Filed Pursuant to Rule 424(b)(5)

Registration No. 333-218297

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 17, 2017)

INTELLIPHARMACEUTICS INTERNATIONAL INC.

5,833,334 Common Shares

We are

offering

5,833,334

common shares, no

par value. In a concurrent private placement, we are also selling

to purchasers of our common shares in this offering, warrants to

purchase up to 2,916,667 common shares

which represent 50% of the number of

our common shares being purchased in this offering. The warrants

and the common shares issuable upon the exercise of the warrants

are not being registered under the United States Securities Act of

1933, as amended, or the U.S. Securities Act, are not being offered

pursuant to this prospectus supplement and the accompanying

prospectus and are being offered pursuant to the exemption provided

in Section 4(a)(2) under the U.S. Securities Act and Rule 506(b)

promulgated thereunder.

Our

common shares are listed for trading on the Toronto Stock Exchange

(the

“

TSX

”

), and on the Nasdaq Capital Market

(

“

Nasdaq

”

), under the symbol

“

IPCI

”

. On March

14

, 2018, the closing sale

price of our common shares as reported by the TSX and Nasdaq was

Cdn$0.87 and $0.65, respectively. On March

14

, 2018, the aggregate

market value of our outstanding common shares held by

non-affiliates was $27,423,454, based on our 34,704,515 outstanding

common shares as of such date, of which 28,866,794 common shares

were held by non-affiliates, and a per share price of $0.95, the

closing sale price of our common shares on January 19, 2018 (which

is the highest closing sale price of our common shares in the last

60 days). We have sold or offered securities having an aggregate

market value of approximately $5,496,563 pursuant to General

Instruction I.B.5 of Form F-3 during the prior twelve calendar

month period that ends on and includes the date of this

prospectus

supplement.

Investing

in our securities involves a high degree of risk. You should review

carefully the risks and uncertainties described under the heading

“Risk Factors” contained in this prospectus supplement

beginning on page S-

4

, and under similar headings

in the other documents that are incorporated by reference into this

prospectus supplement.

We have

retained H.C. Wainwright

& Co., LLC, or Wainwright or the

placement agent, to act as our exclusive placement agent. The

placement agent has agreed to use its

“

reasonable best efforts

”

to arrange for the sale of the

common shares offered by this prospectus supplement. The placement

agent has no obligation to buy any of the common shares from us or

to arrange for the purchase or sale of any specific number or

dollar amount of the common shares. There is no required minimum

number of common shares that must be sold as a condition to

completion of this offering.

We have agreed to pay the placement

agent fees set forth in the table below, which assumes that we sell

all of the common shares we are offering.

|

|

PERSHARE

|

TOTAL

|

|

Offering

price

|

$

0.600

|

$

3,500,000.40

|

|

Placement agent

fees

(1)

|

$

0.042

|

$

245,000.03

|

|

Proceeds to us

before expenses

(2)

|

$

0.558

|

$

3,255,000.37

|

(1)

In addition, we

have agreed to reimburse the placement agent for offering expenses

in the non-accountable sum of $25,000

and for legal fees and

expenses up to $40,000. We have also agreed to issue to the

placement agent warrants in an amount equal to 5% of the number of

shares placed in this offering and issued on closing. See

“

Plan of

Distribution

”

on page

S-

26

of this

prospectus supplement for more information on the placement

agent

’

s

compensation.

(2)

Does not include

proceeds from the exercise of the warrants in cash, if any. We

estimate total expenses of this offering, excluding the placement

agent fees, will be approximately $247,234.

The

offering price of the common shares will be payable in U.S.

dollars. All of the net proceeds of this offering will be paid to

us in U.S. dollars.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement.

Any representation to the contrary is a criminal

offense.

We

expect to deliver the securities being offered pursuant to this

prospectus supplement on or about March

16

, 2018.

H.C. Wainwright & Co.

Prospectus Supplement dated

March

13

,

2018

TABLE OF CONTENTS

Prospectus Supplement

PROSPECTUS

|

TRADEMARKS

|

1

|

|

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING INFORMATION

|

1

|

|

WHERE YOU CAN FIND

MORE INFORMATION; INCORPORATION BY REFERENCE

|

4

|

|

FINANCIAL

INFORMATION

|

6

|

|

EXCHANGE RATE

INFORMATION

|

6

|

|

RISK

FACTORS

|

6

|

|

THE

COMPANY

|

31

|

|

CONSOLIDATED

CAPITALIZATION

|

35

|

|

USE OF

PROCEEDS

|

35

|

|

EXPENSES OF

ISSUANCE AND DISTRIBUTION

|

36

|

|

PLAN OF

DISTRIBUTION

|

36

|

|

RELATED PARTY

TRANSACTIONS

|

37

|

|

DESCRIPTION OF

SHARE CAPITAL

|

37

|

|

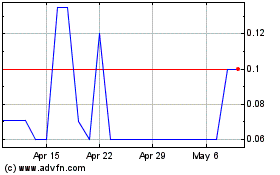

TRADING PRICE AND

VOLUME

|

39

|

|

PRIOR

SALES

|

40

|

|

DIVIDEND

POLICY

|

41

|

|

DESCRIPTION OF

WARRANTS

|

41

|

|

DESCRIPTION OF

SUBSCRIPTION RECEIPTS

|

42

|

|

DESCRIPTION OF

SUBSCRIPTION RIGHTS

|

43

|

|

DESCRIPTION OF

UNITS

|

44

|

|

CERTAIN UNITED

STATES FEDERAL INCOME TAX CONSIDERATIONS

|

44

|

|

CERTAIN CANADIAN

FEDERAL INCOME TAX CONSIDERATIONS

|

54

|

|

EXPERTS

|

56

|

|

LEGAL

PROCEEDINGS

|

56

|

|

LEGAL

MATTERS

|

56

|

|

TRANSFER AGENT AND

REGISTRAR

|

56

|

|

PURCHASERS’

STATUTORY RIGHTS

|

57

|

|

ENFORCEMENT OF

CERTAIN CIVIL LIABILITIES

|

58

|

|

DOCUMENTS FILED AS

PART OF THE REGISTRATION STATEMENT

|

58

|

|

DISCLOSURE OF

COMMISSION POSITION ON INDEMNIFICATION FOR U.S. SECURITIES ACT

LIABILITY

|

58

|

About this Prospectus Supplement

You should rely only on the information contained in or

incorporated by reference in this prospectus supplement, the

accompanying prospectus and in any free writing prospectus that we

have authorized for use in connection with this offering. We have

not, and the placement agent has not, authorized anyone to provide

you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it.

We are not, and the placement agent is not, making an offer to sell

common shares or seeking offers to buy common shares in any

jurisdiction where the offer or sale is not permitted. You should

assume that the information in this prospectus supplement, the

accompanying prospectus, the documents incorporated by reference in

this prospectus supplement and the accompanying prospectus, and in

any free writing prospectus that we have authorized for use in

connection with this offering, is accurate only as of the date of

those respective documents. Our business, financial condition,

results of operations and prospects may have changed since those

dates. You should read this prospectus supplement, the accompanying

prospectus, the documents incorporated by reference in this

prospectus supplement and the accompanying prospectus, and any free

writing prospectus that we have authorized for use in connection

with this offering, in their entirety before making an investment

decision. You should also read and consider the information in the

documents to which we have referred you in the section of this

prospectus supplement entitled “Where You Can Find More

Information; Incorporation by Reference” and the section of

the accompanying prospectus entitled “Where You Can Find More

Information; Incorporation by Reference.” In this prospectus

supplement, the “Company,”

“Intellipharmaceutics,” “we,”

“us” and “our” refer to

Intellipharmaceutics International Inc. and its

subsidiaries.

This

prospectus supplement and the accompanying prospectus form part of

a registration statement on Form F-3 that we filed with the

Securities and Exchange Commission, or SEC, using a

“shelf” registration process. This document contains

two parts. The first part consists of this prospectus supplement,

which provides you with specific information about this offering.

The second part, the accompanying prospectus, provides more general

information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we

are referring to both parts combined. This prospectus supplement

may add, update or change information contained in the accompanying

prospectus. To the extent that any statement we make in this

prospectus supplement is inconsistent with statements made in the

accompanying prospectus or any previously filed documents

incorporated by reference herein or therein, the statements made in

this prospectus supplement will be deemed to modify or supersede

those made in the accompanying prospectus and such documents

incorporated by reference herein and therein.

We

further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference into this prospectus

supplement or the accompanying prospectus were made solely for the

benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such

agreement, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when

made. Accordingly, such representations, warranties and covenants

should not be relied on as accurately representing the current

state of our affairs.

References to

“$,” “U.S.$” or “dollars” are

to U.S. dollars, and all references to “Cdn$” are to

the lawful currency of Canada. In this prospectus supplement, where

applicable, and unless otherwise indicated, amounts are converted

from U.S. dollars to Canadian dollars and vice versa by applying

the closing rate of exchange of the Bank of Canada on March

14,

2018. See

“Exchange Rate Information.” Except as otherwise

indicated, our consolidated financial statements and other

information are presented in U.S. dollars.

Any

reference in this prospectus supplement to our

“products” includes a reference to our product

candidates and future products we may develop.

Whenever we refer

to any of our current product candidates (including additional

product strengths of products we are currently marketing, no

assurances can be given that we, or any of our strategic partners,

will successfully commercialize or complete the development of any

of such product candidates or future products under development or

proposed for development, that regulatory approvals will be granted

for any such product candidate or future product, or that any

approved product will be produced in commercial quantities or sold

profitably.

In this

prospectus supplement, the accompanying prospectus and/or the

documents incorporated by reference herein or therein, we refer to

information regarding potential markets for our products, product

candidates and other industry data. We believe that all such

information has been obtained from reliable sources that are

customarily relied upon by companies in our industry. However, we

have not independently verified any such information.

This

prospectus supplement does not constitute, and may not be used in

connection with, an offer to sell, or a solicitation of an offer to

buy, any securities offered by this prospectus supplement by any

person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

Trademarks

Intellipharmaceutics™,

Hypermatrix™, Drug Delivery Engine™,

IntelliFoam™, IntelliGITransporter™,

IntelliMatrix™, IntelliOsmotics™, IntelliPaste™,

IntelliPellets™, IntelliShuttle™, Rexista™,

nPODDDS™, PODRAS™ and Regabatin™ are our

trademarks. These trademarks are important to our business.

Although we may have omitted the “TM” trademark

designation for such trademarks in this prospectus supplement, all

rights to such trademarks are nevertheless reserved. Unless

otherwise noted, other trademarks used in this prospectus

supplement are the property of their respective

holders.

This summary highlights information contained

elsewhere in this prospectus supplement or incorporated by

reference herein. This summary is not complete and may not contain

all of the information that you should consider before deciding

whether or not you should purchase the securities offered

hereunder. You should read the entire prospectus supplement and

accompanying prospectus carefully, including the section entitled

“Risk Factors” beginning on page

S-4

of

this prospectus supplement and the section entitled “Risks

Factors” in our annual report on Form 20-F for the fiscal

year ended November 30, 2017, and all other information included or

incorporated herein by reference in this prospectus supplement and

the accompanying prospectus before you decide whether to purchase

our securities.

Our Company

We are

a pharmaceutical company specializing in the research, development

and manufacture of novel and generic controlled-release and

targeted-release oral solid dosage drugs. Our patented

Hypermatrix™ technology is a multidimensional

controlled-release drug delivery platform that can be applied to

the efficient development of a wide range of existing and new

pharmaceuticals. Based on this technology platform, we have

developed several drug delivery systems and a pipeline of products

(some of which have received U.S. Food and Drug Administration, or

FDA, approval) and product candidates in various stages of

development, including abbreviated new drug applications, or ANDAs,

filed with the FDA (and one Abbreviated New Drug Submission, or

ANDS, filed with Health Canada) in therapeutic areas that include

neurology, cardiovascular, gastrointestinal tract, or GIT, diabetes

and pain.

We also

have new drug application, or NDA, 505(b)(2) specialty drug product

candidates in our development pipeline. These include our oxycodone

hydrochloride extended release tablets (previously referred to as

Rexista™), or Oxycodone ER, an abuse deterrent oxycodone

based on our proprietary nPODDDS™ novel Point Of Divergence

Drug Delivery System (for which an NDA has been filed with the

FDA), and Regabatin™ XR (pregabalin extended-release

capsules). The NDA 505(b)(2) pathway (which relies in part upon the

approving agency’s findings for a previously approved drug)

both accelerates development timelines and reduces costs in

comparison to NDAs for new chemical entities. An advantage of our

strategy for development of NDA 505(b)(2) drugs is that our product

candidates can, if approved for sale by the FDA, potentially enjoy

an exclusivity period which may provide for greater commercial

opportunity relative to the generic ANDA route.

Recent Developments

Nasdaq Notices

In

September 2017, we were notified by Nasdaq that we were not in

compliance with the minimum market value of listed securities

requirement set forth in Nasdaq Rules for continued listing on

Nasdaq. Nasdaq Listing Rule 5550(b)(2) requires listed securities

to maintain a minimum market value of $35.0 million. A failure to

meet the minimum market value requirement exists if the deficiency

continues for a period of 30 consecutive business days. Based on

the market value of our common shares for the 30 consecutive

business days from August 8, 2017, we no longer meet the minimum

market value of listed securities requirement. We were provided 180

calendar days, or until March 19, 2018, to regain compliance with

Nasdaq Listing Rule 5550(b)(2). To regain compliance, our common

shares must have a market value of at least $35.0 million for a

minimum of 10 consecutive business days. In the event we do not

regain compliance by March 19, 2018, we may be eligible for

additional time to regain compliance. If not, our securities may be

delisted from Nasdaq.

In

December 2017, we were notified by Nasdaq that the minimum bid

price per share for our common shares was below $1.00 for a period

of 30 consecutive business days and that we did not meet the

minimum bid price requirement set forth in Nasdaq Listing Rule

5550(a)(2). We have a period of 180 calendar days, or until June 4,

2018, to regain compliance with Nasdaq's minimum bid price

requirement. To regain compliance, our common shares musthave a

closing bid price of at least $1.00 for a minimum of 10 consecutive

business days. In the event we do not regain compliance by June 4,

2018, we may be eligible for additional time to regain compliance.

If not, our securities may be delisted from Nasdaq.

There can be no assurance

that we will be able to regain or maintain compliance with all

applicable Nasdaq continued listing standards. If our common shares

are delisted from Nasdaq, they may trade on the over-the-counter

market, which may be a less liquid market. In such case, our

shareholders’ ability to trade, or obtain quotations of the

market value of, our common shares would be severely limited

because of lower trading volumes and transaction delays. See

“—Risk Factors-- There can be no assurance that our

common shares will continue to trade on Nasdaq or another national

securities exchange.”

FDA Meetings

In July

2017, a joint meeting of the Anesthetic and Analgesic Drug Products

Advisory Committee and Drug Safety and Risk Management Advisory

Committee of the FDA, or the Advisory Committees, was held to

review our NDA for Oxycodone ER abuse-deterrent oxycodone

hydrochloride extended release tablets. The Advisory Committees

voted 22 to 1 in finding that our NDA for Oxycodone ER

abuse-deterrent oxycodone hydrochloride extended release tablets

should not be approved at that time. The Advisory Committees also

voted 19 to 4 that we did not demonstrate that Oxycodone ER has

properties that can be expected to deter abuse by the intravenous

route of administration, and 23 to 0 that there is not sufficient

data for Oxycodone ER to support inclusion of language regarding

abuse-deterrent properties in the product label for the intravenous

route of administration. The Advisory Committees expressed a desire

to review the additional safety and efficacy data for Oxycodone ER

that may be obtained from human abuse potential studies for the

oral and intranasal routes of administration.

In

February 2018, we and the FDA discussed a previously-announced

Complete Response Letter, or the CRL, for Oxycodone ER, including

issues related to the blue dye in the product candidate. Based on

the meeting, the product candidate will no longer include the blue

dye. The blue dye was intended to act as an additional deterrent if

Oxycodone ER is abused and serve as an early warning mechanism to

flag potential misuse or abuse. The FDA confirmed that the removal

of the blue dye is unlikely to have any impact on formulation

quality and performance. As a result, we will not be required to

repeat in vivo bioequivalence studies and pharmacokinetic studies

submitted in the Oxycodone ER NDA. The FDA also indicated that,

from an abuse liability perspective, Category 1 studies will not

have to be repeated on Oxycodone ER with the blue dye

removed.

Purported Class Action Litigation

In July

2017, three complaints were filed in the U.S. District Court for

the Southern District of New York asserting claims under the

federal securities laws against us and two of our executive

officers on behalf of a putative class of purchasers of our

securities. In a subsequent order, the Court consolidated the three

actions under the caption Shanawaz v. Intellipharmaceutics

Int’l Inc., et al., No. 1:17-cv-05761 (S.D.N.Y.), appointed

lead plaintiffs in the consolidated action, and approved lead

plaintiffs’ selection of counsel. For further information

regarding the purported class action, see “—Risk

Factors-- We operate in a highly litigious environment” and

“—Legal Proceedings.”

Patent Litigation

In

April 2017, we received notice that Purdue Pharma L.P., Purdue

Pharmaceuticals L.P., The P.F. Laboratories, Inc., or collectively

the Purdue parties, Rhodes Technologies, and Gr

ü

nenthal GmbH, or collectively the

Purdue litigation plaintiffs or plaintiffs, had commenced patent

infringement proceedings, or the Purdue litigation, against us in

the U.S. District Court for the District of Delaware in respect of

our NDA filing for our Oxycodone ER product candidate, alleging

that it infringes 6 out of the 16 patents associated with the

branded product OxyContin®,

or

the OxyContin

®

patents, listed in the FDA’s

Approved Drug Products with Therapeutic Equivalence Evaluations,

commonly known as the Orange Book. We are confident that we do not

infringe the subject patents, and will vigorously defend against

these claims. For further information regarding the patent

litigation, see “—Risk Factors-- We operate in a highly

litigious environment” and “--Legal

Proceedings.”

At-The-Market Termination

On

March 13, 2018, we terminated the continuous offering by us under

the prospectus supplement dated July 18, 2017 and prospectus dated

July 17, 2017 in respect of our at-the-market program. If we seek

to offer and sell common shares under our at-the-market program, we

will file another prospectus supplement prior to making such

additional offers and sales. We are not required to sell shares

under the equity distribution agreement. There can be no assurance

that any additional shares will be sold under our at-the-market

program. For further information regarding the at-the-market

program and sales thereunder, see “—Risk

Factors–A large number of our common shares could be sold in

the market in the near future, which could depress our stock

price.”

Our Corporate Information

We were

incorporated under the Canada Business Corporations Act by

certificate and articles of arrangement dated October 22, 2009. Our

registered principal office is located at 30 Worcester Road,

Toronto, Ontario, Canada M9W 5X2. Our telephone number is (416)

798-3001 and our facsimile number is (416) 798-3007. Our website

address is

http://www.intellipharmaceutics.com.

Information on or accessed through our website is not incorporated

into this prospectus supplement and is not a part of this

prospectus supplement. Our common shares are listed for trading on

the TSX and on Nasdaq under the symbol

“IPCI”.

There

can be no assurance that our products will be successfully

commercialized or produce significant revenues for us. Also, there

can be no assurance that we will not be required to conduct further

studies for our Oxycodone ER product candidate, that the FDA will

approve any of our requested abuse-deterrence label claims or that

the FDA will ultimately approve the NDA for the sale of our

Oxycodone ER product in the U.S. market, or that it will ever be

successfully commercialized, that we will be successful in

submitting any additional ANDAs or NDAs with the FDA or ANDSs with

Health Canada, that the FDA or Health Canada will approve any of

our current or future product candidates for sale in the U.S.

market and Canadian market, or that they will ever be successfully

commercialized and produce significant revenue for us. Also, there

can be no assurance that we can achieve Nasdaq’s minimum

market value of listed securities, minimum bid-price or other

requirements.

|

The Offering

|

|

Common shares we are offering:

|

5,833,334

shares

|

|

Offering price:

|

$0.60

per share

|

|

Common shares outstanding before this offering:

|

34,704,515

shares

|

|

Common shares to be outstanding after this offering:

|

40,537,849

shares

|

|

Concurrent private placement:

|

In a

concurrent private placement, we are selling to the purchasers of

common shares in this offering, warrants to purchase one-half the

number of common shares purchased by such purchasers in this

offering, or up to 2,916,667 of our common shares. The warrants

will be exercisable six months after issuance at an exercise price

of $0.60

per

share and will expire on the 30 month anniversary of the initial

exercise date. The warrants and the common shares issuable upon the

exercise of the warrants, are not being offered pursuant to this

prospectus supplement and the accompanying prospectus and are being

offered pursuant to the exemption provided in Section 4(a)(2) under

the U.S. Securities Act and Rule 506(b) promulgated thereunder. See

“Concurrent Private Placement

Transaction.”

|

|

Use of proceeds:

|

We

currently intend to use the net proceeds from this offering for

general corporate purposes, which may include working capital,

capital expenditures, research and development, accounts payable

and other commercial expenditures.

See

“Use of Proceeds” beginning on page S-11.

|

|

Nasdaq and TSX symbol:

|

IPCI.

See “-Recent Developments” above for important

information about the listing of our common shares on

Nasdaq.

|

|

Risk Factors:

|

Investing

in our securities involves substantial risks. You should carefully

review and consider the “Risk Factors” section of this

prospectus supplement for a discussion of factors to consider

before deciding to invest in our securities.

|

The

number of common shares shown above to be outstanding after this

offering is based on 34,704,515 shares outstanding as of March

14

, 2018 and

excludes, as of that date:

●

an aggregate of

5,669,835 common shares issuable upon the exercise of outstanding

options, with a weighted average exercise price of U.S.$3.13 per

common share;

●

up to 564,557

additional common shares that have been reserved for issuance in

connection with future grants under our stock option

plan;

●

an aggregate of

3,979,797 common shares issuable upon the exercise of outstanding

common share purchase warrants, with a weighted average exercise

price of U.S.$1.64

per common

share;

●

an aggregate of

102,791

deferred share

units;

●

an aggregate of

450,000 common shares issuable upon the conversion of an unsecured

convertible debenture held by Drs. Isa and Amina Odidi, our

principal stockholders, directors and executive officers, or the

Debenture (as defined below);

●

an aggregate of

2,916,667 common shares issuable upon the exercise of the warrants

to be issued in the concurrent private placement. See

“Concurrent Private Placement Transaction;”

and

●

an aggregate of

291,667 common shares issuable upon the exercise of the warrants to

be issued to the placement agent with an exercise price of

U.S.$0.75 as described in “Plan of

Distribution.”

Our past experience may not be indicative of future performance,

and as noted elsewhere in this prospectus supplement and documents

incorporated by reference into this prospectus supplement, we have

included forward-looking statements about our business, plans and

prospects that are subject to change. In addition to the other

risks or uncertainties contained in this prospectus supplement and

the accompanying prospectus and documents incorporated by reference

into this prospectus supplement, the following risks may affect our

operating results, financial condition and cash flows. If any of

these risks occurs, either alone or in combination with other

factors, our business, financial condition or operating results

could be adversely affected. Moreover, readers should note this is

not an exhaustive list of the risks we face. Some risks are unknown

or not quantifiable, and other risks that we currently perceive as

immaterial may ultimately prove more significant than expected.

Statements about plans, predictions or expectations should not be

construed to be assurances of performance or promises to take a

given course of action.

The “Risk Factors” beginning on page 6 of the

accompanying prospectus are incorporated by reference in this

prospectus supplement.

Risks Relating to this Offering

Our management will have broad discretion in allocating the net

proceeds of this offering, and may use the proceeds in ways with

which you disagree.

Our

management has significant flexibility in applying the net proceeds

we expect to receive in this offering. Because the net proceeds are

not required to be allocated to any specific product, investment or

transaction, and therefore you cannot determine at this time the

value or propriety of our application of those proceeds, you and

other shareholders may not agree with our decisions. In addition,

our use of the proceeds from this offering may not yield a

significant return or any return at all for our shareholders. The

failure by our management to apply these funds effectively could

have a material adverse effect on our business, results of

operations or financial condition. See “Use of

Proceeds” for a further description of how management intends

to apply the proceeds from this offering.

You will experience immediate dilution in the book value per share

of the common shares you purchase.

Because

the offering price per common share is substantially higher than

the book value per share of our common shares, you will suffer

substantial dilution in the net tangible book value of the common

shares you purchase in this offering. Based on the offering price

of $0.60 per share, if you purchase shares in this offering, you

will suffer immediate and substantial dilution of approximately

$0.52 per share in the net tangible book value of the common shares

you acquire. See “Dilution” below for a more detailed

discussion of the dilution you will incur if you purchase

securities in this offering.

In

addition to this offering, subject to market conditions and other

factors, it is likely that we will pursue additional financings in

the future, as we continue to develop our business. In future

years, we will likely need to raise significant additional capital

to finance our operations and to fund bioequivalence studies and

clinical trials for the advancement

of

product development, as well as for regulatory submissions and the

development, manufacture and marketing of other products under

development and new product opportunities. Accordingly, we may

conduct substantial future offerings of equity or debt securities.

The exercise of outstanding options and warrants and future equity

issuances, including future public offerings or future private

placements of equity securities and any additional common shares

issued in connection with acquisitions, will result in dilution to

investors. In addition, the market price of our common shares could

fall as a result of resales of any of these common shares due to an

increased number of common shares available for sale in the

market.

There can be no assurance that our common shares will continue to

trade on Nasdaq or another national securities

exchange.

In

September 2017, we announced that we had received written

notification from Nasdaq that we were not in compliance with the

minimum market value of listed securities requirement set forth in

Nasdaq Rules for continued listing on Nasdaq. Nasdaq Listing Rule

5550(b)(2) requires listed securities to maintain a minimum market

value of $35.0 million, and Listing Rule 5810(c)(3)(C) provides

that a failure to meet the minimum market value requirement exists

if the deficiency continues for a period of 30 consecutive business

days. Based on the market value of our common shares for the 30

consecutive business days from August 8, 2017, we no longer meet

the minimum market value of listed securities requirement. In

accordance with Nasdaq Listing Rule 5810(c)(3)(C), we have been

provided 180 calendar days, or until March 19, 2018, to regain

compliance with Nasdaq Listing Rule 5550(b)(2). To regain

compliance, our common shares must have a market value of at least

$35.0 million for a minimum of 10 consecutive business days. In the

event we do not regain compliance by March 19, 2018, we may be

eligible for additional time to regain compliance. If not, our

securities may be delisted from Nasdaq.

In

December 2017, we announced that we were notified by Nasdaq that

the minimum bid price per share for our common shares was below

$1.00 for a period of 30 consecutive business days and that we did

not meet the minimum bid price requirement set forth in Nasdaq

Listing Rule 5550(a)(2). We have a period of 180 calendar days, or

until June 4, 2018, to regain compliance with Nasdaq’s

minimum bid price requirement. To regain compliance, our common

shares must have a closing bid price of at least $1.00 for a

minimum of 10 consecutive business days. In the event we do not

regain compliance by June 4, 2018, we may be eligible for

additional time to regain compliance. If not, our securities may be

delisted from Nasdaq.

There

can be no assurance that we will be able to comply with all

applicable Nasdaq continued listing standards. If we are unable to

do so, our common shares may no longer be listed on Nasdaq or

another national securities exchange and the liquidity and market

price of our common shares may be adversely affected. If our common

shares are delisted from Nasdaq, they may trade on the

over-the-counter market, which may be a less liquid market. In such

case, our shareholders’ ability to trade, or obtain

quotations of the market value of, our common shares would be

severely limited because of lower trading volumes and transaction

delays. These factors could contribute to lower prices and larger

spreads in the bid and ask prices for our securities.

If our common shares are not listed on a national securities

exchange, compliance with applicable state securities laws may be

required for subsequent offers, transfers and sales of the common

shares and warrants offered hereby.

Because

our common shares are currently listed on Nasdaq, we are not

required to register or qualify in any state the subsequent offer,

transfer or sale of the common shares. If our common shares are

delisted from Nasdaq and are not eligible to be listed on another

national securities exchange, subsequent transfers of our common

shares offered hereby by U.S. holders may not be exempt from state

securities laws. In such event, it will be the responsibility of

the holder of common shares to register or qualify the common

shares for any subsequent offer, transfer or sale in the United

States or to determine that any such offer, transfer or sale is

exempt under applicable state securities laws.

There may be future sales or other dilution of our equity, which

may adversely affect the market price of our common

shares.

We may

from time to time issue additional common shares, including any

securities that are convertible into or exchangeable for, or that

represent the right to receive, our common shares. The market price

of our common shares could decline as a result of sales of common

shares or securities that are convertible into or exchangeable for,

or that represent the right to receive, our common shares after

this offering or the perception that such sales could

occur.

Future sales of our common shares may cause the prevailing market

price of our common shares to decrease.

We have

registered a substantial number of outstanding common shares and

common shares that are issuable upon the exercise of outstanding

warrants. If the holders of our registered common shares choose to

sell such shares in the public market or if holders of our warrants

exercise their purchase rights and sell the underlying common

shares in the public market, or if holders of currently restricted

common shares choose to sell such shares in the public market, the

prevailing market price of our common shares may decline. The sale

of shares issued upon the exercise of our warrants (and options)

could also further dilute the holdings of our then existing

shareholders. In addition, future public sales by holders of our

common shares could impair our ability to raise capital through

equity offerings.

Risks Relating to our Company

Our business is capital intensive and requires significant

investment to conduct R&D, clinical and regulatory activities

necessary to bring our products to market, which capital may not be

available in amounts or on terms acceptable to us, if at

all.

Our

business requires substantial capital investment in order to

conduct the R&D, clinical and regulatory activities necessary

and to defend against patent litigation claims in order to bring

our products to market and to establish commercial manufacturing,

marketing and sales capabilities. As of November 30, 2017, we had a

cash balance of $1.9 million. As of March 14, 2018, our cash

balance was $0.1 million, which does not include the net proceeds

of this offering . We currently expect to satisfy our operating

cash requirements until June 2018 from cash on hand and quarterly

profit share payments from Par Pharmaceutical, Inc., or Par, and

Mallinckrodt LLC, or Mallinckrodt. We may need to obtain additional

funding prior to that time as we further the development of our

product candidates and if we accelerate our product

commercialization activities. Other potential sources of capital

may include payments from licensing agreements, cost savings

associated with managing operating expense levels, other equity

and/or debt financings, and/or new strategic partnership agreements

which fund some or all costs of product development. If necessary,

and conditions permit, we may utilize the equity markets to bridge

any funding shortfall and to provide capital to continue to advance

our most promising product candidates. Our future operations are

highly dependent upon our ability to source additional capital to

support advancing our product pipeline through continued R&D

activities and to fund any significant expansion of our operations.

Our ultimate success will depend on whether our product candidates

receive the approval of the FDA or Health Canada and whether we are

able to successfully market approved products. We cannot be certain

that we will be able to receive FDA or Health Canada approval for

any of our current or future product candidates, that we will reach

the level of sales and revenues necessary to achieve and sustain

profitability or that we can secure other capital sources on terms

or in amounts sufficient to meet our needs or at all. Our cash

requirements for R&D during any period depend on the number and

extent of the R&D activities we focus on. At present, we are

working principally on our Oxycodone ER 505(b)(2), and selected

generic, product candidate development projects. Our development of

Oxycodone ER will require significant expenditures, including costs

to defend against the Purdue litigation. For our RegabatinTM XR

505(b)(2) product candidate, Phase III clinical trials can be

capital intensive, and will only be undertaken consistent with the

availability of funds and a prudent cash management strategy. We

anticipate some investment in fixed assets and equipment over the

next several months, the extent of which will depend on cash

availability.

The

availability of equity or debt financing will be affected by, among

other things, the results of our R&D, our ability to obtain

regulatory approvals, our success in commercializing approved

products with our commercial partners and the market acceptance of

our products, the state of the capital markets generally, strategic

alliance agreements and other relevant commercial considerations.

In addition, if we raise additional funds by issuing equity

securities, our then existing security holders will likely

experience dilution, and the incurring of indebtedness would result

in increased debt service obligations and could require us to agree

to operating and financial covenants that would restrict our

operations. In the event that we do not obtain sufficient

additional capital, it will raise substantial doubt about our

ability to continue as a going concern and realize our assets and

pay our liabilities as they become due. Our cash outflows are

expected to consist primarily of internal and external R&D,

legal and consulting expenditures to advance our product pipeline

and selling, general and administrative expenses to support our

commercialization efforts. Depending upon the results of our

R&D programs, the Purdue litigation and the availability of

financial resources, we could decide to accelerate, terminate, or

reduce certain projects, or commence new ones. Any failure on

our part to successfully commercialize approved products or raise

additional funds on terms favorable to us or at all, may require us

to significantly change or curtail our current or planned

operations in order to conserve cash until such time, if ever, that

sufficient proceeds from operations are generated, and could result

in us not taking advantage of business opportunities, in the

termination or delay of clinical trials or us not taking any

necessary actions required by the FDA or Health Canada for one or

more of our product candidates, in curtailment of our product

development programs designed to identify new product candidates,

in the sale or assignment of rights to our technologies, products

or product candidates, and/or our inability to file ANDAs, ANDSs or

NDAs, at all or in time to competitively market our products or

product candidates.

We have a history of operating losses, which may continue in the

foreseeable future.

We have

incurred net losses from inception through November 30, 2017 and

had an accumulated deficit of $71,873,459 as of such date, and have

incurred additional losses since such date. As we engage in the

development of products in our pipeline, we may continue to incur

further losses. There can be no assurance that we will ever be able

to achieve or sustain profitability or positive cash flow. Our

ultimate success will depend on how many of our product candidates

receive the approval of the FDA or Health Canada and whether we are

able to successfully market approved products. We cannot be certain

that we will be able to receive FDA or Health Canada approval for

any of our current or future product candidates, or that we will

reach the level of sales and revenues necessary to achieve and

sustain profitability.

Approvals for our product candidates may be delayed or become more

difficult to obtain if the FDA institutes changes to its approval

requirements.

The FDA

may institute changes to its ANDA approval requirements, which may

make it more difficult or expensive for us to obtain approval for

our new generic products. For instance, in July 2012, the Generic

Drug Fee User Amendments of 2012, or GDUFA, were enacted into law.

The GDUFA legislation implemented substantial fees for new ANDAs,

Drug Master Files, product and establishment fees and a one-time

fee for back-logged ANDAs pending approval as of October 1, 2012.

In return, the program is intended to provide faster and more

predictable ANDA reviews by the FDA and more timely inspections of

drug facilities. For the FDA’s fiscal years 2016 and 2017,

respectively, the user fee rates are $76,030 and $70,480 for new

ANDAs, $38,020 and $35,240 for “Prior Approval

Supplements,” and $17,434 for each ANDA already on file at

the FDA. For the FDA’s fiscal year 2016 and 2017, there is

also an annual facility user fee of $258,905 and $273,646,

respectively. Effective October 1, 2017, for the FDA’s fiscal

year 2018, the FDA will charge an annual facility user fee of

$226,087 plus a new general program fee of $159,079. Under GDUFA,

generic product companies face significant penalties for failure to

pay the new user fees, including rendering an ANDA not

“substantially complete” until the fee is paid. It is

currently uncertain the effect the new fees will have on our ANDA

process and business. However, any failure by us or our suppliers

to pay the fees or to comply with the other provisions of GDUFA may

adversely impact or delay our ability to file ANDAs, obtain

approvals for new generic products, generate revenues and thus may

have a material adverse effect on our business, results of

operations and financial condition.

We operate in a highly litigious environment.

From

time to time, we may be exposed to claims and legal actions in the

normal course of business. As of the date of this prospectus

supplement, we are not aware of any pending or

threatened material litigation claims against us, other than

as described below and under the caption “Legal

Proceedings” in this prospectus supplement. Litigation to

which we are, or may be, subject could relate to, among other

things, our patent and other intellectual property rights or such

rights of others, business or licensing arrangements with other

persons, product liability or financing activities. Such litigation

could include an injunction against the manufacture or sale of one

or more of our products or potential products or a significant

monetary judgment, including a possible punitive damages award, or

a judgment that certain of our patent or other intellectual

property rights are invalid or unenforceable or infringe the

intellectual property rights of others. If such litigation is

commenced, our business, results of operations, financial condition

and cash flows could be materially adversely affected.

There

has been substantial litigation in the pharmaceutical industry

concerning the manufacture, use and sale of new products that are

the subject of conflicting patent rights. When we file an ANDA or

505(b)(2) NDA for a bioequivalent version of a drug, we may, in

some circumstances, be required to certify to the FDA that any

patent which has been listed with the FDA as covering the branded

product has expired, the date any such patent will expire, or that

any such patent is invalid or will not be infringed by the

manufacture, sale or use of the new drug for which the application

is submitted. Approval of an ANDA is not effective until each

listed patent expires, unless the applicant certifies that the

patents at issue are not infringed or are invalid and so notifies

the patent holder and the holder of the branded product. A patent

holder may challenge a notice of non-infringement or invalidity by

suing for patent infringement within 45 days of receiving notice.

Such a challenge prevents FDA approval for a period which ends 30

months after the receipt of notice, or sooner if an appropriate

court rules that the patent is invalid or not infringed. From time

to time, in the ordinary course of business, we face and have faced

such challenges and may continue to do so in the

future.

In

April 2017, the Purdue litigation plaintiffs had commenced the

Purdue litigation against us in the U.S. District Court for the

District of Delaware in respect of our NDA filing for our Oxycodone

ER product candidate (abuse-deterrent oxycodone hydrochloride

extended release tablets), alleging that it infringes the

OxyContin® patents, listed in the

Orange

Book. In our NDA filed in November 2016 for Oxycodone ER, we relied

on the 505(b)(2) regulatory pathway, which allowed us to reference

data from Purdue Pharma L.P.'s file for its OxyContin®

extended release oxycodone hydrochloride. Our Oxycodone ER

application was accepted by the FDA for further review in February

2017. We certified to the FDA that we believed that our Oxycodone

ER product candidate would not infringe any of the OxyContin®

patents, or that such patents are invalid, and so notified Purdue

Pharma L.P. and the other owners of the subject patents listed in

the Orange Book of such certification. The complaint seeks

injunctive relief as well as attorneys' fees and costs and such

other and further relief as the Court may deem just and proper. An

answer and counterclaim have been filed.

As a result of

the commencement of these legal proceedings, the FDA is stayed for

30 months from granting final approval to our Oxycodone ER product

candidate. That time period commenced on February 24, 2017, when

the Purdue litigation plaintiffs received notice of our

certification concerning the patents, and will expire on August 24,

2019, unless the stay is earlier terminated by a final declaration

of the courts that the patents are invalid, or are not infringed,

or the matter is otherwise settled among the parties. A trial date

for the Purdue litigation has been set for October 22, 2018. We are

confident that we do not infringe the subject patents, and will

vigorously defend against these claims.

Brand-name

pharmaceutical manufacturers routinely bring patent infringement

litigation against ANDA applicants seeking FDA approval to

manufacture and market generic forms of their branded products. We

are routinely subject to patent litigation that can delay or

prevent our commercialization of products, force us to incur

substantial expense to defend, and expose us to substantial

liability.

In July

2017, three complaints were filed in the U.S. District Court for

the Southern District of New York asserting claims under the

federal securities laws against us and two of our executive

officers on behalf of a putative class of purchasers of our

securities. In a subsequent order, the Court consolidated the three

actions under the caption Shanawaz v. Intellipharmaceutics

Int’l Inc., et al., No. 1:17-cv-05761 (S.D.N.Y.), appointed

lead plaintiffs in the consolidated action, and approved lead

plaintiffs’ selection of counsel. Lead plaintiffs filed a

consolidated amended complaint on January 29, 2018. In the amended

complaint, lead plaintiffs purport to assert claims on behalf of a

putative class consisting of purchasers of our securities between

May 21, 2015 and July 26, 2017. The amended complaint alleges that

the defendants violated Sections 10(b) and 20(a) of the United

States Securities Exchange Act of 1934, as amended, or the U.S.

Exchange Act, and Rule 10b-5 promulgated thereunder by making

allegedly false and misleading statements or failing to disclose

certain information regarding our NDA for Oxycodone ER

abuse-deterrent oxycodone hydrochloride extended release tablets.

The complaint seeks, among other remedies, unspecified damages,

attorneys’ fees and other costs, equitable and/or injunctive

relief, and such other relief as the court may find just and

proper. Under a scheduling order approved by the Court, the

defendants must respond to the amended complaint by March 30, 2018.

We intend to vigorously defend against the claims asserted in the

consolidated action.

We may be subject to intellectual property claims that could be

costly and could disrupt our business.

Third

parties may claim we have infringed their patents, trademarks,

copyrights or other rights. We may be unsuccessful in defending

against such claims, which could result in the inability to protect

our intellectual property rights or liability in the form of

substantial damages, fines or other penalties such as injunctions

precluding our manufacture, importation or sales of products. The

resolution of a claim could also require us to change how we do

business or enter into burdensome royalty or license agreements.

Insurance coverage may be denied or may not be adequate to cover

every claim that third parties could assert against us. Even

unsuccessful claims could result in significant legal fees and

other expenses, diversion of management’s time and

disruptions in our business. Any of these claims could also harm

our reputation.

We are a defendant in purported securities class-action litigation

matters and are at risk of additional similar litigation in the

future that could divert management’s attention and adversely

affect our business and could subject us to significant

liabilities.

We are

a defendant in a purported securities class action litigation

matters as described under the heading “Legal

Proceedings.” The defense of such litigation matters may

increase our expenses and divert our management’s attention

and resources and any unfavorable outcome could have a material

adverse effect on our business and results of operations. Any

adverse determination in such litigation matters, or any amounts

paid to settle such litigation matters could require that we make

significant payments. In addition, we may in the future be the

target of other securities class actions or similar litigation. See

“Legal Proceedings.”

Our significant shareholders have the ability to exercise

significant influence over certain corporate actions.

Our

principal shareholders, Drs. Amina and Isa Odidi, our President and

Chief Operating Officer and our Chairman and Chief Executive

Officer, respectively, and Odidi Holdings Inc., a privately-held

company controlled by Drs. Amina and Isa Odidi, owned in the

aggregate approximately 16.7% of our issued and outstanding common

shares as of March 14, 2018 (and collectively beneficially owned in

the aggregate approximately 25.6% of our common shares, including

common shares issuable upon the exercise of outstanding options and

the conversion of the convertible Debenture in respect of the loan

to us in the original principal amount of $1,500,000 by Drs. Isa

and Amina Odidi, or the

Debenture, of which

$1,350,000 remains outstanding, that are exercisable or convertible

within 60 days of the date hereof). As a result, the principal

shareholders have the ability to exercise significant influence

over all matters submitted to our shareholders for approval whether

subject to approval by a majority of holders of our common shares

or subject to a class vote or special resolution requiring the

approval of 66⅔% of the votes cast by holders of our common

shares, in person or by proxy.

A large number of our common shares could be sold in the market in

the near future, which could depress our stock price.

As of

March 14, 2018, we had approximately 34.7 million common shares

outstanding. In addition, a substantial portion of our common

shares are currently freely trading without restriction under the

U.S Securities Act, having been registered for resale or held by

their holders for over six months and are eligible for sale under

Rule 144. In addition, in November 2013, we established an

at-the-market equity program pursuant to which we originally could,

from time to time, sell up to 5,305,484 of our common shares for up

to an aggregate of $16.8 million (or such lesser amount as may then

be permitted under applicable exchange rules and securities laws

and regulations). As of March 14, 2018, we have issued and sold an

aggregate of 4,740,350 common shares with an aggregate offering

price of $13,872,929 under the at-the-market program. On March 13,

2018, we terminated the continuous offering by us under the

prospectus supplement dated July 18, 2017 and prospectus dated July

17, 2017 in respect of our at-the-market program. If we seek to

offer and sell common shares under our at-the-market program, we

will file another prospectus supplement prior to making such

additional offers and sales. We are not required to sell shares

under the equity distribution agreement. There can be no assurance

that any additional shares will be sold under our at-the-market

program. We have agreed, pursuant to the securities purchase

agreements entered into in connection with this offering, not to

issue, subject to certain exceptions, common shares for a period of

60 days after the closing of this offering.

On July

17, 2017, the recent registration statement of which this

prospectus supplement forms a part was declared effective by the

SEC (the “Shelf Registration Statement”). The Shelf

Registration Statement allows for, subject to securities regulatory

requirements and limitations, the potential offering of up to an

aggregate of US$100 million of the Company’s common shares,

preference shares, warrants, subscription receipts, subscription

rights and units, or any combination thereof, from time to time in

one or more offerings, and are intended to give the Company the

flexibility to take advantage of financing opportunities when, and

if, market conditions are favorable to the Company. The specific

terms of such future offerings, if any, would be established,

subject to the approval of the Company’s board of directors,

at the time of such offering and will be described in detail in a

prospectus supplement filed at the time of any such offering. To

the extent any of our securities are issued under the Shelf

Registration Statement, a shareholder’s percentage ownership

will be diluted and our stock price could be further adversely

affected. As of March

⦁

, 2018, the Company

has not sold any securities under the Shelf Registration Statement,

other than (i) the sale since July 17, 2017 of 485,239 common

shares under our at-the-market, (ii) the sale in October 2017 of

3,636,364 common shares in a registered direct offering and (iii)

the sale in March 2018 of 5,833,334 common shares in a registered

direct offering, and there can be no assurance that any additional

securities will be sold under the Shelf Registration Statement or

the shelf prospectus.

On

October 22, 2009, IntelliPharmaCeutics Ltd., or IPC Ltd., and

Vasogen Inc., or Vasogen, completed a plan of arrangement and

merger, or the IPC Arrangement Agreement, resulting in the

formation of the Company. Our shareholders who received shares

under the IPC Arrangement Agreement who were not deemed

“affiliates” of either Vasogen, IPC Ltd., or us prior

to the IPC Arrangement Agreement were able to resell the common

shares that they received without restriction under the U.S.

Securities Act. The common shares received by an

“affiliate” after the IPC Arrangement Agreement or who

were “affiliates” of either Vasogen, IPC Ltd., or us

prior to the IPC Arrangement Agreement are subject to certain

restrictions on resale under Rule 144.

As of

March 14, 2018, there are currently common shares issuable upon the

exercise of outstanding options and warrants and the conversion of

an outstanding convertible Debenture for an aggregate of

approximately 10,099,632 common shares. To the extent any of our

options and warrants are exercised and the convertible Debenture is

converted, a shareholder’s percentage ownership will be

diluted and our stock price could be further adversely affected.

Moreover, as the underlying shares are sold, the market price could

drop significantly if the holders of these restricted shares sell

them or if the market perceives that the holders intend to sell

these shares.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

INFORMATIO

N

Certain

statements included and incorporated by reference in this

prospectus supplement constitute “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and/or

“forward-looking information” under the

Securities Act

(Ontario). These

statements include, without limitation, statements

expressed or

implied regarding our expectations regarding the completion of this

offering and concurrent private placement, the expected gross

proceeds, the expected use of proceeds and the expected closing of

the offering, plans, goals and milestones, status of developments

or expenditures relating to our business, plans to fund our current

activities, and statements concerning our partnering activities,

health regulatory submissions, strategy, future operations, future

financial position, future sales, revenues and profitability,

projected costs, and market penetration. In some cases, you can

identify forward-looking statements by terminology such as

“appear”, “unlikely”, “target”,

“may,” “will,” “should,”

“expects,” “plans,” “plans to,”

“anticipates,” “believes,”

“estimates,” “predicts,”

“confident,” “prospects,”

“potential,” “continue,”

“intends,” “look-forward,”

“could,”

“would”, “projected”,

“set to”, “seeking”,

or the negative

of such terms or other comparable terminology. We made a number of

assumptions in the preparation of our forward-looking statements.

You should not place undue reliance on our forward looking

statements, which are subject to a multitude of known and unknown

risks and uncertainties that could cause actual results, future

circumstances or events to differ materially from those stated in

or implied by the forward-looking statements.

Risks,

uncertainties and other factors that could affect our actual

results include, but are not limited to, the effects of general

economic conditions, securing and maintaining corporate alliances,

our estimates regarding our capital requirements and the effect of

capital market conditions and other factors, including the current

status of our product development programs, on capital

availability, the estimated proceeds (and the expected use of any

proceeds) we may receive from this or any other offering of our

securities, the potential dilutive effects of this or any future

financing, potential liability from and costs of defending pending

or future litigation, our ability to maintain compliance with the

continued listing requirements of the principal markets on which

our securities are traded, including risks or uncertainties related

to our ability to implement and execute a plan to regain compliance

with Nasdaq continued listing standards, our programs regarding

research, development and commercialization of our product

candidates, the timing of such programs, the timing, costs and

uncertainties regarding obtaining regulatory approvals to market

our product candidates and the difficulty in predicting the timing

and results of any product launches, the timing and amount of

profit-share payments from our commercial partners, and the timing

and amount of any available investment tax credits, the actual or

perceived benefits to users of our drug delivery technologies,

products and product candidates as compared to others, our ability

to establish and maintain valid and enforceable intellectual

property rights in our drug delivery technologies, products and

product candidates, the scope of protection provided by

intellectual property for our drug delivery technologies, products

and product candidates, recent and future legal developments in the

United States and elsewhere that could make it more difficult and

costly for us to obtain regulatory approvals for our product

candidates and negatively affect the prices we may charge,

increased public awareness and government scrutiny of the problems

associated with the potential for abuse of opioid based

medications, pursuing growth through international operations could

strain our resources, our limited manufacturing, sales, marketing

or distribution capability and our reliance on third parties for

such, the actual size of the potential markets for any of our

products and product candidates compared to our market estimates,

our selection and licensing of products and product candidates, our

ability to attract distributors and/or commercial partners with the

ability to fund patent litigation and with acceptable product

development, regulatory and commercialization expertise and, the

benefits to be derived from such collaborative efforts, sources of

revenues and anticipated revenues, including contributions from

distributors and commercial partners, product sales, license

agreements and other collaborative efforts for the development and

commercialization of product candidates, our ability to create an

effective direct sales and marketing infrastructure for products we

elect to market and sell directly, the rate and degree of market

acceptance of our products, delays in product approvals that may be

caused by changing regulatory requirements, the difficulty in

predicting the timing of regulatory approval and launch of

competitive products, the difficulty in predicting the impact of

competitive products on volume, pricing, rebates and other

allowances, the number of competitive product entries, and the

nature and extent of any aggressive pricing and rebate activities

that may follow, the inability to forecast wholesaler demand and/or

wholesaler buying patterns, seasonal fluctuations in the number of

prescriptions written for our generic Focalin XR

®

(dexmethylphenidate hydrochloride

extended-release) capsules, and our generic Seroquel XR

® (quetiapine fumarate extended-release)

tablets

which may produce substantial fluctuations in

revenue, the timing and amount of insurance reimbursement regarding

our products, changes in laws and regulations affecting the

conditions required by the FDA for approval, testing and labeling

of drugs including abuse or overdose deterrent properties, and

changes affecting how opioids are regulated and prescribed by

physicians, changes in laws and regulations, including Medicare and

Medicaid, affecting among other things, pricing and reimbursement

of pharmaceutical products, the effect of recently-enacted changes

in U.S. federal income tax laws, including, but not limited to,

limitations on the deductibility of business interest, limitations

on the use of net operating losses and application of the base

erosion minimum tax, on our U.S. corporate income tax burden, our

ability to retain and hire qualified employees, the availability

and pricing of third-party sourced products and materials,

challenges related to the development, commercialization,

technology transfer, scale-up, and/or process validation of

manufacturing processes for our products or product candidates, the

manufacturing capacity of third-party manufacturers that we may use

for our products, potential product liability risks, the

recoverability of the cost of any pre-launch inventory should a

planned product launch encounter a denial or delay of approval by

regulatory bodies, a delay in commercialization, or other potential

issues, the successful compliance with FDA, Health Canada and other

governmental regulations applicable to us and our third party

manufacturers’ facilities, products and/or businesses, our

reliance on commercial partners, and any future commercial

partners, to market and commercialize our

products and, if

approved, our product candidates, difficulties, delays, or changes

in the FDA approval process or test criteria for ANDAs and NDAs

challenges in securing final FDA approval for our product

candidates, including our Oxycodone ER product candidate in

particular, if a patent infringement suit is filed against us, with

respect to any particular product candidates (such as in the case

of Oxycodone ER), which could delay the FDA’s final approval

of such product candidates, healthcare reform measures that could

hinder or prevent the commercial success of our products and

product candidates, the FDA may not approve requested product

labeling for our product candidate(s) having abuse-deterrent

properties and targeting common forms of abuse (oral, intra-nasal

and intravenous), risks associated with cyber-security and the

potential for vulnerability of our digital information or the

digital information of a current and/or future drug development or

commercialization partner of ours, and risks arising from the

ability and willingness of our third-party commercialization

partners to provide documentation that may be required to support

information on revenues earned by us from those commercialization

partners. Additional risks and uncertainties relating to us and our

business can be found in the “Risk Factors” section of

this prospectus supplement and the accompanying prospectus, as well

as in our other public filings incorporated by reference herein.

The forward-looking statements reflect our current views with

respect to future events and are based on what we believe are

reasonable assumptions as of the date hereof, and we disclaim any

intention and have no obligation or responsibility, except as

required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Nothing

contained in this document should be construed to imply that the

results discussed herein will necessarily continue into the future

or that any conclusion reached herein will necessarily be

indicative of our actual operating results.

We

estimate that our net proceeds from this offering will be

approximately $3.0 million, after deducting the placement agent

fees and estimated offering expenses payable by us. We will receive

additional proceeds from any cash exercise of the warrants offered

by this prospectus supplement. We cannot provide any assurance as

to the amount or timing of receipt of any such additional proceeds,

and it is possible that these warrants may expire and never be

exercised.

We

currently intend to use the net proceeds from this offering for

general corporate purposes, which may include working capital,

capital expenditures, research and development, accounts payable

and other commercial expenditures. The amounts and timing of our

use of proceeds will vary depending on a number of factors,

including the amount of cash generated or used by our operations,

and the rate of growth, if any, of our business. As a result, we

will retain broad discretion in the allocation of the net proceeds

of this offering.

EXCHANGE RATE INFORMATION

The

following table sets out the high and low rates of exchange for one

U.S. dollar expressed in Canadian dollars in effect at the end of

each of the following periods; the average rate of exchange for

those periods; and the rate of exchange in effect at the end of

each of those periods, each based on the closing rate published by

the Bank of Canada.

|

|

Three Months ended

|

Fiscal

years ended November 30,

|

|

|

February 28, 2018

|

2017

|

2016

|

2015

|

|

High

|

Cdn

$1.2886

|

Cdn

$1.3662

|

Cdn

$1.4559

|

Cdn

$1.3418

|

|

Low

|

Cdn

$1.2288

|

Cdn

$1.2480

|

Cdn

$1.2536

|

Cdn

$1.1328

|

|

Average

for the Period

|

Cdn

$1.2586

|

Cdn

$1.3161

|

Cdn

$1.3276

|

Cdn

$1.2603

|

|

End of

Period

|

Cdn

$1.2809

|

Cdn

$1.2888

|

Cdn

$1.3429

|

Cdn

$1.3353

|

On

March

14

, 2018,

the closing rate for Canadian dollars in terms of the United States

dollar, as reported by the Bank of Canada, was U.S.$1.00=Cdn$1.2944

or Cdn$1.00=U.S.$0.7726

Our net

tangible book value as of November 30, 2017 was approximately

$386,383