CACI Makes Bid for CSRA, Seeking to Break Up General Dynamics Deal -- Update

March 19 2018 - 12:50AM

Dow Jones News

By Dana Mattioli and Doug Cameron

CACI International Inc. has made a roughly $7.2 billion bid to

buy CSRA Inc. in an attempt to break up the information-technology

provider's sale to General Dynamics Corp.

CACI has offered $44 per share in cash and stock, the company

said in a statement Sunday, confirming an earlier report by The

Wall Street Journal. The bid consists of $15 a share in cash and

the rest in stock. That compares with the $40.75-a-share all-cash

deal CSRA agreed to last month with General Dynamics that has yet

to close.

CSRA on Sunday confirmed receiving the unsolicited proposal from

CACI and said it would review it, though the board continued its

support for General Dynamics' offer.

It would be a big bite for Arlington, Va.-based CACI, which has

a market value of just under $4 billion even after its shares

closed at an all-time high Friday. It could have a difficult time

outgunning General Dynamics, a major aerospace-and-defense

contractor with a market value of $66 billion.

In a separate statement Sunday, CACI raised its forecast for net

income and the lower end of its revenue guidance for fiscal

2018.

General Dynamics late Sunday said that it would continue its

tender offer for CSRA that is due to close on April 2, and

questioned elements of CACI's unsolicited bid.

"We believe the nominal price of CACI's offer to CSRA overstates

the real value to the CSRA shareholders and understates the risk

attendant to it," General Dynamics said in a statement.

CSRA was approached by two companies early last year about a

potential combination, according to a prior regulatory filing,

triggering a three-way battle that General Dynamics appeared to

have won. CACI was one of those companies, according to people

familiar with the discussions.

Its latest move comes amid a scramble for greater scale among

companies supplying the Pentagon and other government agencies with

IT and analytic services.

Rising defense budgets and the boom in commercial jetliner sales

have fueled a surge in deal-making in the aerospace and defense

sectors.

Last year, United Technologies Corp. agreed to buy Rockwell

Collins Inc. for $23 billion in a deal that would create one of the

world's biggest aircraft-equipment makers. Northrop Grumman Corp.

struck a deal to buy defense contractor Orbital ATK Inc. for $7.8

billion.

Government departments are going through a major refresh of

antiquated IT systems, including switching more services to the

cloud and boosting cybersecurity. That has helped fuel deal-making

over the past five years, with CACI buying intelligence specialist

Six3 Systems Inc. and the IT arm of L-3 Communications Holdings

Inc.

Other big providers include Leidos Inc., which bought the IT arm

of Lockheed Martin Corp. to create an industry leader with forecast

sales of $10.6 billion this year.

CSRA is forecast to have sales of $5.4 billion this year and has

some of the highest margins in the sector. A purchase of the

company would double the size of General Dynamics' federal IT

business.

CACI and General Dynamics' IT arm were both forecast to have

revenues of $4.5 billion this year.

CSRA was formed two years ago when Computer Sciences Corp.

merged its federal arm with SRA International Inc., renaming the

remaining business DXC Technology Co.

DXC plans to bundle more federal IT assets, including two firms

acquired from private-equity investor Veritas Capital, into a new

stand-alone public company in May. Some analysts had expected CACI

to consider a bid for the as-yet unnamed company, which would have

annual sales around $4 billion.

Write to Dana Mattioli at dana.mattioli@wsj.com and Doug Cameron

at doug.cameron@wsj.com

(END) Dow Jones Newswires

March 19, 2018 00:35 ET (04:35 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

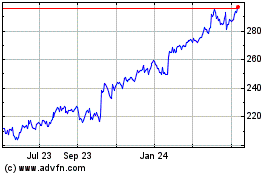

General Dynamics (NYSE:GD)

Historical Stock Chart

From Mar 2024 to Apr 2024

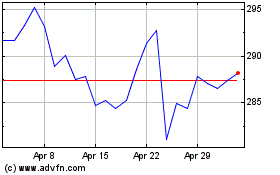

General Dynamics (NYSE:GD)

Historical Stock Chart

From Apr 2023 to Apr 2024