By Rachel Louise Ensign

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2018).

Americans are parking more money with the biggest banks than

ever before, cementing the firms' dominance of the financial

industry less than a decade after the 2008 crisis.

The three largest U.S. banks by assets have added more than $2.4

trillion in domestic deposits over the past 10 years, a 180%

increase, according to a Wall Street Journal analysis of regulatory

data. That amount exceeds what the top eight banks had in such

deposits combined in 2007.

The outsize gain began when the trio of lenders -- JPMorgan

Chase & Co., Bank of America Corp. and Wells Fargo & Co. --

did huge deals during the financial crisis. Their heft has

continued to increase in recent years as consumers opt to put their

money at the behemoths over smaller U.S. banks.

While the crisis led many to question whether banks had become

too large, the lead of the biggest lenders has only widened. At the

end of 2007, the three banks held 20% of the country's deposits. By

the end of 2017, they held 32%, or $3.8 trillion.

It marks a new phase of consolidation in the banking industry,

one driven first by the acquisitions and then by customers'

attraction to the digital tools and ubiquitous locations of the

biggest banks.

Last year, about 45% of new checking accounts were opened at the

three national banks, even though those lenders had only 24% of

U.S. branches, according to research by consulting firm Novantas.

Regional and community banks, by contrast, had 76% of branches but

got only 48% of new accounts, the firm said.

New checking customers, who tend to be younger, are valuable to

banks because they often provide more business later on by, for

instance, taking out a mortgage or opening a brokerage account.

Before online and mobile banking became popular following the

financial crisis, these consumers generally opened a new account at

the bank with the nearest branch, no matter the size of the

institution, said Andrew Frisbie, executive vice president at

Novantas.

But now that many banking transactions are done online or

through smartphones, these customers are picking national banks

because of their well-known brands and the perception that their

technology is better, Mr. Frisbie said.

Large banks' deposit growth is a major advantage because it

provides the banks with an increasing base of cheap financing that

can be used to make loans. It also allows them to avoid paying

higher interest rates to depositors, which disappoints savers but

boosts the firms' profit margins.

"The biggest banks are winning," wrote Tom Brown, CEO of hedge

fund Second Curve Capital LLC, last month. "Small banks should be

very concerned."

Through the 1980s, American banks faced tough legal constraints

on getting bigger that ensured the country's deposits remained

spread out across thousands of small banks. While some rules

limiting size still exist, in 1994, lawmakers passed legislation

that paved the way for national banks that could hold customers'

deposits coast to coast. At the end of that year, the three largest

banks held about 5% of the nation's deposits. Those firms

eventually were a part of multibillion-dollar mergers that created

today's biggest lenders.

Some of the deposit growth comes from businesses parking their

money in bank accounts that earn no interest. That funding is often

considered less valuable because it is seen as likelier to leave as

rates continue to rise.

But the biggest chunk of deposits is held in the banks' retail

units, which hold money consumers leave in their checking and

savings accounts, according to bank filings. These deposits, which

are considered "sticky, " or less likely to leave, have become even

more important because of postcrisis rules.

The biggest banks also have improved customer-satisfaction

ratings that had been damaged by the financial crisis and increase

in home foreclosures.

And they are persuading current customers to leave more money

with them, in part by encouraging customers to keep their primary

checking accounts with them. For instance, the average

checking-account balance at Bank of America has increased to about

$7,000 from $2,000 in 2007.

Prohibited from doing deals, JPMorgan and Bank of America are

planning to keep expanding by opening branches in major U.S. cities

where they have none. Bank of America has opened or announced plans

to open around Denver, Indianapolis and other cities.

JPMorgan hasn't named the 15 to 20 new markets it is entering,

but analysts think they could include Boston, Washington, D.C., and

Philadelphia.

The strategy could steal business from Wells Fargo, which is

struggling to move past the image problems that have come along

with its various regulatory issues. It could also accelerate

deposit-gathering problems for smaller banks, said Mr. Brown of

Second Curve Capital.

And that can lead to other issues, from slowing loan growth to

dwindling fees from other relationships. The risk for small banks,

he said, is that "this is a slow death."

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

March 23, 2018 02:48 ET (06:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

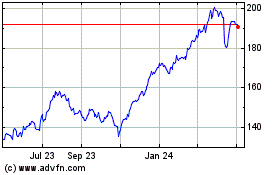

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

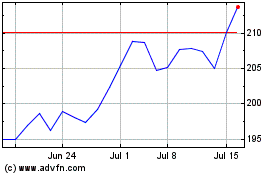

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024