DHL Steps Back Into U.S. Package Delivery in Challenge to UPS, FedEx

March 15 2018 - 5:31PM

Dow Jones News

By Erica E. Phillips

Deutsche Post AG's DHL business is tiptoeing back into the

domestic parcel delivery in the U.S., drawn in by the strong growth

in e-commerce to bring new competition to a market that's been

dominated by United Parcel Service Inc. and FedEx Corp. for a

decade.

DHL said Thursday it is launching a new same-day and next-day

delivery service for online retailers in Chicago, New York and Los

Angeles. The service will expand to Dallas, Atlanta, San Francisco

and Washington, D.C., by the end of the year, and will rapidly add

more cities over the next few years.

"We pay a lot of attention to what consumers are demanding of

the online marketplaces and retailers they're buying from," said

Lee Spratt, chief executive of DHL eCommerce's Americas division.

"Faster, cost-effective delivery is going to be a future

requirement to play in this space."

The firm has been testing its new delivery service, dubbed

Parcel Metro, in select cities over the last two years. The service

engages drivers through crowd-sourced applications for deliveries

within a few hours and taps into local couriers and delivery

companies for one- and two-day deliveries, using DHL eCommerce's

warehouse facilities to consolidate orders.

DHL's move to launch some U.S. delivery services again could

increase competition for both UPS and FedEx, currently the dominant

players in speedy e-commerce deliveries in the U.S. Both companies

have been raising prices aggressively to help cover the costs of

surging residential deliveries, which are more expensive than

traditional business-to-business stops. A new, low-cost entrant to

the market could make that more difficult.

"We need another small-parcel provider here," said Cathy

Roberson, a logistics industry analyst. "The shipping rates need to

come down. They're getting a little ridiculous, so bring it

on."

Representatives for FedEx and UPS did not immediately respond to

requests for comment.

The move by DHL appears to be just a stepping stone for now and

it could be several years before the firm's network is big enough

to compete with UPS and FedEx, Ms. Roberson added. "This sounds

like a very cautious but logical approach" to re-entering the

market, she said.

DHL pulled back its U.S. express-delivery unit in 2008 after

investing billions of dollars to challenge UPS and FedEx, an effort

that included the acquisition of the delivery services of smaller

operator Airborne Express and a regulatory battle over the

German-owned company's right to fly cargo aircraft in the U.S.

Since then, the firm has focused on international parcel shipments,

handing off domestic deliveries from its warehouses to the U.S.

Postal Service. DHL eCommerce currently operates 21 warehouses in

the U.S.

The decision to launch delivery services in more populous urban

markets also echoes a strategy employed by Amazon.com Inc., which

has been handling deliveries from its own fulfillment centers in at

least 37 U.S. cities, as well as through its Prime Now one- and

two-hour offering in more than 50 markets globally. Amazon is also

rolling out a delivery service for third-parties, "Shipping with

Amazon," where the online retail giant will pick up packages from

businesses and ship them to consumers.

Under DHL's new Parcel Metro service, vehicles and drivers will

not display the DHL brand, Mr. Spratt said. But consumers will be

able to see a picture of their driver and follow deliveries to

their doorsteps on a map, similar to the functions in the Uber

Technologies Inc. ride-sharing app.

-- Laura Stevens contributed to this article.

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

March 15, 2018 17:16 ET (21:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

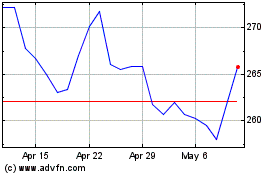

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

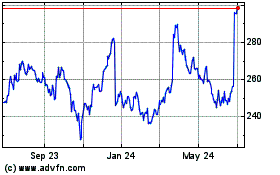

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024