USG Rejects Buyout Offer But Courting Likely Not Over -- 3rd Update

March 26 2018 - 5:35PM

Dow Jones News

By Cara Lombardo

USG Corp. rejected a buyout offer from Germany's Gebr. Knauf KG,

saying the proposal "substantially undervalues" the

building-materials company.

But with USG's largest shareholder, Berkshire Hathaway Inc.,

potentially open to selling its stake, analysts say a deal could

get done at a higher price. Knauf already owns a 10.5% stake in USG

and Warren Buffett's Berkshire Hathaway owns 30.8% of the

company.

USG is open and engaged in reviewing any proposal it receives,

according to people familiar with the matter.

A hostile takeover bid is unlikely and any deal would require

80% shareholder approval, Jefferies analyst Philip Ng said in a

Monday research note, as Knauf is an interested shareholder and

USG's board has recently been re-elected.

"We believe this deal ultimately gets done at a higher price and

will hinge on its shareholders pressuring the board to sell," Mr.

Ng wrote.

Chicago-based USG said Monday its board unanimously rejected a

March 15 offer from Knauf to buy the rest of the company for $42 a

share. The offer topped a November offer of $40.10 a share and

would have been a 25% premium over Friday's closing price of

$33.51.

Instinet analyst Michael Wood said in a Monday research note he

expects Knauf to increase its offer to about $44 a share or

more.

USG shares closed Monday up 20% at $40.03.

USG Chief Executive Jennifer Scanlon said in a letter to Knauf

executives that the company's board and management believes its

long-term plan will deliver more value to shareholders than Knauf's

latest offer.

USG, which makes wallboard, ceiling board and other construction

materials, has benefited as U.S. housing starts have started to

rebound since the last recession. The company has been touting

expanded offerings like premium, lighter-weight wallboard and plans

to trim costs.

Berkshire Hathaway brought the discussions into public view

Monday when it disclosed in a securities filing it proposed

granting an option to Knauf to buy its stake in USG. The option

would be exercisable only if Knauf buys all shares outstanding in

USG that it doesn't own for at least $42 a share.

Under the Berkshire proposal, Knauf would pay $2 per share for

the option, which would be exercisable at $40 per share, or a

combined price of $42 per share.

Berkshire shares rose 3.6% Monday to $199.34.

Executives from Knauf and the related C & G Verwaltungs GmbH

have "from time to time, beginning many years ago" contacted Mr.

Buffett, Berkshire's chief executive, to describe their potential

and conditional interest in a transaction with USG, Berkshire said

in its filing.

Berkshire in 2014 agreed to pay a nearly $900,000 penalty to

settle U.S. allegations it violated antitrust laws by failing to

report the acquisition of an equity stake in USG. The issue came

when Berkshire converted notes it had purchased from USG into

equity.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 26, 2018 17:20 ET (21:20 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

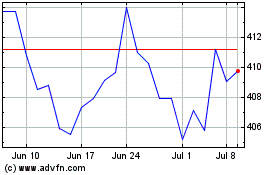

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

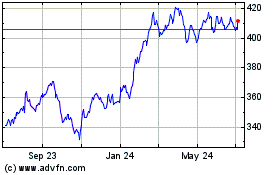

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024