The Market Awakens To Risks Facing Tech -- WSJ

March 29 2018 - 3:02AM

Dow Jones News

By James Mackintosh

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 29, 2018).

The highflying technology stocks had been ignoring rising

threats for a while. Reality reasserted itself on Tuesday.

The immediate cause for plummeting tech shares was

company-specific: Chip maker Nvidia Corp. halted road tests of

driverless vehicles after an Uber Technologies Inc. test car was

involved in a fatal crash, and Facebook Inc. CEO Mark Zuckerberg

will be hauled before Congress. The announcements highlighted the

risks to two of the biggest tech disruption themes, self-driving

cars and social media.

But the market fall wasn't just about Facebook and Nvidia, or

even self-driving cars and social media, although the themes

mattered, with Tesla Inc. dropping more than Nvidia, and Twitter

Inc. losing more than Facebook.

Instead, the market is waking up to an even broader threat:

politics. It might also be sniffing another danger, from

economics.

The political risk is obvious for Facebook, which stands at the

unpleasant intersection of privacy fears and fake news. Facebook is

accused of unwittingly aiding the manipulation of the U.S. election

by Russian agents, of helping swing the Brexit referendum and,

linked to both cases, failing to notice that the personal details

of 50 million users had been snatched.

The arguments about who, what, where and why are far from being

resolved, but Facebook highlights the forces gathering against tech

investors. Disruptive companies are bound to make powerful enemies

in old industries, but the tech companies have alienated many

natural supporters among the wider public through their swagger,

wealth and tax avoidance. Businesses that were once beloved by

consumers for taking on the corporate establishment have become the

corporate establishment in the eyes of many of their customers.

Cities and states were first to flex their muscles, forcing

companies such as Uber and Airbnb Inc. to follow local rules and

pay taxes. The threats now are much bigger.

The European Commission is pushing for a 3% tax on the revenue

of internet giants, while pressure is increasing for "gig economy"

workers to be treated as employees. The rush by companies to pull

their ads from Facebook may be merely temporary, but it shows just

how far the social network has slumped in public opinion and how

much privacy is becoming an issue for Americans. In Europe, privacy

rules have just been tightened again.

There is also a backlash to the sheer scale of many of the big

internet companies. Earnest discussion among economists about the

new monopolies is unlikely to lead directly to government

intervention, but a change in public perception makes antitrust

action more likely. Again, Europe has been leading the way by

taking on Alphabet Inc.'s Google.

There is a further danger, from the economy. A stronger economy

should mean more companies are able to demonstrate rising sales.

Investors who want growth will be able to buy businesses exposed to

the economic cycle, and the fast-expanding tech companies will lose

some of their exclusivity in the minds of shareholders. The same

point can be seen by looking at interest rates. As rates rise,

profits far in the future look less attractive, which should

compress the valuation of disrupters reinvesting all their earnings

in the hope of future returns. If -- and it is a big if -- you

expect the economy to improve and bond yields to rise, disruptive

tech stocks should be less appealing.

Tech stocks rode high in the past three years, ignoring all

these concerns as investors focused on the extraordinary profits

and dominant market shares many were producing. Sentiment was

overly positive, and the backlash was ignored.

It isn't always true that highflying stocks fall further, but it

certainly was on Tuesday. Out of the top 100 stocks in the S&P

500 for the year to Monday, 39 were in the bottom 100 on Tuesday,

about double what would be expected by chance. It worked the other

way, too, with just over one-third of the bottom 100 stocks for the

year in the top 100 on Tuesday, led by General Electric Co., the

fifth-worst performer this year and the best on Tuesday.

In the short run, the drop means the overly fast upward momentum

of the big tech stocks has abated, leaving them less exposed to

further selling driven by technical factors, although Amazon.com

Inc. led more falls on Wednesday after a report that President

Donald Trump wants to target the company.

In the longer run, expect lots of contrition from tech company

CEOs as they try to head off political pressure on the bottom

line.

Write to James Mackintosh at James.Mackintosh@wsj.com

(END) Dow Jones Newswires

March 29, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

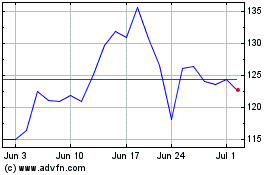

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024