Report of Foreign Issuer (6-k)

March 20 2018 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March 2018

Commission File Number: 000-53805

|

INTELLIPHARMACEUTICS INTERNATIONAL INC.

|

|

(Translation of registrant’s name into English)

|

|

|

|

30 WORCESTER ROAD

TORONTO, ONTARIO M9W 5X2

|

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

|

|

Form 20-F [X]

|

Form 40-F [_]

|

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

___

Note:

Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if

submitted solely to provide an attached annual report to security

holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

___

Note:

Regulation S-T Rule

101(b)(7) only permits the submission in paper of a Form 6-K if

submitted to furnish a report or other document that the registrant

foreign private issuer must furnish and make public under the laws

of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home

country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the

report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security

holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on

EDGAR.

This Report of Foreign Private Issuer on Form 6-K and the attached

exhibits shall be incorporated by reference into the

Company’s effective Registration Statements on Form F-3, as

amended and supplemented (Registration Statement Nos. 333-172796

and 333-218297), filed with the Securities and Exchange Commission,

from the date on which this Report is filed, to the extent not

superseded by documents or reports subsequently filed or furnished

by Intellipharmaceutics International Inc. under the Securities Act

of 1933 or the Securities Exchange Act of 1934.

On

March 19, 2018, Intellipharmaceutics International Inc. (the

“Company”) entered into Securities Purchase Agreements

(the “Purchase Agreements”) with certain institutional

investors (the “Purchasers”) providing for the purchase

and sale by the Company of an aggregate 3,000,000 common shares of

the Company, no par value (the “Common Shares”), at a

purchase price of US$0.60 per share. Concurrently with the sale of

the Common Shares, pursuant to the Purchase Agreements, the Company

also sold unregistered warrants to purchase up to an aggregate of

1,500,000 Common Shares (the “Warrants”). The aggregate

gross proceeds for the sale of the Common Shares and Warrants is

expected to be US$1,800,000. The Warrants will be initially

exercisable commencing six months from the issuance date at an

exercise price equal to US$0.60 per full Common Share, subject to

adjustments as provided under the terms of the Warrants. The

Warrants will expire thirty (30) months after the initial exercise

date. The closing of the sales of these securities under the

Purchase Agreements are expected to occur on or about March 21,

2018, subject to the satisfaction of customary closing

conditions.

The

net proceeds to the Company from the transactions, after deducting

the placement agent’s fees and expenses (not including the

Wainwright Warrants, as defined below), the Company’s

estimated offering expenses, and excluding the proceeds, if any,

from the exercise of the Warrants, are expected to be approximately

US$1,500,000. The Company currently intends to use the net proceeds

of this offering for general corporate purposes, which may include

working capital, capital expenditures, research and development,

accounts payable and other commercial expenditures.

The

Common Shares (but not the Warrants or the Common Shares underlying

the Warrants) were offered and sold by the Company through a

prospectus supplement pursuant to the Company’s shelf

registration statement on Form F-3, which was originally filed with

the Securities and Exchange Commission (the “SEC”) on

May 26, 2017 and subsequently declared effective on July 17, 2017

(File No. 333-218297) (the “Registration Statement”).

The Company will file a prospectus supplement and the accompanying

prospectus in connection with the sale of the Common

Shares.

The

Warrants and the shares issuable upon exercise of the Warrants are

being sold and issued without registration under the Securities Act

of 1933 (the “Securities Act”) in reliance on the

exemptions provided by Section 4(a)(2) of the Securities Act as

transactions not involving a public offering and Rule 506

promulgated under the Securities Act as sales to accredited

investors, and in reliance on similar exemptions under applicable

state laws.

The

Company also entered into an engagement letter (the

“Engagement Letter”) with H.C. Wainwright & Co.,

LLC (“Wainwright”) on March 18, 2018, pursuant to which

Wainwright agreed to serve as exclusive placement agent for the

issuance and sale of the Common Shares and Warrants. The Company

has agreed to pay Wainwright a cash fee equal to 7% of the

aggregate gross proceeds received by the Company from the sale of

the securities in the transactions. Pursuant to the Engagement

Letter, the Company also agreed to grant to Wainwright or its

designees warrants to purchase up to 5% of the aggregate number of

shares sold in the transactions and issued on closing (the

“Wainwright Warrants”). The Engagement Letter has

indemnity and other customary provisions for transactions of this

nature. The Wainwright Warrants have substantially the same terms

as the Warrants, except that the exercise price of the Wainwright

Warrants equals US$0.75 per share. The Wainwright Warrants and the

shares issuable upon exercise of the Wainwright Warrants will be

issued in reliance on the exemption from registration provided by

Section 4(a)(2) of the Securities Act as transactions not involving

a public offering and in reliance on similar exemptions under

applicable state laws. The Company will also pay Wainwright a

reimbursement for non-accountable expenses of US$35,000.00. In

addition, the Company will also pay a reimbursement for up to

US$10,000.00 for the out-of-pocket costs of clearing agent

settlement and financing.

The

forms of Purchase Agreement, the Warrant and the Wainwright

Warrant, as well as the Engagement Letter are filed as Exhibits

99.1, 99.2, 99.3 and 99.4, respectively, hereto. The foregoing

summaries of the terms of these documents do not purport to be

complete and are qualified in their entirety by reference to

Exhibits 99.1, 99.2, 99.3 and 99.4 hereto, which are incorporated

herein by reference.

A

copy of the opinion of Gowling WLG (Canada) LLP, relating to the

legality of the issuance and sale of the securities in the Offering

is attached as Exhibit 5.1 hereto.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

Intellipharmaceutics

International Inc.

(Registrant)

/s/ Andrew

Patient

|

|

Date: March 19, 2018

|

|

Andrew Patient

Chief Financial Officer

|

Exhibit Index

|

Exhibit No.

|

Description

|

|

|

|

|

5.1

|

Opinion of Gowling WLG (Canada) LLP as to the legality of the

securities offered.

|

|

|

|

|

23.1

|

Consent of Gowling WLG (Canada) LLP (included in opinion of Gowling

WLG (Canada) LLP filed as Exhibit 5.1).

|

|

99.1

|

Form of Securities Purchase Agreement dated March 19, 2018, by and

between Intellipharmaceutics International Inc. and the

purchasers.

|

|

|

|

|

99.2

|

Form of Warrant.

|

|

|

|

|

99.3

|

Form of Wainwright Warrant.

|

|

|

|

|

99.4

|

Engagement Letter by and between Intellipharmaceutics, Inc. and

H.C. Wainwright & Co., LLC dated March 18, 2018.

|

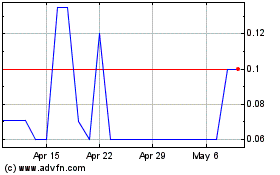

IntelliPharmaCeutics (QB) (USOTC:IPCIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

IntelliPharmaCeutics (QB) (USOTC:IPCIF)

Historical Stock Chart

From Apr 2023 to Apr 2024