Current Report Filing (8-k)

March 16 2018 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 16, 2018 (March 14, 2018)

_________________________

Marriott Vacations Worldwide Corporation

(Exact name of registrant as specified in its charter)

_________________________

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35219

|

|

45-2598330

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

6649 Westwood Blvd., Orlando, FL

|

32821

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (407) 206-6000

N/A

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement

On March 14, 2018, Marriott Vacations Worldwide Corporation (the “Company”) and certain of its subsidiaries entered into Omnibus Amendment No. 7 (the “Amendment”) to certain of the agreements associated with the $250 million warehouse credit facility that the Company and certain of its subsidiaries amended and restated in September 2014 (as amended by the Amendment, the “Warehouse Credit Facility”), including, among others: (1) the Third Amended and Restated Indenture and Servicing Agreement, dated as of September 1, 2014 (as subsequently amended, the “Indenture”), by and among Marriott Vacations Worldwide Owner Trust 2011-1 (the “Trust”), Marriott Ownership Resorts, Inc. (“MORI”), and Wells Fargo Bank, National Association (“Wells Fargo”); and (2) the Second Amended and Restated Sale Agreement, dated as of September 1, 2014 (as subsequently amended, the “Sale Agreement”), by and between MORI SPC Series Corp. and the Trust; and (3) the Third Amended and Restated Standard Definitions attached or incorporated into certain of the agreements associated with the Warehouse Credit Facility (as subsequently amended, the “Standard Definitions”).

The Warehouse Credit Facility allows for the securitization of vacation ownership notes receivable on a non-recourse basis. From time to time, MORI SPC Series Corp., a subsidiary of the Company, will sell to the Trust vacation ownership notes receivable that it purchases from MORI. Pursuant to the Indenture, the Trust will pledge such vacation ownership notes receivable to the Trustee to secure notes issued by the Trust. The advance rate for vacation ownership notes receivable securitized using the Warehouse Credit Facility varies based on the characteristics of the securitized vacation ownership notes receivable. As a result of the Amendment, the revolving period for the Warehouse Credit Facility has been extended to March 13, 2020. In addition, among other things, the Amendment reduced certain fees payable by the Company with respect to amounts available under the Warehouse Credit Facility

and added a reserve option that provides the Company with flexibility in complying with hedging requirements applicable to it under the Warehouse Credit Facility.

Wells Fargo also serves as the trustee and, in some cases, the back-up servicer with respect to certain other transactions involving the securitization of vacation ownership notes receivable undertaken by the Company’s subsidiaries. In addition, from time to time, the financial institutions that provide funding to the Company pursuant to the Warehouse Credit Facility or their affiliates have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for the Company and its affiliates for which they have received, and will receive, customary fees and expenses. In particular, these financial institutions or their affiliates are party to the Company’s revolving corporate credit facility and may also have participated in transactions involving the securitization of vacation ownership notes receivable undertaken by the Company’s subsidiaries.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are being filed herewith:

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

Omnibus Amendment No. 7, dated March 14, 2018, relating to, among other agreements, the Third Amended and Restated Indenture, by and among Marriott Vacations Worldwide Owner Trust 2011-1, Marriott Ownership Resorts, Inc., Wells Fargo Bank, National Association, MORI SPC Series Corp., Marriott Vacations Worldwide Corporation, the Purchasers signatory thereto, Deutsche Bank AG, New York Branch, Wilmington Trust, National Association, and MVCO Series LLC.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

MARRIOTT VACATIONS WORLDWIDE CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

Date: March 16, 2018

|

By:

|

/s/ John E. Geller, Jr.

|

|

|

Name:

|

John E. Geller, Jr.

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer

|

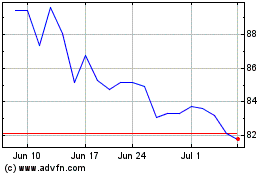

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

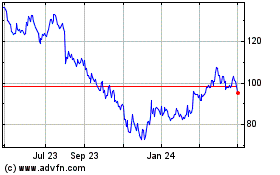

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Apr 2023 to Apr 2024