Current Report Filing (8-k)

March 21 2018 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 15, 2018

Liberty Global plc

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

England and Wales

|

|

001-35961

|

|

98-1112770

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification #)

|

Griffin House, 161 Hammersmith Rd, London, United Kingdom

W6 8BS

(Address of Principal Executive Office)

+44.208.483.6449 or 303.220.6600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements of Certain Officers

For the equity incentive award component of our executive officers’ compensation packages and similar to prior years, the Compensation Committee (the “

Committee

”) of Liberty Global plc's Board of Directors sets a target annual equity value for each executive, of which approximately two-thirds would be delivered in the form of an annual award of performance-based restricted share units (“

PSUs

”) and approximately one-third in the form of an annual award of share appreciation rights (“

SARs

”). A similar approach is applied to the equity incentive compensation for other key employees. In the following text, the terms "we", "our", "our company" and "us" refers to Liberty Global plc.

Except for the PSUs granted in 2016 covering a three-year performance period, each year’s award of PSUs has a two-year performance period. The percentage of the PSU award earned during the relevant performance period is subject to vesting in two equal installments on April 1 and October 1 of the year following the end of the performance period. Each year’s award of SARs is made at the same time as awards are made under our annual equity grant program for employees and on terms consistent with our standard form of SARs award agreement.

Pursuant to the Liberty Global 2014 Incentive Plan, as amended and restated effective February 24, 2015 (the “

Incentive Plan

”), on March 15, 2018, the Committee approved the target annual equity values for 2018 and granted an aggregate of 1,303,776 PSUs (the “

2018 PSUs

”) for our executive officers, including our Chief Executive Officer and the other named executive officers of our company, who we currently anticipate will be among our five most highly compensated executive officers for fiscal 2018 (the “

2018 NEOs

”). The 2018 PSUs will be divided with one-third as Class A PSUs and two-thirds as Class C PSUs. Each 2018 PSU represents the right to receive one Class A ordinary share or Class C ordinary share, as applicable, subject to performance and vesting.

The new target annual equity values and grants for the 2018 PSUs for our 2018 NEOs are set forth in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Two-thirds of Target

Annual Equity Value in the Form of:

|

|

Name and Position

|

|

Target Annual Equity Value

|

|

Class A 2018

PSU Grant

|

|

Class C 2018

PSU Grant

|

|

|

|

|

|

|

|

|

|

Michael T. Fries, Chief Executive Officer & President

|

|

$22,500,000

|

|

|

153,988

|

|

307.976

|

|

|

|

|

|

|

|

|

|

Charles H.R. Bracken, Executive Vice President & Chief Financial Officer (Principal Financial Officer)

|

|

$6,000,000

|

|

|

41,064

|

|

82,128

|

|

|

|

|

|

|

|

|

|

Bryan H. Hall, Executive Vice President, General Counsel & Secretary

|

|

$4,000,000

|

|

|

27,376

|

|

54,782

|

|

|

|

|

|

|

|

|

|

Diederik Karsten, Executive Vice President & Chief Commercial Officer

|

|

$5,000,000

|

|

|

34,220

|

|

68,440

|

The performance period for the 2018 PSUs ends on December 31, 2019. As the performance measure, the Committee selected growth in consolidated operating cash flow (operating income before depreciation and amortization, share-based compensation, provisions and provision releases related to significant litigation for litigation, and impairment, restructuring and other operating items), as adjusted for events such as acquisitions, dispositions and changes in foreign currency exchange rates and accounting principles or policies that affect comparability. In choosing operating cash flow as the performance measure for the 2018 PSUs, the Committee’s goal has been to ensure that the management team is focused on maximizing performance against a key financial metric used by our Board and management in evaluating our operating performance. The target compound annual growth rate in consolidated operating cash flow (“

OCF CAGR

”) selected by the Committee was based upon a comparison of our 2017 actual results to those reflected in our long-range plan for 2019. The target OCF CAGR is subject to upward or downward adjustment for certain events in accordance with the terms of the grant agreement. A performance range of 50% to 125% of the target OCF CAGR would generally result in award recipients earning 50% to 150% of their target 2018 PSUs, subject to reduction or forfeiture based on individual performance. One-half of the earned 2018 PSUs will vest on April 1, 2020 and the balance on October 1, 2020. The Committee also established a minimum OCF CAGR base performance objective, subject to certain limited adjustments, which must be satisfied in order for our chief executive officer to be eligible to earn any of his 2018 PSUs. The base performance objective was designed so that the awards would qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended. If the base performance objective is achieved, our chief executive officer will be eligible to

earn 150% of his 2018 PSUs, subject to the committee’s discretion to reduce the size of the award earned, including to zero, to align with our company’s and the individual’s performance.

The 2018 PSUs are subject to forfeiture or acceleration in connection with certain termination of employment or change-in-control events consistent with the terms of the PSUs granted in 2016. The 2018 PSUs will convert to time-vested restricted share units following certain change-in-control events.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LIBERTY GLOBAL PLC

|

|

|

|

|

|

By:

|

/s/ MICHELLE L. KEIST

|

|

|

|

Michelle L. Keist

|

|

|

|

Vice President

|

Date: March 21, 2018

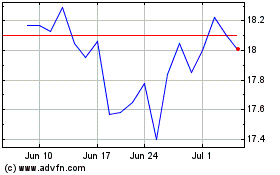

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

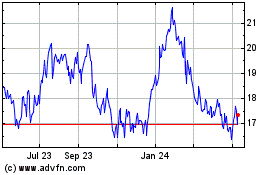

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Apr 2023 to Apr 2024