Oracle Earnings: What to Watch

March 19 2018 - 5:59AM

Dow Jones News

By Jay Greene

Oracle Corp. is set to report financial results for its fiscal

third quarter after the close of trading Monday. Here's what you

need to know:

EARNINGS FORECAST: Analysts surveyed by S&P Global Market

Intelligence expect Oracle to report adjusted profit of 72 cents a

share for the quarter that ended in February, up from 69 cents a

year earlier. Net income was 53 cents a share a year ago.

REVENUE FORECAST: Analysts expect Oracle to post adjusted

revenue of $9.77 billion, up from $9.27 billion a year earlier. The

company reported $9.21 billion in non-adjusted revenue a year

ago.

WHAT TO WATCH:

CLOUDY FORECAST: Oracle shares slid in the previous two quarters

after the company provided guidance for its cloud-computing

business that was below analyst expectations. Three months ago, the

company forecast cloud revenue growth of 21% to 25%, not the 30%

analysts had expected. "Investor expectations have been reset

enough to provide room for a beat this quarter," Barclays analyst

Raimo Lenschow wrote in a recent report. He expects cloud revenue

at the business software giant to climb 25.4% in the period.

CAPEX WATCH: Oracle announced plans in February to open 12 giant

data-center complexes over the next two years, quadrupling the

global footprint of its most advanced facilities as it tries to

grab a larger slice of the cloud-infrastructure market that

Amazon.com Inc. dominates. Those huge data center operations, known

as "regions" in industry-speak, can cost hundreds of millions of

dollars a piece to build. The expansion has led some analysts to

wonder if Oracle's capital spending will climb as a result. Last

month, Deutsche Bank analyst Karl Keirstead quadrupled his

estimated growth rate for the company's capital spending in fiscal

2019 to 8% from 2% in a research report. Keirstead now expects the

business software giant to spend $2.16 billion in fiscal 2019. That

would still pale to Oracle's three biggest U.S.

cloud-infrastructure rivals -- Amazon, Microsoft Corp. and Alphabet

Inc.'s Google -- which reported $41.6 billion combined in capital

expenditures and capital-lease deals in the last calendar year.

Analysts are likely to look for any signs of significant capital

spending growth.

RIVAL REPORTS: Enterprise software companies that have recently

reported results have notch gains on strong tech spending from

their corporate customers. In a recent report, Sanford C. Bernstein

& Co. analyst Mark Moerdler cited comments from Workday Inc.,

Salesforce.com Inc., and VMware Inc. about improved spending as

reason to believe that Oracle will benefit as well, particularly in

sales of software that customers run in their own data centers. "As

we have already seen for the past two quarters, Oracle had better

than expected performance in on-premise license revenue segment, we

expect Oracle to continue to post better than expected results for

on-premise license revenue," Mr. Moerdler wrote.

(END) Dow Jones Newswires

March 19, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

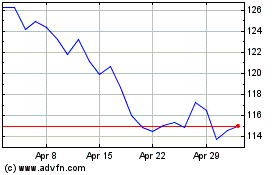

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

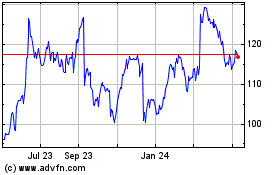

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024