Carpenter Technology to Invest $100 Million in Soft Magnetic Capabilities and New Equipment in Reading, PA Facility

March 26 2018 - 11:15AM

Investment timing accelerated by tax savings

associated with the Tax Cuts and Jobs Act

Carpenter Technology Corporation (NYSE:CRS) today announced it will

invest $100 million in soft magnetics capabilities and a new,

precision strip hot rolling mill in its Reading, PA facility to

help meet increasing demand for aerospace, consumer electronics and

electric vehicle manufacturing customers.

“Carpenter’s industry leading capabilities in the field of soft

magnetic technology for the Aerospace and Defense end-use market

has created a strong platform for growth over the next several

years. In addition, the value proposition of our CarTech Hiperco®

family of soft magnetic alloys provides customers enhanced

electronic properties and significant design flexibility to improve

performance,” said Tony Thene, Carpenter Technology President and

CEO. “This proven capability and product performance also allows us

to differentiate ourselves in key consumer electronics applications

as well as the rapidly evolving electric vehicle space.”

“Given these significant market opportunities and the benefits

associated with the recently enacted Tax Cuts and Jobs Act, we have

decided to accelerate further investment into our business. With

more than 90 percent of our products manufactured in the U.S., this

type of capital investment will strengthen our foundation for

long-term sustainable growth, provide good-paying jobs and increase

value for shareholders for years to come. Today’s announcement

demonstrates the benefits of an effective partnership between

public policy and U.S business.”

U.S. Senator Pat Toomey (R-PA) joined Carpenter President and

CEO Tony Thene in making today’s announcement.

“This is exactly the type of capital investment we envisioned as

a direct benefit of the Tax Cuts and Jobs Act,” said Senator

Toomey. “It’s vitally important for Pennsylvania families that

local companies increase their operations at home and provide

high-paying jobs with a stable future. I’m pleased Carpenter is

making such a strong commitment to Pennsylvania.”

Carpenter estimates the recent legislation will reduce cash

taxes by approximately $90-$100 million over the next five years

and will use the savings to increase its base level of capital

investment in U.S. manufacturing operations over the same

timeframe. The new mill announced today will increase overall

capacity and offer greater flexibility in processing alloys for

highly specialized soft magnetics applications in the aerospace,

consumer electronics and electric vehicle markets. Soft magnetics

are materials that can be easily magnetized and de-magnetized and

are indispensable in modern electrical engineering and electronics

applications. Sophisticated equipment, special processes, and

highly controlled atmospheric conditions are required to produce

soft magnetic alloys to meet extremely stringent

specifications.

About Carpenter Technology

Carpenter Technology Corporation is a leading producer and

distributor of premium specialty alloys, including titanium alloys,

nickel and cobalt based superalloys, stainless steels, alloy steels

and tool steels. Carpenter’s high-performance materials and

advanced process solutions are an integral part of critical

applications used within the aerospace, transportation, medical and

energy markets, among other markets. Building on its history of

innovation, Carpenter’s powder technology capabilities support a

range of next-generation products and manufacturing techniques,

including additive manufacturing and 3D Printing. Information about

Carpenter can be found at www.cartech.com.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on

management’s current expectations and are subject to risks,

uncertainties and other factors that could cause actual results to

differ from those projected, anticipated or implied. The most

significant of these uncertainties are described in Carpenter's

filings with the Securities and Exchange Commission, including

its annual report on Form 10-K for the year ended June 30,

2017, the quarterly reports on Form 10-Q for the quarters

ended September 30, 2017 and December 31, 2017,

and the exhibits attached to those filings. They

include, but are not limited to, statements regarding expected tax

savings and expectations for improving market demand conditions for

certain products. Carpenter undertakes no obligation to

update or revise any forward-looking statements.

Media Inquiries:William J. Rudolph, Jr.+1

610-208-3892wrudolph@cartech.com

Investor Inquiries:Brad EdwardsThe Plunkett Group+1

212-739-6740brad@theplunkettgroup.com

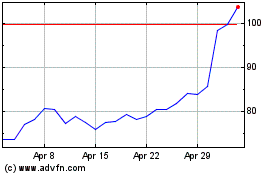

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

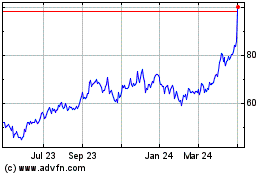

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024