Plunge in Facebook Stock Unleashes Near Record Trading of Options

March 21 2018 - 2:10PM

Dow Jones News

By Gunjan Banerji

The tumble in Facebook Inc.'s shares has triggered frenzied

trading of the company's options, including contracts that pay out

if the stock falls more than 30% or regains most of its losses.

The social-media giant is trading at $172.72 a share Wednesday

afternoon, but has slumped more than 6% so far this week after

reports that a firm tied to President Donald Trump's 2016 campaign

called Cambridge Analytica gathered user data without

authorization.

On Tuesday, volume of Facebook options was the second busiest

ever, according to data provider Trade Alert. And some investors

appeared to be girding for a violent move in the stock.

Among the most popular options changing hands Tuesday were

bearish put contracts expiring in April. Puts give holders the

right but not the obligation to sell the shares at a certain price.

Traders can tap options to make bets on which direction they think

a stock will move or to hedge portfolios.

The "strike prices" for the options -- the levels at which the

contracts can be exercised -- were $115 and $120. That means

Facebook shares would have to plunge 32% or 29%, respectively, from

where they closed Tuesday for the options to pay out. Facebook

shares haven't traded at those levels since around December

2016.

"They're most likely purchasing puts to protect themselves on

the downside," said Mary Ryan, a Chicago-based senior options

strategist at E*Trade Financial Corp. But some options investors

may be positioning for a reversal, she said.

The reports linked to Cambridge Analytica have sent Facebook

shares on their worst two-day streak in more than two years, a

sharp reversal for the company, which has vastly outperformed the

S&P 500 in recent years.

Also popular among Facebook options were bullish call options

that pay out if the stock bounces back to above $180, near where

the stock was trading before this week, Trade Alert data show.

JPMorgan Chase & Co. analysts recommended a bullish options

trade in a note Wednesday.

"Clarity on the Cambridge issue and Facebook's willingness to

self-regulate are likely near-term catalysts that may reduce

investor fears, stabilize the stock and position it for a recovery

into first-quarter results," JPMorgan analysts wrote.

Facebook options tend to be heavily traded, landing it on a list

of the top 10 most-active options in 2017, alongside contracts on

the S&P 500 and Apple, according to a January report from

research firm Tabb Group.

There could be more prices swings ahead, according to JJ

Kinahan, chief market strategist at TD Ameritrade.

"I would expect the activity to stay elevated for the next few

weeks with bouts of intraday volatility," Mr. Kinahan said by

email.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

March 21, 2018 13:55 ET (17:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

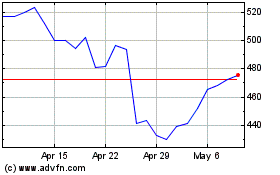

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024