Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

March 19 2018 - 7:56AM

Edgar (US Regulatory)

Filed by Cigna Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Cigna Corporation and Express Scripts Holding Company

(Commission File No.

001-08323

)

Date: March 19, 2018

Cigna-Express Scripts Combination - Questions and Answers

|

1.

|

What are the top reasons for buying Express Scripts?

|

|

•

|

Pharmacy is the most frequently consumed healthcare product for Americans and is the number one cause of gaps in care within the continuum of health. Our combination allows Cigna to fully leverage Express Scripts' leading pharmacy management capabilities, including its specialty pharmacy capabilities. Those capabilities provide end-to-end clinical, medical management and utilization support in a highly specialized and personalized way resulting in high consumer satisfaction, better treatment and better health outcomes.

|

|

•

|

When Express Scripts' leading pharmacy capabilities combine with Cigna's integrated medical offering and health services portfolio (e.g., consumer engagement support, population health management and behavioral services), it will focus care on the whole person and overall improvement in total health. Additionally the combination will, among other things:

|

|

o

|

Expand the reach of the combined company to generate sustained growth

via increased penetration of Express Scripts' pharmacy services into Cigna's existing integrated medical book of business, penetration of Cigna's health services, global services and integrated medical offering into Express Scripts' stand-alone pharmacy offerings, and growth of an enhanced, integrated health services offering (combining Express Scripts' pharmacy and Cigna's health services) into new geographies on a stand-alone basis.

|

|

o

|

Further improve affordability

through improved total cost of care, lower drug costs and deepened partnerships with value-based healthcare providers that allow the combined company to continue to drive best in class medical cost trend results.

|

|

o

|

Deliver differentiated financial results

with double digit accretion in year 1 and outstanding free cash flow, even when excluding the impact of the Express Scripts-Anthem relationship that is transitioning.

|

|

o

|

Create three well-positioned growth platforms

that provide optionality and flexibility in a dynamically changing global marketplace – Integrated U.S. Medical (in Cigna's "Go Deeper" markets); Integrated U.S. Services (with national scope targeting employers of all sizes, health plans and government agencies); and Global Employer and Individual platforms.

|

|

2.

|

Why did you decide to acquire Express Scripts now? Would it have been more advantageous to wait until the CVS-AET transaction closes, to learn from their regulatory review process?

|

|

•

|

We completed a strategic review of the landscape of opportunities and evaluated a broad set of potential actions, and we decided to proactively pursue this combination beginning in October 2017, as we feel it is the most effective means to accelerate our strategy.

|

|

•

|

Our evaluation included extensive consideration of the regulatory and competitive landscape.

|

|

•

|

We understand and respect that regulators are going to review the transaction closely, and we look forward to working proactively and efficiently with regulators to discuss the many benefits of the transaction.

|

|

•

|

We expect the Cigna-Express Scripts transaction to receive approval. This combination will enhance choice, alignment and transparency for customers, clients, health plans and healthcare professionals.

|

|

3.

|

How is the Cigna – Express Scripts deal different from other proposed combinations in the market such as CVS – Aetna?

|

|

•

|

Cigna and Express Scripts are two well positioned platforms, both operating from a position of financial strength.

|

|

•

|

Our combination enhances customer choice by allowing customers to access care in the way that best suits their needs (e.g., in a doctor's office, clinic, at home, etc).

|

|

•

|

Our combination is built on partnering with healthcare professionals to align incentives to improve health outcomes and reduce cost.

|

|

•

|

Our combination is a capital efficient approach that will bring, among other things, enhanced value-creating health services to our customers and clients that can be delivered through a variety of methods. We will not rely on a "bricks and mortar" model.

|

|

4.

|

How do you expect to drive 6-8% revenue growth given Express Scripts is growing in the low single digit range and will be approximately 2/3 of the revenue of the combined company?

|

|

•

|

We are very confident in our ability to achieve our target revenue goals as a combined company.

|

|

•

|

Specifically, we expect a number of new and enhanced growth opportunities including:

|

|

o

|

Cigna and Express Scripts have few employer customer overlaps (approximately 30%). There is a substantial cross-selling opportunity for each of our products and services in this area.

|

|

o

|

Express Scripts also services health plans and government entities. Cigna's health services capabilities and programs can be expanded into these areas.

|

|

o

|

Cigna currently operates a well-performing Seniors business, which is highly reliant on pharmacy services. Express Scripts' leading capabilities will drive lower drug costs for this population.

|

|

o

|

Cigna operates most competitively in its targeted "Go Deeper" geographies. By leveraging Express Scripts' stand-alone services capabilities, Cigna will be able to quickly expand and compete outside of its "Go Deeper" geographies. Greenfield opportunities exist in key geographies where neither Express Scripts nor Cigna have significant health plan relationships.

|

|

o

|

By leveraging Express Scripts' pharmacy management services, Cigna will be able to more deeply drive value-based models with healthcare providers and pharmaceutical manufacturers, thereby creating additional value for customers.

|

|

•

|

Overall, we continue to expect strong earnings performance from each of our growth platforms and would expect to deliver double digit accretion even when excluding the impact of the incremental growth targets.

|

|

5.

|

Can you provide more granularity on what your new services business will be?

|

|

•

|

We expect to establish an integrated health services platform that combines Express Scripts' leading pharmacy management capabilities and Cigna's suite of health services (e.g., consumer engagement support, population health management and behavioral services). This health services offering will focus on the care of the whole person in order to optimize health instead of focusing on sick care or high intervention-based treatments.

|

|

•

|

This health services offering may be sold as part of Cigna's integrated medical offering to employers or on a stand-alone basis to employers, health plans and government entities.

|

|

6.

|

Why do you need another growth platform when you already have four strong platforms?

|

|

•

|

We evaluated a broad portfolio of actions, and we proactively pursued the combination with Express Scripts beginning in October 2017, as it is the most effective means to accelerate our strategy.

|

|

•

|

It is also the most effective way to further build on industry-leading cost trend, creating a big step forward in affordability. It also creates access flexibility and strategic optionality.

|

|

7.

|

Does this mean you are less focused on government markets? What are the implications for the long term mix of businesses for the combined company?

|

|

•

|

Our combination with ESRX will immediately enhance our offering in Medicare Advantage and Part D plans, adding the leading specialty pharmacy capabilities of Express Scripts and clinical management programs like Safeguard Rx to the suite of services we offer seniors to keep them healthy in our collaborative care model.

|

|

•

|

Our Medicare Advantage business continues to be one of our key growth drivers and we see significant additional opportunity in serving the Medicare Advantage population.

|

|

•

|

In addition, we look forward to serving government agencies at the federal and state level through our integrated health services platform, where we see an opportunity to serve the public sector with additional services ranging from behavioral health to population health services.

|

|

8.

|

How have Express Scripts' health plan clients reacted to the announcement of this transaction?

|

|

•

|

We will be pleased to, and see great value in, continuing to serve and drive value for each of Express Scripts' health plan clients through an integrated services platform that will be separate, distinct and firewalled off from the medical platform. After the closing, the integrated services platform of the combined company will continue to service other health plans, including Cigna.

|

|

•

|

Consistent with our standard practice, we do not comment on specific client conversations, but understand health plans have significant interest in learning more about the benefits they will realize from the expanded suite of services offered through a more integrated services platform.

|

|

•

|

Express Scripts' health plan clients have received great service from Express Scripts in the past and the combined company will continue to provide that that same level of service following the combination.

|

|

9.

|

Wouldn't the loss of its independent status weaken Express Scripts' value proposition for health plans that preferred not to partner with a PBM which is owned by another health plan? Isn't the independence a key driver of Express Scripts' existing revenue growth expectations?

|

|

•

|

Broadly speaking, the marketplace increasingly recognizes that the current health care system is not sustainable, and that greater value can be realized through enhanced affordability of solutions that are delivered in a highly personalized fashion.

|

|

•

|

We are excited to broaden the portfolio of offerings (for example, with behavioral health and other services) for the benefit of customers, clients and health plans.

|

|

•

|

Health plans, similar to all of Express Scripts' clients, are looking for innovative solutions and effective cost control. Express Scripts has generated effective cost trend results over the years, including for 2017 wherein pharmaceutical cost trend was contained to an overall 1.5% across their commercial client base.

|

|

•

|

We understand that Express Scripts health plan client feedback from this past renewal season reinforced that the ability to innovate, and to offer differentiated and value-added solutions, was critical to their decision to partner.

|

|

•

|

The combined company's integrated services platform will be separate, distinct and walled off from the integrated medical platform with appropriate firewalls and security protocols between the two.

|

|

10.

|

What did you assume for the lapse of existing Express Scripts clients - either employers or health plans because they liked the standalone model better?

|

|

•

|

We are confident that the combined company's integrated services platform will drive differentiated value for customers, clients and health plans through enhanced affordability of solutions that are delivered in a highly personalized fashion.

|

|

•

|

In our evaluation process, we evaluated and stress-tested a range of potential scenarios, providing for various key operational and financial assumptions including announced client departures from Express Scripts and projected retention.

|

|

•

|

We understand the initial feedback Express Scripts has received from clients has been very encouraging.

|

|

•

|

We are confident that innovation, cost control and service remain the primary drivers for clients' decisions, which puts the combined company in a very good position for maintaining high levels of retention.

|

|

•

|

In consideration of the potential risks and opportunities within the wide range of scenarios we evaluated, we feel very comfortable with the value that this combination would create for our customers, clients, health plans, health care partners, and as a result, for our shareholders.

|

|

11.

|

A common view within the investment community is that Express Scripts margins are likely to compress over time due to competitive and/or regulatory pressures, and potential disruption from new entrants to the space such as Amazon. What is your view of the long-term sustainability of Express Scripts' margins?

|

|

•

|

Broadly speaking, we believe the key to maintaining or expanding margins is ongoing innovation and value delivery for the benefit of customers, clients and health care partners. Both Cigna and Express Scripts have a proven track record of doing just that, and will be well positioned to continue doing so by remaining highly focused on the needs of customers, clients and health care partners.

|

|

•

|

In our evaluation process, we evaluated and stress-tested a wide range of potential scenarios with respect to margin sustainability as well as many other key operational and financial assumptions.

|

|

•

|

We believe this combination will accelerate our ability to drive value creation through enhanced affordability and personalization of solutions. Importantly, customers, clients and health plans will directly benefit from synergies associated with improved medical and pharmacy costs and better clinical outcomes driven by the combined company, providing an opportunity to deepen and expand these relationships with additional value-added solutions.

|

|

•

|

Express Scripts has a long history of maintaining and improving margins in tough competitive environments. It is clear to us that their shared savings model, focused on client alignment, enables them to outperform the market.

|

|

•

|

The combined company would welcome the opportunity to work with Amazon or other new market entrants that are interested in improving health care.

|

|

•

|

On the strength of the combined company's growth platforms, each of which is focused on delivering affordable, personalized solutions, we expect to deliver annual after-tax earnings growth at or above high-single digits

|

|

12.

|

What are the practical benefits of this deal to consumers?

|

|

•

|

The combined company will offer consumers greater choice of health care services, more meaningful coordination between individuals and their health care providers, and greater value by delivering services that are more transparent and affordable.

|

|

•

|

Take the example of Sarah, a 47-year-old mother and executive, who is active in her community. She has been dealing with chronic severe abdominal pain – and her doctor is unaware that she is seeing a psychologist for associated depression. We educate Sarah's doctor about her situation; she coordinates and changes her pain medication and antidepressants as a result. This alone gives Sarah a more positive outlook on her ability to lead a more normal life.

|

|

•

|

We know that people who suffer from a chronic disease are six times more likely to suffer from a mental health issue and that by integrating medical, behavioral, pharmacy and specialty pharmacy services, we can help customers like Sarah live healthier lives.

|

|

13.

|

How will this deal drive better affordability? Will it lower drug costs and, if so, how? How can you ensure that those benefits are actually delivered? What are the specific performance measures to point to?

|

|

•

|

Cigna and Express Scripts together will drive greater consumer affordability in several ways, most importantly, through overall improvement in total health and choices aligned to demonstrated value and outcomes. The combined company's vision is to be the connective fiber that pulls these existing elements together, creating meaningful choices for patients in ways that aggregate information to enable treatment of the whole person today, driving to a new definition of value and quality for our system.

|

|

•

|

There are additional steps that the combined company will take to drive affordability. First, through active management and coordination with pharmaceutical vendors, we will continue to deliver the best drug price to our customers and encourage outcomes-based contracting, driving more value consciousness through the supply chain. Second, we will work to make sure low cost alternatives like generics and biosimilars are available when medically appropriate. Third, our clinical management tools enable customers to work with their health care providers to get the right drug and the right dose at the right site of service aligned to clinical quality and in a way that is most convenient for the customer. The opportunity to partner more effectively with healthcare providers to drive further value creation is particularly evident with regard to clinically complex, high-cost specialty pharmaceuticals which present increasing challenges to consumers, employers and care provision.

|

|

•

|

With this combination:

|

|

o

|

We lock in best in class affordability and solutions for nearly 25% of today's total health benefit cost (medical plus pharmacy). Prescription drugs under both benefits are now nearly 1 in 4 dollars for Commercial clients and are expected to reach approximately 1 in 3 health benefit dollars in ten years.

|

|

•

|

More is/will be spent on prescription drugs than Inpatient Hospitalization costs.

|

|

o

|

We also lock in best in class capabilities in specialty drug management, specialty pharmacy delivery and customer/provider support capabilities under pharmacy and medical benefits, which are key today

and essential in the future

as:

|

|

•

|

Specialty drugs, across both benefits, represent nearly 65 % of total drug costs in commercial clients and, with the expected growth in specialty drugs, we expect them to represent upward of 80% in 10 years.

|

|

•

|

To put in another context, if total medical trend grows at 4.5% per year over the next decade, specialty drugs (across benefits) are expected to account for nearly 45% of the total annual medical trend increase in ten years, or, 2% out of the 4.5% trend.

|

|

•

|

Cigna's core commercial and seniors businesses are structured to provide transparency which drives affordability which flows through to our customers. Our employer business is 85 percent administrative services only (ASO) where our clients pay health care claims directly and work with us to lower their medical cost trend, which overall is the lowest in the industry. Any medical savings derived under an ASO arrangement inure directly to the customer. Our Medicare Advantage business is subject to medical loss ratio (MLR) rules and we return any excess revenue over a legally specified amount.

|

|

•

|

Negotiating discounts with pharmaceutical manufacturers in the form of rebates is one mechanism to produce lowest net cost options for certain drugs. Pharmaceutical rebates will be governed by contractual agreements between the combined company, on the one hand, and customers (i.e., employers, health care plans and government entities) on the other hand and generally provide for the sharing of the rebate dollars. The combined company will be positioned to allow individual consumers to also share in those rebates at the point-of-sale as determined by the relevant employer, health plan or government entity.

|

7

|

14.

|

How will this deal drive incremental transparency as compared to what is provided today?

|

|

•

|

Cigna has a strong history of driving greater transparency in health care. Cigna was one of the first health service companies to post cost and quality comparisons for specific episodes of care online, rating providers on their clinical quality and value, to help our customers choose the right health care professional for them.

|

|

•

|

Our transparency has also extended to our employer clients, as one of the only health services companies to provide population health reports to companies with less than 100 employees to help our clients understand health trends on their team and help them take meaningful moves to improve employee health and reduce their health care spending.

|

|

•

|

Cigna and Express Scripts both offer consumer tools that help individuals understand the cost of their medicines, learn about more affordable alternatives and receive them in the manner most convenient to them.

|

|

•

|

Together we will continue to pursue transparency on the cost of drugs and available options, in partnership with health care professionals, to ensure that customers have the information they need to make the best choice for their health and their wallet.

|

|

15.

|

Can you provide specifics on how this deal improves customer choice?

|

|

•

|

We are committed to an open access and choice model for our customers.

|

|

•

|

We won't require customers to go to specific sites of care – ensuring that they have breadth of access.

|

|

16.

|

How specifically does acquiring Express Scripts improve each company's ability to win in its current markets? New markets?

|

|

•

|

This combination opens up new venues for both companies and brings best in class capabilities to additional customers and geographies.

|

|

o

|

Cigna and Express Scripts have very few employer customer overlaps (approximately 30%).There is a substantial cross-selling opportunity for each of our products and services in this area.

|

|

o

|

Express Scripts also services health plans and government entities. Cigna's capabilities to partner effectively with health plans and other payors in a deep services strategy will be greatly expanded.

|

|

o

|

Cigna currently operates a well-performing Seniors business, which is highly reliant on pharmacy services. Express Scripts' leading capabilities will drive lower drug costs for this population.

|

|

o

|

Greenfield opportunities exist in key geographies where neither Express Scripts nor Cigna have significant health plan relationships.

|

|

o

|

Cigna operates most competitively in its targeted "Go Deeper" geographies. By leveraging Express Scripts' stand-alone services capabilities, Cigna will be able to quickly expand and compete outside of its "Go Deeper" geographies.

|

|

o

|

By leveraging Express Scripts' pharmacy management services, Cigna will be able to more deeply drive value-based models with healthcare providers and pharmaceutical manufacturers, thereby creating additional value for the combined company's customers, clients and partners, and as a result, shareholders.

|

|

17.

|

Why did Cigna choose this transaction rather than other alternatives?

|

|

•

|

We evaluated a broad portfolio of actions, and we proactively pursued the combination with Express Scripts beginning in October 2017, as it is the most effective means to accelerate our strategy. It is also the most effective way to further build on industry-leading cost trend, which enhances affordability.

|

|

•

|

We continue to view the U.S. employer market as an attractive growth market, and this provides an expansion of capabilities needed to offer transparent, market-leading capabilities to companies.

|

|

18.

|

Why did you do a deal that embeds you in a space (i.e., commercial) that is under attack from new entrants?

|

|

•

|

We view the JPMC/Amazon/Berkshire announcement as consistent with what we have described and continue to describe as an unsustainable health care system. We welcome additional voices to change the status quo, and we believe there are potential partnership opportunities.

|

|

19.

|

Is this a defensive transaction for Cigna?

|

|

•

|

We evaluated a broad portfolio of actions, and we proactively pursued the combination with Express Scripts beginning in October 2017, as it is the most effective means to accelerate our strategy.

|

|

•

|

Express Scripts became a preferred option due to its market-leading capabilities.

|

|

•

|

We believe that a combination with Express Scripts will:

|

|

o

|

Further accelerate our strategy of delivering personalized health care solutions to the market that optimize health and wellness;

|

|

o

|

Fuel our sustained growth by expanding our segment and geographical reach;

|

|

o

|

Further improve affordability and allow us to sustain our best in class medical cost trend;

|

|

o

|

Deliver differentiated financial results for our shareholders;

|

|

o

|

Create flexibility and optionality through the creation of three attractive and well-positioned growth platforms: (1) Integrated U.S. Medical (in "Go Deeper" States); (2) Integrated U.S. Services (with national scope targeting employers of all sizes, health plans and governmental agencies); and (3) Global Employer and Individual.

|

|

20.

|

How extensive was the due diligence work you performed on Express Scripts?

|

|

•

|

We took the decision of whether to pursue and enter into this transaction very seriously at the highest levels of our organization.

|

|

•

|

We conducted an extensive evaluation of Express Scripts, and are comfortable with the depth of understanding we gained in this context over key matters pertaining to Express Scripts' business.

|

|

•

|

We believe that this combination will accelerate our ability to drive value creation for our customers, clients, health plans and health care partners and as a result, our shareholders

|

|

21.

|

In valuing Express Scripts, what did you assume relative to the loss of the Anthem business?

|

|

•

|

We conducted an extensive evaluation of Express Scripts, and are comfortable with the depth of understanding we gained in this context over key matters pertaining to Express Scripts' business.

|

|

•

|

We expect to continue serving Express Scripts' customers, including its health plan clients. Even when excluding the effect of Anthem business, we expect this transaction to be highly accretive in the first full year following closing.

|

|

22.

|

How did you get comfortable with the exposure from the litigation that Express Scripts has with Anthem?

|

|

•

|

We conducted an extensive evaluation of Express Scripts, and are comfortable with the depth of understanding we gained in this context over key matters pertaining to Express Scripts' business.

|

|

•

|

Consistent with our standard practice, we do not comment on pending litigation matters.

|

|

23.

|

What is your reaction to the stock price? Is this a signal that you overpaid for Express Scripts?

|

|

•

|

While it is not unusual for the acquirer's stock to decline and the target's stock to increase in a large, complex transaction, we were disappointed by the market's initial reaction.

|

|

•

|

We view the response as a need to digest the transaction by our investors as they evaluate how we, together with Express Scripts, will build sustained growth in a highly fragmented and dislocated market.

|

|

•

|

We continue to focus on building upon our proven track record of delivering differentiated top line and bottom line growth and shareholder value, and we believe that the Express Scripts combination will position us well over the long-term to continue to do so.

|

|

24.

|

What does this mean for your arrangement with Optum? How quickly will you exit that deal?

|

|

•

|

We currently offer pharmacy benefits coverage and services that deliver value to our customers and clients.

|

|

•

|

We contract with Optum to perform certain defined functions to support that benefit and services offering; we have been pleased with that relationship.

|

|

•

|

The focus of our combination with Express Scripts does not lie in swapping out Optum's defined services for those of Express Scripts.

|

|

•

|

The best interest of our customers, clients and partners, and as a result, our shareholders, will guide how we manage our relationship with Optum and ensuring that we do not create unnecessary disruption for any of them.

|

|

25.

|

Will you continue to provide services to health plans? If you do, won't you be competing with yourselves?

|

|

•

|

As previously noted, the combined company will continue to focus on and serve customers, clients, health plans health care partners.

|

|

•

|

Today, Express Scripts serves regional health plans that need key services (including pharmacy, medical utilization management, behavioral, dental and population health) that the combined company will offer in the integrated services platform we are creating. Express Scripts has already shown sustained momentum in their health plan clients adopting pharmacy, specialty and eviCore services, as well as integrated services like SafeguardRx and other tools.

|

|

•

|

This combination creates an integrated services platform to further develop tools with a health plan first focus.

|

|

•

|

The combined company will operate three growth platforms, including an integrated services platform that will be separate, distinct and completely walled off from the integrated medical platform with appropriate firewalls and security protocols between the two.

|

|

•

|

This will allow the integrated services platform to securely serve our health plan customers while providing them access to the full suite of service offerings (e.g., behavioral, pharmacy, consumer support and population health) of the combined company.

|

|

•

|

The combined company will benefit from these growth and expansion opportunities and the health plans will benefit from added value of the expanded suite of services.

|

|

26.

|

What is the timing for the regulatory review of the transaction? Do you expect any regulatory issues?

|

|

•

|

The transaction, which is expected to be completed by December 31, 2018, is subject to the approval of Cigna and Express Scripts shareholders and the satisfaction of customary closing conditions, including applicable regulatory approvals.

|

|

•

|

We understand and respect that regulators will review the transaction closely. We look forward to working proactively and efficiently with regulators to discuss the many benefits of the transaction, and are optimistic in our ability to obtain regulatory approval.

|

|

•

|

Cigna and Express Scripts have complementary businesses, and we are confident that the combination of those businesses will result in numerous pro-competitive benefits for customers, clients, customers, and health plans.

|

|

•

|

This combination will expand choice, lower costs, increase innovation, and enhance alignment and transparency for customers, clients, and healthcare professionals.

|

|

•

|

The combined company will operate in what will continue to be a highly competitive health services marketplace with many options for customers, clients and health plans.

|

|

27.

|

Will the antitrust regulators review the Cigna-Express Scripts and CVS-Aetna together, or independently?

|

|

•

|

We wouldn't want to speculate about how the regulatory process will work, but of course regulators are aware of both pending transactions.

|

|

•

|

Overall, we are confident that the pro-competitive benefits of our deal stand on their own regardless of other pending transactions.

|

|

•

|

We expect the Cigna-Express Scripts transaction to receive approval. This combination will enhance choice, alignment and transparency for customers, clients and healthcare professionals.

|

|

28.

|

When will the proxy statement be filed, and when will the Cigna shareholder vote take place?

|

|

•

|

We are working expeditiously to file the registration statement, which will contain a joint proxy statement / prospectus, but have not set a definitive filing date.

|

|

•

|

We will announce a definitive date for the Cigna and Express Scripts shareholder votes when we have more visibility into the SEC process and timeline.

|

|

29.

|

You said you will reduce leverage into the 30s within 18-24 months following closing of the transaction. Does this mean the mid-30s debt to capitalization ratio target that you've stated is a normalized level for your business? How much debt would have to be repaid to achieve a debt to capitalization level in the 30s?

|

|

•

|

We expect the combined company to have a capital efficient operating model and we expect it to generate very strong ongoing free cash flows, as a result of the differentiated value it will deliver in the marketplace.

|

|

•

|

Within 18-24 months following closing of the transaction, by prioritizing debt repayment we expect to reduce our debt-to-capitalization to a level below 40%. This estimate is consistent with a reduction in pro forma total debt of approximately $41 billion at closing to approximately $33 billion.

|

|

•

|

Importantly, over this two year period, we would also have further capital deployment capacity beyond this debt repayment, which we would look to deploy for the benefit of shareholders consistent with our long-term capital deployment priorities.

|

|

30.

|

You've targeted $600 million in annualized synergies, mainly from administrative efficiencies. Where will these efficiencies come from and what is the expected timing of their realization?

|

|

•

|

"Administrative" efficiencies in this context refers to efficiencies with respect to the administration of our full operating model, following closing, including the managed care components of our business and the PBM operations of Express Scripts.

|

|

•

|

Within Express Scripts, for example, this means we will realize synergies in the full services platform, from claims adjudication and supply chain management to PBM services, which is consistent with our health services growth platform.

|

|

•

|

Naturally, there will be synergistic value in consolidating duplicate capabilities between the entities. These too will result in significant savings for the combined company.

|

|

31.

|

Are there synergies above and beyond the administrative aspects of the business?

|

|

•

|

Yes. In addition to the $600 million in annualized synergies that are mainly administrative in nature, we also expect the Cigna-Express Scripts combination to generate meaningful additional synergies that will primarily be passed through to customers, clients and health care partners through a broader set of solutions and improved medical and pharmacy costs.

|

FORWARD LOOKING STATEMENTS

Information included or incorporated by reference in this communication, and information which may be contained in other filings with the Securities and Exchange Commission (the "SEC") and press releases or other public statements, contains or may contain forward-looking statements. These forward-looking statements include, among other things, statements of plans, objectives, expectations (financial or otherwise) or intentions.

Forward-looking statements, including as they relate to Express Scripts ("Express Scripts") or Cigna ("Cigna"), the management of either such company or the transaction, involve risks and uncertainties. Actual results may differ significantly from those projected or suggested in any forward-looking statements. Express Scripts and Cigna do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events. Any number of factors could cause actual results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the risks associated with the following:

|

•

|

the inability of Express Scripts and Cigna to obtain stockholder or regulatory approvals required for the merger or the requirement to accept conditions that could reduce the anticipated benefits of the merger as a condition to obtaining regulatory approvals;

|

|

•

|

a longer time than anticipated to consummate the proposed merger;

|

|

•

|

problems regarding the successful integration of the businesses of Express Scripts and Cigna;

|

|

•

|

unexpected costs regarding the proposed merger;

|

|

•

|

diversion of management's attention from ongoing business operations and opportunities;

|

|

•

|

potential litigation associated with the proposed merger;

|

|

•

|

the ability to retain key personnel;

|

|

•

|

the availability of financing;

|

|

•

|

effects on the businesses as a result of uncertainty surrounding the proposed merger; and

|

|

•

|

the industry may be subject to future risks that are described in SEC reports filed by Express Scripts and Cigna.

|

You should carefully consider these and other relevant factors, including those risk factors in this communication and other risks and uncertainties that affect the businesses of Express Scripts and Cigna described in their respective filings with the SEC, when reviewing any forward-looking statement. These factors are noted for investors as permitted under the Private Securities Litigation Reform Act of 1995. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider either foregoing lists, or the risks identified in SEC filings, to be a complete discussion of all potential risks or uncertainties.

IMPORTANT INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In connection with the proposed transaction, the newly formed company which will become the holding company following the transaction ("Holdco") intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Cigna and Express Scripts that also constitutes a prospectus of Holdco. Cigna and Express Scripts also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Holdco, Cigna and Express Scripts with the SEC at the SEC's website at www.sec.gov. Copies of documents filed with the SEC by Cigna will be available free of charge on Cigna's website at www.Cigna.com or by contacting Cigna's Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts' website at www.express-scripts.com or by contacting Express Scripts' Investor Relations Department at (314) 810-3115.

PARTICIPANTS IN THE SOLICITATION

Cigna (and, in some instances, Holdco) and Express Scripts and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Investors may obtain information regarding the names, affiliations and interests of directors and executive officers of Cigna (and, in some instances, Holdco) in Cigna's Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 28, 2018, and its definitive proxy statement for its 2018 Annual Meeting, which was filed with the SEC on March 16, 2018. Investors may obtain information regarding the names, affiliations and interests of Express Scripts' directors and executive officers in Express Scripts' Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 27, 2018, and its proxy statement for its 2017 Annual Meeting, which was filed with the SEC on March 17, 2017. You may obtain free copies of these documents at the SEC's website at www.sec.gov, at Cigna's website at www.Cigna.com or by contacting Cigna's Investor Relations Department at (215) 761-4198. Copies of documents filed with the SEC by Express Scripts will be available free of charge on Express Scripts' website at www.express-scripts.com or by contacting Express Scripts' Investor Relations Department at (314) 810-3115. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction if and when they become available. Investors should read the joint proxy statement/prospectus carefully and in its entirety when it becomes available before making any voting or investment decisions.

NO OFFER OR SOLICITATION

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

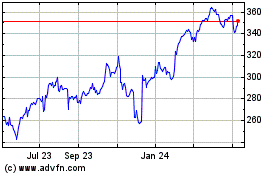

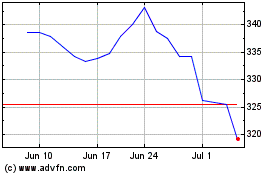

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024