The LGL Group, Inc. (NYSE MKT: LGL) (the “Company” or “LGL”),

announced its financial results for the full year and quarter ended

December 31, 2017.

Summary of 2017 Full-Year Financial Results:

- Revenues of $22.4 million, up 7.2%

compared to 2016

- Net income of $0.04 per share compared

to a net income of $0.06 per share in 2016

- Order backlog improved 11.4% to $11.7

million at December 31, 2017 from $10.5 million at December 31,

2016

- Adjusted EBITDA was $0.36 per share,

compared to $0.27 per share for 2016

Summary of Q4 2017 Financial Results:

- Revenues of $5.7 million, down (2.1%)

compared to Q4 2016

- Net loss of ($0.01) per share compared

to a net income of $0.08 per share in Q4 2016

- Adjusted EBITDA was $0.09 per share,

compared to $0.12 per share for Q4 2016

Commenting on the Company’s 2017 results, Executive Chairman and

CEO, Michael J. Ferrantino, Sr. stated, “I am very pleased to

report to our shareholders our operating subsidiaries more than

made up for the shortfall from hurricane Irma and are trending to a

new normal. Revenue of $22.4 million, up 7.2% compared to 2016, is

particularly significant since our internally developed metrics

indicate our market grew by approximately 3%. Net income was $0.04

per share compared to $0.06 per share in 2016, but the decrease is

not an operational issue, it is due in part to an increase in tax

expense, related to the reversal of a valuation allowance in 2016,

and an impairment of a note receivable of $102,000, related to an

asset sale in 2013. Our backlog improved 11.4% to $11.7 million at

year end up from $ 10.5 million in 2016. This is the metric we pay

particular attention to. We strive for a book to bill of greater

than one. This new business is attributed to our move to

value-added assemblies which are less competitive and that provide

engineered solutions to our customers.”

In closing, Mr. Ferrantino added, “We enter 2018 with a seasoned

group of associates, our backlog is solid, our new order funnel is

growing, and our capacity to handle an increase in business with

small capital investment exists, so yes, I believe we are moving to

a new normal. Finally, I want to thank all our employees, customers

and shareholders for their hard work, commitment to giving us

business and standing by us. I am both humbled and grateful for the

success of our rights offering completed in the fall, which was

oversubscribed and raised net cash of approximately $10.8 million.

Although we are continuing to evaluate the best use of your

investment, I can report we are being extremely judicious in our

pursuit to increase shareholder value.”

About The LGL Group, Inc.

The LGL Group, Inc., through its two principal subsidiaries

MtronPTI and PTF, designs, manufactures and markets

highly-engineered electronic components used to control the

frequency or timing of signals in electronic circuits, and designs

high performance frequency and time reference standards that form

the basis for timing and synchronization in various

applications.

Headquartered in Orlando, Florida, the Company has additional

design and manufacturing facilities in Yankton, South Dakota,

Wakefield, Massachusetts and Noida, India, with local sales offices

in Hong Kong, Sacramento, California and Austin, Texas.

For more information on the Company and its products and

services, contact James Tivy at The LGL Group, Inc., 2525 Shader

Rd., Orlando, Florida 32804, (407) 298-2000, or visit

www.lglgroup.com and www.mtronpti.com.

Caution Concerning Forward Looking Statements

This press release may contain forward-looking statements made

in reliance upon the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21 E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and can be identified by the use of

words such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

These forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to us and our current plans or

expectations, and are subject to a number of uncertainties and

risks that could significantly affect current plans, anticipated

actions and our future financial condition and results. Certain of

these risks and uncertainties are described in greater detail in

our filings with the Securities and Exchange Commission. We are

under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a

result of new information, future events or otherwise.

THE LGL GROUP, INC.

Consolidated Statements of

Operations

(Dollars in Thousands, Except Shares and

Per Share Amounts)

For the year ended December 31, 2017

2016 (audited)

REVENUES $ 22,402 $ 20,891 Costs and

expenses: Manufacturing cost of sales 14,661 13,858 Engineering,

selling and administrative 7,465 7,194 OPERATING

INCOME (LOSS) 276 (161 ) Total other (expense) income, net

(57 ) 144 INCOME (LOSS) BEFORE INCOME TAXES 219 (17 ) Income

tax (provision ) benefit (102 ) 165 NET INCOME $ 117

$ 148 Weighted average number of shares used in basic EPS

calculation 2,929,641 2,665,043 Weighted average

number of shares used in diluted EPS calculation 3,035,104

2,665,730 BASIC AND DILUTED NET INCOME PER COMMON SHARE $

0.04 $ 0.06

For the quarter ended December 31,

2017 2016 (audited)

REVENUES $ 5,657 $ 5,776

Costs and expenses: Manufacturing cost of sales 3,598 3,789

Engineering, selling and administrative 1,936 1,984

OPERATING INCOME 123 3 Total other (expense) income, net (82

) 59 INCOME BEFORE INCOME TAXES 41 62 Income tax (provision

) benefit (72 ) 164 NET (LOSS) INCOME $ (31 ) $ 226

Weighted average number of shares used in basic EPS

calculation 3,681,118 2,664,123 Weighted average

number of shares used in diluted EPS calculation 3,790,812

2,672,549 BASIC AND DILUTED NET (LOSS) INCOME PER COMMON

SHARE $ (0.01 ) $ 0.08

THE LGL GROUP, INC.

Consolidated Balance Sheets

(Dollars in Thousands)

December 31, 2017 December 31, 2016 (audited)

ASSETS Cash and cash equivalents $ 13,250 $ 2,778 Marketable

securities 3,803 2,770 Accounts receivable, net 3,393 3,504

Inventories, net 3,875 3,638 Prepaid expenses and other current

assets 229 200 Total Current Assets 24,550 12,890

Property, plant, and equipment, net 2,179 2,711 Intangible assets,

net 552 628 Deferred income taxes, net 173 214 Other assets, net

101 203 Total Assets $ 27,555 $ 16,646 LIABILITIES

AND STOCKHOLDERS' EQUITY Total Current Liabilities 2,627 2,755

Total Stockholders' Equity 24,928 13,891 Total

Liabilities and Stockholders' Equity $ 27,555 $ 16,646

Reconciliations of GAAP to Non-GAAP Measures

To supplement our consolidated financial statements presented on

a GAAP (generally accepted accounting principles) basis, the

Company uses certain non-GAAP measures, including Adjusted EBITDA,

which we define as net income (loss) adjusted to exclude

depreciation and amortization expense, interest income (expense),

provision (benefit) for income taxes, stock-based compensation

expense and other items we believe are discrete events which have a

significant impact on comparable GAAP measures and could distort an

evaluation of our normal operating performance. These adjustments

to our GAAP results are made with the intent of providing both

management and investors a more complete understanding of the

underlying operational results and trends and our marketplace

performance. The presentation of this additional information is not

meant to be considered in isolation or as a substitute for net

earnings or diluted earnings per share prepared in accordance with

generally accepted accounting principles in the United States.

Reconciliation of GAAP Income (Loss)

Before Income Taxes to Non-GAAP Adjusted EBITDA:

For the period ended December 31, 2017 (in

000's, except shares and per share amounts) Three Months

Twelve Months Net income before income taxes $ 41 $ 219

Interest (income) expense (6 ) 11 Depreciation and amortization 122

642 Non-cash stock compensation 66 88 Impairment of note receivable

102 102 Gain on sale of marketable securities — (21 )

Adjusted EBITDA $ 325 $ 1,041 Basic per share information: Weighted

average shares outstanding 3,681,118 2,929,641

Adjusted EBITDA per share $ 0.09 $ 0.36 Diluted per share

information: Weighted average shares outstanding 3,790,812

3,035,104 Adjusted EBITDA per share $ 0.09 $ 0.34

For the period ended December 31, 2016 (in 000's, except shares

and per share amounts) Three Months Twelve Months

Net income (loss) before income taxes $ 62 $ (17 ) Interest expense

2 22 Depreciation and amortization 185 772 Non-cash stock

compensation 71 67 Gain on disposal of assets — (110 ) Bargain

purchase gain — (4 ) Adjusted EBITDA $ 320 $ 730

Basic per share information: Weighted average shares outstanding

2,664,123 2,665,043 Adjusted EBITDA per share $ 0.12

$ 0.27 Diluted per share information: Weighted average shares

outstanding 2,672,549 2,665,730 Adjusted EBITDA per

share $ 0.12 $ 0.27

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180321006170/en/

The LGL Group, Inc.James Tivy,

407-298-2000jtivy@lglgroup.com

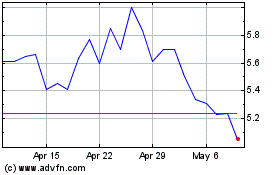

LGL (AMEX:LGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

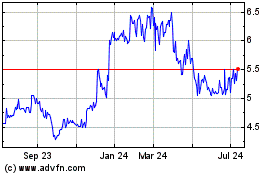

LGL (AMEX:LGL)

Historical Stock Chart

From Apr 2023 to Apr 2024