GSK to Buy Out Novartis Stake in Consumer Health-Care JV for $13 Billion

March 27 2018 - 2:03AM

Dow Jones News

By Nathan Allen

GlaxoSmithKline PLC (GSK.LN) said Tuesday that it would buy out

Novartis AG's (NOVN.EB) 36.5% stake in the consumer health-care

joint venture operated by the two companies for $13 billion in

cash, less than a week after GSK pulled out of the race to buy

Pfizer Inc.'s (PFE) health-care unit.

Following completion, GSK said it expects the deal will be

accretive to earnings in 2018 and will strengthen cash flow, while

the business should post operating margins in the mid-20% range by

2022.

GSK said it will begin a strategic review of its Horlicks brand

and other consumer-nutrition products with a view to funding

transactions.

The joint venture was formed in 2015 between Novartis's

over-the-counter business and GSK's consumer health-care unit,

Novartis said.

"While our consumer health-care joint venture with GSK is

progressing well, the time is right for Novartis to divest a

non-core asset at an attractive price," Novartis's Chief Executive

Vas Narasimhan said. The proceeds of the deal will be used to fund

shareholder returns and pursue bolt-on acquisitions, he said.

Under the terms of the transaction, the joint venture's four

Novartis-appointed directors will step down, Novartis said.

The deal, which is expected to close in the second quarter, is

subject to approval from GSK shareholders.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

March 27, 2018 01:48 ET (05:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

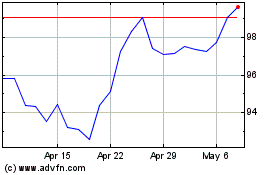

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

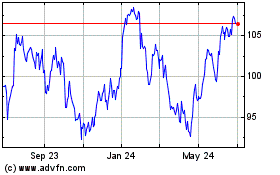

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024