Current Report Filing (8-k)

March 22 2018 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

March 20, 2018

Canterbury Park Holding Corporation

(Exact name of registrant as specified in

its charter)

Minnesota

(State or Other Jurisdiction of Incorporation)

|

001-37858

|

47-5349765

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1100 Canterbury Road, Shakopee, Minnesota

|

55379

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(952) 445-7223

(Registrant’s telephone number, including

area code)

______________________________

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers

|

Compensation of Named Executive Officers

The following information is provided with

respect to President and Chief Executive Officer Randall D. Sampson, Senior Vice President of Operations Daniel J. Kennedy, and

Senior Vice President of Finance and Chief Financial Officer Robert W. Wolf, the three individuals Canterbury Park Holding Corporation

(the “Company”) expects to be identify as its Named Executive Officers (“NEOs”) in the Proxy Statement

for its Annual Meeting of Shareholders scheduled for June 6, 2018.

Annual Base Salaries

On March 20, 2018, the Company’s Board

of Directors increased the annual base salaries of these NEOs to the amounts set forth in the table below:

|

Name and Title

|

Annual Base Salary

|

Randall D. Sampson

President & Chief Executive Officer

|

$264,844

|

Daniel J. Kennedy

Senior Vice President of Operations

|

$227,813

|

Robert W. Wolf

Senior Vice President of Finance and Chief Financial Officer

|

$181,500

|

Grant of 2018 Awards to NEOs Under the Annual Bonus Plan

The Company has adopted a plan for paying

annual incentive compensation to the Company’s NEOs, as well as other officers and key employees (collectively “Senior

Executives”) called the Canterbury Park Annual Incentive Plan (the “Annual Bonus Plan”). Under the Annual Bonus

Plan, the Company selects performance measures and establishes related performance goals under which these Senior Executives have

the opportunity to earn an annual bonus based on actual achievement compared to performance goals. Concurrently, these Senior Executives

are granted personal opportunities (“Incentive Awards”) to receive a payment of cash (“Payout”) based on

the Company’s annual financial performance compared to the pre-established goals. The Payout for 2018, if any, will be determined

by reference to two financial metrics: (i) achievement in relation to a performance goal for earnings (defined as “Adjusted

Net Income From Operations”) and (ii) achievement in relation to a performance goal for consolidated Company revenue (defined

as “Revenue”). Each NEO’s target opportunity for a Payout is based 70% on 2018 Company Adjusted Net Income From

Operations and 30% on Revenue.

Further information regarding the Annual

Bonus Plan is provided in and the text of the Annual Bonus Plan is an exhibit to the Company’s Form 8-K Report filed April

5, 2016.

Pursuant to the Annual Bonus Plan,

on March 20, 2018 the Company’s Board approved 2018 bonus opportunities for the NEOs, expressed as percentage of 2018 Base

Salary based upon the Company’s achievement at Target and Maximum levels of performance. Under matrices associated with the

2018 Annual Bonus Plan achievement at less than the Target level results in a decreasing bonus and, if achievement fails to meet

the Minimum Performance Level, the NEO will not be paid any bonus:

|

Name and Title

|

Annual Bonus Opportunity at Target Level of Performance

|

Annual Bonus Opportunity at Maximum Level of Performance

|

Randall D. Sampson

President & Chief Executive Officer

|

25% of 2018 Base Salary

|

37.5% of 2018 Base Salary

|

Daniel J. Kennedy

Senior Vice President of Operations

|

20% of 2018 Base Salary

|

30% of 2018 Base Salary

|

Robert W. Wolf

Senior Vice President of Finance and Chief Financial Officer

|

20% of 2018 Base Salary

|

30% of 2018 Base Salary

|

Grant of 2018 Awards to NEOs Under the Long Term Incentive

Plan

The Company has adopted a plan for paying

long-term, performance-based incentive compensation to the Company’s NEOs and other Senior Executives called the Canterbury

Park Long Term Incentive Plan (the “LTI Plan”). The LTI Plan authorizes the grant of Long Term Incentive Awards that

provide an opportunity to Senior Executives to receive a payment (a “Payout”) in cash or shares of the Company’s

common stock to the extent of Company achievement at the end of a period greater than one year (the “Performance Period”)

in comparison to performance goals established for the Performance Period. The LTI Plan is a sub-plan of the Company’s Stock

Plan. Further information regarding the LTI Plan is provided in and the text of the LTI Plan is an exhibit to the Company’s

Form 8-K Report filed April 5, 2016.

The following summarizes the Compensation

Committee’s current practice in implementing the LTI Plan. Performance is measured over three-year Performance Periods. The

performance measures currently used are Adjusted Net Income From Operations and Revenue. At the beginning of each Performance Period,

the Compensation Committee determines performance goals for each of the three years in the Performance Period. At his time,. the

Compensation Committee also determines the Payout opportunities for each Senior Executive to earn incentive compensation as a percentage

of the Senior Executive’s average annual base salary over the three-year period. Following the end of each three-year Performance

Period, the Company averages achievement in the three years compared to performance goals and compares the result to Target achievement

to determine the Payout earned, which is then paid in common stock.

Pursuant to the LTI Plan, on March

20, 2018 the Company’s Board established Payout opportunities for the NEOs named below under the 2018 to 2020 LTI Plan. The

following table shows the value of Payouts that may be earned by each of the NEOs under the 2018-2020 LTI Plan based upon the Company’s

average achievement in each of the three years compared to the Target and Maximum goals for each of the three years. Under the

matrices associated with the 2018 – 2020 Performance Period, achievement of the Performance Goals at less than Target results

in a decreasing level of long term compensation and, if achievement fails to meet the minimum performance goals, the NEO will not

be entitled to any payment under the LTI Plan.

|

Name and Title

|

Target Opportunity

|

Maximum Opportunity

|

Randall D. Sampson

President & Chief Executive Officer

|

25% of 2018 – 2020 Average Annual Base Compensation

|

37.5% of 2018 – 2020 Average Annual Base Compensation

|

Daniel J. Kennedy

Senior Vice President of Operations

|

20% of 2018 – 2020 Average Annual Base Compensation

|

30% of 2018 – 2020 Average

Annual Base Compensation

|

Robert W. Wolf

Senior Vice President of Finance and Chief Financial Officer

|

20% of 2018 – 2020 Average Annual Base Compensation

|

30% of 2018 – 2020 Average

Annual Base Compensation

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CANTERBURY PARK HOLDING CORPORATION

|

|

|

|

|

|

Dated: March 22, 2018

|

By:

|

/s/ Randall D. Sampson

|

|

|

|

Randall D. Sampson

|

|

|

|

President and Chief Executive Officer

|

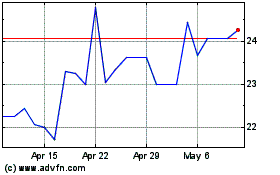

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

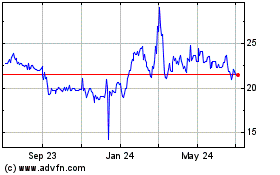

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024