Citi Hires Women-Owned Firms to Lead Distribution of $250 Million Citigroup Inc. Subordinated Bond Issuance

March 20 2018 - 3:13PM

Business Wire

Citi today announced that it hired women-owned firms as lead

managers of a $250 million bond issuance on behalf of Citigroup

Inc.

The transaction represents the third consecutive year that Citi

has worked predominantly with women-owned firms to syndicate a bond

offering, highlighting its deep, long-standing commitment to

diversity and inclusion, and to helping women, minority and

veteran-owned businesses grow and succeed.

In the deal, which priced on March 12, Citi hired nine

women-owned broker-dealers to assist in the distribution of the

bonds to investors. The firms included C.L. King & Associates;

Capital Institutional Services, Inc.; CV Brokerage, Inc.; MFR

Securities, Inc.; R. Seelaus & Co., Inc.; Siebert

Cisneros Shank & Co., L.L.C.; Stern Brothers; Telsey Advisory

Group LLC; and Tigress Financial Partners LLC.

“Citi is pleased to leverage a diverse broker-dealer network for

another successful transaction,” said Michael Verdeschi, Treasurer

of Citi. “By choosing to consistently work with a diverse group of

suppliers for debt offerings, Citi is clearly taking a leadership

role in promoting diversity in the industry.”

Through the March 12 deal, Citigroup Inc. priced a $250 million

reopening issue of previously issued Citi 30-year subordinated

4.750% bonds, bringing the total amount outstanding to $2 billion.

Investors responded positively to the deal, which follows similar

offerings in 2016 and 2017; Citi issued a $2.5 billion bond

offering in March of 2017 and a $1.5 billion bond offering in March

of 2016. In both transactions, Citi worked with women-owned firms

to syndicate the bonds.

"MFR Securities is pleased to participate in this transaction

with Citi and these outstanding firms," said Maria Fiorini Ramirez,

Owner of MFR Securities, Inc. "It is particularly meaningful to be

part of a syndicate composed of predominantly women-owned

businesses, and we appreciate Citi's efforts to highlight the

importance of diversity through its business activities."

“We are proud to continue our work with these firms, which once

again provided exceptional support and execution for the issuance,”

said Tyler Dickson, Head of Global Capital Markets Origination at

Citi. “Diversity represents a core value for Citi, and this

transaction provides a great example of our deep commitment to

inclusion in everything that we do.”

Citi

Citi, the leading global bank, has approximately 200 million

customer accounts and does business in more than 160 countries and

jurisdictions. Citi provides consumers, corporations, governments

and institutions with a broad range of financial products and

services, including consumer banking and credit, corporate and

investment banking, securities brokerage, transaction services, and

wealth management.

Additional information may be found at www.citigroup.com |

Twitter: @Citi | YouTube: www.youtube.com/citi | Blog:

http://blog.citigroup.com | Facebook: www.facebook.com/citi |

LinkedIn: www.linkedin.com/company/citi

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180320006449/en/

Media:CitiRobert Julavits,

212-816-8020robert.w.julavits@citi.com

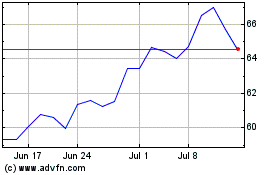

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024