Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

March 28 2018 - 12:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☒ |

|

Soliciting Material under §240.14a-12 |

SUPERVALU INC.

(Name of Registrant as Specified In Its

Charter)

Blackwells Capital LLC

Jason Aintabi

Richard A. Anicetti

Steven H. Baer

R. Chris Kreidler

Frank Lazaran

James J. Martell

Sandra E. Taylor

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

|

|

|

|

| ☒ |

|

No fee required. |

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

| |

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Blackwells

Capital LLC, together with the other participants named herein (collectively, “Blackwells”), intends to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election

of its slate of highly-qualified director nominees at the 2018 annual meeting of stockholders (the “2018 Annual Meeting”)

of SuperValu Inc., a Delaware corporation, and for the approval of a business proposal to be presented at the 2018 Annual Meeting.

Item

1: On October 25, 2017, Blackwells delivered the following letter to the Board of Directors of SuperValu Inc.:

1

2

3

Item

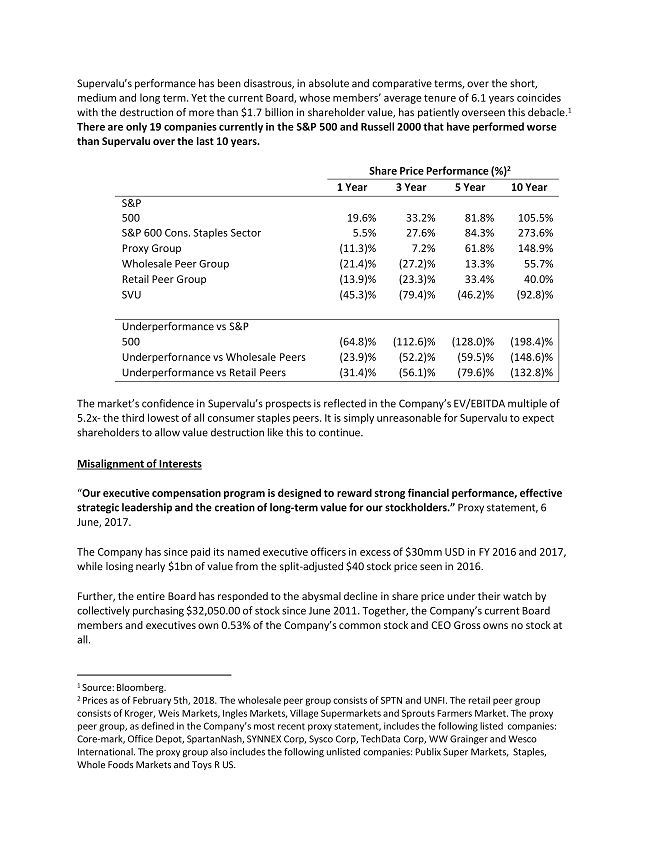

2: On February 6, 2018, Blackwells delivered the following letter to the Board of Directors of SuperValu Inc.:

4

5

6

7

Item

3: Also on February 6, 2018, Blackwells issued an Investor Presentation titled “Save SuperValu: A Fundamental Analysis and

Diagnostics Report.” The Investor Presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

BLACKWELLS STRONGLY

ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN

ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE,

UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in

the proxy solicitation are Blackwells Capital, Jason Aintabi, Richard A. Anicetti, Steven H. Baer, R. Chris Kreidler, Frank Lazaran,

James J. Martell and Sandra E. Taylor (collectively, the "Participants").

As of the date hereof,

Blackwells Capital beneficially owns 1,809,845 shares of common stock, $0.01 par value (the "Common Stock") of the Company,

including 1,066,400 shares underlying currently exercisable call options. Mr. Aintabi, as the managing partner of Blackwells

Capital, may be deemed the beneficial owner of the 1,809,845 shares of Common Stock beneficially owned directly by Blackwells

Capital. In addition, as of the date hereof, Mr. Aintabi beneficially owns directly 96,430 shares of Common Stock, including

18,800 shares underlying currently exercisable call options. As of the date hereof, none of Messrs. Anicetti, Baer, Kreidler,

Lazaran, Martell or Ms. Taylor own any shares of Common Stock.

This regulatory filing also includes additional resources:

dfan14a032718_blackwells.pdf

Supervalu (NYSE:SVU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supervalu (NYSE:SVU)

Historical Stock Chart

From Apr 2023 to Apr 2024