic fracturing;

|

|

|

●

|

legal

challenges or lawsuits;

|

|

|

●

|

damaging

publicity about us;

|

|

|

●

|

increased

costs of doing business;

|

|

|

●

|

reduction

in demand for our products; and

|

|

|

●

|

other

adverse effects on our ability to develop our properties and expand production.

|

Our

need to incur costs associated with responding to these initiatives or complying with any resulting new legal or regulatory requirements

resulting from these activities that are substantial and not adequately provided for, could have a material adverse effect on

our business, financial condition and results of operations.

Economic

risks may adversely affect our operations and/or inhibit our ability to raise additional capital.

Economically,

our operations in Israel may be subject to:

|

|

●

|

exchange

rate fluctuations;

|

|

|

●

|

royalty

and tax increases and other risks arising out of Israeli State sovereignty over the mineral rights in Israel and its

taxing authority; and

|

|

|

●

|

changes

in Israel’s economy that could lead to oil and gas price controls.

|

Consequently,

our operations may be substantially affected by local economic factors beyond our control, any of which could negatively affect

our financial performance and prospects.

Legal

risks could negatively affect our market value.

Legally,

our operations in Israel may be subject to:

|

|

●

|

changes

in the Petroleum Law resulting in modification of license and permit rights;

|

|

|

●

|

adoption

of new legislation relating to the terms and conditions pursuant to which operations in the energy sector may be conducted;

|

|

|

●

|

changes

in laws and policies affecting operations of foreign-based companies in Israel; and

|

|

|

●

|

changes

in governmental energy and environmental policies or the personnel administering them.

|

The

Israeli Energy Ministry has now enacted regulations relating to licensing requirements for entities engaged in the fuel sector

that would result in our having to obtain additional licenses to market and sell hydrocarbons that we may discover.

Further,

in the event of a legal dispute in Israel, we may be subject to the exclusive jurisdiction of Israeli courts or we may not be

successful in subjecting persons who are not United States residents to the jurisdiction of courts in the United States, either

of which could adversely affect the outcome of a dispute.

There

are limitations on the transfer of interests in our petroleum rights, which could impair our ability to raise additional funds

to execute our business plan

.

The

Israeli government has the right to approve any transfer of rights and interests in any license or other petroleum right we hold

or may be granted and any mortgage of any license or other petroleum rights to borrow money. If we attempt to raise additional

funds through borrowings or joint ventures with other companies and are unable to obtain required approvals from the government,

the value of your investment could be significantly diluted or even lost.

Our

dependence on the limited contractors, equipment and professional services available in Israel may result in increased costs and

possibly material delays in our work schedule

.

Due

to the lack of competitive resources in Israel, costs for our operations may be more expensive than costs for similar operations

in other parts of the world. We are also more likely to incur delays in our drilling schedule and be subject to a greater risk

of failure in meeting our required work schedule. Similarly, some of the oil field personnel we need to undertake our planned

operations are not necessarily available in Israel or available on short notice for work in Israel. Any or all of the factors

specified above may result in increased costs and delays in the work schedule.

Our

dependence on Israeli local licenses and permits as well as new regulations calling for enhanced bank guarantees and insurance

coverage may require more funds than we have budgeted and may cause delays in our work schedule.

In

connection with drilling operations, we are subject to a number of Israeli local licenses and permits. Some of these are issued

by the Israeli security forces, the Civil Aviation Authority, the Israeli Water Commission, the Israel Lands Authority, the holders

of the surface rights in the lands on which we intend to conduct drilling operations, local and regional planning commissions

and environmental authorities.

In

the event of a commercial discovery and depending on the nature of the discovery and the production and related distribution equipment

necessary to produce and sell the discovered hydrocarbons, we will be subject to additional licenses and permits, including from

various departments in the Energy Ministry, regional and local planning commissions, the environmental authorities and the Israel

Lands Authority. If we are unable to obtain some or all of these permits or the time required to obtain them is longer than anticipated,

we may have to alter or delay our planned work schedule, which would increase our costs.

If

we are successful in finding commercial quantities of oil and/or gas, our operations will be subject to laws and regulations relating

to the generation, storage, handling, emission, transportation and discharge of materials into the environment, which can adversely

affect the cost, manner or feasibility of our doing business. Many Israeli laws and regulations require permits for the operation

of various facilities, and these permits are subject to revocation, modification and renewal. Governmental authorities have the

power to enforce compliance with their regulations, and violations could subject us to fines, injunctions or both.

If

compliance with environmental regulations is more expensive than anticipated, it could adversely impact the profitability of our

business.

Risks

of substantial costs and liabilities related to environmental compliance issues are inherent in oil and gas operations. It is

possible that other developments, such as stricter environmental laws and regulations, and claims for damages to property or persons

resulting from oil and gas exploration and production, would result in substantial costs and liabilities. This could also cause

our insurance premiums to be significantly greater than anticipated.

The

unavailability or high cost of drilling rigs, equipment, supplies, other oil field services and personnel could adversely affect

our ability to execute our exploration and development plans on a timely basis and within our budget.

Our

industry is cyclical and, from time to time, there is a shortage of drilling rigs, equipment, supplies and oilfield services.

There may also be a shortage of trained and experienced personnel. During these periods, the costs of such items are substantially

greater and their availability may be limited, particularly in locations that typically have limited availability of equipment

and personnel, such as the Eastern Mediterranean, where our operations are located. As a result, drilling rigs and oilfield services

may not be available at rates that provide a satisfactory return on our investment.

Additionally,

the oil and gas sector has been going through difficult financial times due to the persistently low oil and natural gas prices.

This has led to drilling services company reorganizations and even bankruptcies, which could impact our ability to obtain drilling

equipment, crews, and services from the affected companies. All of these contingencies, over which we have little or no control,

can potentially disrupt our budgets and planned time frames.

Risks

Related to our Common Stock

We

will issue additional common stock in the future, which would dilute the ownership interests of our existing stockholders.

In

the future, we anticipate issuing additional securities in connection with capital raising efforts, including shares of our common

stock or securities convertible into or exchangeable for our common stock, resulting in the dilution of the ownership interests

of our stockholders. We are authorized under our amended and restated certificate of incorporation to issue 200,000,000 shares

of common stock. As of March 12, 2018, there were approximately 57,120,812 shares of our common stock issued and outstanding.

We

have an effective shelf registration statement on Form S-3/A (File No. 333-216191) from which additional shares of our common

stock and other securities can be issued. In addition, we may also issue additional shares of our common stock or securities convertible

into or exchangeable for our common stock in connection with the hiring of personnel, future acquisitions, future private placements

of our securities for capital raising purposes or for other business purposes. Future issuances of our common stock, or the perception

that such issuances could occur, could have a material adverse effect on the price of our common stock. The former registration

statement was declared effective by the SEC on March 27, 2014 and therefore, was effective until March 26, 2017 plus 180 days

thereafter.

On

February 23, 2017, the Company filed with the SEC a replacement shelf registration statement on Form S-3 (File No. 333-216191)

to become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement

shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine. From time to time, the Company

may offer up to $102,350,000 of any combination of the securities described in this prospectus, in the form of common stock, debt

securities, warrants, and/or units.

When

we offer a particular series of securities, we will describe the intended use of the net proceeds from that offering in a prospectus

supplement. The actual amount of net proceeds we spend on a particular use will depend on many factors, including, our future

capital expenditures, the amount of cash required by our operations, and our future revenue growth, if any. Therefore, we will

retain broad discretion in the use of the net proceeds.

Because

the likelihood of paying cash dividends on our common stock is remote at this time, stockholders must look solely to appreciation

of our common stock to realize a gain on their investments.

We

do not know when or if we will pay dividends. We currently intend to retain future earnings, if any, to finance the expansion

of our business. Our future dividend policy is within the discretion of our board of directors and will depend upon various factors,

including our business, financial condition, results of operations, capital requirements and investment opportunities. Accordingly,

stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may

not occur.

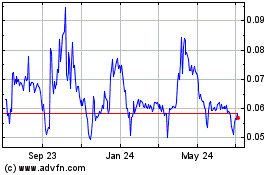

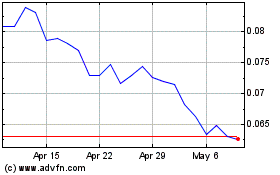

Our

stock price and trading volume may be volatile, which could result in losses for our stockholders.

The

public market for our common stock has been characterized by significant price and volume fluctuations. There can be no assurance

that the market price of our common stock will not decline below its current or historic price ranges. The market price may

bear no relationship to the prospects, stage of development, existence of oil and gas reserves, revenues, earnings, assets or

potential of our company and may not be indicative of our future business performance. The trading price of our common stock

could be subject to wide fluctuations. Fluctuations in the price of oil and gas and related international political events

can be expected to affect the price of our common stock. In addition, the stock market in general has experienced extreme

price and volume fluctuations that have affected the market price for many companies, sometimes unrelated to the operating performance

of these companies. These market fluctuations, as well as general economic, political and market conditions, may have a material

adverse effect on the market price of our common stock.

Some

of the factors that could negatively affect our share price or result in fluctuations in the price or trading volume of our common

stock include:

|

|

●

|

actual

or anticipated quarterly variations in our operating results,

|

|

|

●

|

changes