Novartis Exits Pact for $13 Billion -- WSJ

March 28 2018 - 3:02AM

Dow Jones News

By Nathan Allen and Noemie Bisserbe

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 28, 2018).

GlaxoSmithKline PLC agreed to pay Novartis AG $13 billion for

its 36.5% stake in their consumer health-care joint venture, moving

to consolidate the unit just three years after the two companies

joined forces.

The deal is the first significant strategic move for both

companies' young and newly installed chief executives, as they

reposition their respective firms amid a series of other reviews

and deal making across the industry.

GSK Chief Executive Emma Walmsley, 48 years old, has moved to

shake up the company's drug-research efforts, reshuffling or

letting go hundreds of executives and scientists since taking over

about a year ago. That is part of a broader industrywide effort at

several big pharmaceutical firms -- including Novartis -- to

refocus attention and resources on the high-risk, but high-reward

business of discovering and bringing to market new drugs.

Amid that push, both have also been considering how to prune, or

bolster, their businesses at the deal table. GSK was among several

companies kicking the tires at Pfizer Inc.'s large consumer-health

business, but last week said it wouldn't bid. Novartis, meanwhile,

is considering a sale or spin off its Alcon eye business, while

also weighing options for its U.S. generics business.

Novartis Chief Executive Vasant Narasimhan, 41, on the job just

since February, has similarly said his main aim is to reinvigorate

the company's drug-discovery pipeline. As part of a deal announced

in 2014 and completed the next year that created the joint venture,

Novartis starting this month was entitled to require GSK to buy the

rest of its stake.

"While our consumer health-care joint venture with GSK is

progressing well, the time is right for Novartis to divest a

noncore asset at an attractive price," Dr. Narasimhan said in a

statement. The proceeds of the deal will be used to fund

shareholder returns and pursue bolt-on acquisitions, he said.

Ms. Walmsley characterized the deal as a way of anchoring her

own efforts at refocusing the company on research and development.

The slower-growing, but often steadier, sales from consumer-health

products, like toothpaste and over-the-counter cough and flu

medicine, can serve as a crutch for the often more volatile

business of creating and marketing new drugs.

"Our number one priority is the strengthening of our pharma

business and at the heart of that is R&D and its pipeline,"

said Ms. Walmsley in a conference call with reporters. This deal

"brings more certainty" and "allows us the flexibility to invest in

R&D as appropriate," she said.

Investors in both companies endorsed the deal. Shares in GSK

were up 6.4% in afternoon trading in London, while Novartis rose

2.2% in Zurich.

Ms. Walmsley ran GSK's consumer-health business for more than

five years before taking over as CEO in April 2017. Her

predecessor, Andrew Witty, agreed with Novartis to combine their

consumer-health businesses, creating a giant that brought some of

the world's best-known brands under one roof -- including Excedrin

pain medicine, antismoking aides like NiQuitin and Theraflu cold

medicine.

That was just one part of a bigger series of transactions

between the two. The deals beefed up GSK's consumer health and

vaccines footprint. Novartis, meanwhile, bought GSK's cancer drugs

business.

Under the terms of the transaction, the joint venture's four

Novartis-appointed directors will step down, Novartis said.

Following completion, GSK said it expects the deal to boost

earnings in 2018 and strengthen cash flow, while the business

should post operating margins in the mid-20% range by 2022. GSK

said it would also begin a strategic review of its Horlicks brand

and other consumer-nutrition products with a view to funding

transactions. Most of Horlicks and other nutrition products sales

are in India, said Ms. Walmsley.

The deal, which is expected to close in the second quarter, is

subject to approval from GSK shareholders.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

March 28, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

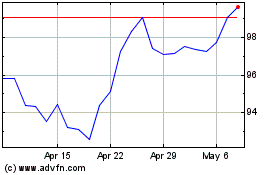

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

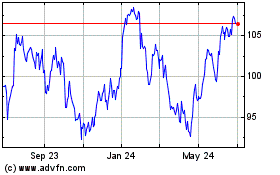

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024