GSK to Buy Out Novartis's Stake in Health-Care Venture for $13 Billion -- Update

March 27 2018 - 3:17AM

Dow Jones News

By Nathan Allen

GlaxoSmithKline PLC agreed to pay Novartis AG $13 billion for

its 36.5% stake in their consumer health care joint venture, moving

to consolidate the unit just three years after it and Novartis

joined forces.

The deal is the first significant strategic move for both

companies' young and newly installed chief executives, as they

reposition their respective companies amid a series of other

reviews and deal making across the industry.

GSK Chief Executive Emma Wamsley, 48 years old, has moved to

shake up the company's drug-research efforts , reshuffling or

letting go hundreds of executives and scientists since taking over

about a year ago. That is part of an industry wide effort at

several big pharmaceutical firms to refocus attention and resources

on the high-risk, but high-reward business of discovering and

bringing to market new drugs.

Novartis Chief Executive Vasant Narasimhan, 41, on the job just

since February, has similarly said his main aim is to reinvigorate

the company's drug discovery pipeline.

Amid those efforts, both have also been considering how to

prune, or bolster, their businesses at the deal table. GSK was

among several companies kicking the tires at Pfizer Inc.'s large

consumer-goods business, but last week said it wouldn't bid.

Novartis, meanwhile, is considering a sale or spin off its Alcon

eye business, and Dr. Narasimhan has said he is also considering

options for its U.S. generics business.

(END) Dow Jones Newswires

March 27, 2018 03:02 ET (07:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

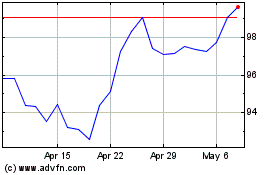

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

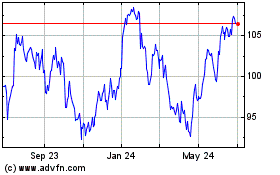

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024