IQiyi, Baidu's Netflix of China, Falls in U.S. Market Debut -- Update

March 29 2018 - 5:54PM

Dow Jones News

By Austen Hufford

The Netflix-like video-streaming unit of Chinese search-engine

giant Baidu Inc. closed 13% below its offering price in its market

debut Thursday.

The decline came despite American depositary shares of iQiyi

Inc. opening trading Thursday at $18.20, slightly higher than the

$18 offering price. The IPO, which sold 125 million shares and

raised $2.25 billion, priced at the midpoint of its $17 to $19

marketed range.

IQiyi shares, trading on the Nasdaq Global Market under the

ticker IQ, closed at $15.55. IQiyi was the most heavily traded

stock by share volume Thursday on the Nasdaq.

The unprofitable company has been looking to raise money to stay

ahead in the competitive Chinese video-streaming sector where tech

titans Tencent Holdings Ltd. and Alibaba Group Holding Ltd. also

have offerings. It plans to spend half of the proceeds raised from

the IPO to "expand and enhance" its content offerings, according to

a securities filing.

Robin Li, Baidu co-founder and chief executive, is retaining

more than 93% of voting control in iQiyi, the filing said.

IQiyi, founded in 2010, said it is China's largest

video-streaming service by amount of time spent watching. IQiyi

reported 60.1 million subscribers as of Feb. 28, roughly 59 million

of whom pay for the service.

Underwriters of the offering could also purchase up to 18.8

million iQiyi shares.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

March 29, 2018 17:39 ET (21:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

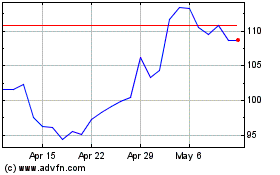

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

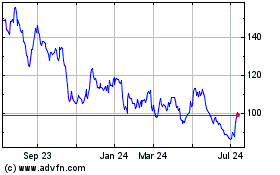

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024