General Mills Hit by Higher Food, Shipping Costs -- Update

March 21 2018 - 10:05AM

Dow Jones News

By Annie Gasparro

General Mills Inc. said higher food and shipping costs hurt

profitability in the latest quarter and will weigh on the food

maker's earnings for the year.

Comparable sales rose 1% in the quarter, including a bump in the

U.S., as more people bought General Mills products like Nature

Valley granola bars and Cheerios cereal. But like its competitors,

General Mills paid more for ingredients and said shipping costs in

North America were near 20-year highs, dragging adjusted operating

margins down 1.2 percentage points to 15.7%.

Chief Executive Jeff Harmening said General Mills may raise

prices to reflect the higher costs.

"Our third-quarter operating profit fell well short of our

expectations, " he said. "We are moving urgently to address this

increasingly dynamic cost inflation environment."

For its fiscal year ending in May, General Mills projects

adjusted earnings per share will rise by up to 1%, compared to

previous guidance for an increase up to 4%.

Shares fell 10% Wednesday in early trading. General Mills shares

have fallen 25% over the past year, while the S&P 500 has risen

16%.

Mr. Harmening, who took over as CEO less than a year ago, said

he plans to continue selling off the Minneapolis-based

conglomerate's weaker businesses while acquiring new brands with

more growth potential.

General Mills in February agreed to buy pet-food maker Blue

Buffalo for $8 billion. Mr. Harmening said the deal will give

General Mills a foothold in the premium pet food aisle, where sales

are growing significantly faster than for products like baking

mixes. He intends to expand Blue Buffalo to more retail outlets and

to expand the brand with new products like treats.

Those acquisitions come alongside divestitures of older brands

like the Green Giant frozen and canned vegetable business that

General Mills sold to B&G Foods Inc. in 2015. Wall Street

analysts have speculated that Hamburger Helper or Bisquick could be

the next brands General Mills sells.

The company has struggled in recent years as customers migrated

away from those brands. Yoplait yogurt, meanwhile, was hurt by the

rapid expansion of Greek-style yogurt and nondairy

alternatives.

Lately, General Mills' brands like Cheerios and Progresso soup

have been selling faster in stores than rival brands -- a sign of

progress for a company that hasn't seen that kind of success since

2014, according to J.P. Morgan analyst Ken Goldman. He and other

analysts questioned whether General Mills can raise prices without

losing customers.

Profit for the quarter rose to $941.4 million. Excluding

one-time items, adjusted earnings of 79 cents a share topped

analysts' expectations of 78 cents, according to FactSet. Revenue

rose 2% to $3.88 billion, beating projections of $3.87 billion.

Imani Moise contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

March 21, 2018 09:50 ET (13:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

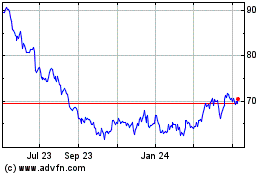

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

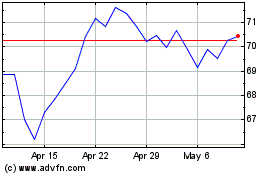

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024